Chart Book: Tracking the Post-Great Recession Economy

Note: The Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), the acknowledged arbiter of business-cycle dating, describes a recession as “the period between a peak of economic activity and its subsequent trough, or lowest point…involv[ing] a significant decline in economic activity that is spread across the economy and lasts more than a few months.” An expansion is the period from a trough to its subsequent peak or highest point.

The Committee announced on June 8, 2020, that the economic expansion following the trough in June 2009 peaked in February 2020. On July 19, 2021, it announced that the trough of the ensuing recession was in April 2020. While the recession was very deep, it was the shortest on record at just two months. The committee noted that this recession “had different characteristics and dynamics than prior recessions” but nonetheless the unprecedented magnitude of the decline in employment and production, and its broad reach across the economy, warranted the designation of this episode as a recession, even though the downturn was briefer than earlier contractions. On a quarterly basis the NBER dated the previous peak as the fourth quarter of 2019 and the latest trough as the second quarter of 2020.

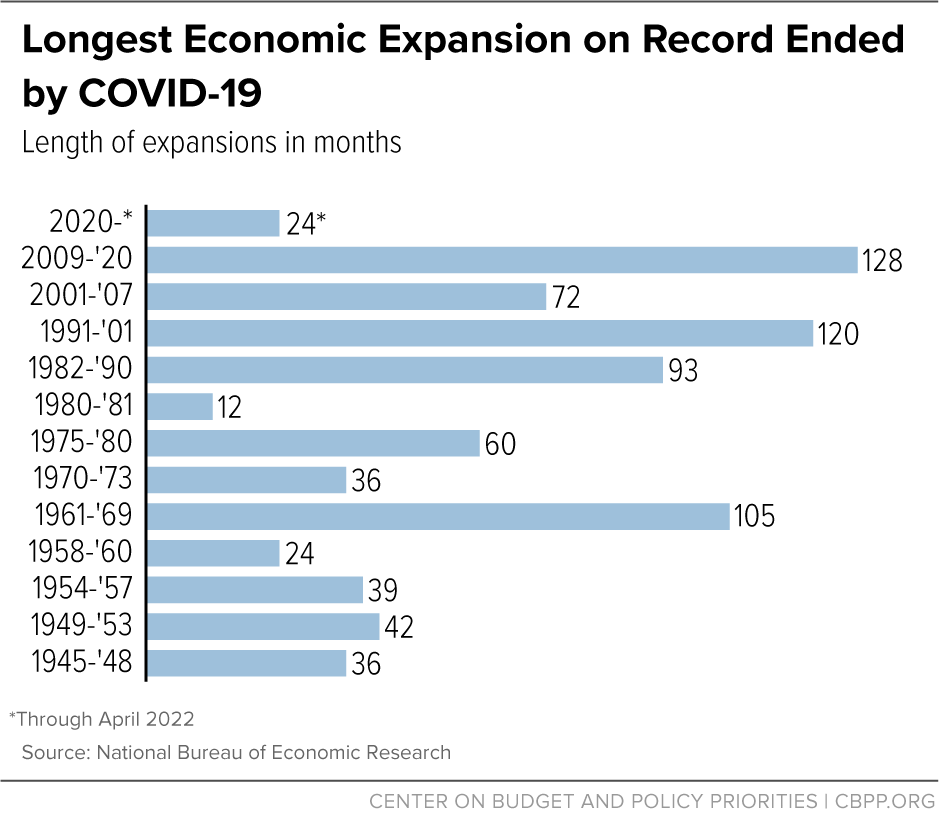

When President Trump took office in January 2017, he inherited an economy in its 91st month of economic expansion following the end of the Great Recession in June 2009. That expansion continued into 2020, becoming the longest on record but peaked at 128 months in February 2020. The current expansion, which began following the April 2020 trough, reached 24 months in April.

While the post-Great Recession expansion was long, both the economy’s average annual growth rate and the typical worker’s earnings gains were relatively modest by the standards of earlier long expansions. Former President Trump claimed that his policies would produce a substantial and sustained increase in economic growth, and his Council of Economic Advisers claimed that those policies would boost wages and employment substantially. By contrast, the Congressional Budget Office (CBO) and many other non-partisan analysts projected much slower economic growth and smaller increases in most workers’ earnings.

This chart book documents the 2009-2020 economic expansion and will continue to track the evolution of the economy. It supplants its predecessor, “The Legacy of the Great Recession,” which covers the decade from the start of the recession in December 2007 through December 2017 with a focus on the plunge into and recovery from the Great Recession.

Part I: COVID-19 Ended Long Recovery and Expansion After the Great Recession

Economic Growth From Mid-2009 Into Early 2020 Ended Abruptly

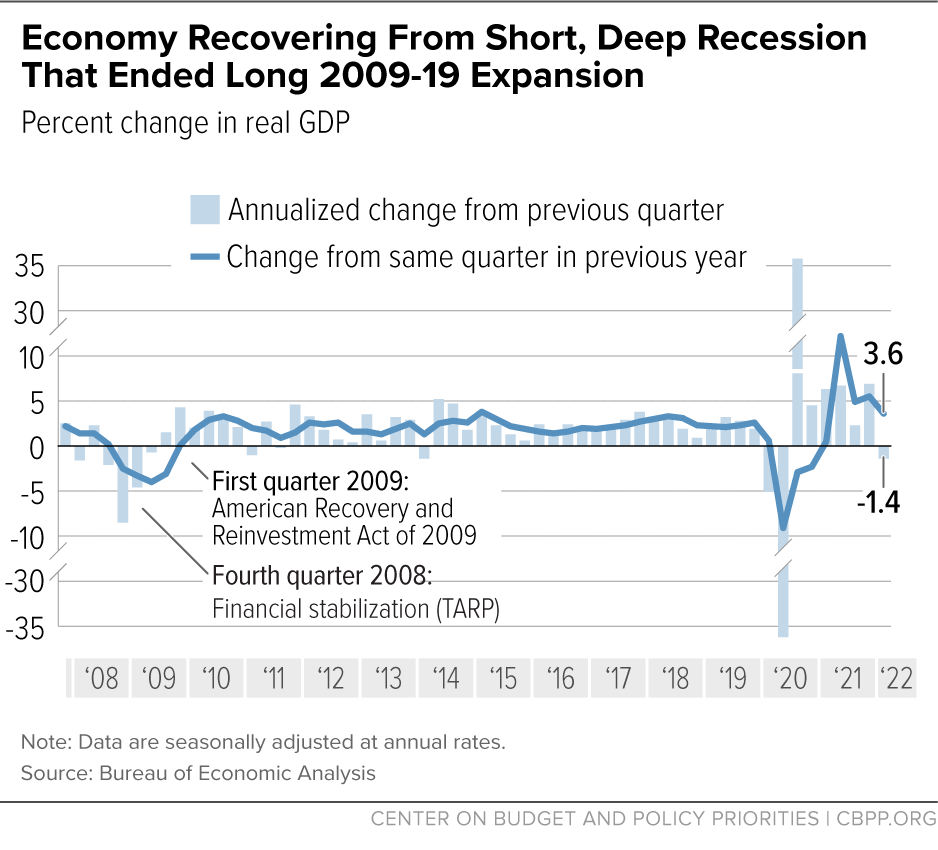

After contracting sharply in the Great Recession, the economy began growing in mid-2009, following the enactment of the financial stabilization bill (Troubled Asset Relief Program or TARP) and the American Recovery and Reinvestment Act. Economic growth averaged 2.3 percent per year from mid-2009 through 2019. The pattern of quarterly growth was uneven, with the expansion including several quarters of growth well above 3.5 percent but also three quarters where it was negative.

The onset of COVID-19 produced a sharp contraction in economic activity in March 2020, resulting in a decline in real GDP of 5.1 percent at an annual rate in the year’s first quarter and 31.2 percent in the second quarter. Because GDP was so much lower in the second quarter than it was at the end of 2019, the dollar amount of the 33.8 annualized growth in the third quarter was much smaller than the dollar amount of the second-quarter drop. Growth slowed to a 4.5 percent annual rate in the fourth quarter of 2020.

A reopening of businesses and government relief and stimulus actions fueled the ongoing recovery in the first quarter of 2021, when GDP rose by 6.3 percent but was still 0.8 percent below its level at the peak of the last expansion in the fourth quarter of 2019. Growth of 6.7 percent in the second quarter pushed GDP 0.9 percent above that previous peak. After relatively weak growth in the third quarter, GDP rose at a robust 6.9 percent annual rate in the fourth, putting GDP 5.5 percent above its level a year earlier and 3.1 percent above its previous peak.

Real GDP fell 1.4 percent in the first quarter of 2022, but for reasons that did not suggest a recession was underway. GDP is a measure of current domestic production of goods and services. Imports are goods and services produced abroad and are subtracted from domestically produced consumption and investment in calculating GDP. Inventory accumulation (when production exceeds sales) adds to GDP, which it did in the fourth quarter of 2021; inventory decumulation (when sales exceed production) reduces GDP, which it did in the first quarter of 2022.

In the first quarter, real consumer purchases added 1.8 percentage points to GDP growth, and business and residential investment added 1.3 points, but the trade deficit (the excess of imports over exports) subtracted 3.2 points. A decrease in inventories subtracted 0.8 points and a drop in government purchases subtracted 0.5 points. With the 1.4 percent drop, GDP in the first quarter of 2022 was 3.6 percent higher than it was a year earlier and 2.8 percent above its pre-pandemic peak in the fourth quarter of 2019.

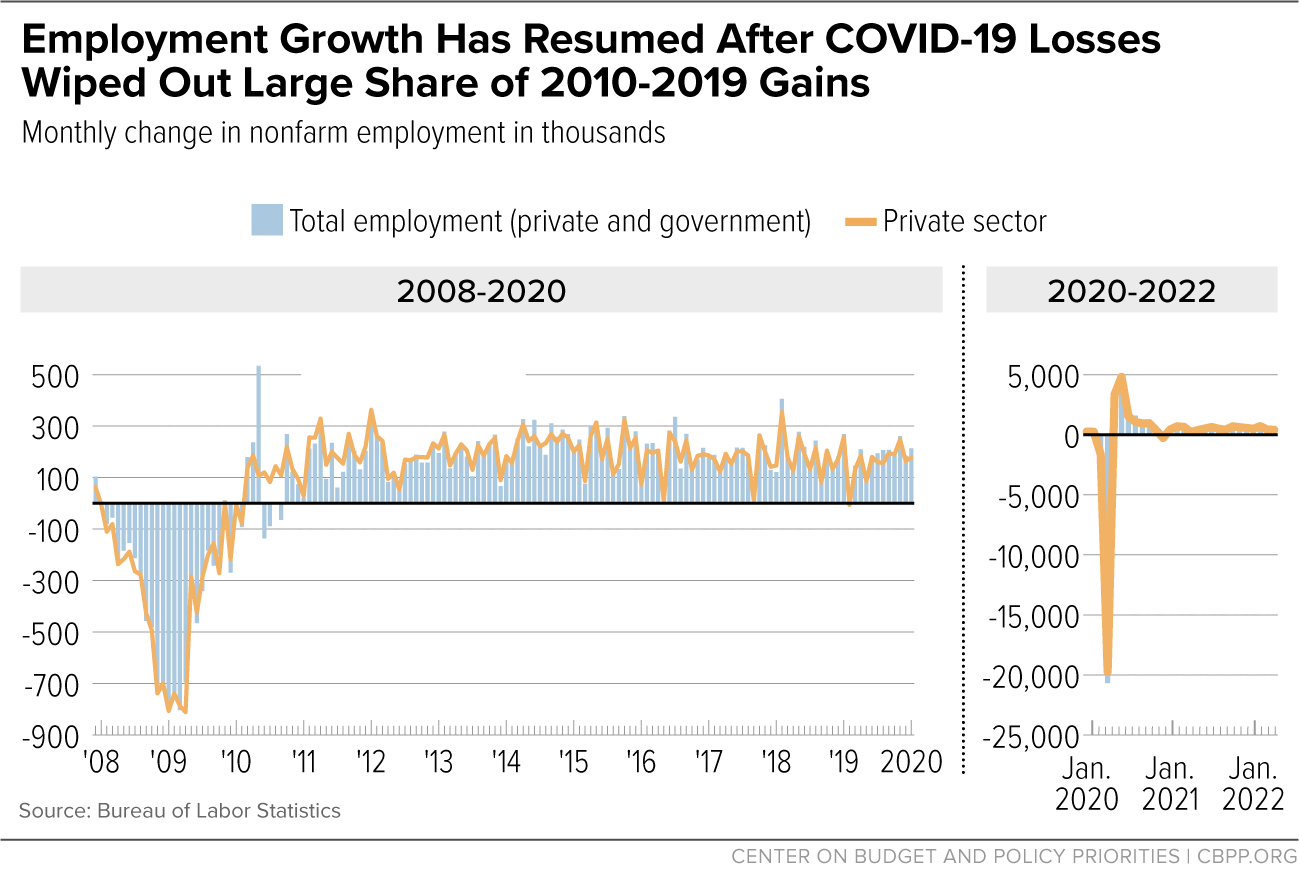

Employment Growth Has Resumed After COVID-19 Losses Wiped Out Large Share of 2010-2019 Gains

Through February 2020, total (private and government) payroll employment had risen for 113 straight months. Private employment had risen for 120 straight months, but total government employment was barely above what it was at the start of the expansion. Large employment losses in March and April 2020 wiped out a large share of those gains.

Total nonfarm employment fell by a staggering 20.7 million jobs in April 2020, largely erasing the gains from a decade of job growth. Job gains in every month except December 2020 have narrowed the deficit in April 2022 to 1.2 million jobs below the pre-pandemic February 2020 level.

Private employment rose by 406,000 jobs in April 2022 but remains 500,000 jobs below its February 2020 level. Federal government employment decreased by 6,000; state employment increased by 7,000 (putting losses since February 2020 at 103,000); and local employment rose by 21,000 (putting losses since February 2020 at 596,000)

Note: Every January, the Bureau of Labor Statistics publishes revised figures for payroll employment data based on a re-benchmarking of the previous March’s estimates using administrative data rather than a survey. The revisions changed the pattern of monthly growth substantially and increased average monthly growth in 2021 from 537,000 per month to 555,000 per month.

Job Growth Greater Than in 2001-2007 Expansion Ended in March 2020

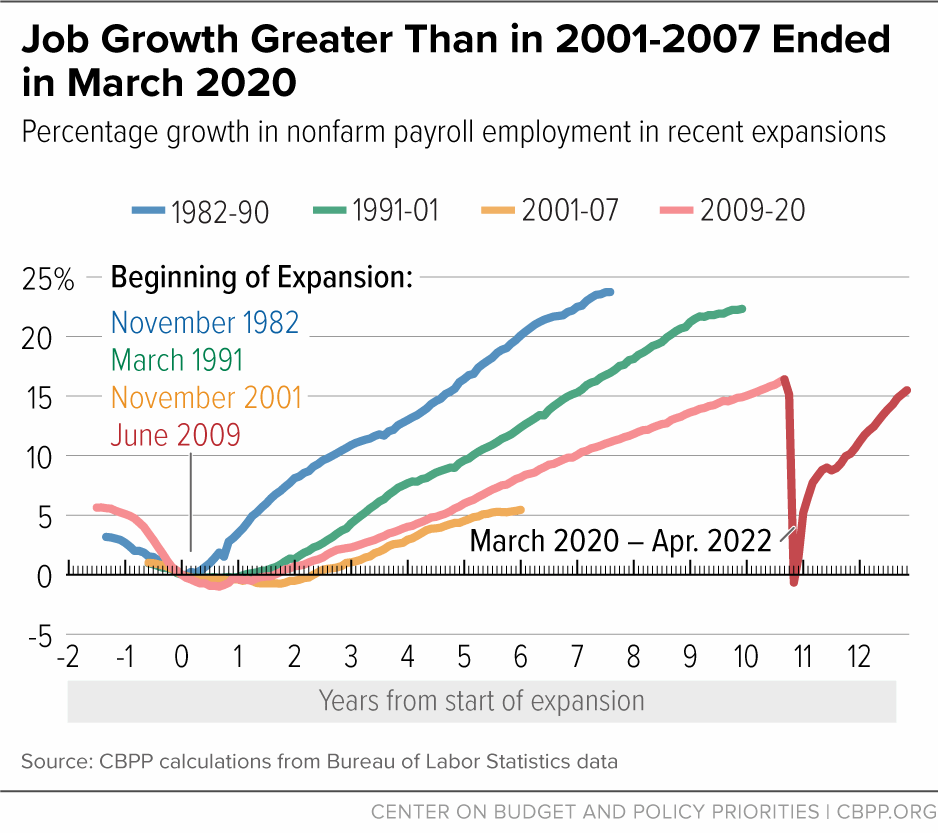

Nonfarm payroll employment fell more sharply in the Great Recession than in the three prior recessions. In contrast to the rapid bounce-back in employment at the start of the 1980s expansion, the turnaround in the labor market trailed the revival of economic activity marking the beginning of the three expansions prior to the 2020 recession. Job gains starting in May 2020 have been very large by historical standards but have not yet brought total employment back to its February 2020 level.

In the pandemic, the drop in payroll employment in April 2020 was huge and the turnaround in payroll employment in the months since then reflected some lifting of pandemic restrictions in many states and some people returning to work in May and June 2020. But states facing outbreaks began re-imposing restrictions and payroll job growth slowed for five straight months prior to falling by 227,000 jobs in December 2020. Policymakers enacted relief measures at the end of December 2020 and the American Rescue Plan in March 2021, which — together with some opening up of the economy — produced job gains averaging 562,000 a month in 2021, although health and safety concerns arising from the delta and omicron variants were a barrier to job creation later in the year.

Looking back at the 2009-2020 expansion, the jobs deficit at the beginning was much larger than those at the start of the previous two expansions, and it took a long time simply to get back to the level of payroll employment at the start of the recession. That said, payroll employment growth was somewhat better than in the 2001-2007 expansion, and it continued much longer.

Nonfarm payroll employment was 10.2 percent (14.1 million jobs) higher in February 2020 than at the start of the Great Recession. But due to the job losses since, in April 2022 such employment was just 9.3 percent (12.9 million jobs) higher than at the start of the Great Recession.

The rise in payroll employment over its peak in the expansion preceding the Great Recession was almost entirely due to private-sector job gains. Government employment was 459,000 jobs (2.1 percent) higher in February 2020 than in December 2007, accounting for only 3.2 percent of the total job gains.

In contrast, government employment in the three expansions preceding the Great Recession accounted for 13 percent (1982-1990), 10 percent (1991-2001), and 25 percent (2001-2007) of each expansion’s employment gains over the level of employment at the peak of the previous expansion. In each case, state and local government job growth was the major contributor.

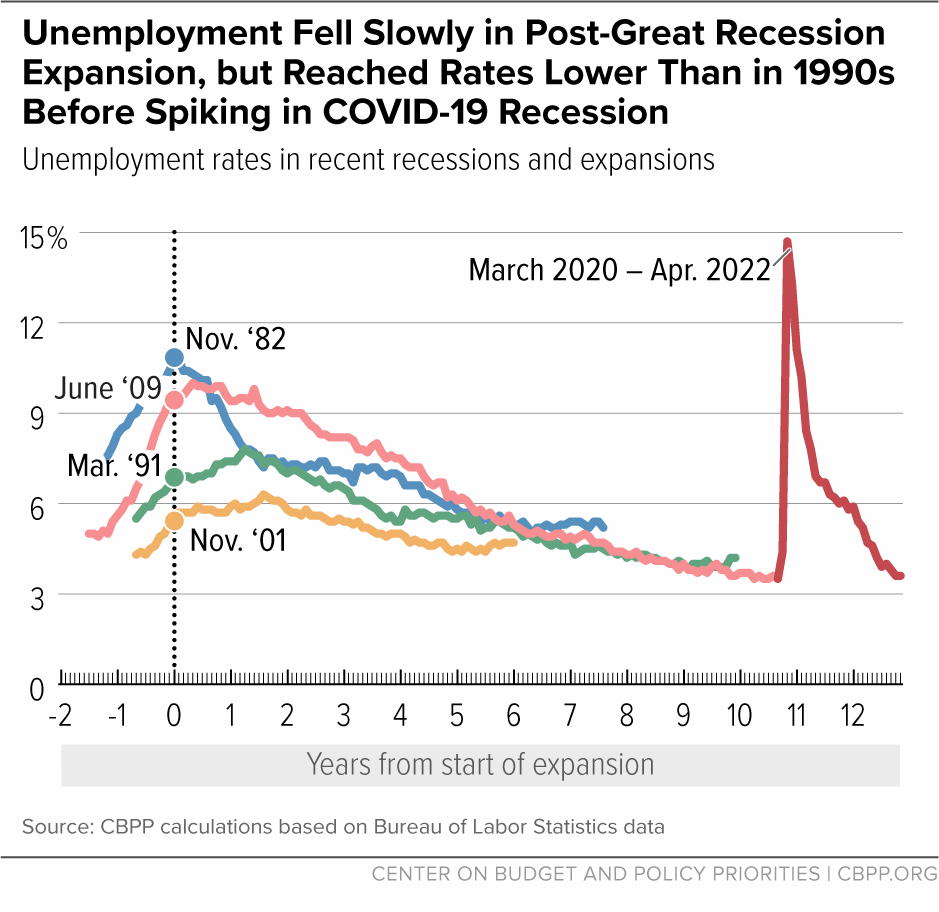

Unemployment Fell Slowly in Post-Great Recession Expansion but Reached Rates Lower Than in 1990s Before Spiking in COVID-19 Recession

The relatively modest pace of job growth in the first years of the 2009-2020 expansion (compared with the size of the job losses in the recession) kept unemployment quite high for some time after economic activity picked up. This initial persistence of high unemployment was similar to but more extreme than what happened at the start of the two previous expansions. The pattern in all three, however, is quite different from the sharp decline in unemployment at the start of most earlier expansions, including the expansion following the severe 1981-1982 recession.

Nevertheless, by late 2015 the unemployment rate had fallen to 5 percent, its rate at the start of the recession, and it began to fall further at the beginning of 2017. The unemployment rate was 4 percent or lower for the last 24 months of the expansion. It was in the 3.5 percent to 3.7 percent range from April 2019 through February 2020, reaching rates even lower than in the long 1990s expansion. Rates that low were last seen in 1969.

The rise in unemployment since February 2020, however, pushed the unemployment rate well above the 10.8 percent rate reached in late 1982, which itself was the highest since the 1930s. Unemployment has come down sharply after peaking in April 2020, reaching 3.6 percent in April 2022. The Bureau of Labor Statistics says the actual rate likely is somewhat higher due to misclassification of some workers. In addition, the unemployment rate does not take into account workers who have stopped looking for work and left the labor force. Unlike the unemployment rate, labor force participation (the share of the population age 16 and over either working or actively looking for work) has only recently begun to edge up.

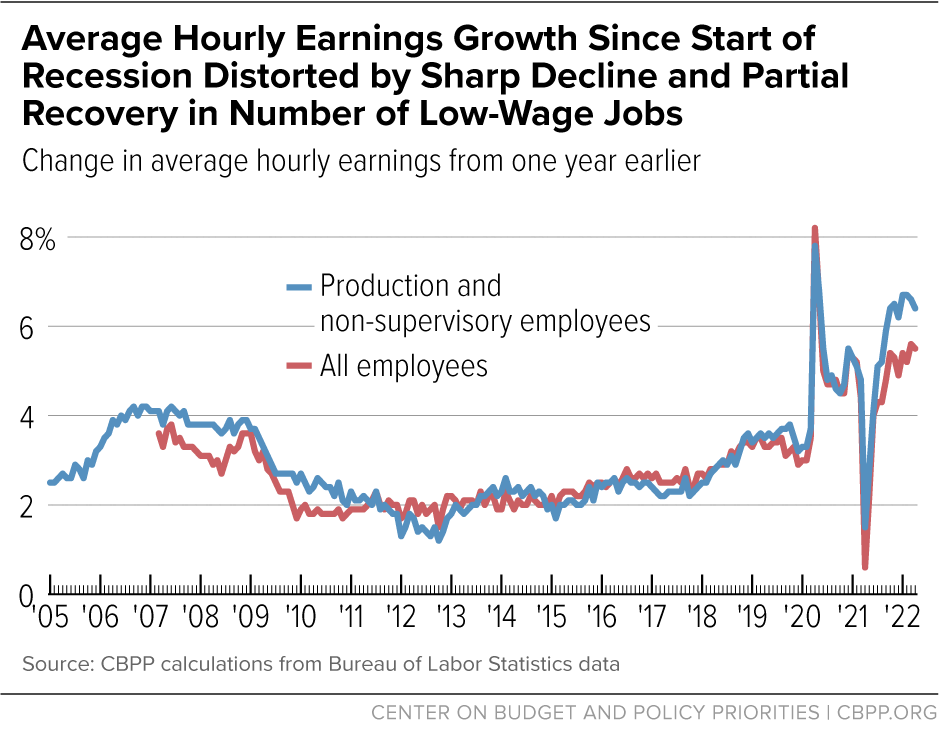

Average Hourly Earnings Growth Since Start of Recession Distorted by Sharp Decline and Partial Recovery in Number of Low-Wage Jobs

Average hourly earnings of employees on private payrolls grew modestly through much of the recovery from the 2007-09 recession, and through February 2020, wage growth averaged 2.4 percent annually. Inflation was modest as well, but over much of the expansion, real (inflation-adjusted) wages failed to keep up with increases in workers' productivity, as we discuss below in Part III.

The pace of wage growth (before adjusting for inflation) quickened in 2015 and into 2016 but subsequently stalled below 3 percent until 2018, when it began edging up again. The upward trend in earnings growth for all employees stalled in 2019, however, despite very low unemployment. Low inflation led to solid real wage gains in 2015 and 2016 and to a lesser degree in 2019.

Average wage growth increased sharply after February 2020, but not because of widespread wage gains. Rather, large numbers of lower-wage workers bore the brunt of the job losses in the recession and the shift in the composition of total payroll employment toward higher-paid jobs was large enough to temporarily raise the average wage substantially. The partial recovery in low-wage jobs had the opposite effect.

Extraordinary circumstances in the pandemic recession have continued to distort recent 12-month changes, but wages do seem to be on the rise. The monthly average annual earnings data will be a poor guide to trends in worker pay, however, as long as the composition of the labor force is changing as the recovery in low-wage job continues.

In April 2022, average hourly earnings of all employees on private payrolls were 5.5 percent higher than a year earlier; earnings of non-management employees were up 6.4 percent.

Part II: Federal Reserve Policy, High Employment, and Inflation

As the 2009 Recovery Act’s temporary fiscal stimulus measures expired with the economy still far short of full employment, the primary responsibility for nurturing the economic recovery fell to the Federal Reserve. The Fed has a “dual mandate” from Congress to pursue stable prices and “maximum employment.” In normal times, the Fed does so primarily by trying to keep interest rates at a level that balances the demand for goods and services with the economy’s ability to supply them, lowering interest rates to stimulate economic activity and employment when the economy falls short of maximum employment, and raising interest rates to restrain economic activity and avoid unwanted inflation in an overheating economy.

From the early 1980s until the global financial crisis and the Great Recession, the Fed has primarily used changes in its target for the federal funds rate — the interest rate banks charge each other for overnight loans — to influence economic activity. Changes in the federal funds rate induce changes in mortgage interest rates, other consumer interest rates, and the cost of business investment that influence households’ and businesses’ spending. By the end of 2008, however, the Fed had cut the federal funds rate essentially to zero and turned to unconventional tools, as described below, to continue to provide the stimulus to spending needed to achieve its maximum employment mandate.

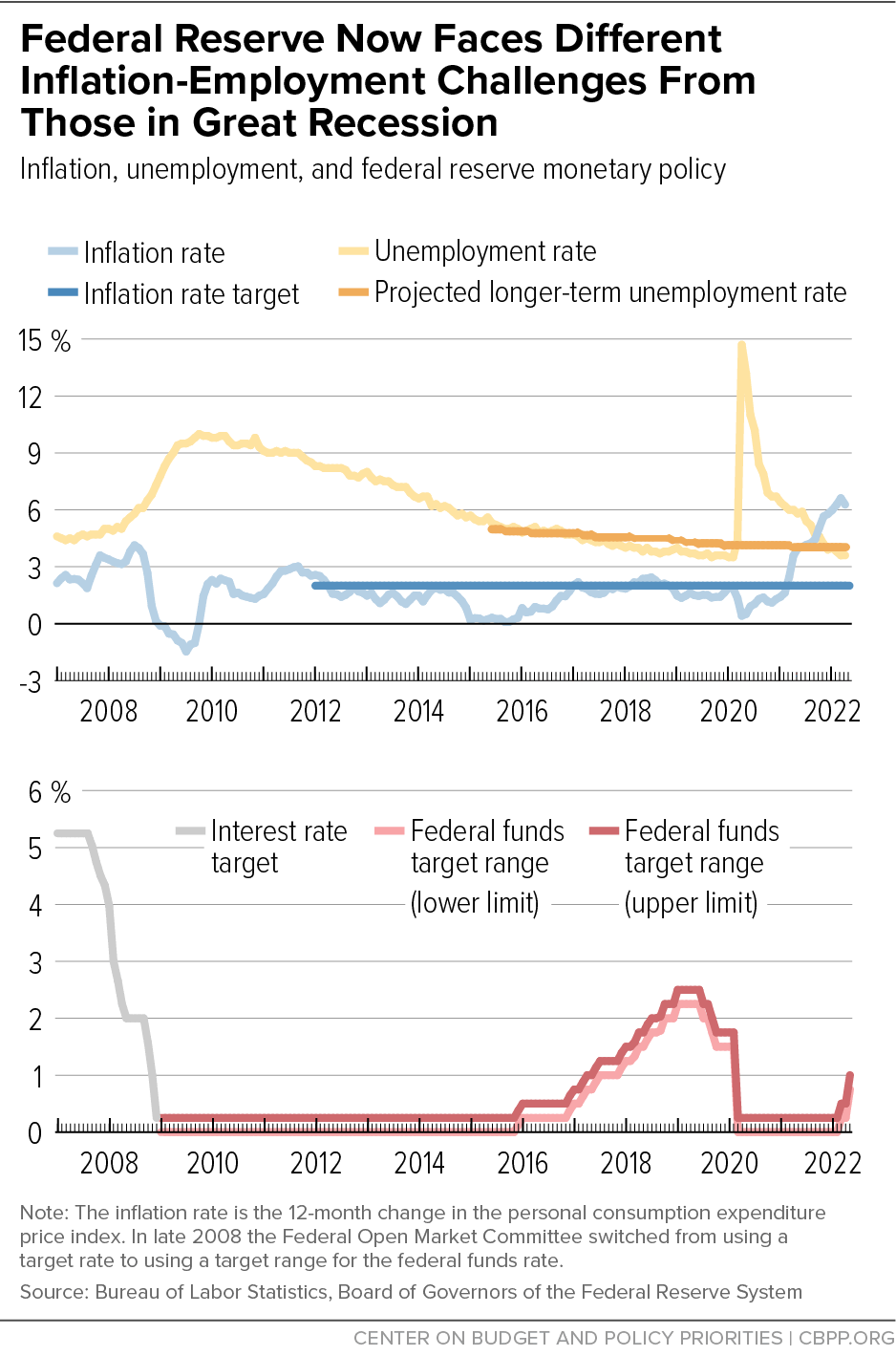

Normally, continuing to provide substantial monetary stimulus would be expected to push up inflation as the labor market became tighter. But inflation fell short of the Fed’s target through much of the expansion, even as standard indicators such as the unemployment rate and the share of the population with a job reached levels that historically indicated a tightening labor market.

In January 2012 the Fed formally adopted a 2 percent inflation target as its goal for achieving low and stable prices, using the 12-month change in the personal consumption expenditures (PCE) price index as its preferred measure. The Fed subsequently made explicit that this was a symmetric target, not a ceiling, meaning that temporary deviations either below or above 2 percent would not necessarily elicit an immediate policy response. In practice, inflation was below the Fed’s target for most of the 2009-’20 expansion, leading many analysts to believe the Fed was implicitly treating its inflation target as a ceiling. In August 2020, however, after a year-long review of its operating procedures, the Fed issued a new statement on longer-run goals and monetary policy strategy, stating that “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

The Fed does not have a specific target for maximum employment. While it takes into consideration a variety of labor market indicators besides the unemployment rate, it periodically publishes projections by members of its monetary-policymaking committee of what they expect the unemployment rate to be in the longer run under their policies. As actual unemployment fell below those projections while inflation remained below target, the committee members revised down their long-term unemployment rate projections. The median projection fell from 5.0 percent in 2015 to 4.1 percent in December 2019, and then to 4.0 percent in March 2021, although the actual unemployment rate at the peak of the expansion in February 2020 was 3.5 percent.

For most of the period from late 2008 through early 2021, inflation was lower than the Fed’s 2 percent target rate. Therefore, the accommodative monetary policy for pursuing the Fed’s maximum employment goal (using low interest rates and other measures to stimulate economic activity) was also appropriate for raising inflation to the 2 percent target rate. However, the larger-than-expected burst of inflation that started in April 2021 requires the Fed to address inflation without losing sight of its high-employment dual mandate goal.

Monetary Policy at the “Zero Lower Bound” Raised Employment but Not Inflation

As the global financial crisis sent the economy plunging into a deep recession, the Fed cut its federal funds target from 5.25 percent in the late summer of 2007 to essentially zero by the end of 2008, where it remained until late 2015. With conventional rate cuts no longer possible at this “zero lower bound” but with the labor market still weak and inflation tame, the Fed turned to unconventional monetary policy tools to continue to provide stimulus and accommodate an economic recovery. These tools included large-scale purchases of longer-term assets (“quantitative easing”) to put downward pressure on longer-term interest rates and support the mortgage market and efforts to improve transparency in communicating with the public about the likely future course of monetary policy (“forward guidance”).

The Fed carried out three rounds of large-scale purchases of Treasury securities and other long-term assets between 2008 and 2014, and then kept the stock of longer-term assets large by reinvesting principal payments when these assets matured. The Fed maintained this reinvestment policy through September 2017, after which it began to taper the amount reinvested. As the unemployment rate began to approach monetary policymakers’ projections of the longer-run sustainable unemployment rate, the Fed also began to raise its target for the federal funds rate, starting in December 2015, eventually raising it to between 2.25 and 2.5 percent in 2019.

At the peak of the expansion in February 2020, the unemployment rate and other measures of labor market slack (that is, excess unemployment and underemployment) were below their levels at the peak of the 2001 expansion. For example, the unemployment rate fell below the CBO’s estimate of the “natural” rate of unemployment (the rate expected to prevail when the economy is operating at full sustainable productive capacity). Yet inflation and wage growth were not signaling an overheating economy.

This situation gave the Fed an opportunity to probe how low the unemployment rate could go without generating unacceptable inflation. But such probing was thought to carry the risk that inflation might begin to rise fast enough that the Fed would have to act more aggressively to cool an overheating economy.

Nevertheless, letting the economy run as “hot” as possible without triggering unacceptable inflation had many advantages, including reducing long-term unemployment, drawing people who wanted to work but were no longer actively looking back into the labor force, and reducing racial disparities in unemployment. So long as businesses and households believed that the Fed would act to rein in unacceptable inflation if it appeared, the costs of prematurely cutting off possible additional employment gains deterred the Fed from tightening monetary policy too aggressively. That belief also gave the Fed leeway to cut interest rates in 2019 when the post-Great Recession expansion showed signs of faltering.

Early in the COVID-19 pandemic, however, the Fed’s task changed from continuing to support a high-employment economy to doing all it could to limit the damage from the 2020 recession in the short term and to promote a robust recovery when economic activity began to revive. In response to what it saw as “evolving risks to economic activity” posed by the pandemic, the Fed cut its target range to 1.00 to 1.25 percent on March 3, 2020, and then to 0 to 0.25 percent. The Fed adopted additional unconventional measures on March 15, 2020, in response to COVID-19’s effects on economic activity and policy measures to contain the crisis The Fed also launched substantial quantitative easing measures and measures to stabilize financial markets like those it used to address the 2008 financial crisis.

While the 12-month change in the PCE price index remained below 2 percent from 2019 into early 2021, it jumped to 3.6 percent in April 2021 and was 6.3 percent in April 2022. The 12-month change in the more widely recognized CPI (which tends to grow somewhat faster than the PCE price index) was 8.3 percent in April 2022.

In September 2021, monetary policymakers decided to continue making large-scale asset purchases of Treasury and mortgage-backed securities, but they indicated that they could begin tapering these purchases soon. In December Fed policymakers also continued to believe that inflation, while currently higher than they wanted, was being driven by pandemic-related factors that would gradually dissipate. They also indicated that the Fed was close to achieving its maximum employment goals, with the unemployment rate below its longer-term projections, but labor force participation and the share of the population with a job still below pre-recession levels.

The Fed announced on November 3, 2021, that it would begin to taper its large-scale asset purchases, slowing the pace of stimulus from quantitative easing. In other words, the total dollar amount of Fed holdings would continue to grow, but the rate of growth would slow. The Fed emphasized that it would continue to monitor economic conditions for any change in the economic outlook that would require adjustments to its monetary policy stance, followed by a December announcement that it would be speeding up the pace at which it would be reducing its asset purchases.

Then, in March 2022, the Fed announced that it was raising its target for the federal funds rate to a range between 0.25 and 0.50 percent; in May it raised the rate again to a range between 0.75 and 1.00 percent. The Fed also has begun shrinking its stock of long-term assets by not rolling over a portion of those assets when they mature. Together, these rate hikes and quantitative tightening are intended to slow the growth of aggregate demand to reduce inflationary pressures.

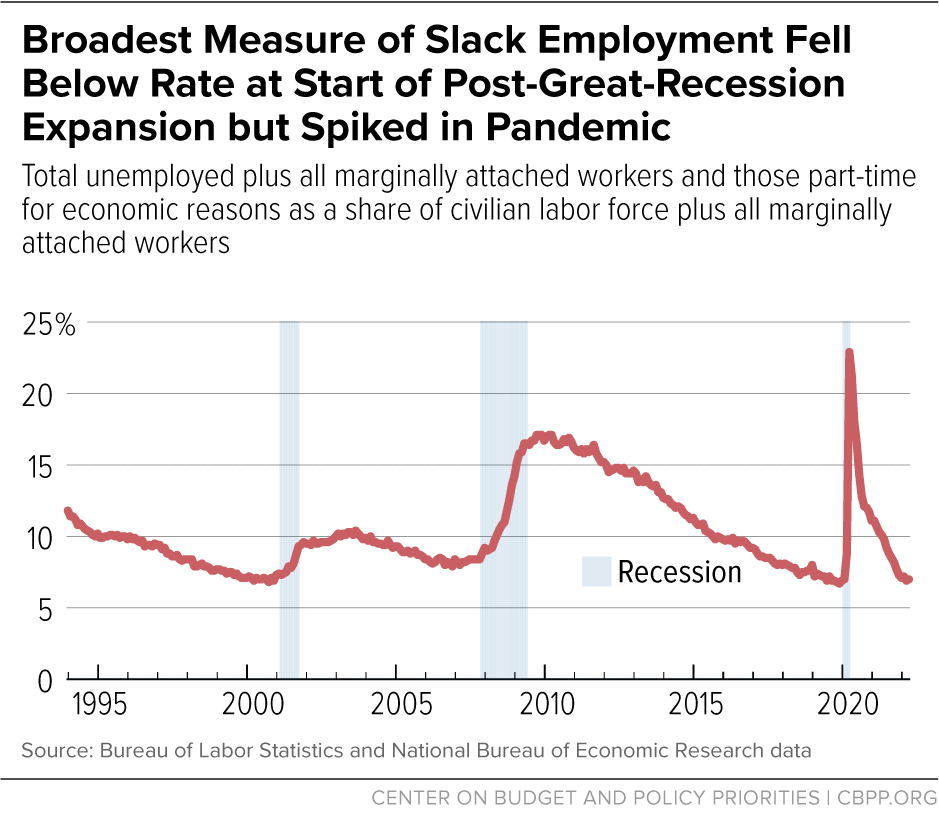

Broadest Measure of Slack Employment Fell Below Rate at Start of Post-Great-Recession Expansion but Spiked in Pandemic

The Labor Department's most comprehensive alternative unemployment rate measure — which includes people classified as “marginally attached” to the labor force, who want to work but have not looked for a job recently enough to be classified as unemployed, and people working part time because they can't find full-time jobs — recorded its highest reading on record in November 2009 in data that go back to 1994. This measure, known as U-6, fell steadily beginning in 2011 and was below 8.8 percent — its rate at the start of the recession — from February 2017 through February 2020. It jumped from 8.8 percent in March 2020 to 22.9 percent in April 2020 but has since fallen and was 7.0 percent in April 2022.

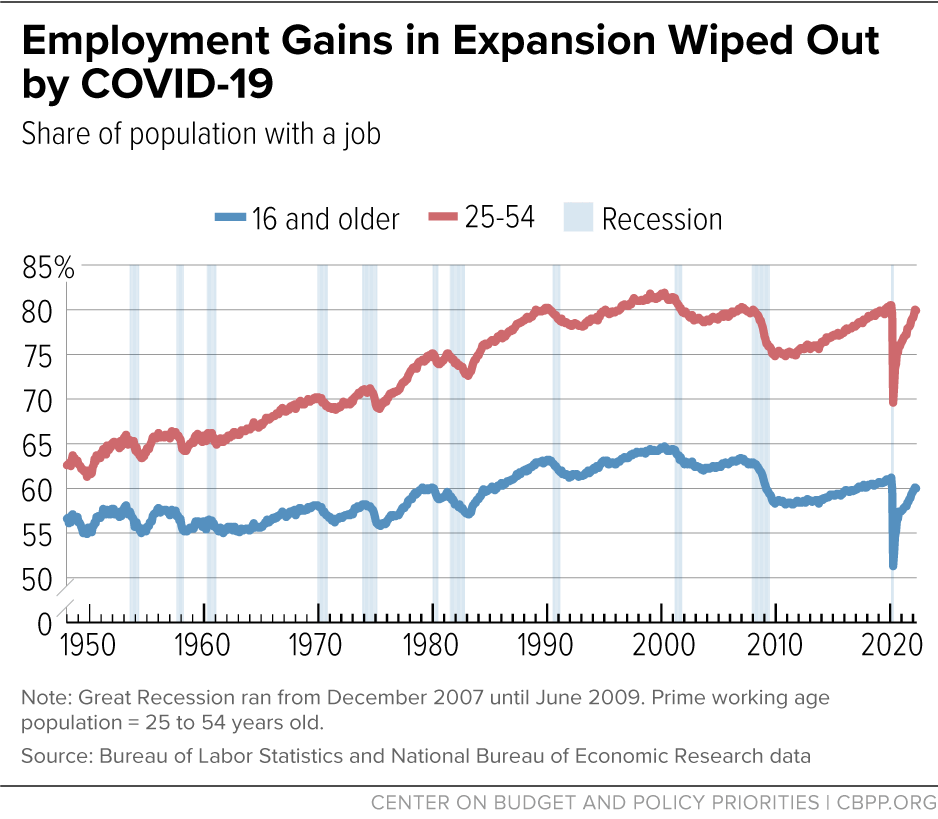

Employment Gains in Expansion Wiped Out by COVID-19

The sharp rise in unemployment and discouragement over the prospects of finding a job in the Great Recession caused the labor force participation rate (the percentage of the population either working or actively looking for work) to fall sharply. The combination of rising unemployment and falling labor force participation produced a historically steep decline in the percentage of the population with a job (the employment-to-population ratio) for both the prime working-age population (those aged 25-54) and for the entire population aged 16 and older.

The employment-to-population ratio of those aged 16 and older remained near its recession low until 2014, when it began to rise as labor force participation leveled off while unemployment continued to fall. Nevertheless, in February 2020 it was still 2.6 percentage points below its rate at the start of the recession. It fell in March and again in April to its lowest rate on record, 51.3 percent. A partial recovery brought it to 57.4 percent in October, where it remained through December 2020. Further increases in 2022 brought it to 60.0 percent in March 2022, which was still below the 61.2 percent rate at the start of the recession.

That population includes an increasing number of baby boomers near retirement or already retired. Thus, some of the difference between their employment rate at the start of the recession and the rate more than a decade later reflected demographic trends rather than labor market weakness. In contrast, the employment-to-population ratio for those in their prime working years (age 25-54), which fell 4.9 percentage points between the start of the recession and December 2009, recovered all of that loss and was 80.4 percent in February 2020. Nevertheless, it remained below the peak rates achieved in the 1990s expansion, fell to a recent low of 69.6 percent in April 2020, and has subsequently risen to 79.9 percent in April 2022.

The household survey used to estimate employment statistics is designed to distinguish between people who are unemployed (actively looking and available for work) and those who are not in the labor force (not actively looking and in most cases not wanting a job). Marginally attached workers, who are included in the U-6 measure of unemployment and underemployment, are not in the labor force because even though they say they want a job, they have not looked recently enough to be counted as unemployed.

These distinctions have become blurred in the pandemic, because the number of people receiving unemployment insurance benefits, which normally requires that one actively search for a job, was expanded greatly under the CARES Act, enacted in March 2020. How people answer the survey question of whether they are unemployed and looked for a job recently will determine whether they are classified as unemployed, marginally attached, or not in the labor force. If lots of people who expect to be going back to work when it is safe and pandemic-control measures are relaxed are recorded as not actively looking, true unemployment could be undercounted and the rise in the unemployment rate could be muted. The employment-to-population ratio might then more accurately reflect the extent of joblessness.

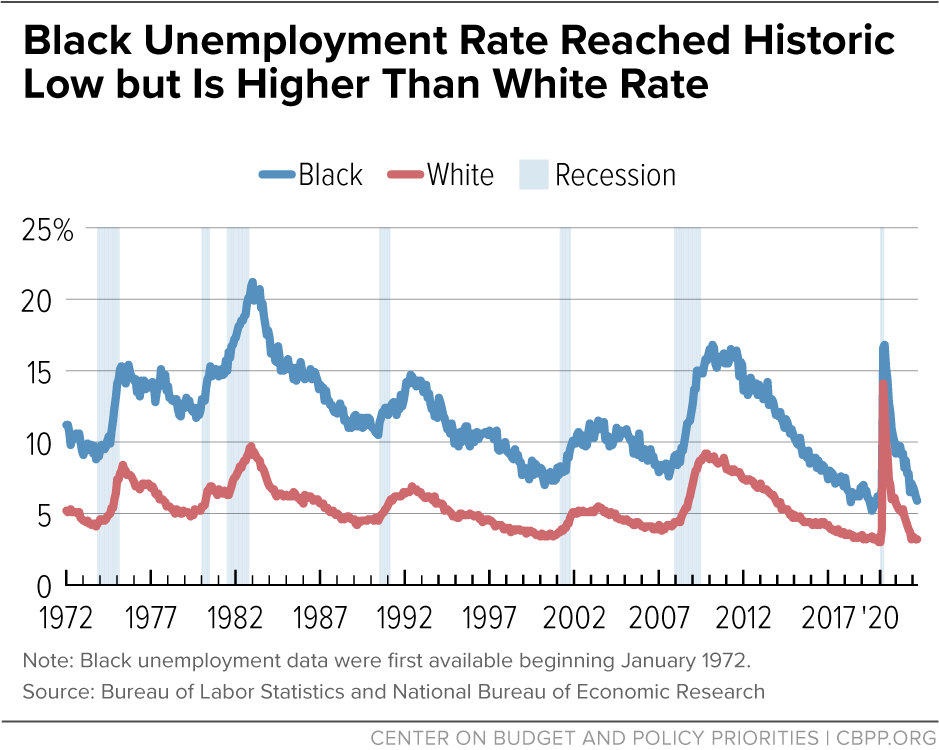

Black Unemployment Rate Reached Historic Low but Is Much Higher Than White Rate

Black or African American unemployment is persistently higher — roughly twice as high on average over time — than white unemployment. The difference between the two rates typically narrows when the economy is particularly strong and widens in recessions. Across data that go back to 1972, however, Black unemployment in the best of times is not much better than white unemployment in the worst of times.

Black unemployment averaged 6.1 percent in 2019 and reached a historic low of 5.2 percent in August 2019. It jumped to 16.7 percent in April 2020 and was still a high 5.9 percent in April 2022. The white unemployment rate averaged 3.3 percent in 2019 and rose to 14.1 percent in April 2020. It was 3.2 percent in April 2022.

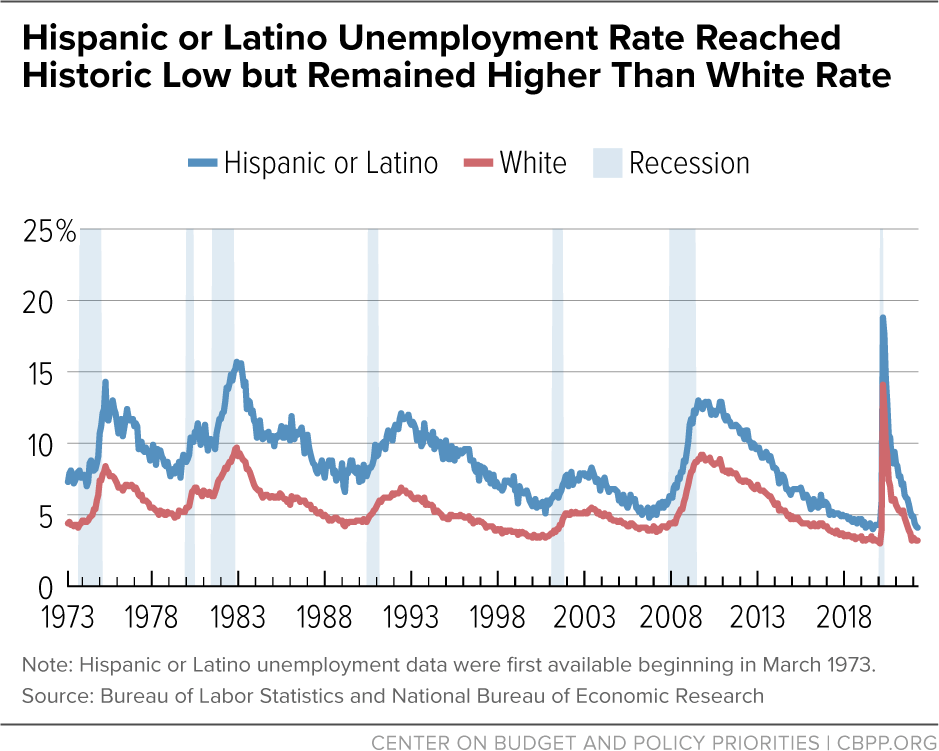

Hispanic/Latino Unemployment Rate Reached Historic Low but Remained Higher Than White Rate

Historically, the unemployment rate for Hispanic/Latino workers has remained between the Black and white unemployment rates in recessions and expansions, but in April 2020 it rose above both. It averaged 4.3 percent in 2019, reached an all-time low of 3.9 percent in September 2019 in data that go back to 1973 and was 4.4 percent in February 2020. Similar to the Black and white unemployment rates, it rose substantially in March and April 2020, reaching 18.9 percent in April. It was 4.1 percent in April 2022.

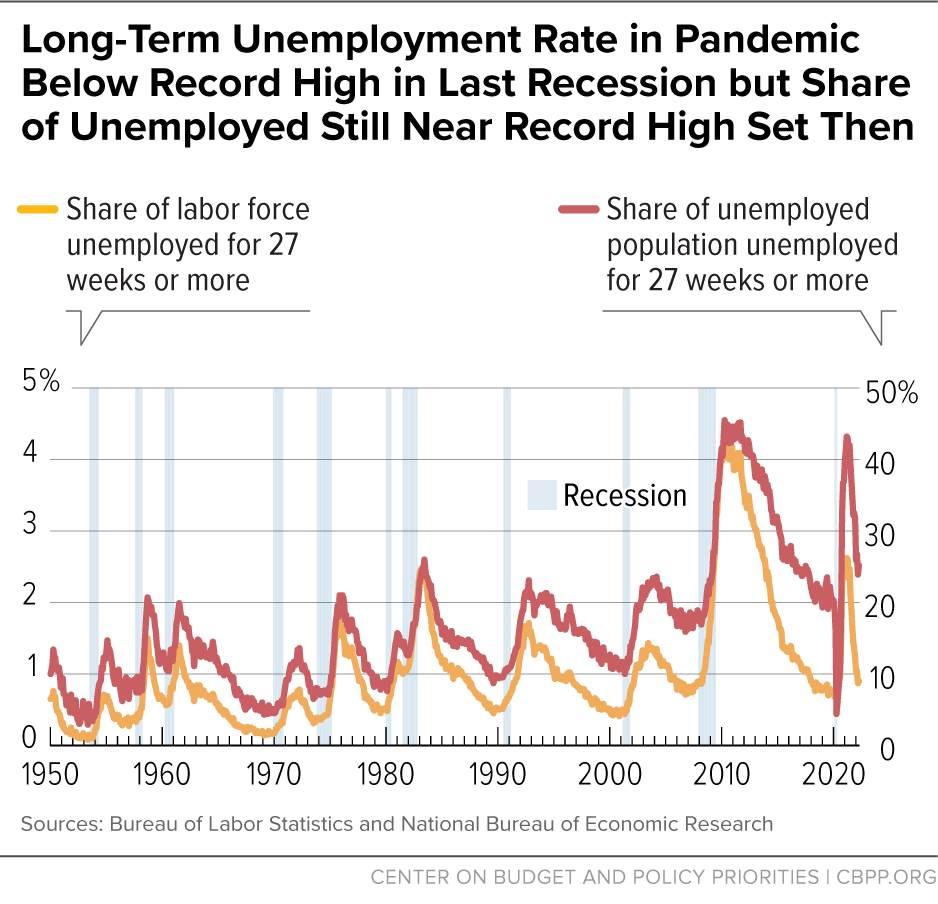

Long-Term Unemployment Rate in Pandemic Below Record High in Last Recession but Share of Unemployed Still Near Record High Set Then

Long-term unemployment — the state of looking for work for 27 weeks or longer — reached much higher levels and persisted much longer in the Great Recession and lingering jobs slump in the early stages of the expansion than in any previous period in data back to the late 1940s. The worst previous episode was in the early 1980s, when long-term unemployment as a share of all unemployed workers peaked at 26.0 percent and the long-term unemployment rate peaked at 2.6 percent.

In the earlier episode, however, a year after peaking at 2.6 percent, the long-term unemployment rate had dropped to 1.4 percent. It took six years to fall back to that rate in the post-Great-Recession expansion, which it did in June 2015. That rate was 0.9 percent in April 2022.

As the number of newly unemployed swelled after February 2020, the share of all unemployed people who have been looking for work for 27 weeks or longer fell to 4.4 percent in April 2020; but as unemployment spells lengthened, it rose and was 25.2 percent (or 1.5 million people) in April 2022.

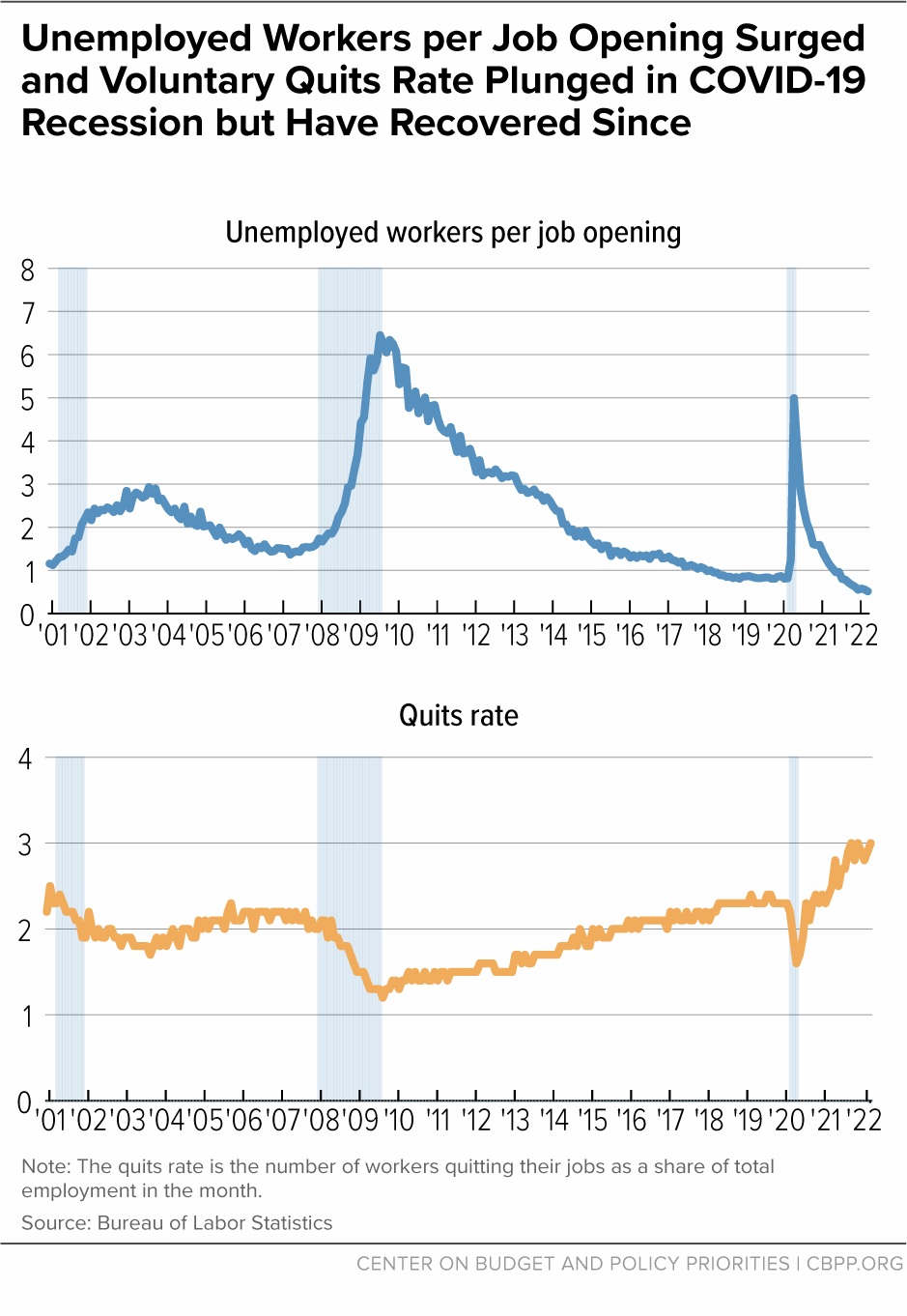

Unemployed Workers per Job Opening Surged and Voluntary Quits Rate Plunged in COVID-19 Recession but Have Recovered Since

The number of people looking for work swelled in the Great Recession while the number of job openings shrank. At the beginning of the last expansion, there were nearly seven people looking for work for every job opening. That ratio declined substantially over the expansion, to the point where in February 2020 there were 5.7 million unemployed workers and 7.0 million job openings (about 82 job seekers for every 100 job openings).

Whether workers are happy or unhappy in their current job, they are far less willing to quit to look for another one when job prospects are poor than when they are good. The percentage of workers quitting their jobs fell sharply in the Great Recession but rose in the expansion, surpassing the rate at the start of the recession. It remained, however, below the rate at the peak of the 1990s expansion.

These favorable trends ended with the sharp contraction in economic activity and job openings in March and April 2020, when there were about five unemployed workers for every job opening. That ratio has come down substantially since, and in March 2022 there were 6.0 million unemployed workers and 11.5 million job openings. In March there were 52 officially unemployed workers for every 100 job openings.

The share of employed workers quitting their jobs to look for another job fell sharply in the recession but has been rising since. The quits rate, which is an indicator of the confidence workers feel that they can quickly find a new job, rose to the highest rate on record at 3.0 percent in November and December 2021. It was 3.0percent in March 2022.

Part III: Prospects for Economic Growth and Earnings

Great Recession Sharply Reduced GDP and Growth Projections; Pandemic Delivered Another Sharp Blow

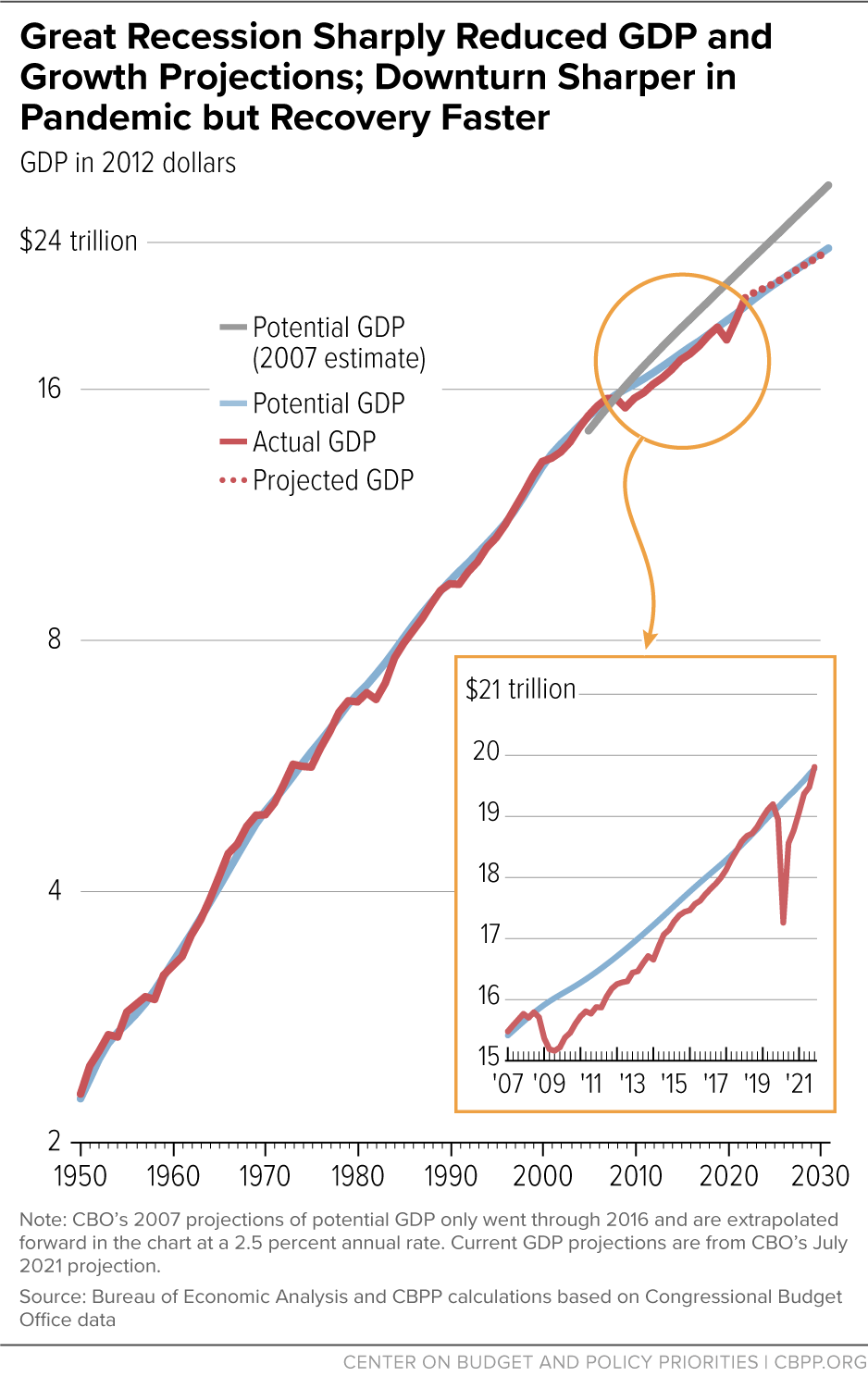

For a half century prior to the Great Recession, actual GDP, which except in unusual circumstances such as the COVID-19 pandemic, is determined by the demand for goods and services, fluctuated in a relatively narrow range around CBO’s estimate of what the economy could supply on a sustainable, non-inflationary basis (potential GDP). Actual GDP fell below potential in recessions and temporarily rose above it in booms. The Great Recession created what at the time was an unusually large and long-lasting gap between actual and potential GDP. This “output gap” generated substantial excess unemployment and underemployment and underutilized productive capacity among businesses even as the economy began to recover. The output gap gradually shrank, however, and late in the expansion, actual GDP rose above potential GDP.

The major disruptions to normal economic activity in the pandemic produced a drop in GDP in 2020 that was much steeper than that of the Great Recession, but quickly enacted relief and stimulus measures contributed to a strong partial recovery in the second quarter of 2020. CBO’s July 2021 projections show the recovery continuing through 2021 and actual GDP rising above potential GDP from 2022 through 2026. That forecast was predicated on the effects of COVID-19-related impacts diminishing much more than they did, however, although strong fourth quarter growth closed the output gap to just 0.5 percent of potential GDP at the end of 2021.

Part of the output gap-closing in the expansion following the Great Recession reflected growth in actual GDP as the economy recovered from the recession. A significant part, however, resulted from CBO’s successive downward revisions after 2007 to its projections of potential GDP. As a result, CBO’s estimates of both the level and growth rate of potential GDP in the post-Great Recession expansion were much lower than projections made before the Great Recession. (The chart below is constructed so that a straight line represents a constant growth rate, with a steeper slope representing a higher growth rate.)

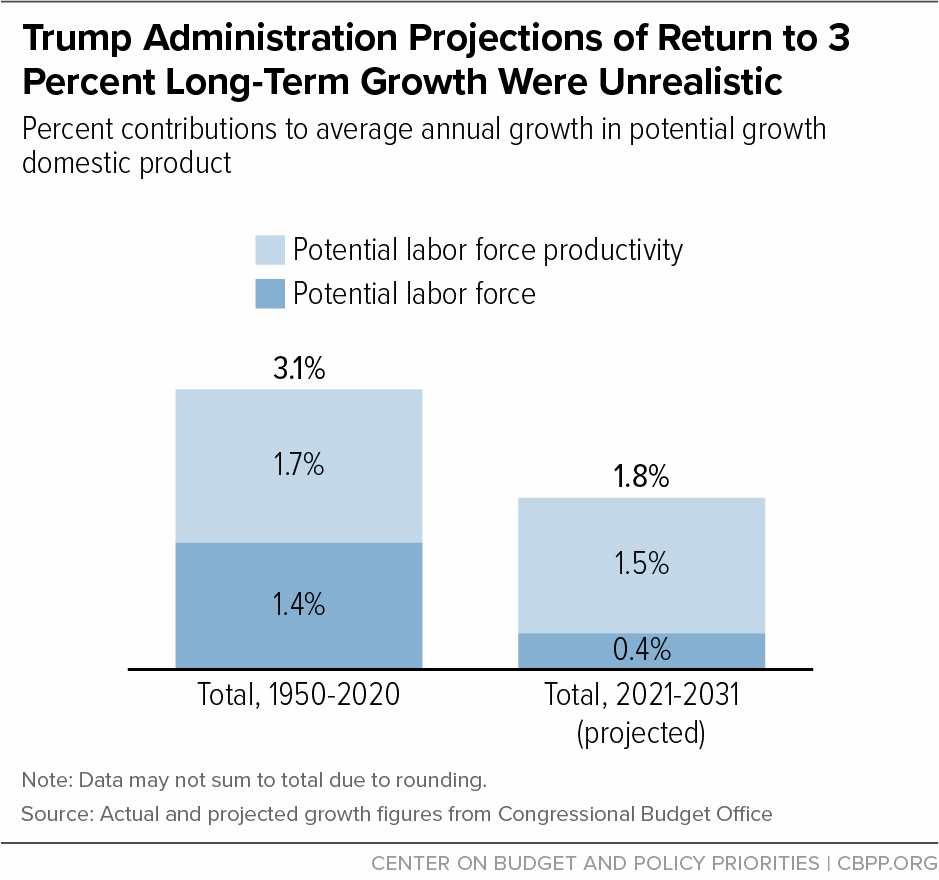

Trump Administration Projections of Return to 3-Percent Long-Term Growth Were Unrealistic

Growth in potential GDP, and hence in the limit on sustainable growth in actual GDP, is determined by how fast the potential labor force and labor productivity grow. The potential labor force, in turn, grows primarily through native population growth and immigration, while labor productivity grows through business investment in physical capital (machines, factories, offices, and stores), public investments in infrastructure, and public and private investments in R&D and other intellectual property. Improvements in labor quality through education and training can also boost productivity, as can improvements in managerial efficiency or technology that enable businesses to produce more with the same amount of labor and capital.

Short-term changes in monetary and fiscal (tax and spending) policies aim to minimize bouts of excessive inflation or unemployment due to fluctuations in aggregate demand around potential GDP. “Supply-side” policies, such as well-conceived tax, regulatory, and public investment measures, can complement labor force growth and private investment in expanding potential GDP. They can also produce public benefits that GDP does not necessarily capture, such as distributional fairness and health and safety improvements. Poorly conceived policies, however, can impede growth and hurt national economic welfare.

The Trump Administration argued that its policies would return the economy to growth rates of 3 percent or more like those achieved in the second half of the last century. CBO’s more sober assessment at the time and its current assessment reflected the importance of demographic factors such as the retirement of the baby boom generation, which, without greater immigration, will slow population and potential labor force growth substantially. CBO also projected at the time (and continues to project) that potential GDP growth will be far short of the 3.1 percent average annual rate achieved over the entire period since 1950, which included 4.0 percent average annual growth in 1950-73.

The path of potential GDP is highly uncertain at this point. The deterioration in potential GDP growth in the Great Recession, however, is a cautionary tale about the risks to longer-term growth when the economy undergoes a deep recession and slow recovery.

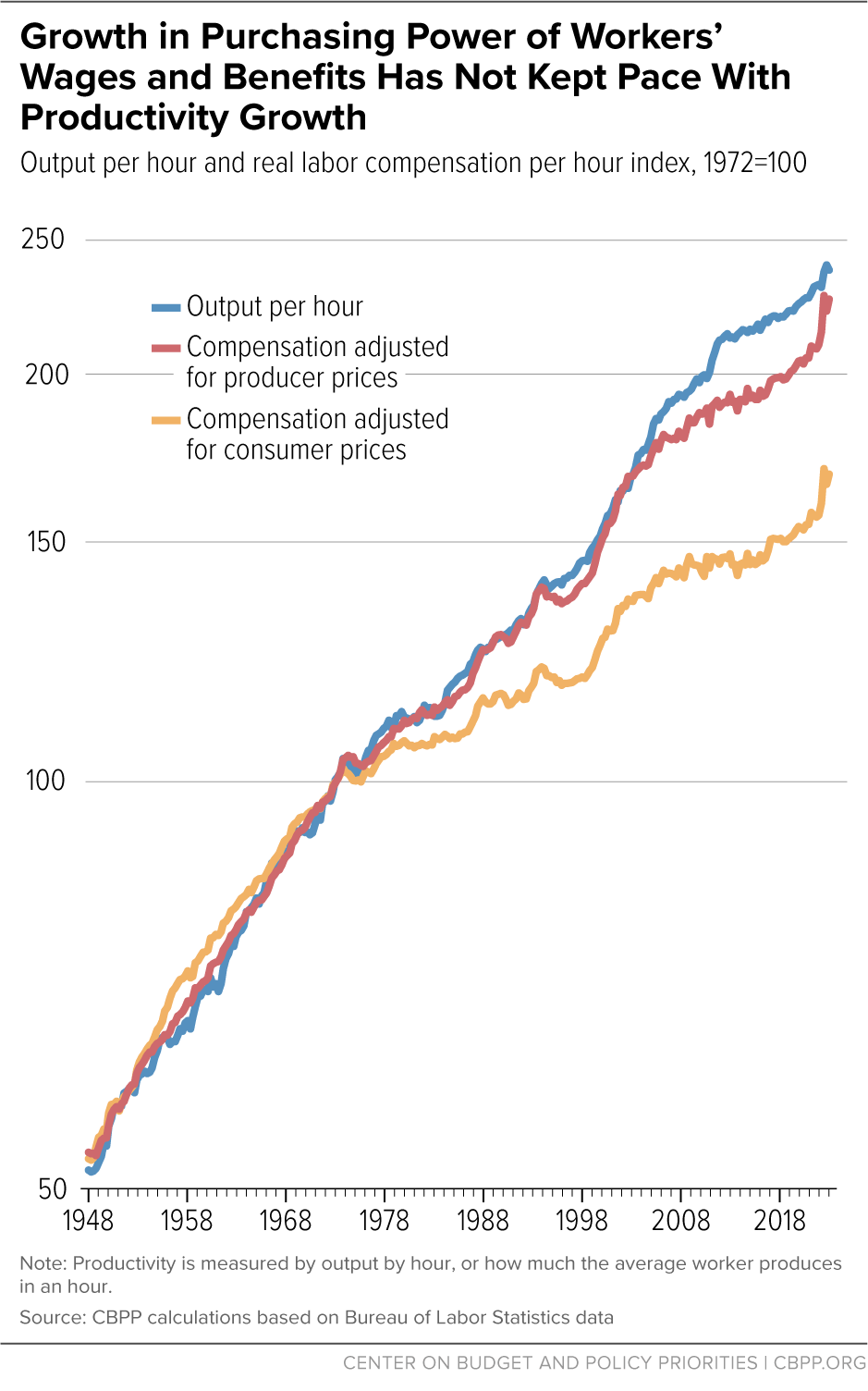

Growth in Purchasing Power of Workers’ Wages and Benefits Has Not Kept Pace With Productivity Growth

Productivity growth is the key to a rising material standard of living. Employers can afford to pay workers more without threatening their bottom line when their workers produce more per hour worked and when businesses can charge higher prices for the goods and services they sell. Workers enjoy a rising material standard of living when their earnings rise faster than the cost of the goods and services they buy.

From 1948 to 1973, productivity and the real (inflation-adjusted) average hourly compensation (wages and salaries plus fringe benefits) of workers in the nonfarm business sector each nearly doubled, irrespective of whether inflation is measured using producer prices or consumer prices. From the mid-1970s to the mid-1990s, however, productivity growth slowed. At the same time, compensation per hour adjusted for inflation in consumer prices grew much more slowly than productivity, while compensation adjusted for inflation in producer prices grew at roughly the same rate as productivity.

That disparity arose because nonfarm business output includes not just consumer goods and services but also investment goods and exports, and those output components’ prices rose more slowly than consumer prices. Because compensation adjusted for producer prices tracked productivity fairly closely during this period, profit margins and hence the split in total income between the share going to workers and the share going to business owners and shareholders, did not change much during this period. But because consumer prices rose more than producer prices, growth in the purchasing power of workers’ earnings fell short of growth in labor productivity.

Productivity picked up considerably in the late 1990s and early 2000s but was disappointingly slow in the expansion following the Great Recession. Workers saw a brief spurt in their real compensation in the second half of the 1990s but have seen little progress since. Productivity has grown faster than compensation adjusted for producer prices since the turn of the century, indicating that producers have been able to increase their profit margins, raising capital’s share of nonfarm business income at the expense of labor’s share.

Over the course of that expansion, which ended in the fourth quarter of 2019, output per hour rose at an average rate of 1.2 percent per year, compensation per hour adjusted for consumer prices rose 0.7 percent per year, and compensation per hour adjusted for producer prices rose 1.0 percent per year.

As with the average hourly earnings data in Part I, trends in compensation per hour in the pandemic have been distorted by shifts in the composition of the labor force. Disproportionate employment losses among lower-compensated workers increased the share of more highly compensated workers, producing a higher average compensation among those still working in the first half of 2020. Compared with a year earlier, output per hour in the first quarter of 2022 was 0.6 percent lower, compensation per hour adjusted for consumer prices was 1.4 percent lower, and compensation per hour adjusted for producer prices was 0.5 percent lower.

(CBO’s data on potential productivity growth discussed above cover the entire economy, including general government output and the output of households and some nonprofits, for all of which output is measured in a way that assumes no productivity growth. The data discussed here are for actual productivity growth in the nonfarm business sector, which covers about 75 percent of economic activity but makes a disproportionate contribution to measured productivity growth.)

| TABLE 1 | ||

|---|---|---|

| Average Annual Growth in Real Output per Hour and Real Compensation per Hour (Percent) | ||

| 2009:Q2 - 2019:Q4 | 2021:Q1 - 2022:Q1 | |

| Output per hour | 1.2% | -0.6% |

| Real compensation per hour (consumer prices) | 0.7% | -1.4% |

| Real compensation per hour (producer prices) | 1.0% | -0.5% |

Part IV: International Trade, Federal Budget Deficits, and Growth

The United States buys more goods from the rest of the world than they buy from us. But the trade deficit in goods does not reflect the full scope of the United States’ balance of payments with the rest of the world, and contrary to some recent rhetoric, a trade deficit does not make the United States “losers” in international trade or justify a trade war.

The view of trade as a situation in which one country can only gain at the expense of other countries is at odds with the vast majority of economists’ broadly accepted understanding that trade makes each trading partner richer than it would be on its own. Trade expands the amount, quality, and variety of goods and services a country’s residents can buy by allowing the country to expand production of goods and services for export that it can profitably trade for other goods and services that are cheaper to import than to produce domestically. Economists find that trade wars — where countries impose tariffs or other restrictions on imports from one another and/or subsidize their own exports — can shrink those opportunities and make countries that engage in them worse off than they would be with more open trade.

While international trade can increase the overall size of the economy and provide net benefits to the country as a whole, it also creates winners and losers within the country, with the larger gains from trade spread broadly but thinly and the smaller losses concentrated in particular industries, regions, or groups of workers. The United States needs better policies to cushion the blow for those most affected by economic shocks of all kinds, including trade shocks, and to ease the inevitable transition to new patterns of activity in a dynamic, growing economy. It is also important for the United States to be a party to negotiating multilateral international trade agreements that set the rules under which countries trade with one another and settle international trade disputes for the United States and its trading partners to enjoy the mutual benefits from trade while avoiding costly trade wars.

While trade policy can affect the composition of U.S. imports and exports and the trade balance with individual countries, the overall size of the trade deficit is determined by a complex set of relationships among broader forces, such as how fast the United States is growing relative to its trading partners, households’ and domestic businesses’ saving and investment decisions, multinational corporations’ decisions about where to invest (which are influenced by tax policy and economic fundamentals), and finally, federal budget policy and foreign central banks’ and international investors’ willingness to hold U.S. debt.

When U.S. households, businesses, and governments collectively spend more than they produce, excess spending must be met through net imports, and foreigners must be willing to finance that excess spending. Incomes, interest rates, and the foreign exchange value of the dollar adjust to bring the amount of excess spending, the trade balance, and foreign willingness to lend to the United States into alignment.

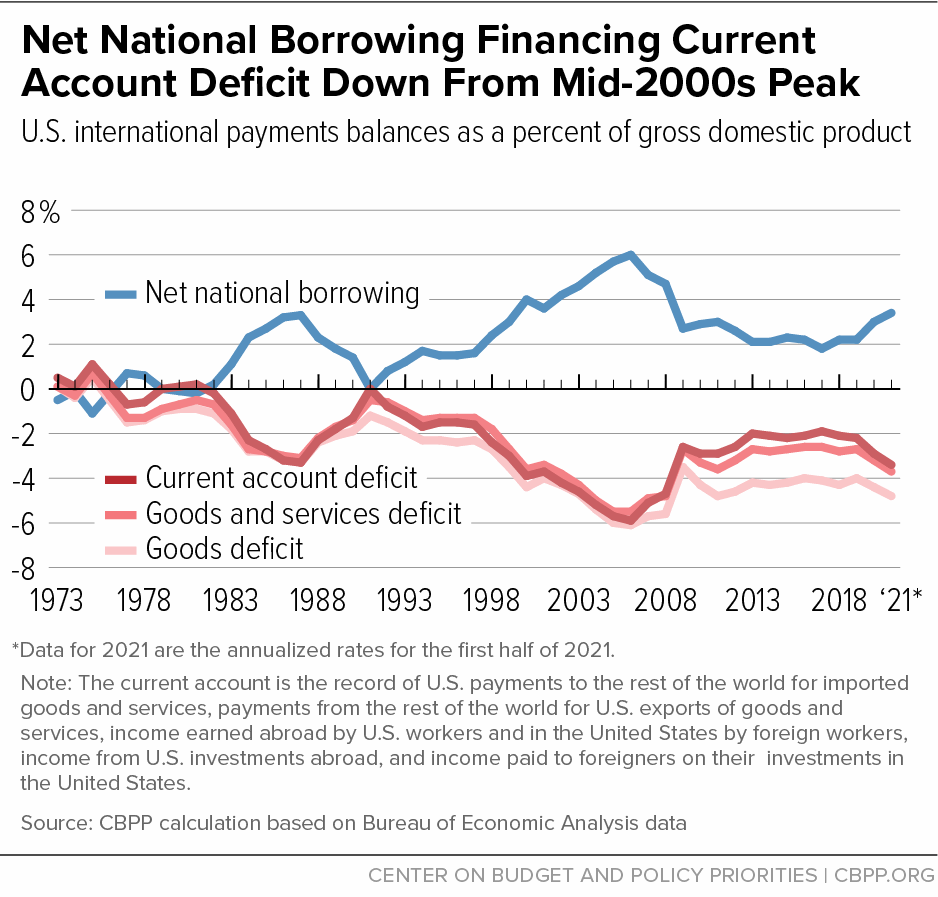

Net Borrowing From Foreigners to Finance Current Account Deficit Still Well Below Mid-2000's Peak

The United States sold $1.43 trillion worth of goods to the rest of the world in 2020 and bought $2.35 trillion worth of goods from the rest of the world, resulting in a goods deficit of $922 billion, equal to 4.4 percent of GDP. The United States ran a surplus in services (such as tourism, education, and financial services) and received more investment income and other payments from abroad than it sent abroad. As a result, the current account — the most comprehensive measure of trade and income flows between the United States and the rest of the world, because it includes goods, services, and income earned in or paid to the rest of the world — had a deficit of $616 billion, equal to 2.9 percent of GDP in 2020.

The United States’ balance of payments, however, includes not only the income flows recorded in the current account but also capital flows associated with borrowing, lending, and investment by the United States and its trading partners. Dollars flow in when the rest of the world lends to the United States by buying U.S. Treasury securities and other U.S. financial assets or invests directly in the United States by acquiring, establishing, or expanding businesses here. Dollars flow out when the United States lends to the rest of the world by buying foreign financial assets or when U.S. companies invest abroad.

The United States is both the largest direct investor in other countries and the largest recipient of foreign direct investment. The difference between new foreign direct investment in the United States and new U.S. direct investment abroad is relatively small in most years. The United States is a large net borrower from the rest of the world, however, because sales of U.S. Treasury debt and other financial assets to the rest of the world far exceed U.S. purchases of foreign financial assets.

The dollars that flow out to purchase imports must ultimately flow back in as export sales or as an increase in foreign holdings of U.S. assets net of U.S holdings of foreign assets. In other words, net national borrowing is the mirror image of the current account deficit in the year those capital flows occur. Subsequently, the interest and profits that foreigners receive by lending to or investing in the United States will be income payments to the rest of the world in future current accounts, and the income the United States receives from foreign direct investment or purchases of foreign financial assets will be income payments from the rest of the world.

The United States has been a net borrower for much of the last four decades, with borrowing peaking at 6.0 percent of GDP in 2006. U.S. net borrowing and its complement, the current account deficit, then shrank with the collapse of trade and capital flows worldwide in the financial crisis and Great Recession. After hovering around 2 percent of GDP since 2013, net borrowing from abroad rose to 3 percent of GDP in 2020 as the deficit in the balance on goods edged up and the surplus in the balance of services and current income flows edged down. Data for the first half of 2021 indicate a further increase in net borrowing from abroad, as a share of GDP, but to a level still below the 2006 peak.

As a result of decades of net borrowing, the difference between total U.S. assets held abroad and total foreign assets held in the United States, known as its net international investment position, was negative $14 trillion at the end of 2020, compared with negative $11.2 trillion at the end of 2019. Nevertheless, the rest of the world so far has been a willing lender to the United States.

Moreover, despite this large net debt, the income the United States receives from its holdings of foreign assets has exceeded the income it pays to foreign holders of U.S. Treasury debt and other U.S. assets. Historically, the United States has enjoyed relatively low borrowing costs due in part to the dollar’s role as a “reserve currency” that is in demand worldwide to facilitate international trade and settle international financial obligations whether or not they involve the United States. Since the 2008-09 global financial crisis, worldwide demand for safe financial assets, especially U.S. Treasury securities, has kept U.S. international borrowing costs particularly low relative to the income the United States earns on its investment abroad.

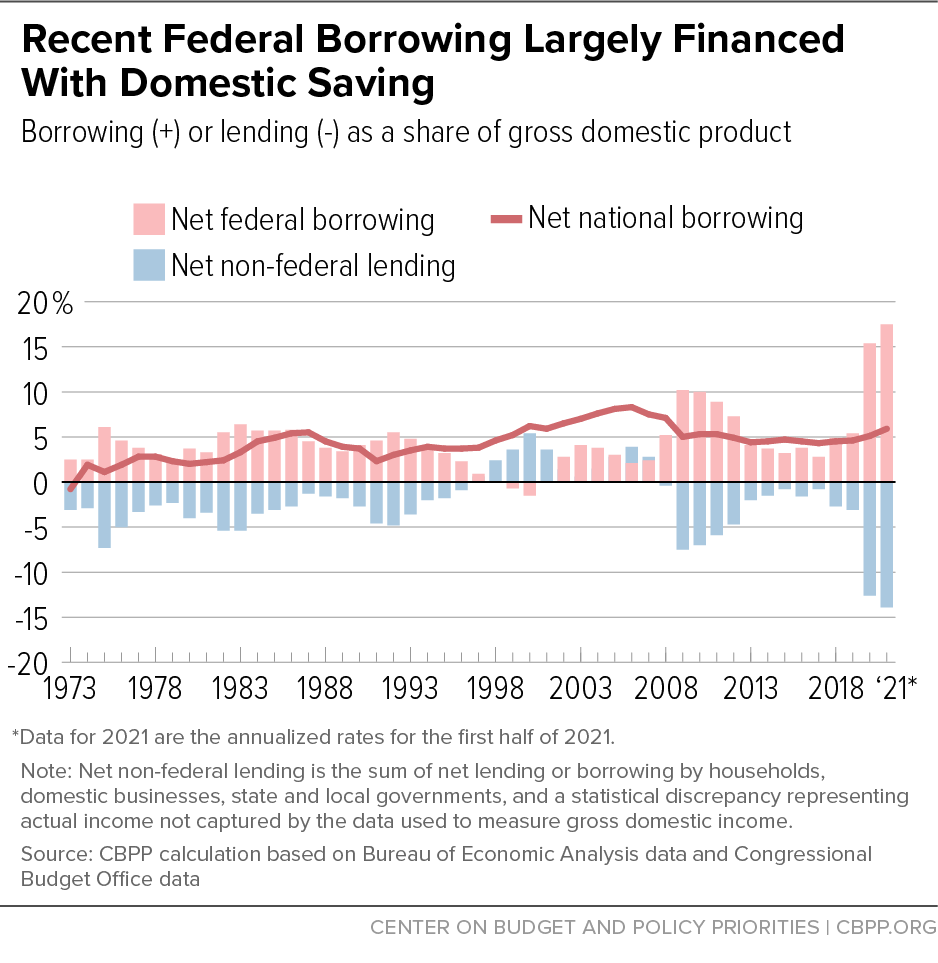

Federal Budget Deficits Are Often (but Not Always) the Major Source of Net National Borrowing

The United States has been a net international borrower every year but one since 1982. That’s because in most of those years federal budget deficits were larger than net lending in the rest of the economy.

Net lending or borrowing in a particular sector of the economy is the difference between that sector’s aggregate saving and its aggregate investment in productive capital. Any surplus of saving over investment is available for lending; any shortfall of saving relative to investment requires borrowing. An economy-wide surplus of saving over investment must be lent or invested abroad; a shortfall must be offset by borrowing or attracting investment from the rest of the world.

In the early to mid-1980s, a steep recession and policymakers’ decisions to lower tax rates and increase defense spending produced large federal budget deficits. Non-federal saving consistently exceeded non-federal investment, but by less than federal borrowing, hence the country was a net borrower in the international economy. (Non-federal lending or saving is the sum of such activity by households, domestic businesses, and state and local governments.)

In the 1990s expansion, by contrast, a strong economy together with effective deficit-reduction and budget-enforcement policies produced declining budget deficits and eventually surpluses in 1998-2001. Meanwhile, foreign funding attracted by the strong economy and booming stock market flowed in to help fuel a surge in domestic investment that outstripped domestic saving. These foreign capital inflows turned the non-federal sector into a large enough net borrower to keep the country a net borrower, despite the falling federal budget deficits and eventual surpluses.

The 2001 recession and deficit-producing tax cuts in 2001 and 2003 ended the brief era of federal budget surpluses. The federal government became a major borrower again, but businesses and households also went on a borrowing binge in the housing boom preceding the Great Recession. That combination led to record net national borrowing that reached 6.0percent of GDP in 2006.

The Great Recession and policymakers’ enactment of temporary fiscal stimulus measures created large budget deficits in 2009-12. However, the substantial rise in federal borrowing to fund these deficits was partly offset by a collapse in investment and sharp reduction in borrowing in the non-federal sector. As a result, net national borrowing, while still substantial, actually was lower as a share of GDP over this period than it had been immediately prior to the recession.

Tax cuts and spending increases in late 2017 and early 2018 led to increased federal borrowing in 2018 and 2019 that was partly offset by greater net lending. The sharp fall in economic activity in early 2020 lowered government revenues while spending on relief and recovery measures increased sharply. Federal borrowing rose sharply, but private saving increased sharply as well, and U.S. net borrowing rose only to about 3 percent of GDP in 2020 (methodological differences produce slightly different net borrowing in the balance of payments statistics described above from those in the national income accounts). Data for the first half of 2021 show an increase in federal borrowing and non-federal lending resulting in a modest increase in net borrowing.

Part V: Conclusion

The economy was on solid footing in February 2020. It had been growing since mid-2009 and the huge job losses from the 2007-2009 Great Recession had been erased by 2014. The economic expansion continued into 2020, becoming the longest expansion on record before ending abruptly in the COVID-19 pandemic.

Growth in the long expansion averaged 2.3 percent per year, below the rate the Congressional Budget Office was projecting just prior to the Great Recession. President Trump made bold claims for how his policies would raise the economy’s sustainable growth rate significantly above the 2.2 percent growth rate it had achieved prior to his inauguration and produce a significant increase in the typical worker’s earnings. Those claims were much more optimistic than what the Congressional Budget Office and most other outside analysts expected and were not borne out.

While the recovery from the Great Recession appeared to be faltering in 2015, it regained momentum in the second half of 2016 and economic growth trended upward, with GDP 3.2 percent higher in the second quarter of 2018 than in the same quarter a year earlier. The growth rate trended down thereafter, however, and GDP grew just 2.3 percent between the fourth quarter of 2018 and the fourth quarter of 2019, which turned out to be the peak of the longest expansion in U.S. history.

The 2020 recession turned out to be the deepest but shortest of all recessions in the post-World War II years. Substantial fiscal relief and recovery legislation, together with a highly accommodative monetary policy allowed the economy to recover about half of the losses incurred in the recession relatively quickly, but subsequent waves of the virus have contributed to an uneven pattern of GDP and employment growth in the post-2020-recession recovery and expansion.