Report

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises

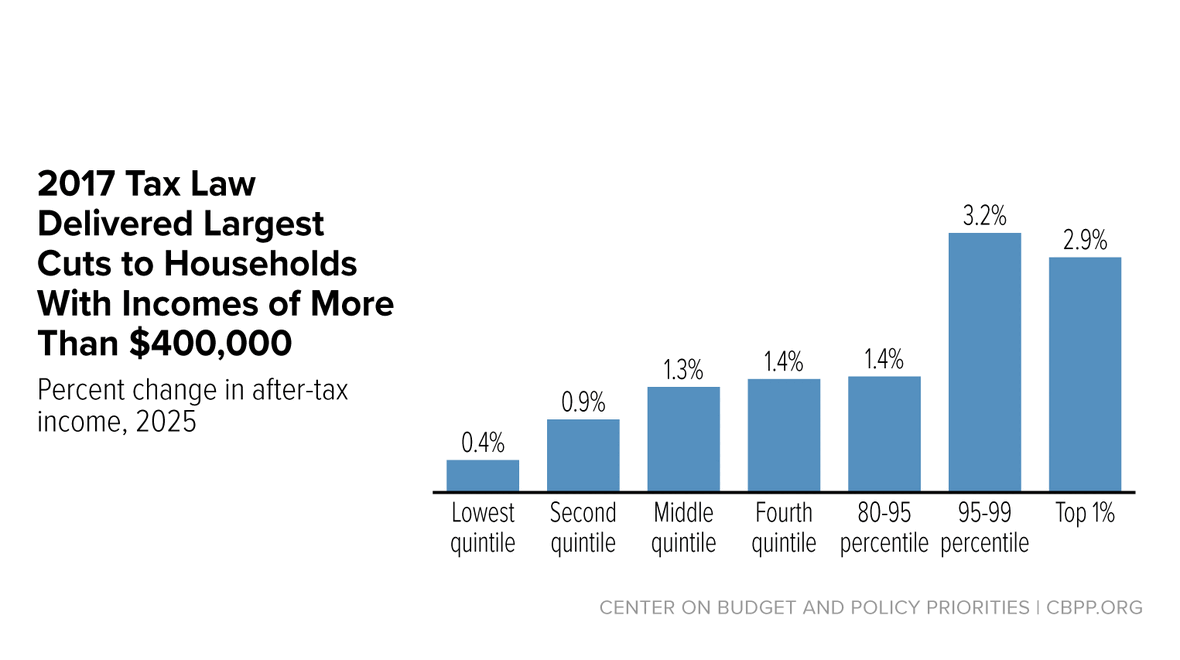

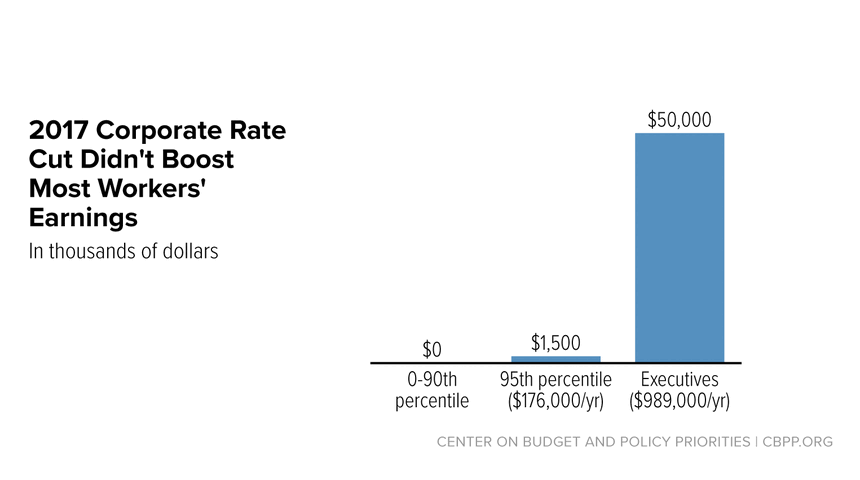

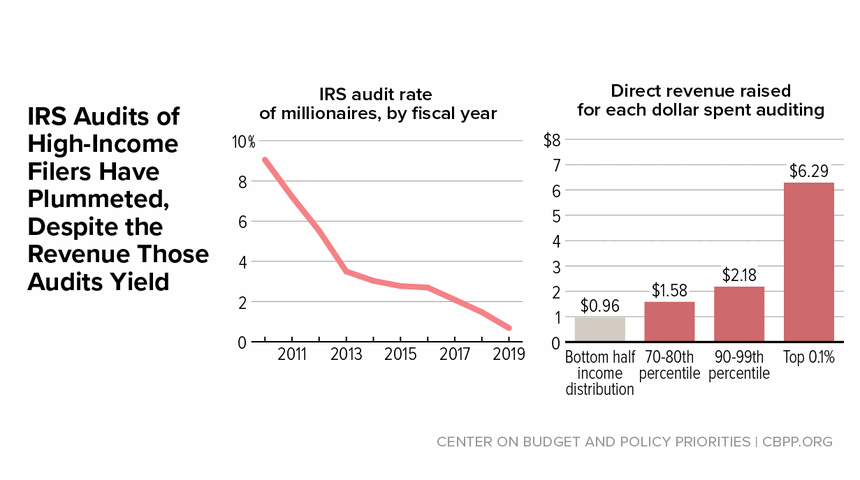

Policymakers and the public should understand that the 2017 Trump tax law was skewed to the rich, was expensive and eroded the U.S. revenue base, and failed to deliver promised economic benefits. A 2025 course correction is needed.