Statement

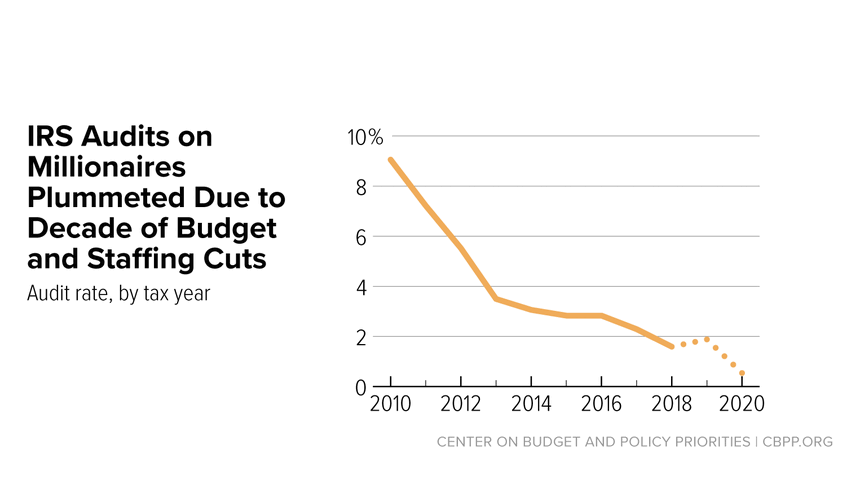

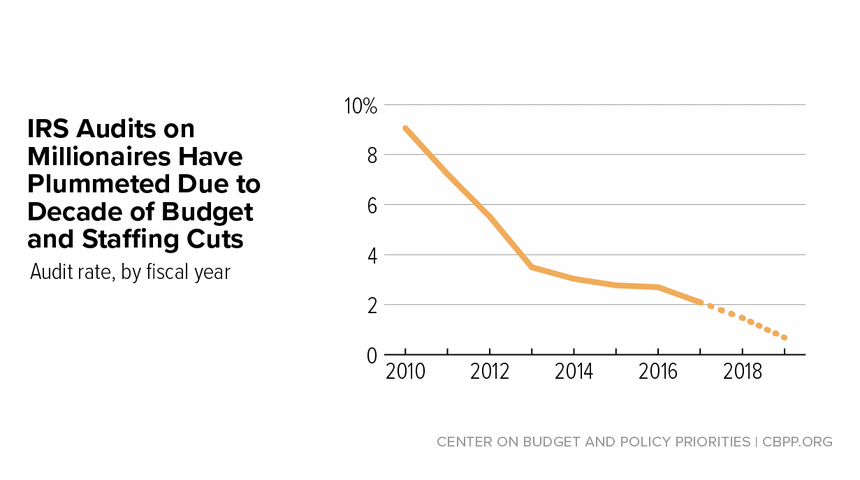

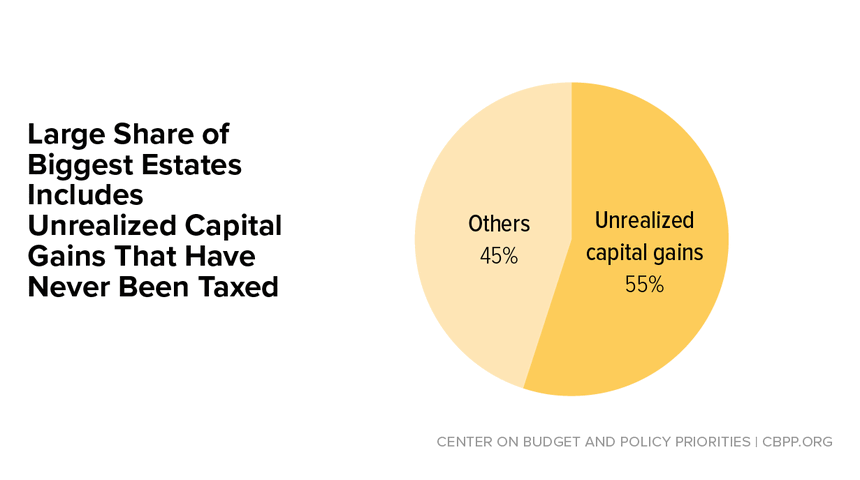

Funding Agreement Preserves Reasonable Funding Levels; IRS Funding Rescissions Are Harmful

Congressional leaders’ new agreement on a topline funding level for 2024 rightly ensures that overall funding available for non-defense programs will stay at $773 billion, the already tight level set in May’s bipartisan debt ceiling agreement.