BEYOND THE NUMBERS

April 4, 2024: This post has been updated.

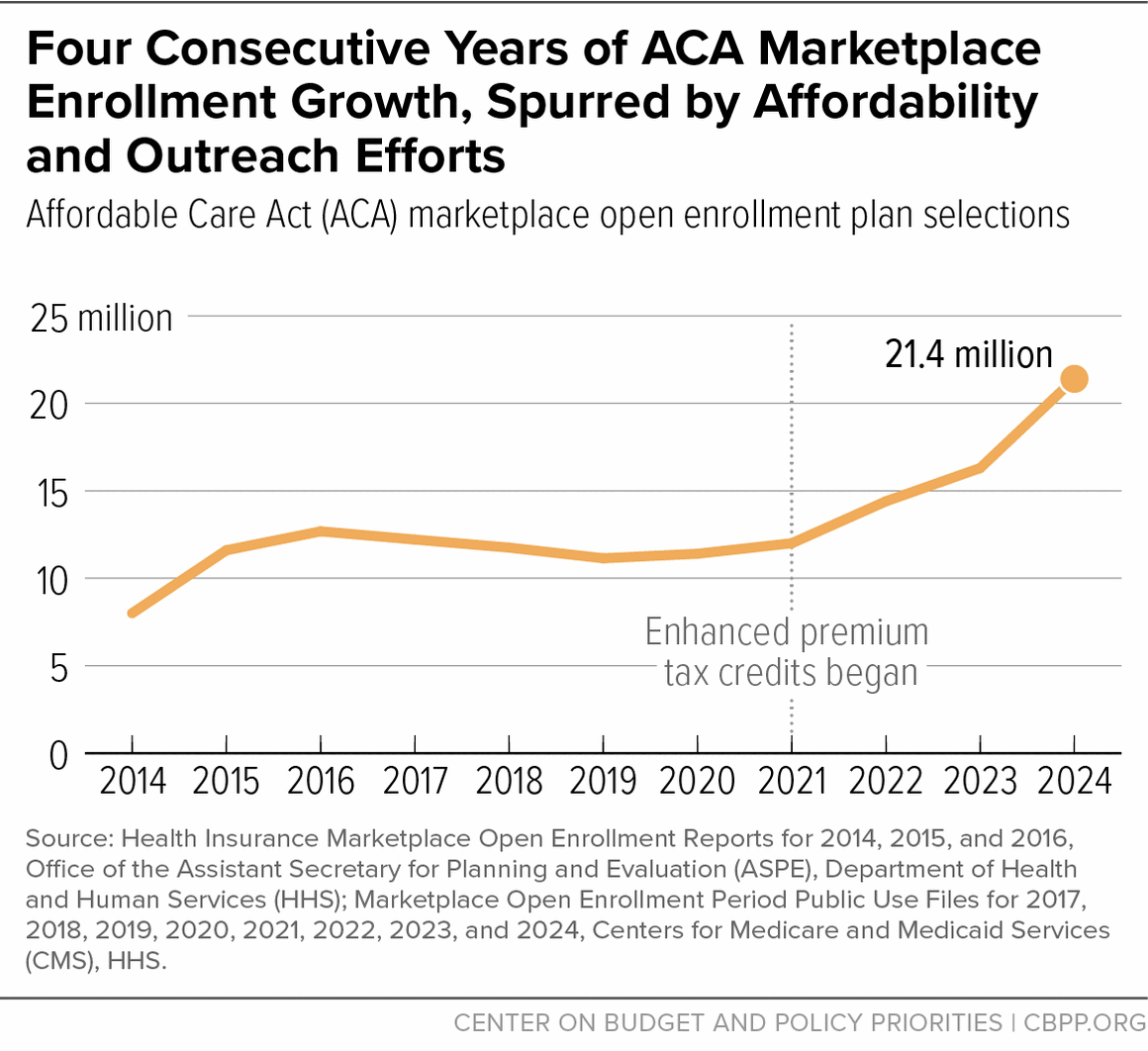

When the annual open enrollment period for Affordable Care Act (ACA) marketplace coverage ended earlier this month, a record-breaking 21.4 million people had selected a marketplace health insurance plan for 2024. This is a 30 percent increase over last year and is the fourth consecutive year of record ACA marketplace enrollment.

What’s driving these historic enrollment rates? Over the past four years, federal policy improvements have made coverage more affordable, and they’ve made it easier for people to get help with the application and plan selection process and to enroll.

More affordable coverage. Most importantly, the amount of financial assistance available to marketplace enrollees to lower their premiums rose in 2021 as part of the American Rescue Plan. The Inflation Reduction Act extended these enhancements through 2025. These changes greatly reduced what people pay for a plan, with the lowest-income people eligible to get a silver-level plan without paying any premium.

Those laws also removed the income cap on premium tax credit (PTC) eligibility (previously set at four times the federal poverty level, or about $58,000 a year for an individual), ensuring that no one pays more than 8.5 percent of their income for the silver-level benchmark plan. These enhancements have driven consistent enrollment growth since 2021.

Although data for 2024 aren’t yet available, more than 90 percent of marketplace enrollees received PTCs in 2023. If 2023 HealthCare.gov enrollees chose a plan in the same metal tier for 2024, two-thirds could have selected a plan for less than $10 per month, according to estimates from the Department of Health and Human Services (HHS).

Additionally, changes to PTC eligibility last year — the so-called “family glitch fix” — are allowing more people with unaffordable offers of employer coverage to qualify for PTCs. The threshold used to determine whether an employer offer is considered unaffordable also dropped for 2024, from 9.12 percent of household income to 8.39 percent, potentially allowing more households to qualify for PTCs.

- Easier to get help enrolling. Personalized assistance with the application and plan selection process is critical for many enrollees, especially people with limited English proficiency, people who are immigrants (whose application and eligibility verification processes can be more complex), and people with other complex eligibility situations. Federal grants to Navigator organizations rose substantially in 2021 and were awarded for a three-year term (through mid-2024). This has increased outreach and enrollment assistance resources. The multi-year commitment of stable funding has also helped programs sustain their coalitions, retain staff, and plan for the future.

- Easier to enroll. Changes to special enrollment rules in recent years have let people with low incomes (up to about $22,000 for a single adult) enroll in ACA marketplace coverage at any time during the year. These individuals qualify for marketplace plans with a free or very low premium, but they may have had difficulty enrolling during standard timelines due to administrative or logistical barriers or lack of awareness. Between October 2022 and August 2023, 1.3 million people in HealthCare.gov states used these changed rules to enroll in ACA marketplace coverage. These individuals are then automatically re-enrolled in coverage for the coming year, contributing to overall marketplace enrollment growth.

The marketplace open enrollment period coincided with a period of unprecedented Medicaid coverage loss nationwide. Starting in the spring of 2023, states resumed Medicaid redeterminations following the end of a continuous coverage policy that had, since 2020, kept people from losing Medicaid to reduce coverage disruptions during the COVID-19 pandemic.

Many of the more than 14 million people who have lost Medicaid or the Children’s Health Insurance Program coverage since states resumed redeterminations remain eligible and have lost coverage for paperwork reasons. However, some of them are newly eligible for marketplace coverage, and this may be contributing to the historic marketplace enrollment numbers for 2024. Mid-year marketplace enrollment (between March 31 and September 30) was up by more than 5 percent in 2023, according to KFF estimates, likely driven by people losing Medicaid.

Nearly one-third of the people expected to lose Medicaid coverage during unwinding would be eligible for ACA marketplace coverage with PTCs to lower their premium costs HHS estimated. And more than 60 percent of these individuals would be eligible for a plan where the PTC covers the entire premium as a result of the enhanced PTC.

Due to lags in data processing, we don’t know yet what share of people who have lost Medicaid since unwinding began subsequently enrolled in an ACA marketplace plan. Through the end of September, so-called “conversion rates” from Medicaid to ACA marketplace coverage were lower than expected, but once data from November through January (marketplace open enrollment months) are taken into account, these rates will likely increase.

Coverage in the ACA marketplaces started in January 2014. On this tenth anniversary, marketplaces are working as intended, serving as a vital source of coverage for people with low and moderate incomes, especially as their life circumstances — jobs, income, and eligibility for other forms of coverage — change.