BEYOND THE NUMBERS

For Tax Day, 7 Charts on the 2017 Trump Tax Law and Why Congress Should Set a New Course

A high-stakes tax debate has begun over the scheduled expiration of the 2017 Trump tax law’s individual income tax and estate tax provisions at the end of 2025. Ahead of this year’s tax day, we are highlighting data showing why policymakers should use that debate to chart a new course for the nation’s revenue policies: the 2017 Trump tax law was skewed to the rich, eroded the revenue base, and failed to deliver its promised economic benefits. We close with a set of principles for policymakers to guide that course correction.

Trump Tax Law Is Skewed to the Rich

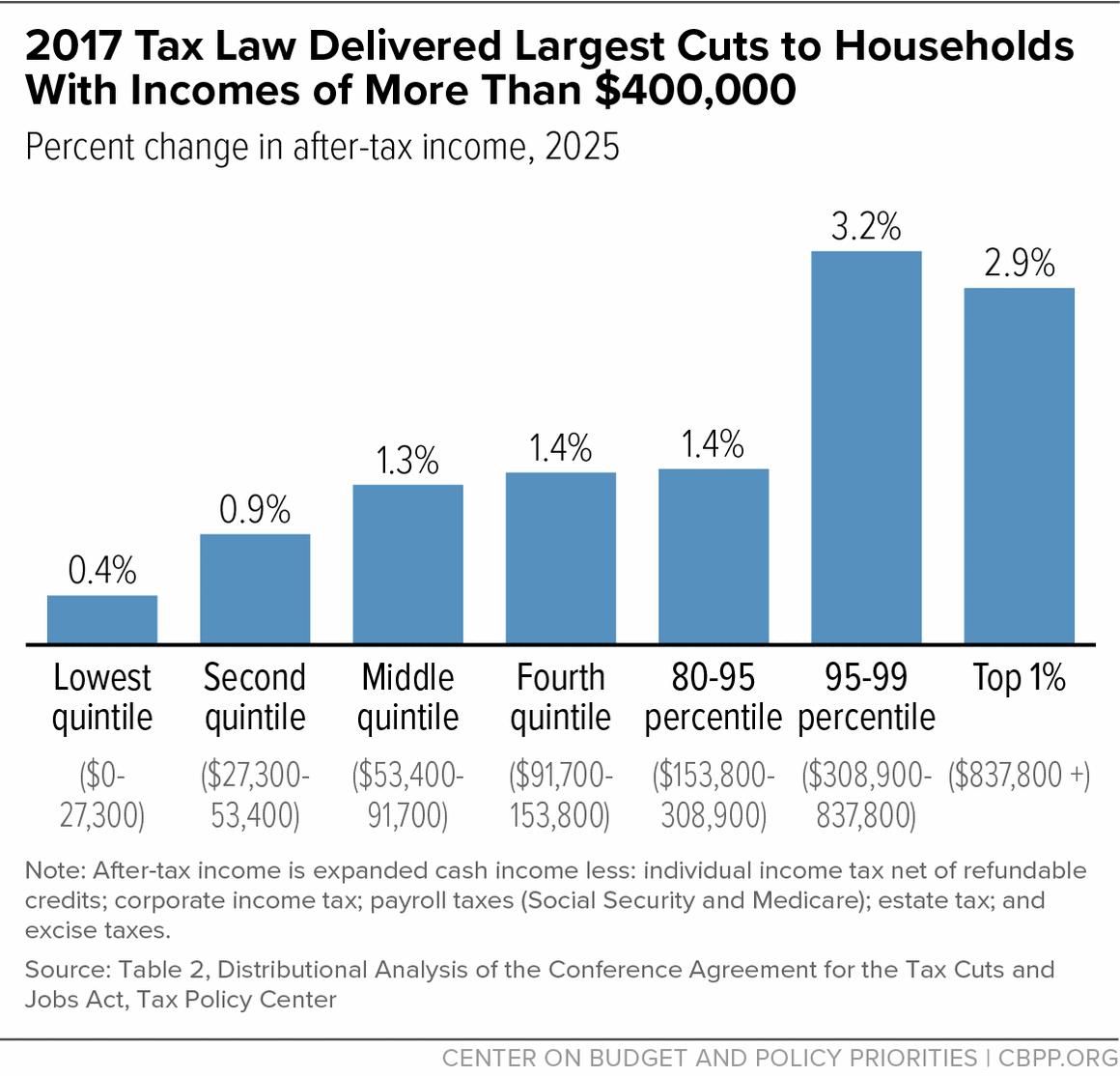

The 2017 law benefits high-income households far more than anyone else. In 2025, the tax cuts will average $61,090 for the top 1 percent of households (and $252,300 for the top one-tenth of 1 percent), compared to $70 for the bottom 20 percent. That’s because several costly provisions of the law — some of which expire after 2025 — skew heavily to the top. These include the cuts in individual tax rates, the 20 percent deduction for owners of certain pass-through businesses (which New York University law professor Daniel Shaviro has termed “the worst provision ever even to be seriously proposed in the history of the federal income tax”), and the further weakening of the estate tax.

When measured as a percentage of after-tax income, the biggest tax cuts are going to households in the 95-99th percentile, whose incomes are roughly between $400,000 and $1 million. This is important because the Biden Administration’s pledge not to raise taxes on those with incomes below $400,000 will likely feature prominently in the coming tax debate. The 95-99th percentile group is often referred to as the “upper middle class,” but in reality these households are very well off, with a median net worth over $3.9 million. The $400,000 threshold is quite high, and policymakers should resist any efforts to increase it.

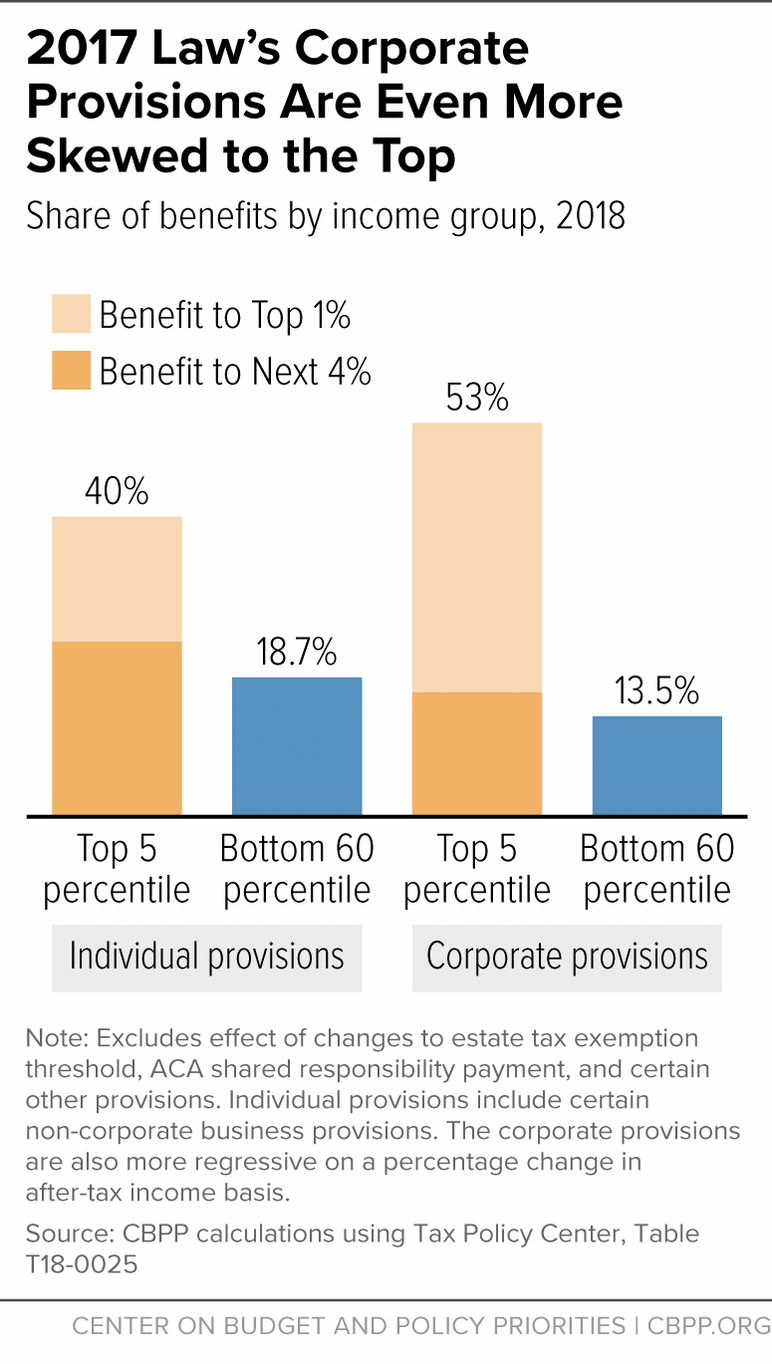

The 2017 law’s corporate tax cuts — including the deep cut in the corporate tax rate from 35 percent to 21 percent — are tilted even more heavily to wealthy people than its expiring individual income tax cuts, and the corporate tax cuts are permanent. As former House Speaker Paul Ryan recently acknowledged, congressional Republicans “made temporary [the tax cuts that] we thought could get extended; we made permanent what we thought might not get extended.” This cynical political calculation — making the less-popular corporate tax changes permanent to avoid having to debate them when the other provisions expired — should not prevent policymakers from revisiting the corporate tax cuts during the 2025 tax debate and paying for any that are extended.

Trump Tax Law Was Expensive and Further Eroded Our Revenue Base

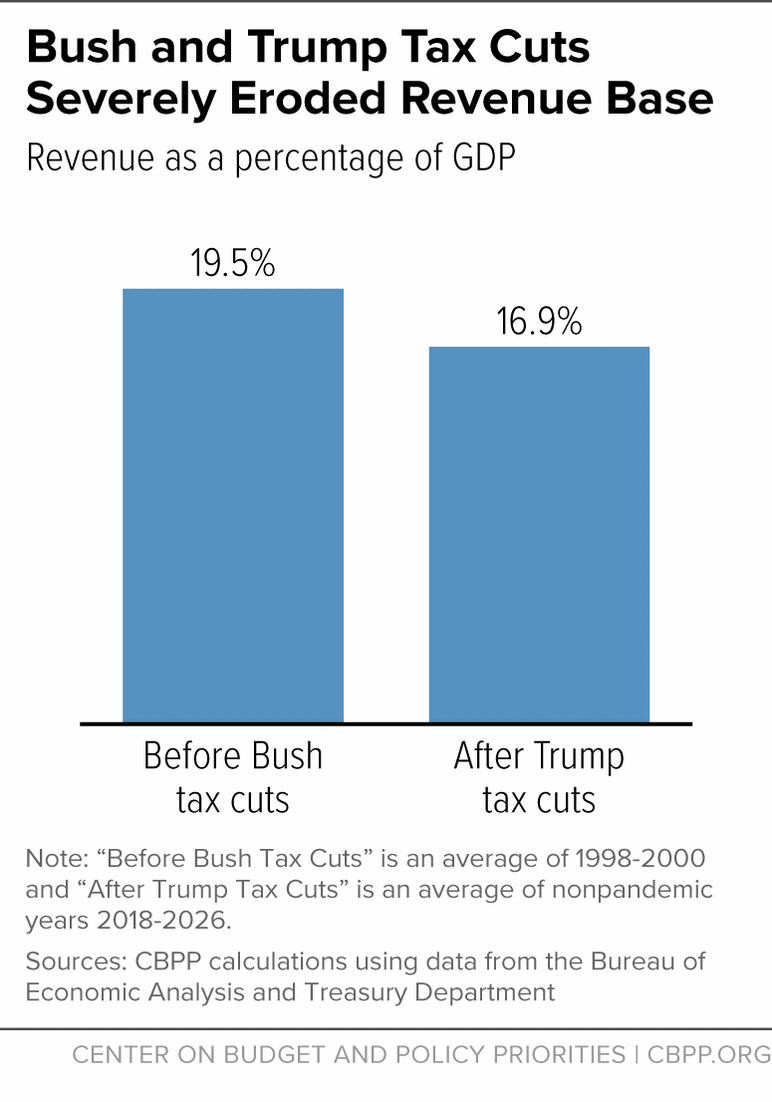

The nation needs more revenue, not less. When the 2001 Bush tax cuts were enacted, the baby boomers were in their prime working years. By contrast, in 2025 the youngest baby boomer will be 61 and the oldest 79; the share of the population above age 65 has risen sharply and will continue doing so. This will significantly increase the budgets of Medicare, Medicaid, and Social Security, requiring much more revenue.

Instead of helping prepare the nation for this long-expected demographic shift, the Bush and Trump tax cuts have severely eroded the federal revenue base. In the three years before the first Bush tax cuts, revenues averaged 19.5 percent of gross domestic product (GDP); from 2018 through 2026 (excluding pandemic years), they will average just 16.9 percent. This is far too little revenue for a country with an older population, a large military, and substantial investment needs in areas such as child poverty, where the U.S. rate exceeds most other developed countries.

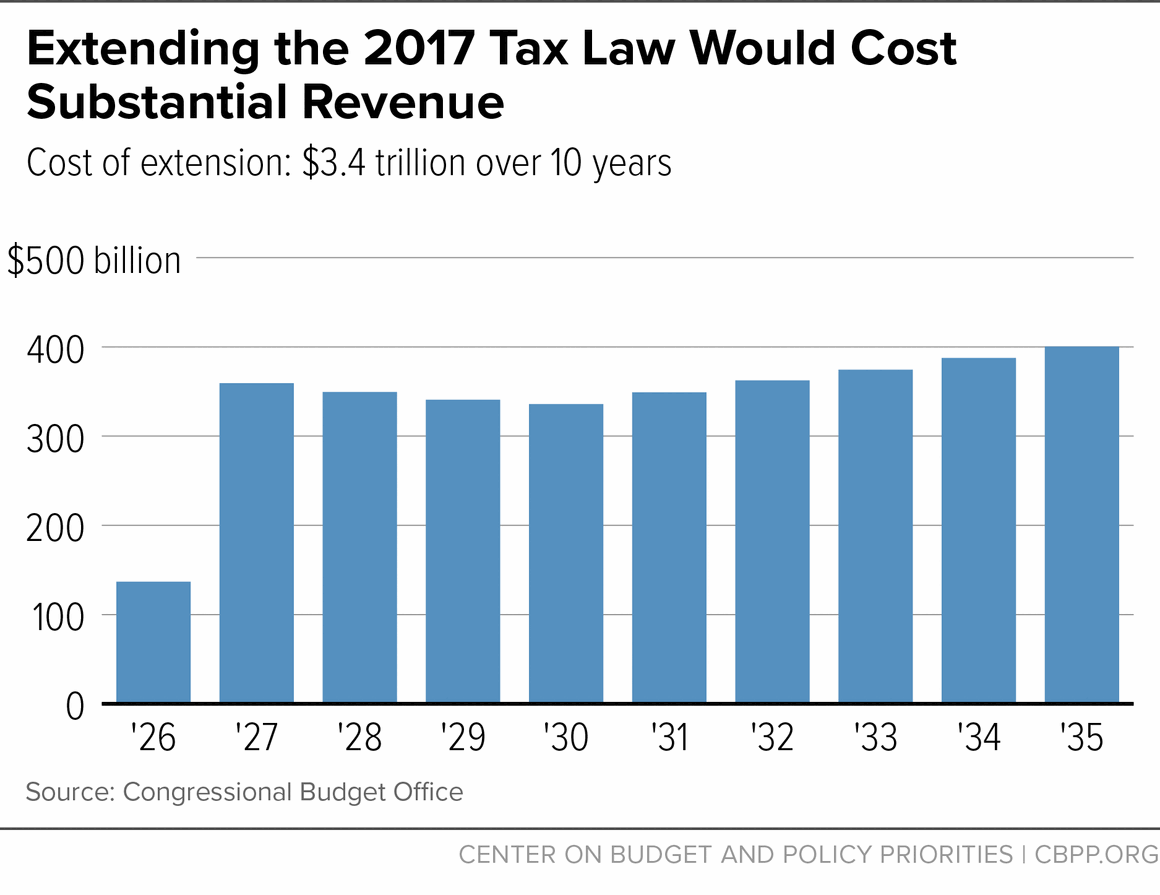

Given the need to raise revenues, making the 2017 tax law’s individual income and estate tax cuts permanent — which would cost roughly $3.4 trillion from 2026 to 2035, or roughly $350 billion a year beginning in 2027 — would be a costly mistake.

Trump Tax Law Failed to Deliver Its Promised Economic Benefits

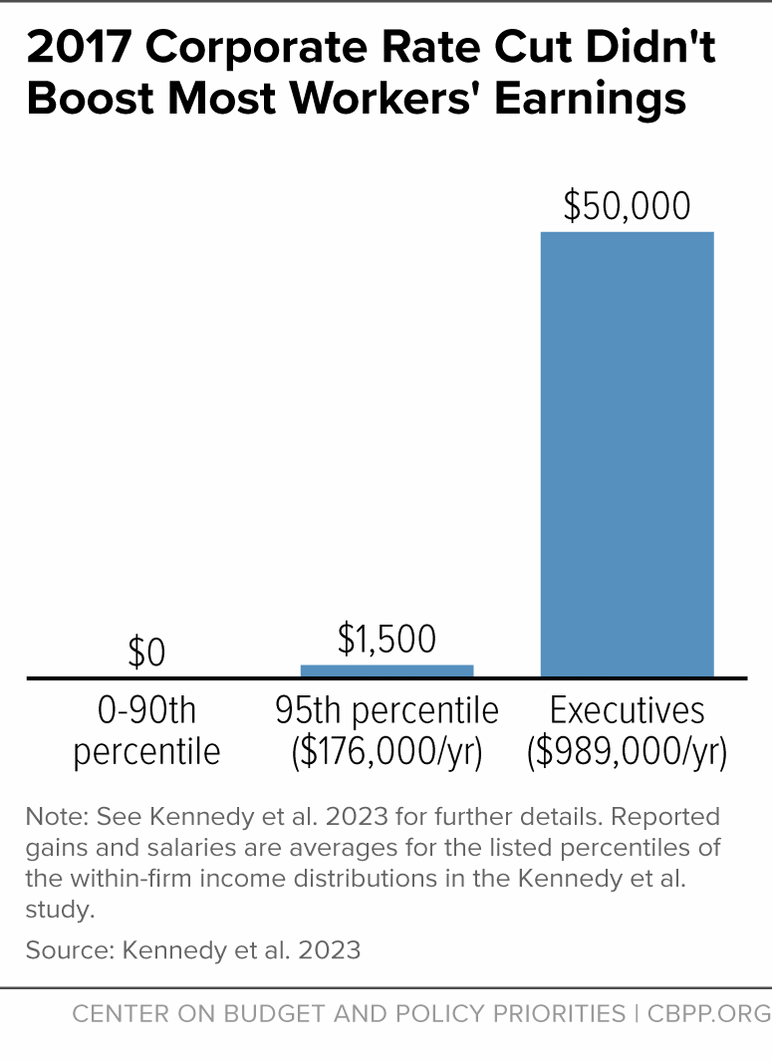

The 2017 tax law also failed to deliver the economic benefits its proponents promised. President Trump’s Council of Economic Advisers claimed the centerpiece corporate tax rate cut would “very conservatively” lead to a $4,000 boost in household income. But new research shows that workers who earned less than about $114,000 in 2016 saw “no change in earnings” from the corporate rate cut, while top executive salaries increased sharply. Like the Bush tax cuts, the 2017 tax cut was a trickle-down failure.

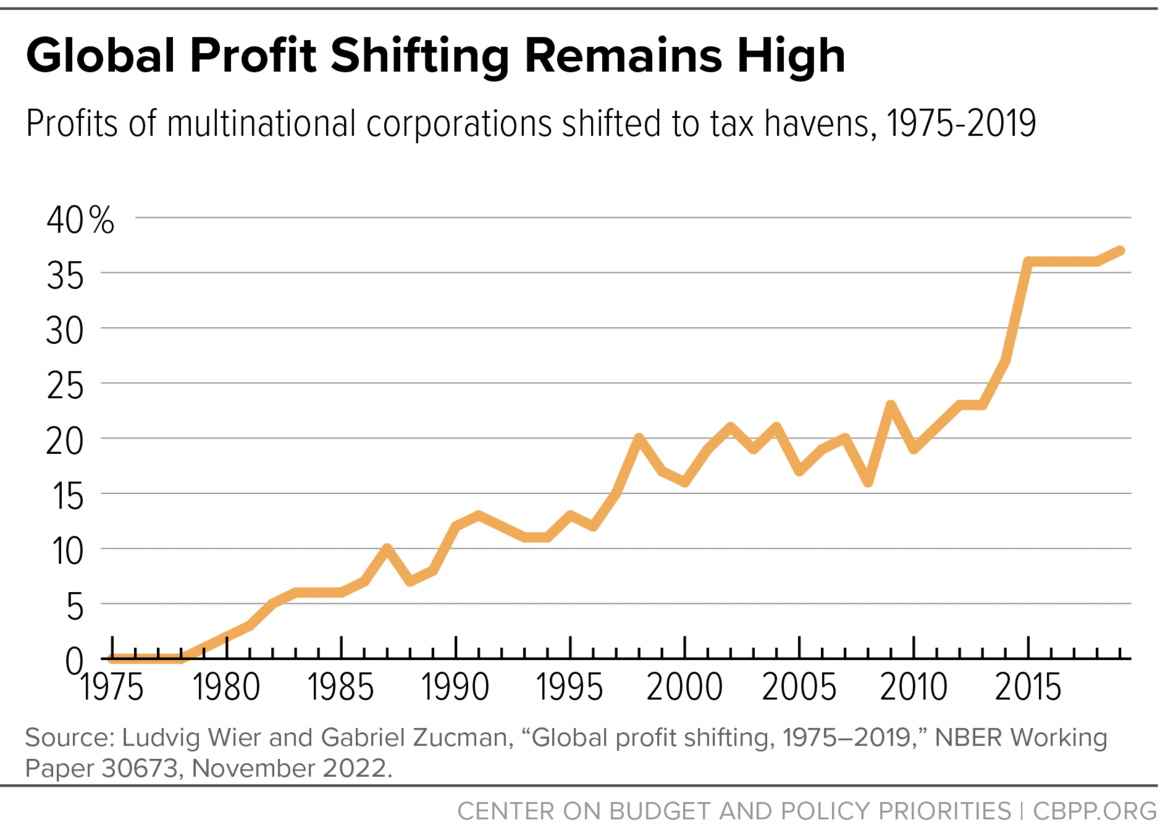

The 2017 tax law also largely failed to significantly reduce corporate profit shifting. The law made major, permanent changes to the tax code’s treatment of the foreign income of U.S.-based multinational corporations. While it exempted some of that income from U.S. tax, it added several provisions, including the global intangible low-taxed income (GILTI) minimum tax, to try to limit incentives for multinationals to shift profits to foreign tax havens. Then-Treasury Secretary Steven Mnuchin argued these changes would “bring trillions of dollars back on shore.” Unfortunately, the law left significant room for multinationals to continue avoiding taxes through profit shifting. In 2019, economists Ludvig Wier and Gabriel Zucman found “no discernible decline in global profit shifting or in profit shifting by U.S. multinationals” as a result of the 2017 international tax changes.

Core Principles for 2025 Tax Debate

Given the 2017 law’s skew to the top, high cost, and failure to deliver on its economic promises, policymakers should seize the opportunity the 2025 expirations provide and make a course correction in the nation’s revenue policies. This would mean reversing the regressive tilt of the 2017 law, raising more revenue, and prioritizing low- and moderate-income families instead of wealthy shareholders. Three core principles should guide this course correction:

- Tax cuts for people making over $400,000 should end on schedule.

- The tax system needs to raise more revenues from wealthy people and profitable corporations to offset any tax cuts extended or expanded for those with incomes below $400,000, to finance high-value investments in people and communities, and to improve our fiscal outlook.

- Top priorities for extending and expanding tax provisions in 2025 should be the Child Tax Credit, the Earned Income Tax Credit for adults not raising children, and the enhanced premium tax credits for Affordable Care Act marketplace coverage; increased revenues can also be used for other critical investments outside of the tax code.