The Senate Appropriations Committee unanimously advanced a Financial Services funding bill that passes a minimal test of protecting honest taxpayers by maintaining efforts to rebuild and modernize an IRS decimated by years of steep funding cuts. The committee-passed bill provides $12.3 billion for fiscal year 2024 — the same amount appropriated for fiscal year 2023 — across the board for the major accounts covering IRS’s operational areas, while rescinding $10 billion of the roughly $80 billion in mandatory IRS funding provided in the Inflation Reduction Act (IRA). The Senate’s bipartisan approach is far more responsible than bills from House Republicans and should set the bare minimum for congressional action on IRS funding.

The Senate’s approach is still far from ideal. By not accounting for the effects of inflation on the cost of providing services, the flat funding level will squeeze the IRS as it undertakes new initiatives and seeks to improve services. But this level of funding satisfies a criterion crucial to the continued success of the IRS rebuilding effort: enough base funding to maintain (at least for this year) what the IRA’s supplementary funding has already kickstarted. Moreover, rescinding $10 billion from the IRA funding is at least consistent with the agreement reached to prevent defaulting on U.S. debt.

In contrast, proposals from House Republicans together would rescind $67 billion — the vast majority of what remains of the $80 billion IRA funding — and set this year’s appropriations far below what’s needed. In their version of the Financial Services appropriations bill, House Republicans cut IRS funding $1.1 billion below a freeze, taking essentially the entire amount from tax enforcement. Such funding cuts do not “save” money but would instead do the opposite: they would hamper the agency’s efforts to restore its under-resourced capacity to audit the complex returns of wealthy tax cheats. Such audits raise multiple dollars for every dollar spent, a long-understood phenomenon that recent, notable research lent additional support to. The $67 billion rescission, combined over multiple appropriations bills, would gut investments for operations support and enforcement that are at the heart of the IRS modernization effort.

In each of these bills, House Republicans sided with dishonest over honest taxpayers while undermining efforts to repair the damage created by more than a decade of IRS funding cuts pushed by congressional Republicans. That damage was not just in enforcement but in taxpayer services, as understaffed offices and outdated systems degraded the experience for honest taxpayers. The 2023 filing season saw improvements in the form of shorter wait times for calls and timelier return processing. Honest taxpayers deserve a modern, functional IRS, which requires a full congressional commitment to the rebuilding effort.

To understand the importance of Congress passing this minimal test for funding the IRS — that is, treating the bipartisan Senate bill’s funding as a floor and rejecting the House Republican bills out of hand — it’s helpful to recall this chain of events:

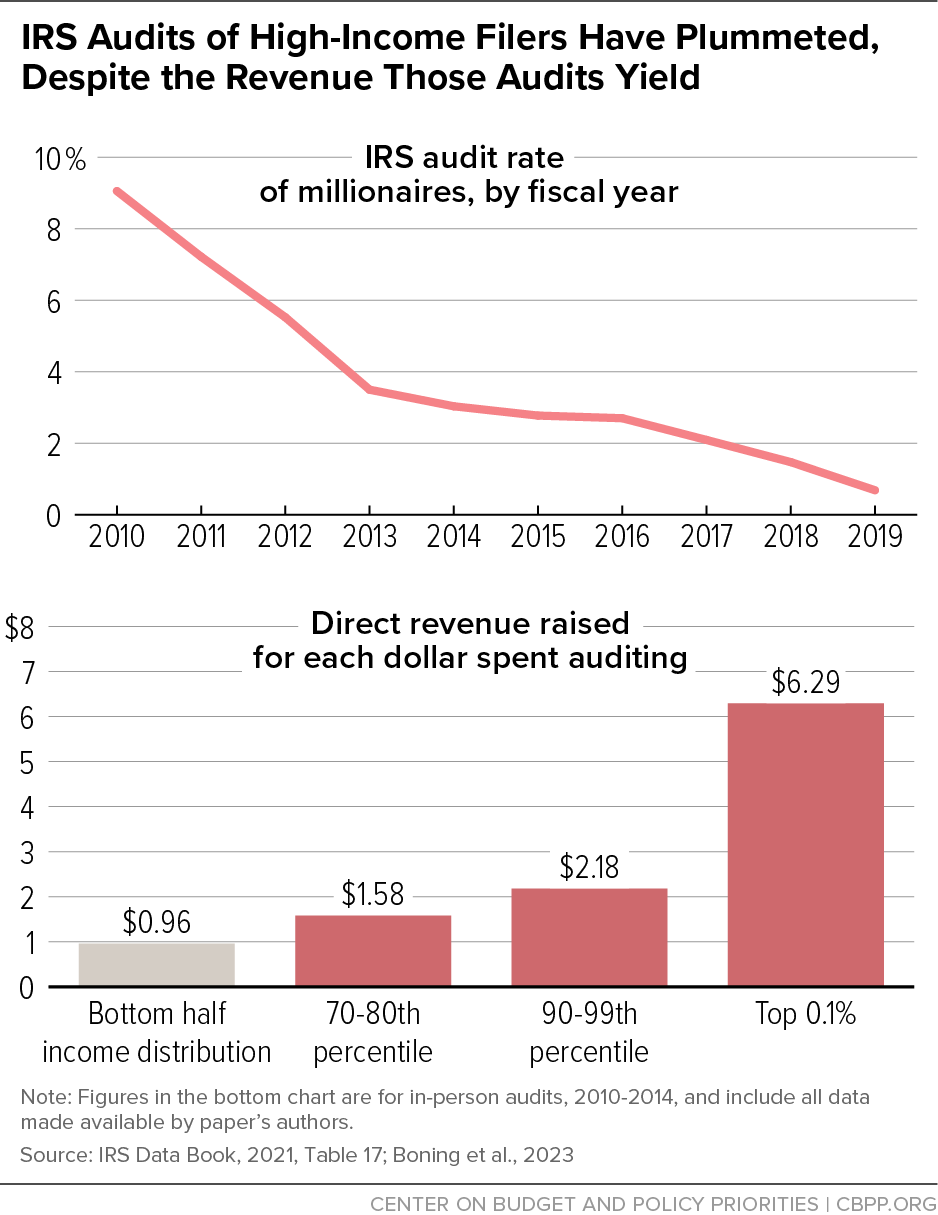

- Decade after 2010: House Republicans targeted the IRS budget for sustained cuts after regaining the majority in 2010 during the Obama Administration, and the results were devastating. A severely under-resourced IRS couldn’t answer honest tax filers’ phone calls or challenge wealthy tax cheats, with the latter problem a major factor in the roughly half-trillion-dollar annual tax gap.[1] The audit rates of millionaires fell by more than 80 percent between 2010 and 2018. Wealthy people’s tax returns are complex, and their income is often hard to trace because of complicated, multi-layered ownership structures, requiring highly trained auditors to review and audit their returns. But the IRS in 2018 had fewer such auditors than at any time since 1953 as result of these budget cuts, and its computer software dates back to the Kennedy Administration.

- Inflation Reduction Act of 2021: To help finance a long-overdue rebuilding effort, the IRA created an $80 billion, ten-year mandatory funding stream (that is, funding provided directly in authorizing law as opposed to discretionary annual appropriations). The mandatory funding offers a degree of budget certainty to allow the agency to undertake the years-long process of hiring and training staff and to make badly needed technology upgrades. And it is already paying off in improved customer service and millions in additional collections through high-profile audits.[2] But the IRA’s funds are designed to supplement and not to supplant the agency’s regular budget, which is set each year through the appropriations process. Providing adequate base funding for the IRS through annual appropriations is an essential part of the effort to rebuild the agency.[3]

- Debt limit agreement: Debt ceiling negotiators — including these same House Republicans — agreed to cut $21 billion of the IRA’s funding infusion, mostly by rescinding $10 billion in appropriations bills in each of the next two years. This agreement was reached after House Republicans first demanded eliminating all of those funds under threat of U.S. default and ensuing economic chaos.[4] Paying that ransom in full would have thwarted the IRS’s efforts to rebuild its operational and enforcement capacity so it can collect legally owed federal revenue and improve customer service for years to come. Rescinding $67 billion of this funding through the appropriations process would also thwart that effort. As it is, losing a quarter of that funding threatens serious damage, damage that Congress has the power — and responsibility — to undo.

Congress’s task for the IRS for 2023 and 2024 is simple: protect the modernization effort. The bipartisan Senate appropriations bill passes this minimal test, although it is far from ideal. It freezes base IRS funding at the fiscal year 2023 amount of $12.3 billion, which is significantly below the $14.1 billion the Biden Administration requested in its proposed budget, before the debt limit agreement. The Biden budget’s 15 percent increase over 2023 is needed to help get base funding back on track, to account for inflation, and to make up for a 2 percent cut in 2022.

While it would be better for the Senate bill to be closer to the Biden budget request, it at least provides flat funding for the major IRS accounts: taxpayer service, operations support, and enforcement. And it does not go beyond the $10 billion rescission of mandatory funding that policymakers, including House Republicans, agreed to as part of the debt limit deal.

In contrast, the House Republicans’ bills, taken together, would rescind $67 billion — the vast majority of what remains of the $80 billion IRA funding — and set this year’s appropriations $1.1 billion below the Senate’s bill. The rescissions come from multiple appropriations bills: $10.2 billion in the Financial Services bill; $25.0 billion in the Transportation, Housing, and Urban Development bill; $22.0 billion in the Commerce, Justice, and Science bill; and $9.8 billion in the Labor, Health and Human Services, and Education bill.

House Republicans’ historical and ongoing efforts to underfund the IRS — while vilifying its public servants along the way — has resulted in degraded customer service for honest taxpayers and encouragement of wealthy tax cheats.[5] It has also resulted in lower revenue collections. The basic math of tax enforcement efforts, on which there is broad consensus, is that every dollar spent on IRS funding raises multiple dollars in revenue.[6] This means that every dollar cut from IRS enforcement loses more than a dollar of revenue. With the tax gap already at half a trillion dollars, the cuts that House Republicans propose would just dig the hole deeper.

Recent research underscores just how damaging the cuts to IRS enforcement would be. As the Washington Post’s Catherine Rampell highlighted,[7] a group of researchers found that every $1 the IRS spends auditing a very high-income taxpayer yields over $6 in revenue from audit collections.[8] (See Figure 1.) And that figure rises to $12 per dollar of audit spending when combined with the indirect revenue resulting from increased voluntary compliance among audited taxpayers in later years.[9]

Recall that repeated cuts starting in 2010 left the IRS with fewer sophisticated auditors than at any time since 1953, causing audit rates to plummet, making it easier for wealthy people to cheat on their taxes, and costing the Treasury much more than whatever was “saved” from conducting fewer audits.

It is beyond time for Congress to put the interests of honest taxpayers ahead of dishonest ones. Congress should reject the House legislation’s cuts to IRS base funding and its gutting of the Inflation Reduction Act’s mandatory IRS funds. The Senate’s bipartisan approach should set the bare minimum for IRS base funding and the maximum for rescinding mandatory IRS funding.

Meanwhile, the IRS should make no changes as it continues to implement its strategic plan, by: hiring the staff necessary to answer the phones so tax filers can get their questions answered; creating new customer service tools; modernizing outdated computer systems; and hiring the auditors needed to review complex tax returns and collect taxes from wealthy households trying to cheat.[10] The effect of the $21 billion cut from the debt limit agreement would come later in the decade: the IRA’s $80 billion was intended to last for ten years, so the cut would accelerate the IRS’s existing funding cliff (that is, when the mandatory is scheduled to expire) by roughly two years.

The Inflation Reduction Act has already yielded promising early results: the IRS is now answering taxpayer calls as it should, clearing backlogs, and transmitting timelier tax refunds. A new IRS initiative to boost enforcement efforts on high-income taxpayers is already generating significant revenue.[11] The IRS should press ahead on these and other rebuilding efforts, further demonstrating to policymakers and the public what the IRS can deliver when it has the funding it needs.[12]

Moreover, the 2017 tax law’s individual income and estate tax cuts are set to expire in 2025, which is widely expected to spur legislative action.[13] Congress should use that opportunity to restore the $21 billion that was cut and create a permanent, mandatory funding stream to ensure the IRS avoids a steep funding cliff toward the end of the decade.