BEYOND THE NUMBERS

The IRS reported yesterday that it audited fewer millionaires and large corporations in fiscal year 2018 than the previous year, continuing a multi-year decline. Since 2010, the President and Congress have cut IRS funding substantially, causing workforce reductions and shortages of top auditors who have the expertise to review millionaires’ and corporations’ complex returns. These budget cuts pose a risk to a basic government function — i.e., collecting the revenue needed to fund public services — because the federal government relies largely on voluntary compliance with the tax code and, for such compliance to continue, taxpayers must trust that the IRS is enforcing the law fairly and people are paying the taxes they owe. As a result, policymakers must reverse their deep IRS funding cuts of recent years and commit to a multi-year effort to rebuild the agency.

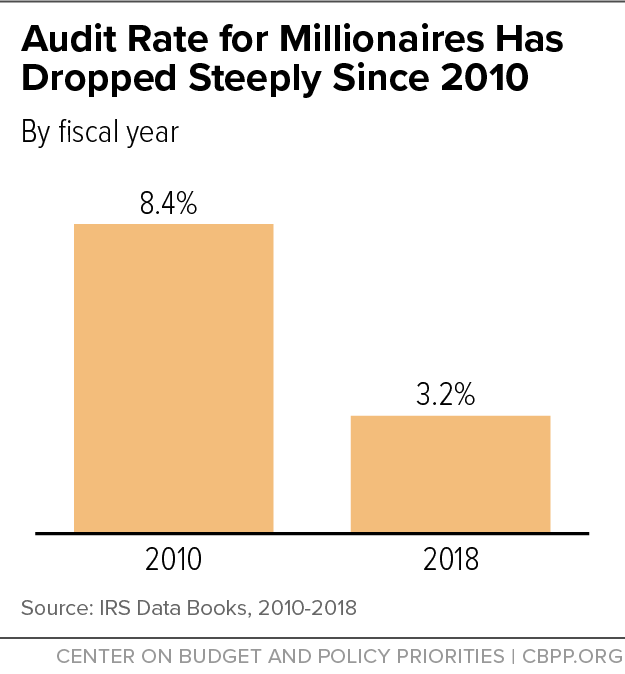

The IRS in 2018 audited just 3.2 percent of tax returns with incomes above $1 million, down from 4.4 percent in 2017 and less than half of the 8.4 percent rate in 2010.

Audits of the largest corporations (with assets of $1 billion or more) also continue to fall: from 21.3 percent in 2017 to 18.6 percent in 2018. As with millionaires, the audit rate for these corporations has fallen by more than half since 2010, when it was 37.6 percent.

Since 2010, the President and Congress have slashed IRS enforcement division funding by a quarter in inflation-adjusted terms. IRS enforcement is now so depleted that the agency has fewer revenue agents (auditors who tend to audit the most complex returns) than in 1954, when the economy was roughly one-seventh its current size.

The President and Congress must commit to a multi-year effort to rebuild this essential agency. Congressional leaders of both parties reportedly have agreed to begin negotiations to raise the annual statutory caps of the 2011 Budget Control Act (BCA) on total defense and non-defense discretionary funding and thereby provide additional funding in 2020 and 2021. They should make higher IRS enforcement funding a specific part of any such funding agreement.

Fortunately, both President Trump and the Democrat-run House Budget Committee have proposed more funding for tax enforcement that would not be subject to the BCA caps. Policymakers have provided such added funding outside the caps in past years, and they should do so again as part of any budget agreement this year.

Restoring IRS enforcement, however, will also require that policymakers provide additional IRS funding that does count against the BCA caps. Thus, as negotiations progress and the appropriations process moves forward, policymakers should provide sufficient IRS enforcement funding both within and outside the caps to return IRS funding to the 2010 level in inflation-adjusted terms — and also rebuild the IRS audit staff — within the next four years.