Black and Hispanic or Latino[1] unemployment rates are consistently higher than white rates, gaps that widen quickly in recessions and narrow much more slowly after an economic recovery begins. These patterns highlight the importance of policymakers maintaining robust, expanded unemployment insurance assistance until the economy has recovered substantially from the current recession. Doing so would relieve hardship that falls disproportionately on workers of color, reduce racial and ethnic disparities in unemployment and other labor market outcomes, and speed the economic recovery.

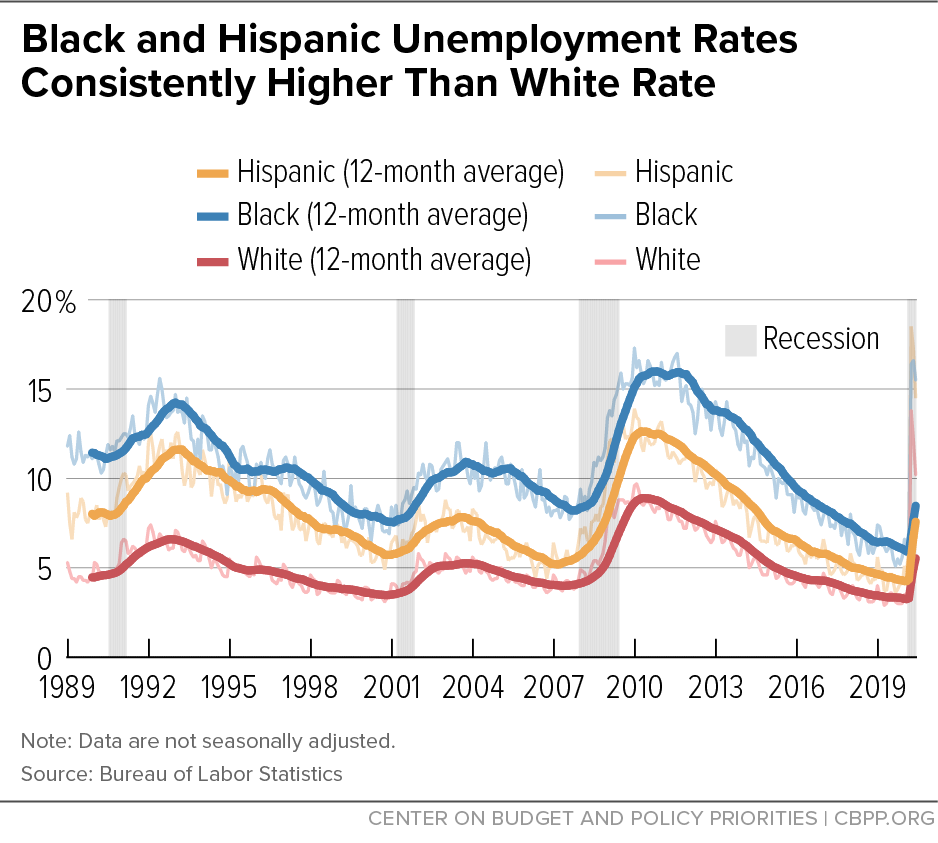

Even as Black and Hispanic unemployment rates reached historic lows in the 2009-2020 expansion, they remained higher than the white rate. In the current economic crisis, white unemployment has risen to very high levels, but Black and Hispanic unemployment has shot up even higher. (See Figure 1.[2]) If the recovery from this recession follows the historical pattern, Black unemployment in particular will remain staggeringly high longer and come down more slowly than white unemployment.

Differences in the age structure or other observable characteristics of these populations explain little of these historical patterns, researchers find.[3] For Black workers, disparities in employment outcomes are rooted in the United States’ history of structural racism, which curtails employment opportunities through many policies and practices such as unequal school funding, mass incarceration, and hiring discrimination. Black workers also tend to be “the last hired and first fired.”[4] Higher Latino unemployment rates reflect many of the same barriers to opportunity.

Policymakers must ensure that the recovery from the COVID-19 recession is robust and broad based to prevent a devastating setback to the employment gains Black and Hispanic workers made in the low-unemployment years of the 2009-20 expansion. In particular, policymakers must not turn off measures enacted to combat hardship and support spending in the economy while workers of color and their families face high unemployment and difficulties meeting basic needs like affording food and paying rent,[5] even if overall unemployment starts to return to more normal levels.

An economic free-fall from February to April 2020 resulted from the COVID-19 outbreak and households’ and governments’ response to its serious health risks, including curtailing normal economic activity requiring face-to-face interaction with fellow workers or consumers. Economic activity contracted sharply and unemployment surged from 3.5 percent in February to 14.7 percent in April — a level not seen since the 1930s. While some jobs returned in May and June as the economy began to reopen, the unemployment rate still stood at 11.1 percent in June, higher than at any point in the Great Recession. Further, the resurgence of the virus in many states that reopened, and the resulting slowdown of reopening plans, is a sign that a full recovery cannot occur until the virus is under control and people feel safe resuming less restricted economic activity.[6]

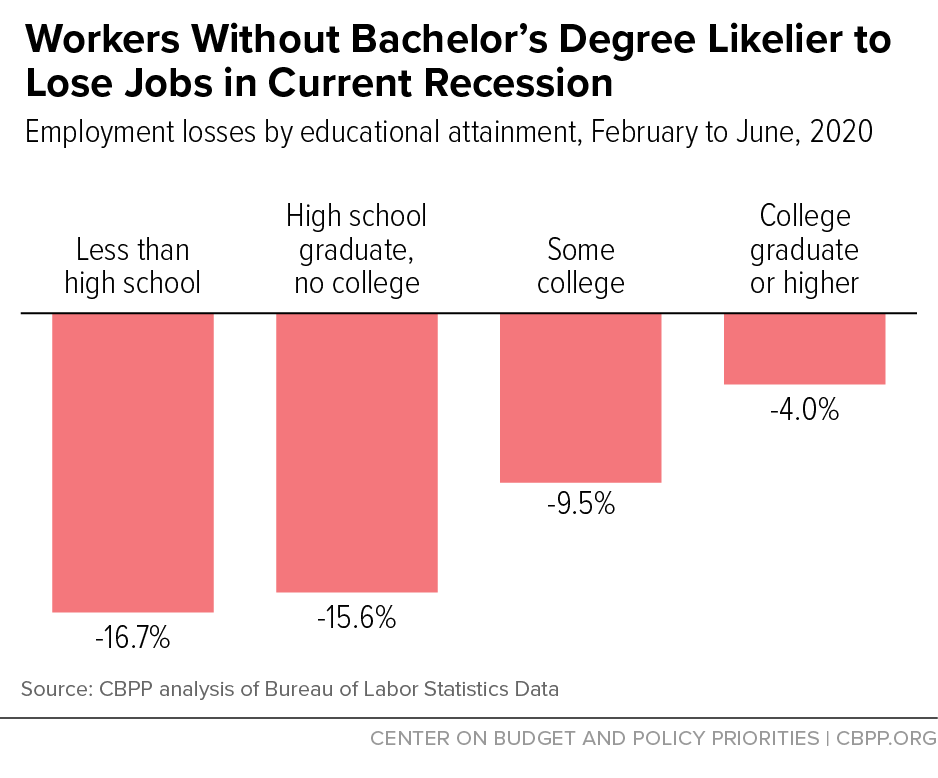

Job losses have been concentrated among people who already faced barriers to economic opportunity working in industries that pay low wages.[7] Even with gains in May and June, employment losses since February remain substantial. Black, Hispanic, and Asian workers have experienced sharper employment declines than white workers, with losses greater for women in all groups; workers with less than a bachelor’s degree have experienced sharper declines than those with a bachelor’s degree or higher; and foreign-born workers have experienced sharper declines than native-born workers.[8] (See figures 2-4.)

The CARES Act enhanced unemployment insurance in various ways, providing crucial support for unemployed workers and the economy. None of these enhancements is scheduled to last beyond year’s end, however; the weekly $600 UI benefits boost expired July 31, and Republican policymakers have proposed far less than that in their initial offer for the next relief package.[9] The Congressional Budget Office estimates that without further relief or stimulus legislation, unemployment in the first quarter of 2021 will exceed 9 percent and will not fall below 6 percent until the second half of 2024.[10]

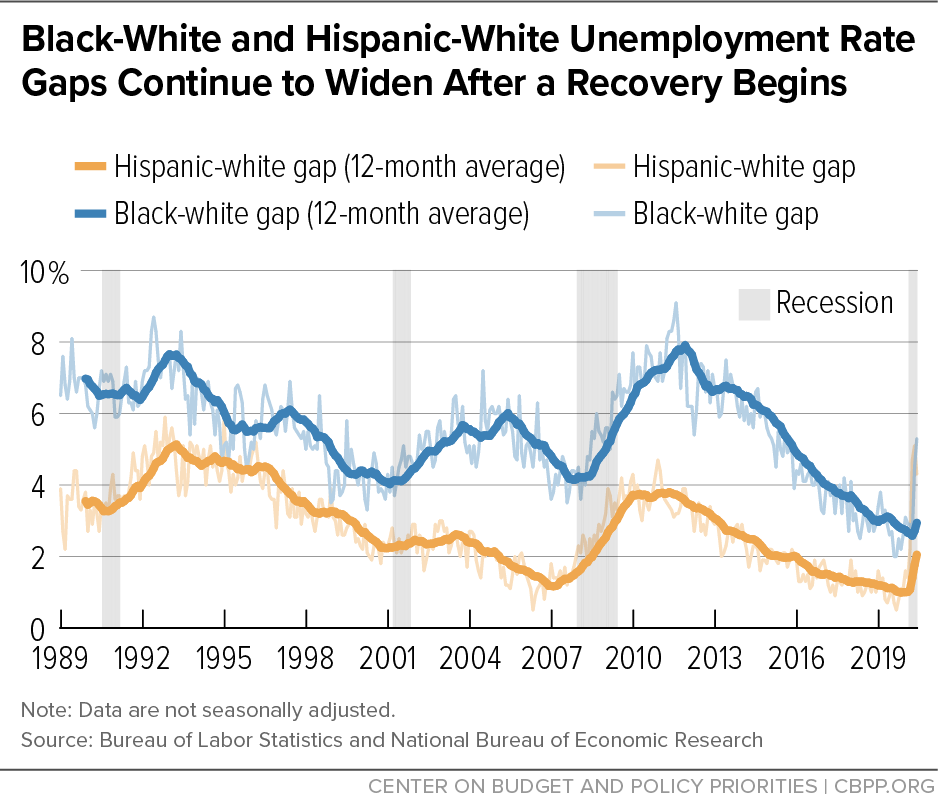

Experience from past recessions strongly suggests that even if the economy is formally out of the recession and economic activity is expanding, unemployment will still be high and racial employment disparities still widening, as discussed further below. This is what happened in the Great Recession. Congress and Presidents Bush and Obama enacted substantial stimulus measures starting in 2008, most notably the American Recovery and Reinvestment Act (ARRA) in February 2009, which had its peak impact on the economy in 2010.[11] As shown in Figure 1, unemployment continued to rise after the recession formally ended in June 2009. The gap between the Black and white unemployment rates continued to widen through 2011 and didn’t fall below its pre-recession level until much later in the long 2009-2020 expansion.[12]

It is now clear that as substantial as ARRA was, it was not large enough to quickly close the huge racial and ethnic employment gaps that opened in the Great Recession, and it ended prematurely, exerting a drag on the recovery.[13] When the last of ARRA’s emergency unemployment insurance measures expired in December 2013 — four and a half years after the recession’s formal end — the overall seasonally adjusted unemployment rate (not shown in Figure 1) was still an elevated 6.7 percent (compared with 5.0 percent at the start of the recession in December 2007). The white rate was 5.9 percent (compared with 4.4 percent at the start of the recession). The Black rate, in contrast, was still 11.9 percent (compared with 9.0 percent at the start of the recession).[14]

Policymakers should not make the same mistake again in the current recession, with its even larger output and employment gaps. Congress and the President got off to a good start, with substantial relief measures, but they will be dropping the ball if they do not maintain substantial assistance to unemployed workers and others who, without such measures, will have too little income to prevent hardship and thus may reduce spending, slowing the recovery. Similarly, without further federal assistance, state governments will have to find ways to reduce spending and/or increase revenues to satisfy their balanced budget requirements, which likely would increase hardship and slow the recovery.[15]

The COVID-19 recession is unique in important ways, notably the extent to which health concerns and social distancing measures are affecting the recession’s depth and the likely pace of recovery. In a report issued July 2, CBO projected that economic activity will pick up strongly in the second half of this year but will still be well below what is required for full employment for several years.[16] CBO’s projections rest on a particular assumption about how social distancing requirements will evolve and the degree to which the gradual easing of those requirements will allow the substantial assistance measures enacted so far to partially mitigate the deterioration of economic conditions and spur the economic recovery. The agency acknowledges, however, that “the severity and duration of the pandemic are subject to significant uncertainty.”

Achieving a faster and more complete recovery will require robust and well-designed measures to control the virus and additional financial assistance for people who can’t quickly find employment and others struggling to meet basic needs — financial assistance that will also stimulate economic activity and hasten the recovery. If policymakers do not provide that assistance, they will delay a strong recovery, and the historical pattern of widening racial disparities seen in past recessions and the early stages of recoveries will inevitably appear again.

The Black-white unemployment rate gap has a distinct cyclical pattern of widening in weak labor markets and generally narrowing but not being erased when the labor market is strong, as Figure 1 shows. There’s a similar pattern for the Hispanic-white gap, if less pronounced in the 2003 post-recession episode.

Figure 5 highlights what might be less obvious in Figure 1, which is that the racial/ethnic unemployment gaps widen in recessions and keep widening as the economy begins to recover. The Black unemployment rate, in particular, not only rises faster than the white rate in a recession but also peaks later and comes down more slowly in a recovery. In the Great Recession episode, for example, the difference between the Black unemployment rate and the white rate was greatest (about 8 percentage points) nearly two years after the Great Recession ended and did not narrow to its pre-recession level (about 4 percentage points) until almost a decade later.

Unemployment rates do not fully reflect the extent of joblessness. Many people who would like a job have not looked recently enough to be classified as unemployed and are instead classified as not in the labor force but wanting a job. (See box, “Glossary of Labor Market Status”). In a recession, the labor force participation rate falls as people stop looking for work, and in a recovery it rises as better prospects of finding a job draw people back in. Changes in the share of the population with a job reflect both changes in unemployment and changes in labor force participation. The employment-to-population ratio (EPop), the share of the population employed, captures the combined effect. Not surprisingly, there are racial disparities in labor force participation and the EPop as well as in the unemployment rate, especially the Black-white gap, as reflected in Figure 6.

In the 12 months ending in December 2007, the start of the Great Recession, the gap between the Black and white EPops averaged 5.2 percentage points. That gap widened over the course of the recession and beyond, reaching 7.7 percentage points in December 2011. It narrowed thereafter, falling below 5.2 percentage points in May 2015 and reaching 2.3 percentage points just before the pandemic. The Hispanic-white EPop gap shows a similar pattern to the Black-white gap over the business cycle, but the Hispanic Epop tracks the white EPop more closely and, in fact, rose above the white EPop in the later stages of the 2009-20 expansion before falling faster than the white rate in the recession and nearly closing that gap by June 2020.

Statistics on people’s labor market outcomes reported in the monthly jobs report from the Bureau of Labor Statistics are estimated from a survey of households asking a series of questions to determine who in the household aged 16 and over and not in the military or an institution (such as prison or long-term health care facility) had a job in the week containing the 12th of the month, who did not, and why not.

A person aged 16 and over with a job in that week who worked:

- at least 35 hours is employed (full time);

- less than 35 hours but wanted to be working more hours is employed (part time for economic reasons, or PTER).

A person without a job in that week who:

- wanted one and had looked for one in the most recent four weeks is unemployed;

- did not want a job or hadn’t looked in the last four weeks is not in the labor force;

- wanted a job and was available for work, had searched in the past year but not the past four weeks, is marginally attached to the labor force but not in it.

The labor force is the sum of the employed and the unemployed.

The unemployment rate is the share of the labor force that is unemployed.

The labor force participation rate is the share of the civilian non-institutional population aged 16 and over that is in the labor force, that is, working or actively looking for work.

The employment-to-population ratio is the share of the civilian non-institutional population aged 16 and over that is employed.

U-6 is a broad measure of unemployment and underemployment that includes the unemployed, the marginally attached, and those working part time for economic reasons and is expressed as a share of the labor force plus the marginally attached.

Structural Barriers and Racial/Ethnic Disparities in Labor Market Outcomes

A proper examination of different economic outcomes across groups should account for differences in observable characteristics across those groups: if, for example, younger people have different levels or trends in average unemployment rates than older people, and one racial or ethnic group has a higher percentage of younger people than another, some portion of the observed differences in economic outcomes will be due to the different composition of the two groups rather than differences in outcomes across the groups for people with similar observable characteristics.

While the above figures illustrate the broad trends in racial/ethnic disparities in labor market outcomes, the Black-white gaps measure differences in labor market outcomes between two groups that each contain people of Hispanic or Latino ethnicity. Similarly, there are some white people in the Hispanic population and some Hispanic people in the white population in the calculation of the Hispanic-white gap. Thus, a more precise analysis would employ non-overlapping groups and account for as many distinct observable characteristics as possible to identify the importance of race or ethnicity.

Federal Reserve researchers have conducted such an analysis.[17] A brief summary cannot do justice to the rich detail they explore, but one thing that stands out is that the observable characteristics they could incorporate in their analysis, such as educational attainment and marital status, generally explain little of the gaps they analyze. Moreover, they acknowledge the likely possibility that some of the observable characteristics used in their analysis may themselves be influenced by other unmeasured factors such as opportunity barriers that stand in the way of a higher level of educational attainment, which means that educational attainment itself has less explanatory power than their analysis finds because it reflects those unmeasured barriers.

Economist Olugbenga Ajilore, writing in February 2020 at what turned out to be the tail end of the 2009-20 expansion, cuts to the chase. He points to America’s history of structural racism to explain why racial disparities in labor market outcomes persisted even in that very-low-unemployment labor market:

The fact that the unemployment gap persists speaks to structural barriers in the labor market that prevent African Americans from gaining employment at a rate similar to whites. Hiring discrimination is one of the primary structural barriers, as many employers exhibit and act upon biases against African Americans or other demographic groups. . . . In addition, the mass incarceration of African Americans offers yet another example of structural barriers in the labor market.[18]

The Fed’s detailed analysis reinforces what is evident in the raw data: Black and Hispanic employment outcomes are more sensitive to the business cycle than white rates. Both the risk of losing a job and the difficulty of finding a job increase across all groups in a recession, but as the Fed researchers conclude, “Overall, the cyclicality of the racial gaps in the unemployment rate indicates that . . . [Black and Hispanic people] are affected relatively more than white [people] (on average), for both men and women.”

The same is true for involuntary part-time employment (PTER), which is included in the broad “U-6” measure of un- and underemployment. (See box.) PTER is more prevalent among Black and Hispanic workers than among white workers. While PTER rose substantially in the Great Recession for all groups it showed distinctly different behavior in the recovery. The Fed researchers found that the incidence of involuntary part-time work was especially notable for Hispanic workers at the trough of the Great Recession in mid-2009, while PTER continued to rise for Black workers until 2013, rather than until just after the recession as was the case with white and Hispanic workers.

Economists Jhacova Williams and Valerie Wilson present evidence that in addition to racial disparities in involuntary part-time employment, Black workers with a college education are less likely than their white counterparts to be employed in a job that is consistent with their level of education.[19] Occupations that require a college degree or in which a majority of people hold college degrees are not immune to the effects of a recession. But in general, workers in those occupations have greater job security and higher earnings, and hence are less likely to become unemployed and better able to weather a period of unemployment financially if they do become unemployed. The large racial wealth gap,[20] however, means that even Black college graduates in jobs consistent with their education typically would be less able to weather a spell of unemployment than their white counterparts.

The adverse effects of a recession on Black and Hispanic workers’ labor market outcomes and overall well-being are larger than those for white workers. Black and Hispanic workers are more likely to lose their job in a recession and have greater difficulty finding a new job in a recovery. Long expansions eventually at least reduce disparities, which makes it imperative that policymakers enact measures that promote a strong recovery from the COVID-19 recession. But it is also imperative that they pursue policies that remove the barriers to opportunity that allow disparities to persist even when the labor market is strong.