Recovery Proposals Adopt Proven Approaches to Reducing Poverty, Increasing Social Mobility

End Notes

[1] Liana Fox, “The Supplemental Poverty Measure: 2019,” U.S. Census Bureau, September 2020, https://www.census.gov/content/dam/Census/library/publications/2020/demo/p60-272.pdf.

[2] For additional details on data by race and ethnicity, see Appendix.

[3] Raj Chetty, “Improving Opportunities for Economic Mobility: New Evidence and Policy Lessons,” Federal Reserve Bank of St. Louis, 2016, https://www.stlouisfed.org/~/media/files/pdfs/community%20development/econmobilitypapers/section1/econmobility_1-1chetty_508.pdf; Raj Chetty et al., “Race and Economic Opportunity in the United States: An Intergenerational Perspective,” December 26, 2019, https://academic.oup.com/qje/article/135/2/711/5687353.

[4] National Academies of Sciences, Engineering, and Medicine, A Roadmap to Reducing Child Poverty, The National Academies Press, 2019.

[5] National Academies of Sciences, Engineering, and Medicine, “Ten Policy and Program Approaches to Reducing Child Poverty,” A Roadmap to Reducing Child Poverty, The National Academies Press, 2019.

[6] Chuck Marr et al., “Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent,” CBPP, May 24, 2021, https://www.cbpp.org/research/federal-tax/congress-should-adopt-american-families-plans-permanent-expansions-of-child.

[7] Ibid.

[8] H. Luke Shaefer and Kathryn J. Edin, “A Simple Approach to Ending Extreme Poverty,” Atlantic, June 2021, https://www.theatlantic.com/magazine/archive/2021/06/how-to-end-extreme-child-poverty/618720/.

[9] H. Luke Shaefer et al., “A Universal Child Allowance: A Plan to Reduce Poverty and Income Instability Among Children in the United States,” RSF: The Russell Sage Foundation Journal of the Social Sciences, Vol. 4, No. 2, 2018, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6145823/.

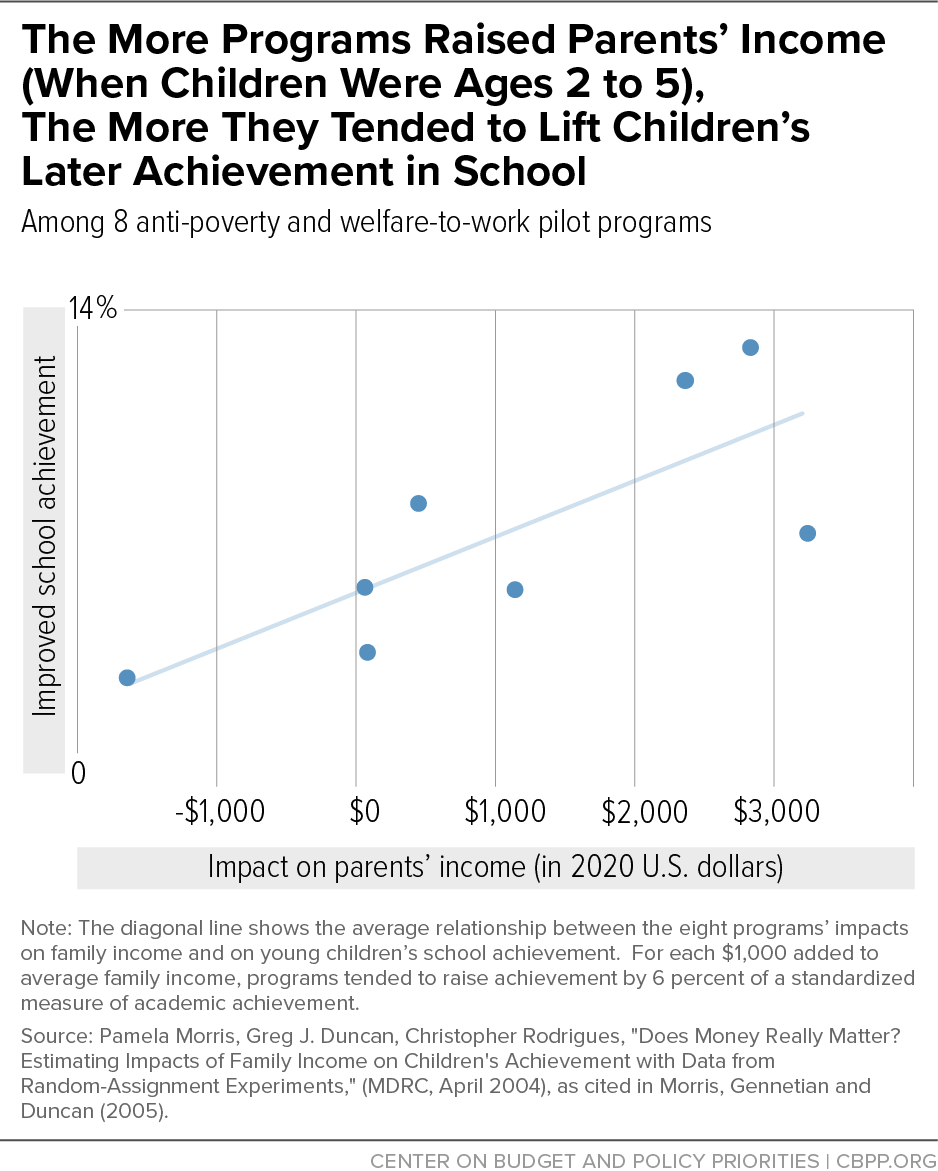

[10] Greg J. Duncan, Pamela A. Morris, and Chris Rodrigues, “Does money really matter? Estimating impacts of family income on children’s achievement with data from random-assignment experiments,” MDRC, April 2004; Greg J. Duncan, Pamela A. Morris, and Chris Rodrigues, “Does money really matter? Estimating impacts of family income on young children’s achievement with data from random-assignment experiments,” Developmental Psychology, Vol. 47, No. 5, 2011, https://pubmed.ncbi.nlm.nih.gov/21688900/.

[11] Kevin Milligan and Mark Stabile, “Do Child Tax Benefits Affect the Well-Being of Children? Evidence from Canadian Child Benefit Expansions,” American Economic Journal: Economic Policy, Vol. 3, No. 3, August 2011, https://www.aeaweb.org/articles?id=10.1257/pol.3.3.175.

[12] Randall K. Q. Akee et al., “Parents’ Income and Children’s Outcomes: A Quasi-Experiment,” American Economic Journal: Applied Economics, Vol. 2, No. 1, January 2010, https://pubmed.ncbi.nlm.nih.gov/20582231/.

[13] Raj Chetty, John N. Friedman, and Jonah Rockoff, “New Evidence on the Long-Term Impacts of Tax Credits,” Internal Revenue Service, November 2011, https://www.irs.gov/pub/irs-soi/11rpchettyfriedmanrockoff.pdf.

[14] Chloe N. East, “The Effect of Food Stamps on Children’s Health: Evidence from Immigrants’ Changing Eligibility,” University of Colorado Denver, September 2, 2016, http://www.chloeneast.com/uploads/8/9/9/7/8997263/east_jmp.pdf.

[15] Hilary Hoynes, Diana Whitmore Schanzenbach, and Douglas Almond, “Long-Run Impacts of Childhood Access to the Safety Net,” American Economic Review, Vol. 106, No. 4, April 2016, https://www.aeaweb.org/articles?id=10.1257/aer.20130375.

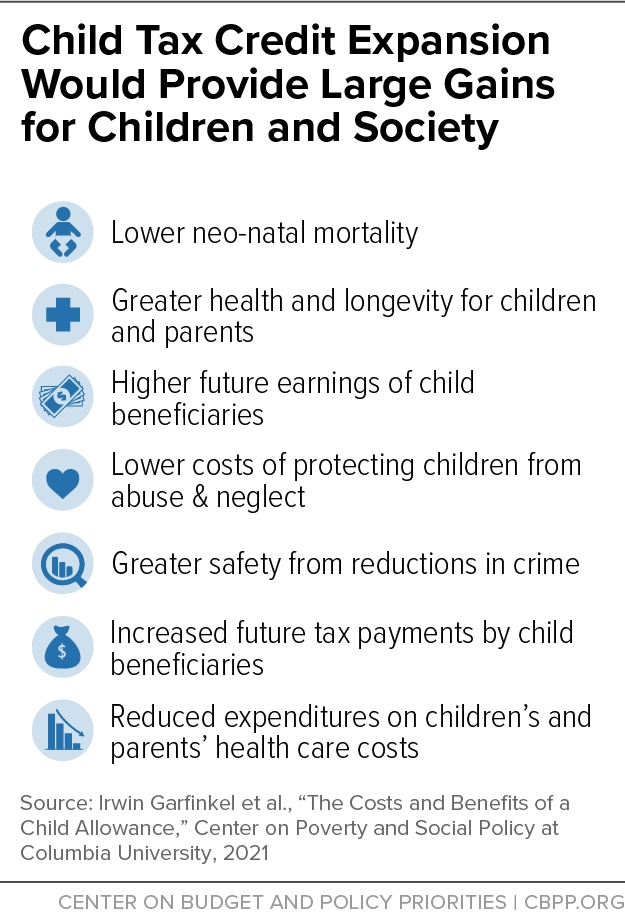

[16] Irwin Garfinkel et al., “The Costs and Benefits of a Child Allowance,” Center on Poverty and Social Policy (CSSP) at Columbia University, Vol. 5, No. 1, February 18, 2021, https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/602ec9c7ddddd01cd29430e1/1613679049611/Child-Allowance-CBA-brief-CPSP-2021.pdf.

[17] Michael Baker, Derek Messacar, and Mark Stabile, “The Effects of Child Tax Benefits on Poverty and Labor Supply: Evidence from the Canada Child Benefit and Universal Child Care Benefit,” National Bureau of Economic Research (NBER), Working Paper 28556, March 2021, https://www.nber.org/papers/w28556.

[18] The NAS report estimates that 25.49 million people in families below 200 percent of the Supplemental Poverty Measure would be employed after the enactment of a $3,000-per-child allowance. That compares to 25.61 million people employed in such families under existing policy. The NAS report estimates that 4.55 million people in families below 200 percent of the Supplemental Poverty Measure would opt to work fewer hours, thereby decreasing their earnings. For these figures, see “CA Main Sheet” tab in Appendix E: TRIM3 Summary Tables found here: https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty#resources. Below 200 percent of the Supplemental Poverty Measure is roughly equivalent to the lower half of the disposable income distribution. See Danilo Trisi and Ife Floyd, “Benefits of Expanding Child Tax Credit Outweigh Small Employment Effects,” CBPP, March 1, 2021, https://www.cbpp.org/research/federal-tax/benefits-of-expanding-child-tax-credit-outweigh-small-employment-effects#_ftn16.

[19] Will Fischer, “Research Shows Housing Vouchers Reduce Hardship and Provide Platform for Long-Term Gains Among Children,” CBPP, updated October 7, 2015, https://www.cbpp.org/research/housing/research-shows-housing-vouchers-reduce-hardship-and-provide-platform-for-long-term.

[20] Danilo Trisi et al., “Recovery Legislation Provides Historic Opportunity to Advance Racial Equity,” CBPP, June 2, 2021, https://www.cbpp.org/research/poverty-and-inequality/recovery-legislation-provides-historic-opportunity-to-advance.

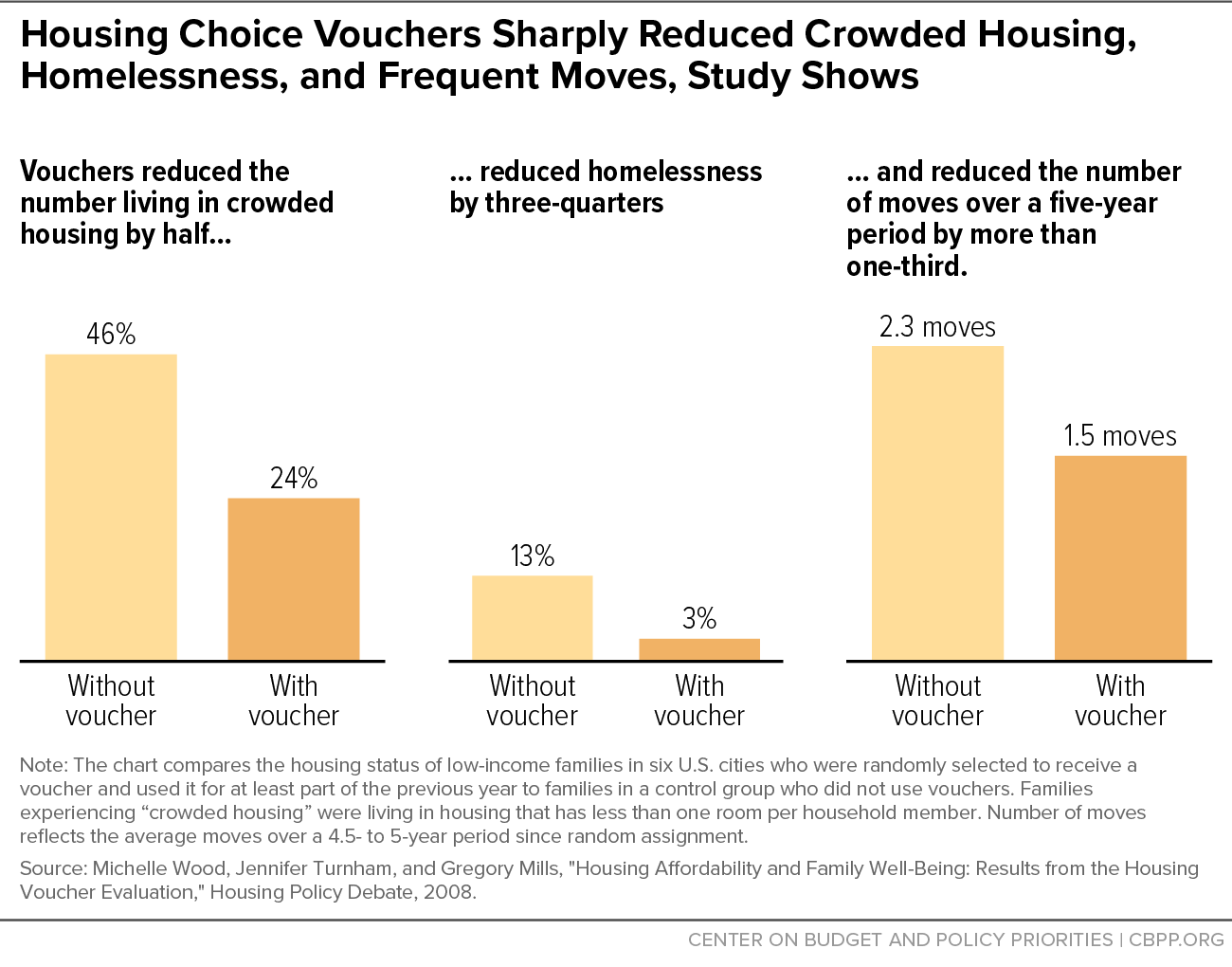

[21] Michelle Wood, Jennifer Turnham, and Gregory Mills, “Housing Affordability and Family Well-Being: Results from the Housing Voucher Evaluation,” Housing Policy Debate, Vol. 19, No. 2, 2009, https://www.tandfonline.com/doi/abs/10.1080/10511482.2008.9521639.

[22] Daniel Gubits et al., “Family Options Study: Short-Term Impacts of Housing and Services Interventions for Homeless Families,” prepared for Department of Housing and Urban Development Office of Policy Development and Research, July 2015, http://www.huduser.org/portal/sites/default/files/pdf/FamilyOptionsStudy_final.pdf.

[23] Daniel Gubits et al., “Family Options Study: 3-Year Impacts of Housing and Services Interventions for Homeless Families,” prepared for Department of Housing and Urban Development, October 2016, https://www.huduser.gov/portal/sites/default/files/pdf/Family-Options-Study-Full-Report.pdf.

[24] Brian Jacob, Max Kapustin, and Jens Ludwig, “Human Capital Effects of Anti-Poverty Programs: Evidence from a Randomized Housing Voucher Lottery,” NBER Working Paper 20164, May 2014, http://www.nber.org/papers/w20164.

[25] The study uses an experimental design and has a large sample size, making the findings highly reliable for the population it studies, but it only assesses families issued vouchers in 1997-98 and 2000-03 in Chicago. Chicago had a far greater degree of racial segregation and a far higher share of vouchers concentrated in high-poverty areas than was (or is) typical nationally. Moreover, the city at that time was undertaking the nation’s largest public housing transformation — a process that resulted in many public housing residents being displaced, issued vouchers, and placed in competition with other voucher holders for apartments, and may have made it harder for families to use their vouchers in stable, well-located housing of adequate quality that they could rent with their vouchers. These conditions may have muted vouchers’ positive effects, making it unclear whether the study’s findings can be generalized to voucher holders in other places and times.

[26] Raj Chetty, Nathaniel Hendren, and Lawrence Katz, “The Effects of Exposure to Better Neighborhoods on Children: New Evidence from the Moving to Opportunity Project,” American Economic Review, Vol. 106, No. 4, 2016, https://scholar.harvard.edu/hendren/publications/effects-exposure-better-neighborhoods-children-new-evidence-moving-opportunity.

[27] Ibid.

[28] Craig Evan Pollack et al., “Association of Receipt of a Housing Voucher With Subsequent Hospital Utilization and Spending,” JAMA, Vol. 331, No. 21, December 3, 2019, https://pubmed.ncbi.nlm.nih.gov/31794624/.

[29] Heather Schwartz, “Housing policy is school policy: Economically integrative housing promotes academic success in Montgomery County, Maryland,” in R.D. Kahlenberg, ed., The Future of School Integration, Century Foundation, 2012.

[30] The American Jobs Plan, the other main component of the Administration’s recovery agenda, includes funds for affordable housing development subsidies, but almost none for rental assistance. Development subsidies can help build more housing in markets where inadequate supply is a problem, but they generally don’t make housing affordable to people with incomes around or below the poverty line unless they also have a voucher or other rental assistance. Will Fischer, Sonya Acosta, and Erik Gartland, “More Housing Vouchers: Most Important Step to Help More People Afford Stable Homes,” CBPP, May 13, 2021, https://www.cbpp.org/research/housing/more-housing-vouchers-most-important-step-to-help-more-people-afford-stable-homes.

[31] Zoë Neuberger, “American Families Plan Could Substantially Reduce Children’s Food Hardship,” CBPP, May 21, 2021, https://www.cbpp.org/research/food-assistance/american-families-plan-could-substantially-reduce-childrens-food-hardship.

[32] Kristin Blagg, Macy Rainer, and Elaine Waxman, “How Restricting Categorical Eligibility for SNAP Affects Access to Free School Meals,” Urban Institute, October 2019, https://www.urban.org/sites/default/files/publication/101280/how_restricting_categorical_eligibility_for_snap_affects_access_to_free_school_meals_0.pdf, and Amelie A. Hecht, Keshia M. Pollack Porter, and Lindsey Turner, “Impact of The Community Eligibility Provision of the Healthy, Hunger-Free Kids Act on Student Nutrition, Behavior, and Academic Outcomes: 2011-2019,” American Journal of Public Health, Vol. 110, No. 9, September 2020, https://ajph.aphapublications.org/doi/full/10.2105/AJPH.2020.305743.

[33] Krista Ruffini, “Universal Access to Free School Meals and Student Achievement: Evidence from the Community Eligibility Provision,” University of California Berkeley, October 25, 2018, https://escholarship.org/content/qt2c79q8fc/qt2c79q8fc.pdf. We have used “Hispanic” here to reflect the data as reported in this study. For more on our usage of Hispanic and Latino in this paper, see Appendix.

[34] Nora E. Gordon and Krista J. Ruffini, “School Nutrition and Student Discipline: Effects of Schoolwide Free Meals,” NBER Working Paper 24986, September 2018, https://www.nber.org/system/files/working_papers/w24986/w24986.pdf.

[35] Will Davis and Tareena Musaddiq, “Estimating the Effects of Subsidized School Meals on Child Health: Evidence from the Community Eligibility Provision in Georgia Schools,” 7th Annual Conference of the American Society of Health Economists, April 22, 2018, https://static1.squarespace.com/static/5ad910ec365f02f74f353357/t/5aec97feaa4a99fc541bc0eb/1525454848660/Davis_Musaddiq_2018.pdf.

[36] Zoë Neuberger, “Recovery Legislation Could Help End Summer Childhood Hunger,” CBPP, June 30, 2021, https://www.cbpp.org/research/food-assistance/recovery-legislation-could-help-end-summer-childhood-hunger.

[37] Food Research & Action Center, “Hunger Doesn’t Take a Vacation: Summer Nutrition Status Report,” August 2020, https://frac.org/wp-content/uploads/FRAC-Summer-Nutrition-Report-2020.pdf.

[38] Neuberger, “Recovery Legislation Could Help End Summer Childhood Hunger.”

[39] David M. Quinn and Morgan Polikoff, “Summer learning loss: What is it, and what can we do about it?” Brookings Institution, September 14, 2017, https://www.brookings.edu/research/summer-learning-loss-what-is-it-and-what-can-we-do-about-it/.

[40] Claire Zippel and Arloc Sherman, “Bolstering Family Income Is Essential to Helping Children Emerge Successfully From the Current Crisis,” CBPP, updated February 25, 2021, https://www.cbpp.org/research/poverty-and-inequality/bolstering-family-income-is-essential-to-helping-children-emerge.

[41] P.L. 117-80 § 748.

[42] Ann M. Collins et al., “Summer Electronic Benefit Transfer for Children (SEBTC) Demonstration: Summary Report,” Abt Associates and Mathematica Policy Research, May 2016, https://fns-prod.azureedge.net/sites/default/files/ops/sebtcfinalreport.pdf.

[43] CBPP, “CBPP/FRAC P-EBT Documentation Project Shows How States Implemented a New Program to Provide Food Benefits to Up to 30 Million Low-Income School Children,” www.cbpp.org/pebt.

[44] All 50 states, the District of Columbia, and the Virgin Islands implemented P-EBT for the spring of the 2019-2020 school year. USDA has approved P-EBT plans for 49 states, the District of Columbia, Puerto Rico, the Virgin Islands, and the Commonwealth of the Northern Mariana Islands for the 2020-2021 school year; the state awaiting approval is Wyoming. See USDA, “State Guidance on Coronavirus P-EBT,” July 21, 2021, https://www.fns.usda.gov/snap/state-guidance-coronavirus-pandemic-ebt-pebt.

[45] Lauren Bauer et al., “The Effect of Pandemic EBT on Measures of Food Hardship,” Hamilton Project, July 2020, p. 5, https://www.brookings.edu/wp-content/uploads/2020/07/P-EBT_LO_7.30.pdf.

[46] HighScope Educational Research Foundation, “Perry Preschool Project – Study Results,” https://highscope.org/perry-preschool-project/.

[47] Francis A. Campbell et al., “Adult Outcomes as a Function of an Early Childhood Educational Program: An Abecedarian Project Follow-Up,” Developmental Psychology, Vol. 48, No, 4, January 16, 2012, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3989926/.

[48] Jorge Luis García et al., “The Dynamic Benefits of Early Childhood Education,” NBER Working Paper 29004, July 2021, https://www.nber.org/system/files/working_papers/w29004/w29004.pdf?utm_campaign=Economic%20Studies&utm_source=hs_email&utm_medium=email.

[49] Greg J. Duncan and Katherine Magnuson, “Investing in Preschool Programs,” Journal of Economic Perspectives, Vol. 27, No. 2, 2013, https://pubs.aeaweb.org/doi/pdf/10.1257/jep.27.2.109.

[50] U.S. Department of Health and Human Services, “Head Start Impact Study Final Report,” January 2010, https://www.acf.hhs.gov/opre/report/head-start-impact-study-final-report-executive-summary; U.S. Department of Health and Human Services, “Head Start Impact Study Final Report,” January 2010, https://www.acf.hhs.gov/opre/report/head-start-impact-study-final-report-executive-summary.

[51] Deborah A. Phillips, “Puzzling It Out: The Current State of Scientific Knowledge on Pre-Kindergarten Effects,” Brookings, 2017, https://www.brookings.edu/wp-content/uploads/2017/04/consensus-statement_final.pdf.

[52] Guthrie Gray-Lobe, Parag Pathak, and Christopher Walters, “The Long-Term Effects of Universal Preschool in Boston,” School Effectiveness & Inequality Initiative, May 2021, https://seii.mit.edu/wp-content/uploads/2021/05/SEII-Discussion-Paper-2021.4-Gray-Lobe-Pathak-and-Walters.pdf.

[53] Ibid.

[54] Cortney Sanders, “Research Note: Combining Early Education and K-12 Investments Has Powerful Positive Effects,” CBPP, February 28, 2019, https://www.cbpp.org/research/state-budget-and-tax/research-note-combining-early-education-and-k-12-investments-has; see also Rucker C. Johnson and C. Kirabo Jackson, “Reducing Inequality Through Dynamic Complementarity: Evidence from Head Start and Public School Spending,” NBER Working Paper 23489, June 2017, https://www.nber.org/papers/w23489.

[55] Martha J. Bailey, Brenden D. Timpe, and Shuqiao Sun, “Prep School for Poor Kids: The Long-Run Impacts of Head Start on Human Capital and Economic Self-Sufficiency,” NBER Working Paper 28268, December 2020, https://www.nber.org/system/files/working_papers/w28268/w28268.pdf.

[56] Hirokazu Yoshikawa et al., “Investing in Our Future: The Evidence Base on Preschool Education,” Society for Research in Child Development, October 2013, https://www.fcd-us.org/assets/2013/10/Evidence20Base20on20Preschool20Education20FINAL.pdf.

[57] James Heckman, “Cognitive Skills Are Not Enough,” presentation at Chicago, Illinois, December 16, 2010, https://heckmanequation.org/resource/cognitive-skills-are-not-enough/.

[58] Francis A. Pearman II et al., “Teachers, Schools, and Pre-K Effect Persistence: An Examination of the Sustaining Environment Hypothesis,” Annenberg Institute at Brown University, July 2019, https://www.edworkingpapers.com/sites/default/files/ai19-85.pdf; see also Johnson and Jackson, op. cit.

[59] Margaret Burchinal et al., “Threshold analysis of association between child care quality and child outcomes for low-income children in pre-kindergarten programs,” Early Childhood Research Quarterly, Vol. 25, No. 2, 2010, https://www.sciencedirect.com/science/article/abs/pii/S0885200609000738.

[60] Phillips et al., op. cit.

[61] Maria E. Enchautegui, “Effects of the CCDF Subsidy Program on the Employment Outcomes of Low Income Mothers,” U.S. Department of Health and Human Services, December 2016, https://aspe.hhs.gov/effects-child-care-subsidies-maternal-labor-force-participation-united-states.

[62] Shiva Sethi et al., “An Anti-Racist Approach to Supporting Child Care Through COVID-19 and Beyond,” Center for Law and Social Policy (CLASP), July 14, 2020, https://www.clasp.org/publications/report/brief/anti-racist-approach-supporting-child-care-through-covid-19-and-beyond.

[63] Karen Schulman, “On the Precipice: State Child Care Assistance Policies 2020,” National Women’s Law Center (NWLC), May 2021, https://nwlc.org/wp-content/uploads/2021/05/NWLC-State-Child-Care-Assistance-Policies-2020.pdf.

[64] NWLC, “Child Care: A Core Support to Children and Families,” February 2013, https://www.nwlc.org/sites/default/files/pdfs/childcareoverview.pdf.

[65] Robert Paul Hartley et al., “A Lifetime’s Worth of Benefits: The Effects of Affordable, High-quality Child Care on Family Income, the Gender Earnings Gap, and Women’s Retirement Security,” NWLC and CSSP, March 2021, https://nwlc.org/wp-content/uploads/2021/04/A-Lifetimes-Worth-of-Benefits-_FD.pdf.

[66] Gina Adams and Monica Rohacek, “Child Care Instability,” Urban Institute, October 2010, https://www.urban.org/sites/default/files/publication/29446/412278-Child-Care-Instability-Definitions-Context-and-Policy-Implications.PDF; see also Alejandra Ros Pilarz and Heather D. Hill, “Child-Care Instability and Behavior Problems: Does Parenting Stress Mediate the Relationship?” Journal of Marriage and Family, Vol. 79, No. 5, October 2017, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5666338/.

[67] Taryn W. Morrissey, “Child care and parent labor force participation: a review of the research literature,” Review of Economics of the Household, Vol. 15, No. 1, 2017, https://link.springer.com/article/10.1007/s11150-016-9331-3; see also Enchautegui, op. cit.

[68] Enchautegui, op. cit.; see also Morrissey, op. cit.

[69] Christina Felfe and Rafael Lalive, “Does early child care affect children’s development?” Journal of Public Economics, Vol. 159, March 2018, https://www.sciencedirect.com/science/article/pii/S0047272718300148.

[70] Grace E. Noboa-Hidalgo and Sergio S. Urzúa, “The Effects of Participation in Public Child Care Centers: Evidence from Chile,” Journal of Human Capital, Vol. 6, No. 1, 2012, https://www.journals.uchicago.edu/doi/abs/10.1086/664790.

[71] Deborah Low Vandell and Margaret Burchinal, “Early child care and adolescent functioning at the end of high school: Results from the NICHD Study of Early Child Care and Youth Development,” Developmental Psychology, Vol. 52, No. 10, October 2016, https://www.researchgate.net/publication/308878544_Early_child_care_and_adolescent_functioning_at_the_end_of_high_school_Results_from_the_NICHD_Study_of_Early_Child_Care_and_Youth_Development.

[72] Ibid.

[73] Carolyn J. Heinrich, “Parents’ Employment and Children’s Wellbeing,” Future of Children, Vol. 24, No. 1, 2014, EJ1029033.pdf.

[74] Michael Baker et al., “The Long-Run Impacts of a Universal Child Care Program,” American Economic Journal: Economic Policy, Vol. 11, No. 3, 2019, https://www.aeaweb.org/articles?id=10.1257/pol.20170603.

[75] Margherita Fort, Andrea Ichino, and Giulio Zanella, “The cognitive cost of daycare 0-2 for children in advantaged families,” February 8, 2017, https://sbe.maastrichtuniversity.nl/duhr/wp-content/uploads/sites/13/2017/03/paper_Fort.pdf.

[76] CCPA National Office, “You must be kidding: Confronting key myths about Quebec’s childcare system,” Monitor, April 25, 2017, https://monitormag.ca/articles/you-must-be-kidding-confronting-key-myths-about-quebecs-childcare-system; see also Conor Williams, “When ‘Universal’ Child Care Isn’t Universally High-Quality,” Atlantic, May 1, 2018, https://www.theatlantic.com/family/archive/2018/05/quebec-child-care-family-leave/559310/.

[77] Raquel Bernal and Michael P. Keane, “Child Care Choices and Children’s Cognitive Achievement: The Case of Single Mothers,” Journal of Labor Economics, Vol. 29, No. 3, July 2011, https://www.researchgate.net/publication/227631888_Child_Care_Choices_and_Children's_Cognitive_Achievement_The_Case_of_Single_Mothers.

[78] Steven Jessen-Howard et al., “Understanding Infant and Toddler Child Care Deserts,” Center for American Progress (CAP), October 21, 2018, https://www.americanprogress.org/issues/early-childhood/reports/2018/10/31/460128/understanding-infant-toddler-child-care-deserts/.

[79] National Institute of Child Health and Human Development Early Child Care Research Network, and Greg J. Duncan, “Modeling the impacts of child care quality on children’s preschool cognitive development,” Child Development, Vol. 74, No. 5, October 2003, https://www.jstor.org/stable/3696188.

[80] Victoria Jackson and Matt Saenz, “States Can Choose Better Path for Higher Education Funding in COVID-19 Recession,” CBPP, February 17, 2021, https://www.cbpp.org/research/state-budget-and-tax/states-can-choose-better-path-for-higher-education-funding-in-covid.

[81] Douglas N. Harris, “Is free college a good idea? Increasingly, evidence says yes,” Brookings, May 10, 2021, https://www.brookings.edu/blog/brown-center-chalkboard/2021/05/10/is-free-college-a-good-idea-increasingly-evidence-says-yes/; see also Douglas N. Harris and Jonathan Mills, “Optimal College Financial Aid: Theory and Evidence on Free College, Early Commitment, and Merit Aid from an Eight-Year Randomized Trial,” Annenberg Institute at Brown University, May 2021, https://edworkingpapers.com/sites/default/files/ai21-393.pdf.

[82] Timothy J. Bartik, Brad J. Hershbein, and Marta Lacohwska, “The Effects of the Kalamazoo Promise Scholarship on College Enrollment, Persistence, and Completion,” W.E. Upjohn Institute for Employment Research, December 2017, https://research.upjohn.org/cgi/viewcontent.cgi?article=1246&context=up_workingpapers.

[83] Joshua Angrist, David Autor, and Amanda Pallais, “Marginal Effects of Merit Aid for Low-Income Students,” NBER Working Paper 27834, September 2020, https://www.nber.org/system/files/working_papers/w27834/w27834.pdf.

[84] Lindsay C. Page et al., “The Promise of Place-Based Investment in Postsecondary Access and Success: Investigating the Impact of the Pittsburgh Promise,” Education Finance and Policy, Vol. 14, No. 4, 2019, https://direct.mit.edu/edfp/article/14/4/572/12330/The-Promise-of-Place-Based-Investment-in.

[85] Harris and Mills, op. cit.

[86] Joshua Goodman, Michael Hurwitz, and Jonathan Smith, “College Access, Initial College Choice and Degree Completion,” NBER Working Paper 20996, February 2015, https://scholar.harvard.edu/files/joshuagoodman/files/collegetypequality.pdf; see also Celeste K. Carruthers, William F. Fox, and Christopher Jepsen, “Promise kept? Free community college, attainment, and earnings in Tennessee,” Federal Reserve Bank of Atlanta, February 2020, https://www.atlantafed.org/-/media/documents/news/conferences/2020/04/16/southeastern-micro-labor-workshop/Carruthers_Fox_Jepsen.pdf.

[87] Table 1.1 in Emily Kelly et al., “Trends in Pell Grant Receipt and the Characteristics of Pell Grant Recipients: Selected Years, 2003–04 to 2015–16,” prepared for the National Center for Education Statistics, September 2019, https://nces.ed.gov/pubs2019/2019487.pdf.

[88] Michelle Dimino, “How Doubling the Pell Grant Could Be a Down Payment on Free College,” Third Way, May 19, 2021, https://www.thirdway.org/memo/how-doubling-the-pell-grant-could-be-a-down-payment-on-free-college.

[89] President Biden has proposed Pell Grant increases in both the American Families Plan and the Fiscal Year 2022 Budget Request for the Department of Education, totaling a $1,875 increase.

[90] Catherine A. Hawkins et al., “The relationships among hours employed, perceived work interference, and grades as reported by undergraduate social work students,” Journal of Social Work Education, Vol .41, No. 1, 2005, https://www.tandfonline.com/doi/abs/10.5175/JSWE.2005.200202122; see also Gary R. Pike, George D. Kuh, and Ryan Massa-McKinley, “First-Year Students’ Employment, Engagement, and Academic Achievement: Untangling the Relationship Between Work and Grades,” Journal of Student Affairs Research and Practice, January 2008, https://www.luminafoundation.org/files/advantage/document/Affordability.Benchmark.Research/First-Year.Students.Employment.Engagement.and.Academic.Achievement.pdf.

[91] David Deming and Susan Dynarski, “College Aid,” NBER, August 2010, https://www.nber.org/system/files/chapters/c11730/c11730.pdf; see also Spiros Protopsaltis and Sharon Parrott, “Pell Grants — a Key Tool for Expanding College Access and Economic Opportunity — Need Strengthening, Not Cuts,” CBPP, July 17, 2017, https://www.cbpp.org/research/federal-budget/pell-grants-a-key-tool-for-expanding-college-access-and-economic.

[92] Tuan D. Nguyen, Jenna W. Kramer, and Brent J. Evans, “The Effects of Grant Aid on Student Persistence and Degree Attainment: A Systematic Review and Meta-Analysis of the Causal Evidence,” Association for Education Finance and Policy, February 7, 2018, https://aefpweb.org/sites/default/files/webform/Financial%20aid%20meta%20analysis%20manuscript.pdf.

[93] Jeffrey Denning, Benjamin Marx, and Lesley Turner, “Propelled: The Effects of Grants on Graduation, Earnings, and Welfare,” Institute for the Study of Labor, September 17, 2018, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3249906.

[94] Douglas A. Webber and Ronald G. Ehrenberg, “Do Expenditures Other Than Instructional Expenditures Affect Graduation and Persistence Rates in American Higher Education,” NBER Working Paper 15216, August 2009, https://www.nber.org/papers/w15216.

[95] Susan Scrivener et al., “Doubling Graduation Rates: Three-Year Effects of CUNY’s Accelerated Study in Associate Programs (ASAP) for Developmental Education Students,” MDRC, February 2015, https://www1.cuny.edu/sites/asap/wp-content/uploads/sites/8/2015/02/MDRC_Doubling_Graduation_Rates_ASAP_Executive_Summary_Feb_2015.pdf.

[96] MDRC, “CUNY ASAP Doubles Graduation Rates in New York City and Ohio,” February 2021, https://www.mdrc.org/publication/cuny-asap-doubles-graduation-rates-new-york-city-and-ohio.

[97] See the testimony statement by Pronita Gupta, “Paid Family and Medical Leave,” to the U.S. House of Representatives Committee on Ways and Means, May 8, 2019, https://www.clasp.org/sites/default/files/publications/2019/05/2019%2005%2008%20Pronita%20Gupta%20PFML%20testimony%20.pdf.

[98] Ibid.

[99] Maya Rossin-Slater, Christopher J. Ruhm, and Jane Waldfogel, “The Effects of California's Paid Family Leave Program on Mothers’ Leave-Taking and Subsequent Labor Market Outcomes,” Journal of Policy Analysis and Management, Vol. 32, No. 2, December 17, 2012, https://onlinelibrary.wiley.com/doi/abs/10.1002/pam.21676; see also Ann P. Bartel et al., “Paid Family Leave, Fathers’ Leave-Taking, and Leave-Sharing in Dual-Earner Households,” Journal of Policy Analysis and Management, Vol. 37, No. 1, November 6, 2017, https://onlinelibrary.wiley.com/doi/10.1002/pam.22030.

[100] Pedro Carneiro, Katrine V. Løken, and Kjell G. Salvanes, “A Flying Start? Maternity Leave Benefits and Long-Run Outcomes of Children,” Journal of Political Economy, Vol. 123, No. 2, 2015, https://www.journals.uchicago.edu/doi/abs/10.1086/679627?journalCode=jpe.

[101] Tara O’Neill Hayes and Margaret Barnhorst, “How Children Benefit from Paid Family Leave Policies,” American Action Forum, June 9, 2020, https://www.americanactionforum.org/research/how-children-benefit-from-paid-family-leave-policies.

[102] Rossin-Slater, Ruhm, and Waldfogel, op. cit. See also Charles L. Baum II and Christopher J. Ruhm, “The Effects of Paid Family Leave in California on Labor Market Outcomes,” Journal of Policy Analysis and Management, Vol. 35, No. 2, February 2, 2016, https://onlinelibrary.wiley.com/doi/abs/10.1002/pam.21894; and Joelle Saad-Lessler and Kate Bahn, “The Importance of Paid Leave for Caregivers,” CAP, September 27, 2017, https://www.americanprogress.org/issues/women/reports/2017/09/27/439684/importance-paid-leavecaregivers/.

[103] Jenna Stearns, “The effects of paid maternity leave: Evidence from Temporary Disability Insurance,” Journal of Health Economics, Vol. 43, September 2015, https://www.sciencedirect.com/science/article/abs/pii/S0167629615000533?via%3Dihub.

[104] Ibid.

[105] Ariel Marek Pihl and Gaetano Basso, “Did California Paid Family Leave Impact Infant Health?” Journal of Policy Analysis and Management, Vol. 38, No. 1, October 18, 2018, https://onlinelibrary.wiley.com/doi/10.1002/pam.22101.

[106] Rui Huang and Muzhe Yang, “Paid maternity leave and breastfeeding practice before and after California's implementation of the nation's first paid family leave program,” Economics & Human Biology, Vol. 16, January 2015, https://www.sciencedirect.com/science/article/pii/S1570677X14000021?via%3Dihub; see also Agnitra Roy Choudhury and Solomon W. Polachek, “The Impact of Paid Family Leave on the Timing of Infant Vaccinations,” IZA Institute of Labor Economics, July 2019, https://www.iza.org/publications/dp/12483/the-impact-of-paid-family-leave-on-the-timing-of-infant-vaccinations.

[107] Shirlee Lichtman-Sadot and Neryvia Pillay Bell, “Child Health in Elementary School Following California’s Paid Family Leave Program,” Journal of Policy Analysis and Management, Vol. 36, No. 4, July 25, 2017, https://onlinelibrary.wiley.com/doi/abs/10.1002/pam.22012.

[108] See e.g. Jason M. Fletcher, “The Effects of Childhood ADHD on Adult Labor Market Outcomes,” Health Economics, Vol. 23, No. 2, February 2014, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6714576/pdf/nihms-1024944.pdf.