BEYOND THE NUMBERS

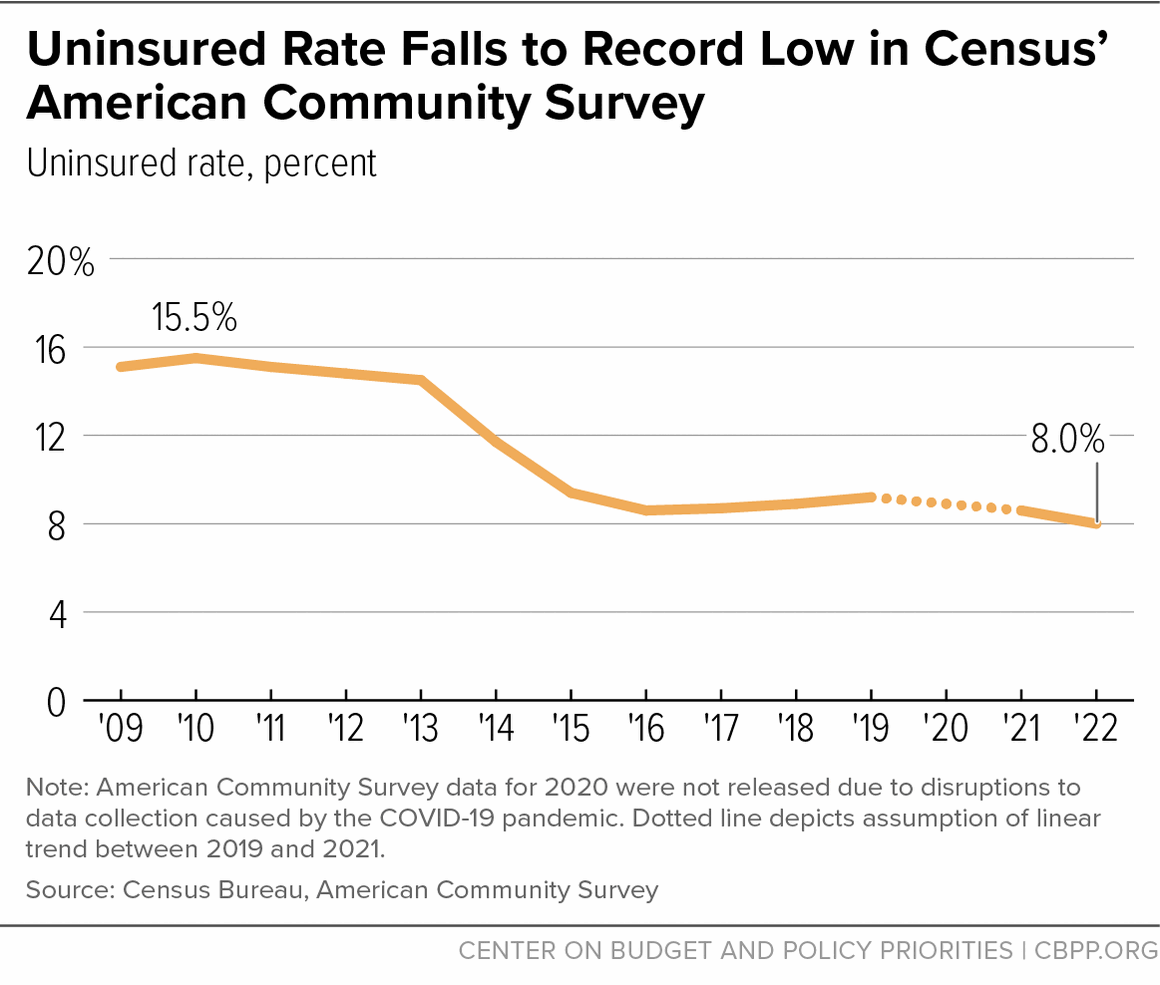

The uninsured rate fell to an all-time low of 8.0 percent in 2022, according to data released today in the Census Bureau’s American Community Survey (ACS). That’s well below the prior record of 8.6 percent reached in both 2021 and 2016. It represents 1.9 million fewer people who lacked health coverage in 2022 relative to 2021. From 2019 to 2022, the uninsured rate fell from 9.2 percent to 8.0 percent, and the number of people lacking coverage fell by 3.3 million even as the total population increased.

The reduction in the uninsured rate shows that policy can drive major coverage gains. In particular, the drop in the uninsured rate was driven by pandemic-era Medicaid protections, Affordable Care Act (ACA) Medicaid expansions, and policies that improved access and affordability in the ACA marketplace. Although the recent expiration of pandemic-era Medicaid protections is now causing many to lose their coverage, the policies that led to 2022’s historically low uninsured rate provide a roadmap to future coverage gains.

The reductions in the uninsured rate over the past three years extend the large coverage gains that occurred in the initial years after implementation of the ACA’s major provisions in 2014. Today’s ACS data follow recent releases from two other surveys, the National Health Interview Survey and the Current Population Survey, which also showed record low uninsured rates in 2022.

The coverage gains were largely driven by record enrollment in ACA marketplace coverage and Medicaid coverage. Gains in marketplace coverage were prompted by enhanced premium tax credits that were first enacted in March 2021, along with expanded enrollment periods and record investments in outreach and enrollment assistance through the federally funded Navigator program. Average marketplace premiums after tax credits were 21 percent lower in February 2023 than in February 2021, before the tax credit enhancements. A record 15.7 million people were enrolled in February 2023, up 40 percent from the 11.2 million people enrolled in February 2021.

Gains in Medicaid coverage were driven by the pandemic-related Medicaid continuous coverage protection that barred states from terminating Medicaid coverage beginning in March 2020. That protection ended April 1, 2023. Over the subsequent 18 months, the unwinding of the protection could cause 15.5 million people to lose Medicaid coverage and 6.2 million to become uninsured, the Congressional Budget Office projects. As of September 8, about 6 million people have been disenrolled from Medicaid, according to data from 48 states and the District of Columbia.

The declines in the uninsured rate were largest among lower-income groups, consistent with the fact that the Medicaid continuous coverage provision and recent marketplace policies have been particularly helpful for people with low and moderate incomes who do not have access to affordable coverage through their employers.

The number of uninsured people fell by 1.4 percentage points to a record low among people with incomes below 138 percent of the poverty threshold (roughly $32,500 for a family of three), which is generally used as the eligibility threshold for Medicaid coverage in states that have expanded Medicaid. The uninsured rate fell by 0.8 percentage points among people with incomes at 138 to 399 percent (roughly $32,500 to $94,100 for a family of three) of the poverty threshold. Meanwhile, the uninsured rate held roughly steady among people with incomes at or above 400 percent of the poverty threshold, who already have a relatively low uninsured rate.

Differences between some racial and ethnic groups narrowed. The uninsured rates for Black people and Latino people, groups with higher uninsured rates due to systemic racism and discrimination in areas such as education and employment, each fell by 0.9 percentage points to all-time lows. The uninsured rate for American Indian and Alaska Native people, who also have high uninsured rates and tend to be employed in jobs that do not offer employer coverage, fell by 1.1 percentage points to a record low. The uninsured rates for Asian people and white people each fell by 0.4 percentage points, also reaching record lows.

Trends may differ among the racial or ethnic groups that comprise each broader category (e.g., Korean within the Asian category); uninsured rates for a larger number of groups will be available when the Census Bureau releases ACS microdata in October.

The 2022 ACS data also show the large and positive impacts of Medicaid expansion on insurance coverage. The two states that adopted the ACA Medicaid expansion in 2021 — Oklahoma and Missouri — saw large declines in uninsured rates. The uninsured rates of people in Oklahoma and Missouri declined by 2.1 and 0.8 percentage points, respectively.

This is consistent with the fact that since they each expanded, administrative data show that Medicaid enrollment increased far more in Oklahoma and Missouri than in any other state, and numerous studies show that Medicaid expansion boosts overall coverage. Most recently, South Dakota expanded Medicaid in 2023, and North Carolina adopted expansion but is still finalizing the implementation date.

Looking ahead, the enhanced marketplace premium tax credits — set to expire after 2025 — should be made permanent to maintain and build upon gains in coverage and affordability in the ACA marketplace. Expanded marketplace enrollment periods, such as one implemented in 2022 that allows year-round enrollment for certain people with low incomes in states that use the HealthCare.gov platform, should be continued and broadened to include more enrollees. And increased investments in outreach and enrollment assistance should be continued.

While the Medicaid continuous coverage protection was temporary, its success put a spotlight on other policies that would help make permanent improvements in access to coverage. The protection temporarily eliminated churn, in which eligible people lose coverage at renewal and have to reapply, which historically has caused frequent and harmful gaps in coverage. States can strengthen Medicaid and reduce churn in the long run through policies that reduce administrative hurdles, improve communication with enrollees, and streamlineenrollment and renewal processes. States also can seek federal approval — or Congress could authorize states — to implement continuous eligibility periods for children up to age 6 or one-year continuous eligibility for adults.

Finally, policymakers should eliminate immigration-related barriers to affordable health coverage and also close the Medicaid coverage gap to provide a pathway to coverage for people with incomes below the poverty level in the states that still refuse to enact the ACA Medicaid expansion. People in the coverage gap — 60 percent of whom are people of color — are ineligible for both Medicaid and financial assistance in the marketplace despite having incomes below the poverty level.

More people are becoming uninsured right now due to the unwinding of the Medicaid continuous coverage protection. But the policies that led to a record low uninsured rate in 2022 offer a roadmap for achieving historically low uninsured rates on an ongoing basis.