Report

House Republicans’ Pledge to Cut Appropriated Programs to 2022 Level Would Have Severe Effects, Particularly for Non-Defense Programs

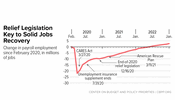

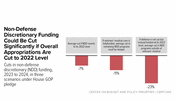

House Republicans reportedly pledged to cut programs funded by annual appropriations in 2024 back to their 2022 levels as part of the deal to elect Rep. Kevin McCarthy as Speaker. The required cuts to important domestic needs would be deep under any likely scenario that meets their pledge, and would hit programs still feeling the after-effects of a decade of austerity.