Policymakers stepped up in the pandemic to greatly expand unemployment assistance beyond what the country’s outdated joint federal-state unemployment insurance (UI) system would have provided. Policy experts have long recognized that fundamental reform is needed to address weaknesses in the UI system that hurt unemployed workers and their families in normal times and risk delay in providing the economic assistance they deserve and the support the economy needs to recover quickly from a recession.[1] Congress should answer President Biden’s call in the American Families Plan[2] to work together with him to enact such reforms.

Built for an earlier industrial age, the UI system gives states considerable discretion over eligibility, benefit levels, number of weeks available, and financing. The result of that discretion, however, has been an underfunded UI system that poorly serves unemployed workers, particularly low-paid workers, women, and workers of color. The following are among the most salient indicators from the period immediately preceding the pandemic and recession that the current system is not working as it should:

- very low recipiency rates (UI recipients as a share of total unemployed), with fewer than 3 in 10 unemployed workers receiving UI nationwide and fewer than that in many states;

- low replacement rates (share of lost earnings replaced by UI), with less than half of the average worker’s previous earnings replaced nationwide and less than that in many states; and

- fewer than the standard 26 weeks of regular benefits available to UI recipients in several states.

In addition, a weak and unresponsive Extended Benefits (EB) program for providing additional assistance automatically in a recession has meant policymakers have had to debate and agree on the amount and extent of additional discretionary measures to provide, often delaying needed action.

Congress enacted a host of temporary measures during the pandemic that addressed key shortcomings of the UI program, expanding eligibility to more workers, increasing benefits, and adding more weeks of benefits. But the measures were built on a system that was unprepared to deliver them quickly and effectively.[3] As a result, there were significant implementation challenges and some people who lost their jobs waited weeks or even longer to receive benefits.

Moreover, there was marked uncertainty for people out of work around looming expiration deadlines for supplemental benefit payments in July 2020 and for all of the emergency UI provisions in December 2020. While supplemental benefit payments were allowed to lapse in July,[4] policymakers did enact short-term end-of-year legislation that extended into March the expanded-eligibility and additional-weeks provisions and a restored but smaller supplemental weekly benefit. The similar provisions enacted in the American Rescue Plan in early March are slated to expire on September 6, irrespective of labor market conditions at that time.

These temporary UI expansions also don’t address the long-standing problems in the underlying system. No matter the state of the national economy, losing a job is devastating for low-paid workers with few assets, many of whom get little or no UI. And losing a job is common during normal economic times, both as businesses downsize periodically due to changes in demand and because workers can lose their jobs if they aren’t able to work for a period of time for various reasons, like attending to a family health situation. Of course, job losses mount during a recession, and the need for a robust UI system that automatically serves the increased number of workers who lose their jobs and provides adequate benefits for a reasonable number of weeks becomes all the more urgent.

Federal policymakers should work together to make permanent reforms and create a more robust and equitable UI program that can help workers during normal economic times and that can meet the needs of large numbers of workers who lose their jobs during a recession.

Created in 1935, UI was designed for the industrial labor force of the time composed of male breadwinners, whose jobless spells were typically temporary layoffs from an employer experiencing a business downturn to which they expected to return when business improved. In a diverse modern economy with more working women, greater job turnover, and more people working part time or holding multiple jobs, states’ failure to a adapt to the modern labor market has limited UI eligibility for years.

UI was created to provide financial assistance to people who are attached to the labor force (rather than retired or otherwise not looking for work) when they face a temporary jobless spell. In the 21st century economy such workers include not only employees on temporary layoff, but also people who have to leave their job for “good cause” reasons such as dealing with a family emergency, escaping domestic violence, or moving with a spouse who has taken a job out of the area. They also include workers who, despite being attached to the labor force, move among jobs and may not meet state earnings-history requirements for receiving UI that do not take into account an employee’s most recent earnings.[5]

For a worker to receive UI, their employer must have paid state UI payroll taxes on their behalf. This excludes people who work as contract workers rather than employees, “gig” workers who should be treated as employees but often are not, and new entrants into the labor force, including recent graduates. Relatively newly hired workers on whose earnings taxes have been paid may be ineligible because not enough of their earnings are taken into account to meet their state’s monetary eligibility criteria.

State UI tax receipts in excess of benefits paid accumulate in a trust fund during good times and the trust fund is drawn down in a recession when benefit claims exceed tax receipts. To continue meeting their obligation to pay benefits in a deep recession, states may borrow from the federal government. Interest and principal payments on federal loans are deferred, but eventually must be repaid.

Under pressure from employers not to raise taxes to make these payments in the aftermath of the Great Recession, several states cut benefit levels and, in some cases, the maximum number of weeks of regular state benefits an unemployed worker could receive.[6] Many also began to deny benefit claims at higher rates.

Nationally, UI receipt as share of the total number of unemployed workers fell to historic lows of less than 30 percent after 2010. In 2019, only nine states had recipiency rates above 40 percent, topped by New Jersey with 60 percent and Massachusetts with 52 percent; 17 states had rates below 20 percent, with North Carolina at 9 percent, Florida and Mississippi at 10 percent, and Louisiana at 11 percent.[7]

Weekly benefits are far from generous in many states. At the start of the recession in February 2020, average weekly UI benefits nationwide were $387 and ranged from a high of $550 in Massachusetts to lows of $215 in Mississippi and $161 in Puerto Rico.[8] In 2019, average weekly UI benefits replaced only 45 percent of average weekly wages nationwide, and less than 40 percent in 26 states, Department of Labor analysis finds.[9]

With no action thus far during this economic crisis to reform UI, the same dynamic that played out after the Great Recession in states with depleted trust funds cutting back on their UI programs could happen again.[10] But even without further cuts, the UI system will return to its pre-pandemic status, when fewer than 3 in 10 jobless workers got any help at all, benefits were low, and some states offered fewer than the 26 weeks of benefits that, historically, have been the standard for the program.

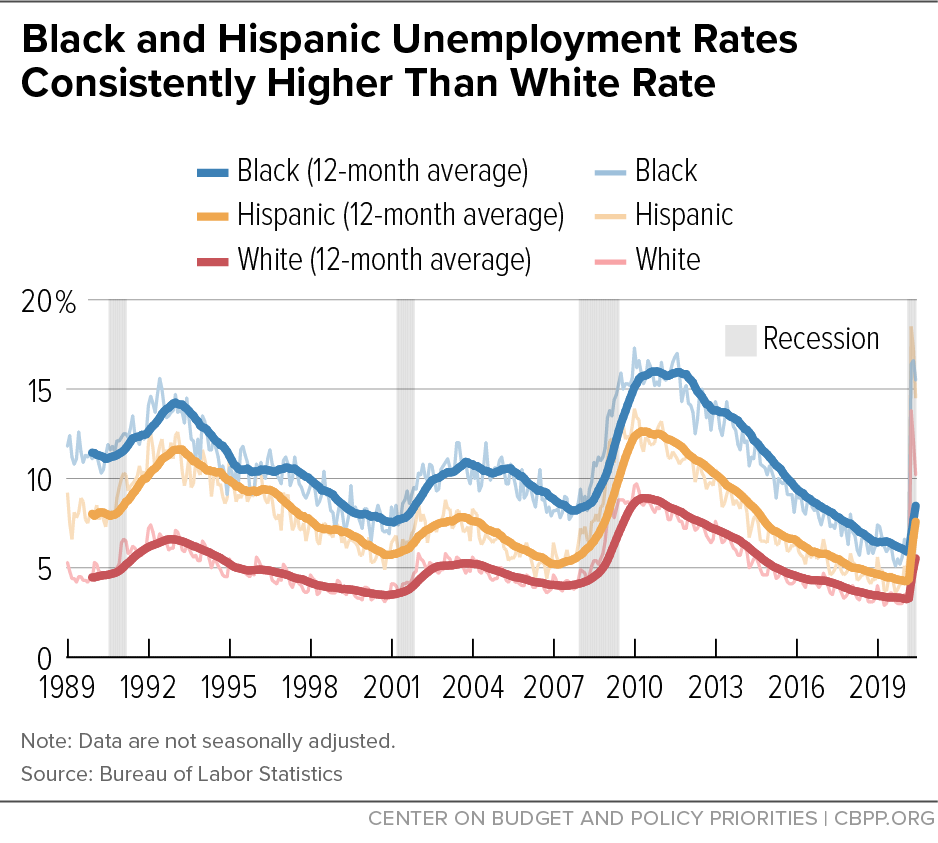

The outdated eligibility requirements described above keep many low-paid workers from receiving UI benefits. The system’s faults also disproportionately affect women and workers of color. At the end of the post-Great Recession expansion in February 2020, women were 47 percent of unemployed workers but only 35 percent of UI recipients. Workers of color experience higher rates of unemployment than white workers in good labor markets and bad[11] (see Figure 1) and live and work disproportionately in states with the weakest UI systems. They are thus less likely to get benefits,[12] and the benefits they do get are miserly.

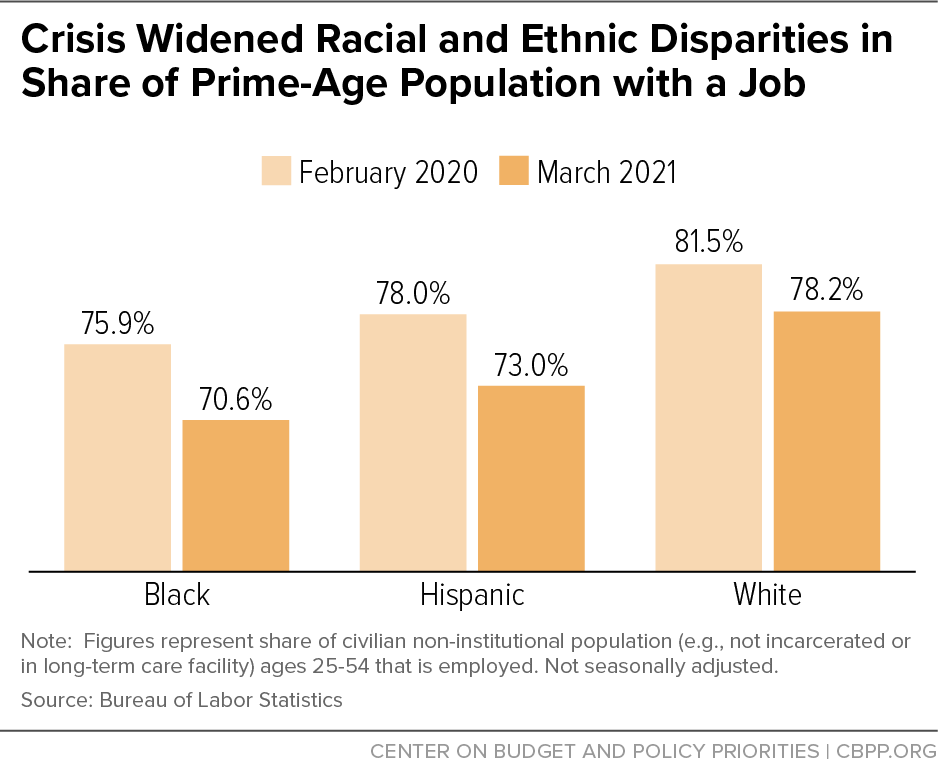

Moreover, the unemployment rate understates the extent of job loss in the pandemic. A better indicator is the change in the share of the population in its prime working years (age 25-54) with a job. Here racial disparities that were apparent before the crisis have widened. (See Figure 2.) The share of white workers with a job in this age group fell by 3.3 percentage points between February 2020 and March 2021, compared with 5.3 and 5.0 points for Black and Hispanic workers, respectively. The white rate in March 2021 exceeded the February 2020 pre-crisis rate for Black and Hispanic workers.

Pandemic Measures Addressed Many Weaknesses But Are Temporary

While policymakers have expanded UI eligibility and enhanced benefits during the COVID-19 emergency, these measures are temporary. Permanent reforms are needed to fix an underlying system in which too many unemployed workers get inadequate benefits or no benefits at all.

In the week ending April 10, for example, 73 percent of the claims for unemployment insurance were in the Pandemic Emergency Unemployment Compensation program, which provides additional weeks of federal benefits to workers who have exhausted their regular state benefits, or the Pandemic Unemployment Assistance program, which provides benefits to workers excluded from the regular UI program, including contract and gig workers, workers sidelined by the pandemic, and workers who can’t meet the work history test or other eligibility requirements in the standard UI program. Workers in all programs receive a $300 federal boost to their weekly benefits through the Federal Pandemic Unemployment Compensation provision. All of these federal pandemic programs are scheduled to expire September 6.

The temporary provisions have provided enormous help to millions of people who lost their job during the pandemic. But the program’s underlying weaknesses hindered the effectiveness of these expansions. State UI systems themselves are weak and were unprepared for the large number of applicants who needed help in the spring of 2020 when many businesses shut down due to the public health emergency. The weakness of the systems also made it hard for many states to implement the expansion policies. Some people never made it through the red tape while many waited weeks and even months for their applications to be processed. Setting up whole new programs to expand eligibility and augment benefit levels in the midst of an economic crisis was extremely challenging. One key goal of UI reform is to shore up the program so that it can better respond automatically during recessions and other crises.

Senators Ron Wyden and Michael Bennet have released draft UI reform legislation that illustrates what fundamental reform might look like.[13] Key provisions in their proposal would require all states to offer at least 26 weeks of benefits, replace 75 percent of wages up to the state maximum, and modernize eligibility criteria to reflect the realities of the 21st century labor market by covering part-time workers and workers who quit their jobs with good cause.

Their bill would reform the EB program to provide fully federally funded additional weeks of benefits and to increase weekly benefit amounts automatically based on economic conditions nationally and in individual states. It would also establish a $250-per-week jobseeker allowance that would be available to any unemployed workers not covered by the traditional unemployment insurance system, such as self-employed workers and new entrants to the labor force. The Wyden-Bennet proposal does not specifically address UI financing, although it does outline principles for reforming that financing to provide the resources necessary to fund a robust UI system that works well in both good economic times and bad.