- Home

- Federal Budget

- State Of The Union, President’s Budget B...

Commentary: State of the Union, President’s Budget Begin Debates on Critical Fiscal Policy Choices Policymakers Will Face in 2025

The upcoming State of the Union address and the release of the President’s Budget mark an important time to take stock of our priorities and consider the country we want to become. Congress is unlikely to engage in significant budget-related policymaking this year once it gets past 2024 appropriations and decides on the bipartisan tax bill. But the debates taking place now in Washington and across the country during the election season foreshadow critical fiscal policy decisions that will have to be made in 2025, regardless of the outcome of the fall elections.

In 2025, federal policymakers will have to make decisions that bear directly on a fundamental fiscal policy question: are we willing to raise revenues so we can invest in broadening opportunity and prosperity, improving well-being, and promoting equity? Or will we continue on a path of tax cuts that limit our investments, exacerbate inequality, and increase deficits and debt?

Critical decisions lie ahead in three areas in particular: tax policy, health care, and investments in people and communities.

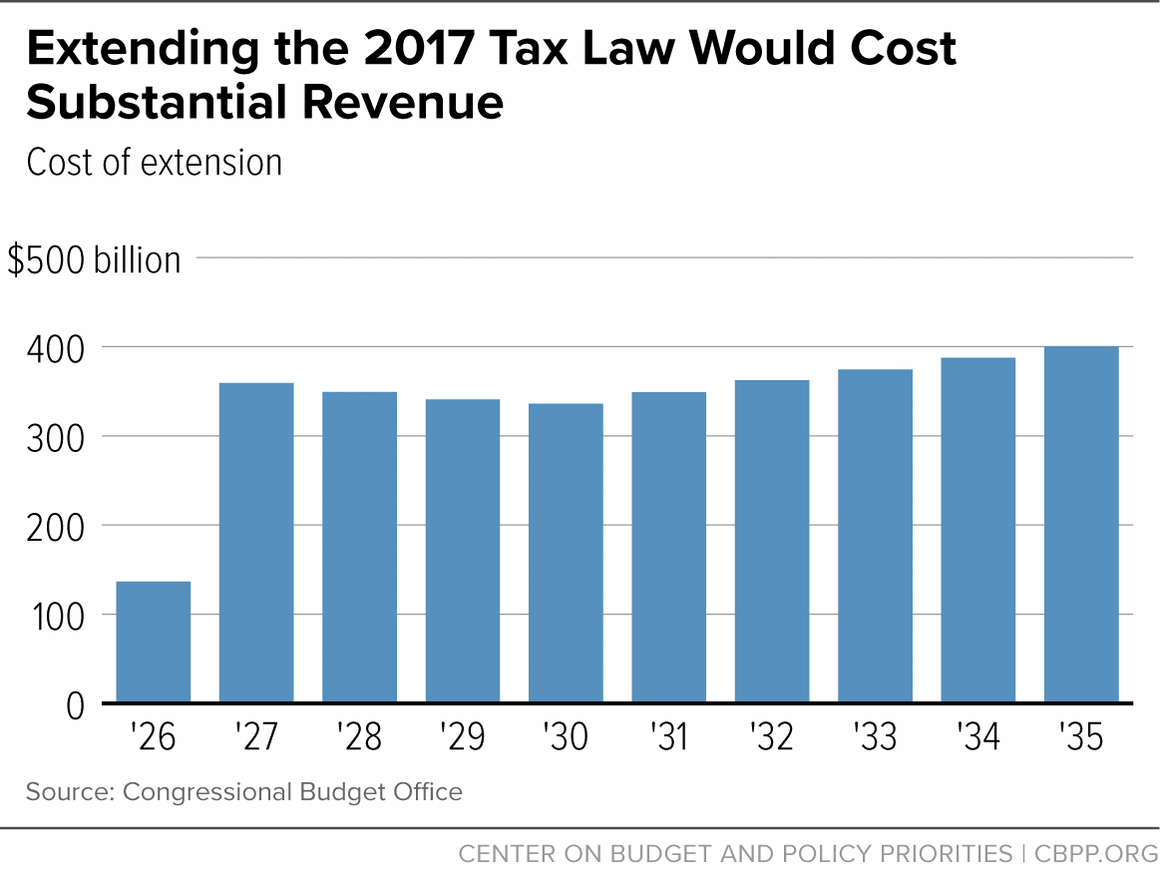

Tax policy. Congress will reevaluate our tax system’s adequacy and fairness next year, when large portions of the individual tax cuts enacted in 2017 are due to expire, along with some business tax cuts. The 2017 tax law was very expensive; extending all of the expiring provisions would cost some $3.4 trillion over the 2026-2035 period, or about $350 billion per year starting in 2027. (See Figure 1.) It was also heavily skewed toward wealthy people and profitable corporations.

The combination of tax cuts enacted under Presidents George W. Bush and Donald Trump have driven down revenues, limited our investments, and increased deficits. These deficits have too often led to misguided calls for austerity rather than for a reversal of costly tax cuts to support high-priority investments.

The nation faces a host of pressing national needs. Poverty spiked in 2022. Health care, housing, and child and family care remain unaffordable for millions of families. And we’ve only taken first steps to address climate change. Congress will have to decide whether to continue prioritizing tax cuts for those who need them the least and allowing profitable corporations to pay too little in taxes, or whether to make a course correction that raises revenues, invests in people and communities, and improves our fiscal outlook.

President Biden’s previous budgets called for such a course correction — fully paying for any extensions of provisions in the 2017 tax law and raising substantial revenues from wealthy people and profitable corporations. He has proposed using those revenues for much-needed investments in a range of areas — including reducing poverty and supporting health, child care and early learning, education, and the environment — while also reducing future economic risk by lowering deficits.

A further backdrop to next year’s revenue debate will be the need to address the debt limit again in 2025. The agreement struck in May 2023 only suspended the debt limit for two years. Congress will once again have to raise or suspend the debt limit or the nation will default, with serious economic consequences. Last year, House Republicans tried to use threat of default as leverage to secure a host of harmful cuts in assistance for people with low incomes and in domestic appropriated programs. While the final agreement rejected most of the worst demands, it included cuts to food assistance and tight caps on domestic program funding, and the brinkmanship damaged our credit rating. Policymakers can and must do better in 2025.

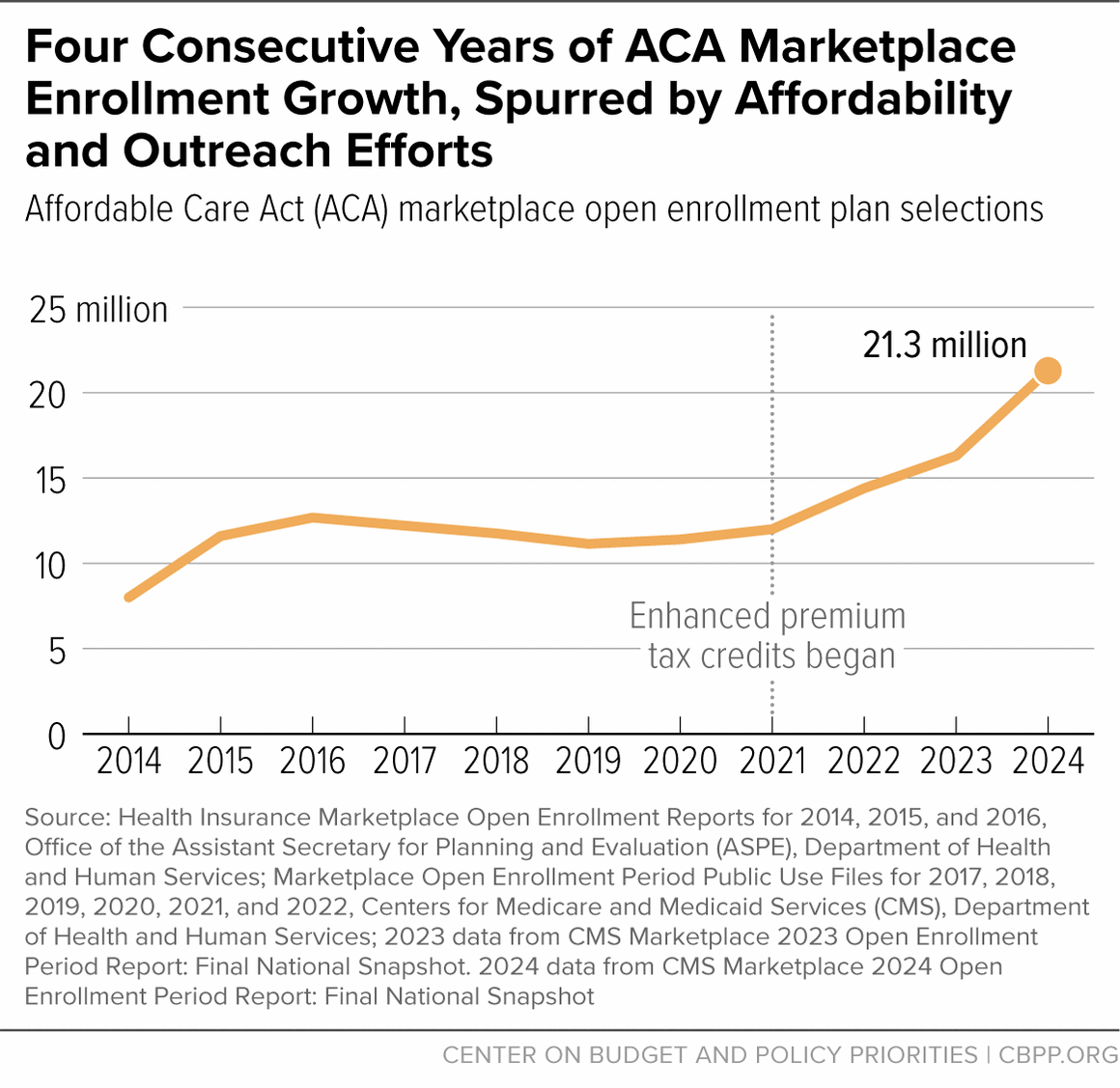

Health care. A record high number of people — more than 21 million — signed up for an Affordable Care Act (ACA) marketplace health plan during the open enrollment period for 2024. (See Figure 2.) This was 9 million more people than signed up for 2021. Fully 4 in 5 marketplace enrollees were able to find a plan for $10 or less.

The sharp rise in enrollment is due in large part to expanded financial assistance for marketplace coverage provided in the American Rescue Plan, which was then extended in the Inflation Reduction Act. In 2025, the expanded assistance expires. Congress and the President will have to decide whether to continue the assistance or allow it to end and see coverage fall again. Prior Biden budgets have called for making this financial assistance permanently available (and paying for the increased costs).

Executive actions also have a significant effect on health coverage. The Biden Administration has made it easier for people to enroll by lengthening the open enrollment period, allowing people with low incomes and people losing Medicaid coverage more time to enroll, making it easier for families to qualify for financial assistance for marketplace coverage, and increasing funding for outreach and enrollment efforts. These actions followed a series of steps the Trump Administration took that undermined marketplace enrollment, including shortening the open enrollment period, defunding outreach and enrollment assistance, and promoting subpar plans that don’t provide ACA benefits and consumer protections.

Further legislative action will be needed to broaden coverage and improve affordability. In 2022, even with pandemic coverage measures in place and expanded financial assistance for marketplace coverage, some 26 million people lacked coverage. Congress should fill this gap, starting by ensuring access to coverage for the more than 1.6 million people who lack an affordable pathway to coverage because their states have refused to adopt the ACA’s Medicaid expansion. In addition, too many older adults and people with disabilities can’t access the home-based care they need. And many people who have coverage face significant affordability issues.

Investing in people and communities. While we’ve made progress against poverty over the last five decades, we have a long way to go to build a nation where everyone, regardless of background or identity, has the resources they need to thrive. Each year, Congress and the President must agree on annual appropriations bills that can help address these and other priorities. But broader action is needed in 2025 and beyond to confront the serious challenges facing many people and communities across the U.S. For example, investments are needed to:

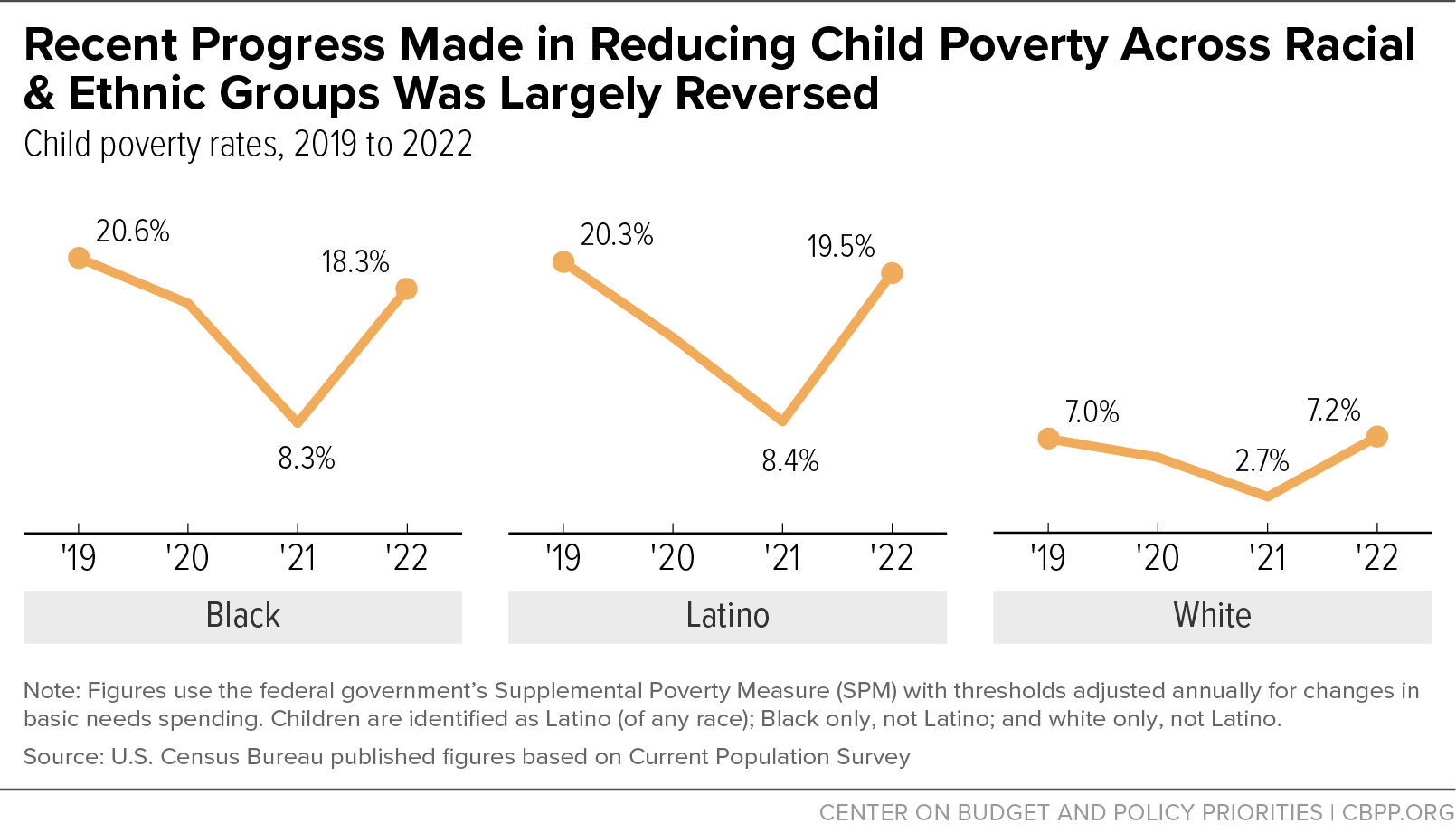

- Reduce child poverty: After poverty rates fell to historically low levels in 2021, poverty spiked, with 1 in 8 children living in families with incomes below the poverty line in 2022. (See Figure 3.) Poverty affects children of all races and ethnicities, but Black, Latino, and Indigenous children are overrepresented, due to a long history of discrimination and systemic barriers to opportunity that have limited economic opportunity for many families of color. An expanded Child Tax Credit and other investments can reduce child poverty and improve long-term outcomes.

- Reduce housing hardship: Some 12.1 million households paid more than half their income for rent in 2022, in part because funding for housing assistance is so inadequate that just 1 in 4 households eligible for assistance receives it.

- Increase access to child care: Millions of families don’t have access to affordable, high-quality child care, with only about 1 in 6 children eligible for child care assistance under federal rules receiving it prior to pandemic relief measures (which have now expired).

- Expand paid leave: The U.S. stands alone among wealthy nations in lacking a national paid leave program, with only 1 in 5 workers with wages at or below the median having access to paid family leave.

- Increase food security: In 2022, food insecurity rose with the end of many pandemic relief measures. Some 1 in 8 households experienced food insecurity in 2022. As we saw in the pandemic, investments in food assistance and anti-poverty measures can drive down food hardship.

This list is not exhaustive — investment in areas such as education and the environment are also needed to improve well-being, support healthy communities, and broaden prosperity.

Underinvesting in people and communities increases hardship and limits access to opportunity in ways that hurt the country as a whole. On the positive side, we have substantial evidence and experience about what works, including from pandemic-related measures that drove down poverty and from state and local action in areas such as paid leave.

Ultimately fiscal policy is about who and what we invest in as a country and how we raise the revenues to finance those investments. The choices we make will shape the country we become. The State of the Union and the President’s 2025 budget plan are opening salvos in a year-long conversation leading up to critical decisions that policymakers will have to make in 2025.

More from the Authors