Widespread Economic Insecurity Pre-Pandemic Shows Need for Strong Recovery Package

End Notes

[1] SIPP tracks cohorts of individuals for three to five years. Prior to 2014, SIPP asked each cohort about their recent hardship experiences one or two times. Since the 2014 redesign, SIPP has asked each cohort hardship questions every year. (The redesign also affected other SIPP questions and reduced the frequency of interviews per participant from three per year to one.)

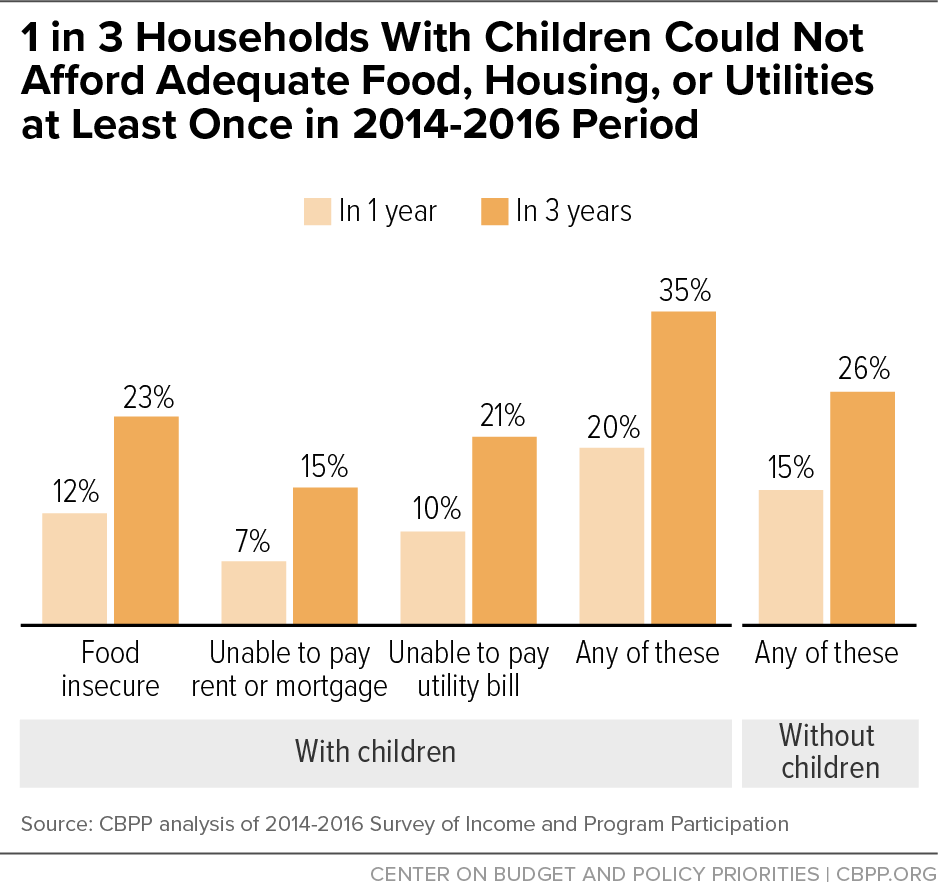

Economic conditions in the three years of this analysis were not exceptional. Poverty rates declined steadily from 16.9 percent in 2014 to 14.9 percent in 2016 — similar to or slightly better than the average poverty rate of 16.5 percent over the last 30 years — according to Supplemental Poverty Measure data from Danilo Trisi and Matt Saenz, “Economic Security Programs Cut Poverty Nearly in Half Over the Last 50 Years,” CBPP, updated November 26, 2019, https://www.cbpp.org/research/poverty-and-inequality/economic-security-programs-cut-poverty-nearly-in-half-over-last-50.

[2] A household’s composition may change over the three-year period as people move. Our analysis, therefore, focuses on the experience of the reference person in the current household, generally the owner or renter of the housing unit. In our analysis, households with children are those with children in December of a given year.

[3] Alisha Coleman-Jensen et al., “Household Food Security in the United States in 2019,” USDA, September 2020, https://www.ers.usda.gov/webdocs/publications/99282/err-275.pdf?v=8745.4. Census considers households in SIPP to be food insecure if the household reference person answers affirmatively to at least two of six questions such as, “In [a particular year], were you ever hungry but didn’t eat because there wasn’t enough money for food?” and “In [a particular year], did you ever eat less than you felt you should because there wasn’t enough money to buy food?” USDA measures food insecurity in a separate survey using a longer list of up to 18 questions. For each year of 2014, 2015, and 2016, the share of households with children with food insecurity in SIPP was somewhat lower than USDA’s estimate for that year, suggesting that SIPP somewhat understates food insecurity for families with children.

[4] Moreover, household survey figures such as these leave out some of the worst-off children, including more than 300,000 homeless public school students living in shelters, hotels, motels, or on the street in the 2018-2019 school year. U.S. Department of Education, “Homeless Enrolled Students by State,” https://eddataexpress.ed.gov/dashboard/homeless.

[5] For all three income groups, these cumulative three-year hardship figures were much higher than the corresponding rates of hardship in a single year, which were 34 percent, 16 percent, and 4 percent, respectively. (The one-year figures represent hardship rates in the same year that income was measured.)

[6] When measuring three-year exposure to hardship, we ranked households with children by their annual household cash income in a given year, adjusted for household size by dividing income by the appropriate poverty line for the household’s size and age composition. (For example, we ranked middle-third households in 2014 based on 2014 income.) For each year we examined the share of middle-third households in that year that faced a hardship in any of the years 2014-2016. Then we averaged these shares across the three years. In our SIPP data, the middle third of households with children had annual incomes between $48,500 and $105,600 in 2020 dollars.

[7] When analyzing households’ income declines in 2015 and 2016, we sorted households into thirds based on annual income in 2014.

[8] Pew Charitable Trusts, “The Role of Emergency Savings in Family Financial Security: How Do Families Cope With Financial Shocks?” October 2015, https://www.pewtrusts.org/~/media/assets/2015/10/emergency-savings-report-1_artfinal.pdf.

[9] Alisha Coleman-Jensen and Mark Nord, “Food Insecurity Among Households With Working-Age Adults With Disabilities,” U.S. Department of Agriculture Economic Research Service, January 2013, https://www.ers.usda.gov/webdocs/publications/45038/34589_err_144.pdf; Alicia Coleman-Jensen, “Thirty Years After Enactment of the Americans with Disabilities Act, Disabilities Remain a Risk Factor for Food Insecurity,” U.S. Department of Agriculture Economic Research Service, December 7, 2020, https://www.ers.usda.gov/amber-waves/2020/december/thirty-years-after-enactment-of-the-americans-with-disabilities-act-disabilities-remain-a-risk-factor-for-food-insecurity.

[10] CBPP analysis of Current Population Survey outgoing rotation groups, 12-month average for 2019.

[11] Bureau of Labor Statistics, Job Openings and Labor Turnover Survey (JOLTS), total nonfarm layoffs and discharges.

[12] Chad Stone, “Congress Should Heed President Biden’s Call for Fundamental UI Reform,” CBPP, May 5, 2021, https://www.cbpp.org/research/economy/congress-should-heed-president-bidens-call-for-fundamental-ui-reform. The share of jobless workers qualifying for jobless benefits tends to rise in recessions and lawmakers expanded eligibility for jobless benefits further in the pandemic.

[13] Caroline Ratcliffe, “Child Poverty and Adult Success,” Urban Institute, September 2015, https://www.urban.org/sites/default/files/publication/65766/2000369-Child-Poverty-and-Adult-Success.pdf. The analysis shows data only for all, Black, and white children.

[14] The 2014 SIPP panel collected these cost figures for December, a month when child care costs may be higher than usual. See: Brian Knop and Abinash Mohanty, “Child Care Costs in the Redesigned Survey of Income and Program Participation: A Comparison to the Current Population Survey Annual Social and Economic Supplement,” U.S. Census Bureau Working Paper No. SEHSD-WP2018-21, July 2018, https://www.census.gov/library/working-papers/2018/demo/SEHSD-WP2018-21.html. The figures in our analysis reflect the higher of weekly child care costs (divided by estimated weekly household income in December) or monthly child and dependent care expenses (divided by monthly household income in December), asked in a separate SIPP question.

[15] “Child Care and Development Fund (CCDF) Program,” Federal Register, December 24, 2015, https://www.federalregister.gov/documents/2015/12/24/2015-31883/child-care-and-development-fund-ccdf-program.

[16] Kenneth Brevoort et al., “Medicaid and Financial Health,” National Bureau of Economic Research Working Paper 24002, November 2017, https://www.nber.org/system/files/working_papers/w24002/w24002.pdf. Charity care and bad debt among hospitals also fell by $8.6 billion (23 percent) from 2013 to 2015 following Medicaid expansion, with declines several times larger among states that expanded Medicaid than among non-expansion states. Gideon Lukens, “Medicaid Expansion Cuts Hospitals’ Uncompensated Care Costs,” CBPP, April 20, 2021, https://www.cbpp.org/blog/medicaid-expansion-cuts-hospitals-uncompensated-care-costs.

[17] Medicaid expansion increases the use of preventive care and significantly reduces the use of emergency care, resulting in earlier detection of cancers and more effective treatment of chronic illnesses. A recent study found that Medicaid expansion saved the lives of at least 19,200 adults aged 55 to 64 between 2014 and 2017. Conversely, 15,600 older adults died prematurely as a result of some states’ decisions not to expand Medicaid. Sarah Miller, Norman Johnson, and Laura Wherry, “Medicaid and Mortality: New Evidence from Linked Survey and Administrative Data,” Quarterly Journal of Economics, Vol. 136, No. 3, January 30, 2021, https://doi.org/10.1093/qje/qjab004.

[18] Gideon Lukens and Breanna Sharer, “Closing Medicaid Coverage Gap Would Help Diverse Group and Narrow Racial Disparities,” CBPP, revised June 14, 2021, https://www.cbpp.org/research/health/closing-medicaid-coverage-gap-would-help-diverse-group-and-narrow-racial.

[19] This analysis categorizes households by race and ethnicity according to the race and ethnicity of the household reference person, who is usually the person in whose name the home is owned or rented. “Latino” in this report refers to people of Hispanic, Latino, or Spanish ancestry, regardless of race. “Black” refers to people identifying as Black or African American. “Black,” “white,” and “Asian” refer to people identifying with a single race and exclude Latino.

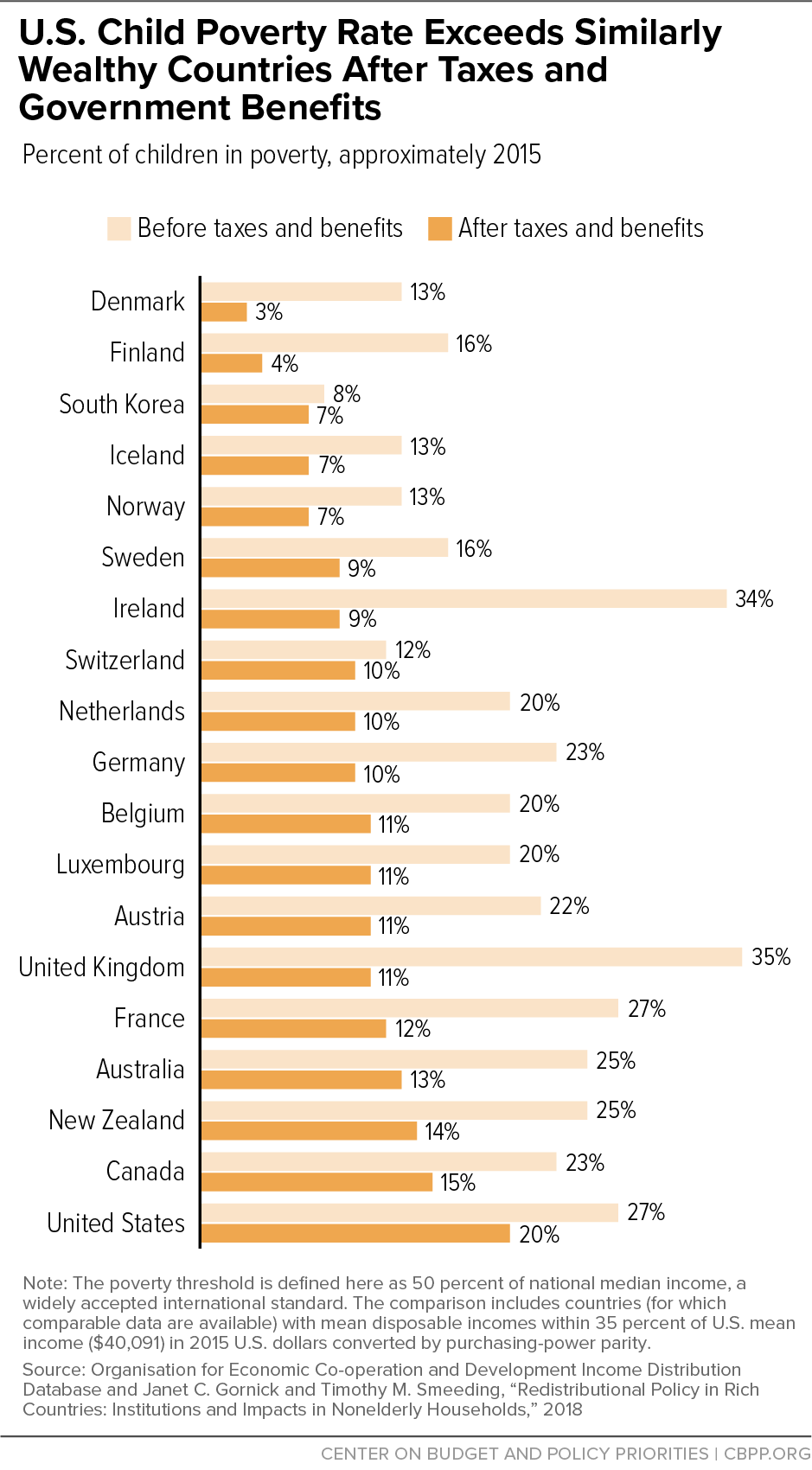

[20] The survey includes data for a combined category of American Indian, Alaska Native, Native Hawaiian and Pacific Islander, and people identifying with more than one race; approximately half of this group reported one or more problems affording enough food, shelter, or utilities at least once over three years. Such hardships were less common for Asian households with children (11 percent), but the numbers of households in the survey were too small to make this estimate reliable.

[21] Rural areas are more racially and ethnically diverse than is sometimes appreciated: 16 percent of non-metropolitan households are headed by a person of color, of which the largest groups are Black (6 percent of all non-metro households), Latino (7 percent), and American Indian or Alaska Native (2 percent), according to 2016 data from the American Community Survey. (In SIPP data for 2014-2016, metropolitan status was not identified for 6.5 percent of households with children.)

[22] U.S. Social Security Administration and International Social Security Association, “Country Profiles,” https://ww1.issa.int/country-profiles; Sarah A. Donovan, “Paid Family and Medical Leave in the United States,” Congressional Research Service, updated February 19, 2020, https://crsreports.congress.gov/product/pdf/R/R44835. “Similarly wealthy nations” are defined, as in Figure 3, as countries with mean disposable incomes within 35 percent of U.S. mean income.

[23] Canada’s child poverty rate fell from 17.1 percent in 2015, the year before the policy was implemented, to 11.4 percent in 2017, according to the Organisation for Economic Co-operation and Development. Looking at families rather than children, and adjusting for the improving economy and other trends, one study estimated that the policy lowered the poverty rate for Canadian mothers by 5 percentage points, from about 40 percent. The researchers also found that the more generous benefit did not lower parents’ employment. Michael Baker et al., “The Effects of Child Tax Benefits on Poverty and Labor Supply: Evidence from the Canada Child Benefit and Universal Child Care Benefit,” National Bureau of Economic Research Working Paper 28556, March 2021, https://www.nber.org/papers/w28556.

[24] National Academies of Sciences, Engineering, and Medicine, A Roadmap to Reducing Child Poverty, National Academies Press, 2019, https://www.nap.edu/read/25246.

[25] Craig Gunderson and James P. Ziliak, “The Role of Food Stamps in Consumption Stabilization,” University of Kentucky Center for Poverty Research, 2003, https://uknowledge.uky.edu/ukcpr_papers/79; Douglas Almond, Hilary W. Hoynes, and Diane Whitmore Schanzenbach, “Inside the War on Poverty: The Impact of Food Stamps on Birth Outcomes,” Institute for Research on Poverty, Discussion Paper Number 1359-08, October 2008, http://www.irp.wisc.edu/publications/dps/pdfs/dp135908.pdf; Caroline Ratcliffe et al., “How Much Does the Supplemental Nutrition Assistance Program Reduce Food Insecurity?” American Journal of Agricultural Economics, Vol. 93, No. 4, 2011, pp. 1082-1098, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3570848; Hilary Hoynes, Diane Whitmore Schanzenbach, and Douglas Almond, “Long-Run Impacts of Childhood Access to the Safety Net,” American Economic Review, Vol. 106, No. 4, April 2016, pp. 903–934, earlier version at http://www.nber.org/papers/w18535; Martha Bailey et al., “Is the Social Safety Net a Long-Term Investment? Large-Scale Evidence from the Food Stamps Program,” Goldman School of Public Policy, April 2020, https://gspp.berkeley.edu/assets/uploads/research/pdf/w26942.pdf.

[26] Chloe N. East, “The Effect of Food Stamps on Children’s Health: Evidence from Immigrants’ Changing Eligibility,” Journal of Human Resources, September 5, 2018; earlier version at http://www.chloeneast.com/uploads/8/9/9/7/8997263/east_jmp.pdf.

[27] Will Fischer, Douglas Rice, and Alicia Mazzara, “Research Shows Rental Assistance Reduces Hardship and Provides Platform to Expand Opportunity for Low-Income Families,” CBPP, December 5, 2019, https://www.cbpp.org/research/housing/research-shows-rental-assistance-reduces-hardship-and-provides-platform-to-expand.

[28] The most generous program raised average annual income by $3,200 a year per family in 2021 dollars. Greg Duncan, Pamela Morris, and Chris Rodrigues, “Does Money Really Matter? Estimating Impacts of Family Income on Young Children’s Achievement with Data from Random-Assignment Experiments,” Developmental Psychology, Vol. 47, No. 5, 2011.

[29] Pamela Morris, “The Effects of Welfare Reform Policies on Children,” Social Policy Report, Vol. 16, No. 1, 2002, pp. 4-18, http://srcd.org/sites/default/files/documents/spr16-1.pdf.

[30] Irwin Garfinkel et al., “The Costs and Benefits of a Child Allowance,” Columbia University Center on Poverty and Social Policy, February 23, 2021, https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/605978841a7c672eaed64ec6/1616476294180/Child-Allowance-CBA-brief-CPSP-March-2021.pdf.

[31] National Academies of Sciences, Engineering, and Medicine, op. cit.

[32] CBPP, “Make Child Tax Credit Improvements Permanent in Upcoming Recovery Legislation,” June 21, 2021, https://www.cbpp.org/blog/make-child-tax-credit-improvements-permanent-in-upcoming-recovery-legislation.

[33] Laura Meyer, “Subsidized Employment Must Be a Part of Any Recovery Package,” CBPP, April 27, 2021, https://www.cbpp.org/blog/subsidized-employment-must-be-a-part-of-any-recovery-package.

[34] Doug Rice, “Large-Scale Investment in Rental Assistance Needed for Equitable Recovery,” CBPP, May 27, 2021, https://www.cbpp.org/blog/large-scale-investment-in-rental-assistance-needed-for-equitable-recovery.

[35] Gideon Lukens and Breanna Sharer, “Closing Medicaid Coverage Gap Would Help Diverse Group and Narrow Racial Disparities,” CBPP, revised June 14, 2021, https://www.cbpp.org/research/health/closing-medicaid-coverage-gap-would-help-diverse-group-and-narrow-racial.

[36] “Make Child Tax Credit Improvements Permanent in Upcoming Recovery Legislation,” op. cit.

[37] Chad Stone, “Congress Should Heed President Biden’s Call for Fundamental UI Reform,” CBPP, May 5, 2021, https://www.cbpp.org/research/economy/congress-should-heed-president-bidens-call-for-fundamental-ui-reform.