Indexing Capital Gains for Inflation Would Worsen Fiscal Challenges, Give Another Tax Cut to the Top

End Notes

[1] Brendan Duke, “House Republicans’ New Tax Plan Doubles Down on 2017 Tax Law’s Flaws,” CBPP, July 24, 2018, https://www.cbpp.org/blog/house-republicans-new-tax-plan-doubles-down-on-2017-tax-laws-flaws; Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring,” CBPP, updated August 14, 2018, https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.

[2] Bernie Becker, “How do you get a floor vote?,” Politico, July 25, 2018, https://www.politico.com/newsletters/morning-tax/2018/07/25/how-do-you-get-a-floor-vote-296963; H.R. 1261: Capital Gains Inflation Relief Act of 2007, https://www.congress.gov/bill/110th-congress/house-bill/1261/text.

[3] Alan Rappeport and Jim Tankersley, “Trump Administration Mulls a Unilateral Tax Cut for the Rich,” New York Times, July 30, 2018, https://www.nytimes.com/2018/07/30/us/politics/trump-tax-cuts-rich.html; John Micklethwait, Margaret Talev, and Jennifer Jacobs, “Trump Says He’s Thinking About Indexing Capital Gains to Inflation,” Bloomberg, August 30, 2018, https://www.bloomberg.com/news/articles/2018-08-30/trump-says-thinking-about-indexing-capital-gains-to-inflation.

[4] Leonard Burman, “Should Treasury Index Capital Gains?,” Tax Policy Center, May 10, 2018, https://www.taxpolicycenter.org/taxvox/should-treasury-index-capital-gains; John Ricco, Efraim Berkovich, and Richard Prisinzano, “No Bang for the Bucks – Indexing Capital Gains Doesn’t Lead to Economic Growth,” Penn Wharton Budget Model, August 20, 2018, http://budgetmodel.wharton.upenn.edu/issues/2018/8/20/no-bang-for-the-bucks-indexing-capital-gains-doesnt-lead-to-economic-growth.

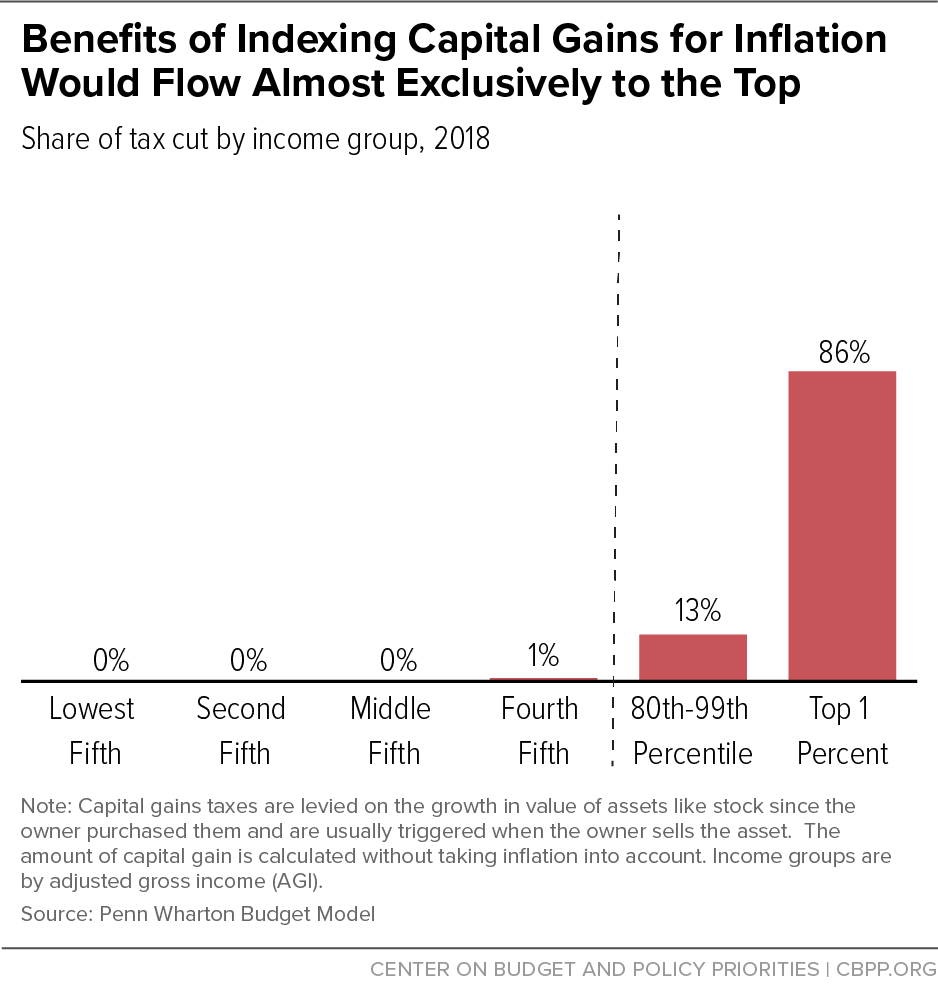

[5] John Ricco, “Indexing Capital Gains to Inflation,” Penn-Wharton Budget Model, March 23, 2018, http://budgetmodel.wharton.upenn.edu/issues/2018/3/23/indexing-capital-gains-to-inflation. TPC has not yet issued an estimate of the distribution of the tax cut from indexing capital gains for inflation.

[6] Chye-Ching Huang, “Indexing Capital Gains Would Be Yet Another Tax Cut For Top 1 Percent,” CBPP, August 1, 2018, https://www.cbpp.org/blog/indexing-capital-gains-would-be-yet-another-tax-cut-for-top-1-percent.

[7] H.R. 6444: Capital Gains Inflation Relief Act of 2018, https://www.congress.gov/bill/115th-congress/house-bill/6444/text?format=txt; S. 2688: Capital Gains Inflation Relief Act of 2018, https://www.congress.gov/bill/115th-congress/senate-bill/2688.

[8] Burman, 2018; Ricco, Berkovich, and Prisinzano.

[9] Letter from Thomas A. Barthold to Warren Gunnels, “Revenue Estimates of Making Permanent Certain Provisions Enacted in 2017,” September 4, 2018, https://twitter.com/BBKogan/status/1037353559963193344.

[10] Burman, 2018; Ricco, Berkovich, and Prisinzano.

[11] Ricco, Berkovich, and Prisinzano.

[12] Ibid. Penn Wharton estimates that the cost of a prospective indexing policy grows to about $160 billion over a 20-year budget window.

[13] The bills would therefore create an incentive to sell and “reacquire” existing assets as soon as the law went into effect.

[14] Huang, “Indexing Capital Gains Would Be Yet Another Tax Cut for Top 1 Percent.”

[15] Ricco, 2018.

[16] Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring,” CBPP, updated August 14, 2018, https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.

[17] “Changes in U.S. Family Finances from 2013 to 2016: Evidence from the Survey of Consumer Finances,” Board of Governors of the Federal Reserve System, September 2017, https://www.federalreserve.gov/publications/files/scf17.pdf; Chad Stone et al., “A Guide to Statistics on Historical Trends in Income Inequality,” CBPP, updated August 29, 2018, https://www.cbpp.org/research/poverty-and-inequality/a-guide-to-statistics-on-historical-trends-in-income-inequality. While there is considerable overlap, the top 1 percent of the income distribution does not contain the identical group of people as the top 1 percent of the wealth distribution.

[18] CBPP analysis of Survey of Consumer Finances data, using tables from Edward N. Wolff, “Household Wealth Trends in the United States, 1962 to 2016: Has Middle Class Wealth Recovered?” NBER Working Paper No. 24085, November 2017, http://www.nber.org/papers/w24085. The benefit of these tax-preferred retirement accounts is still skewed to the highest-income filers, as they have the most wealth to save in these accounts and also receive the greatest benefit per dollar of tax savings. See Chuck Marr, Nathaniel Frentz, and Chye-Ching Huang, “Retirement Tax Incentives Are Ripe for Reform,” CBPP, December 13, 2013, https://www.cbpp.org/research/retirement-tax-incentives-are-ripe-for-reform.

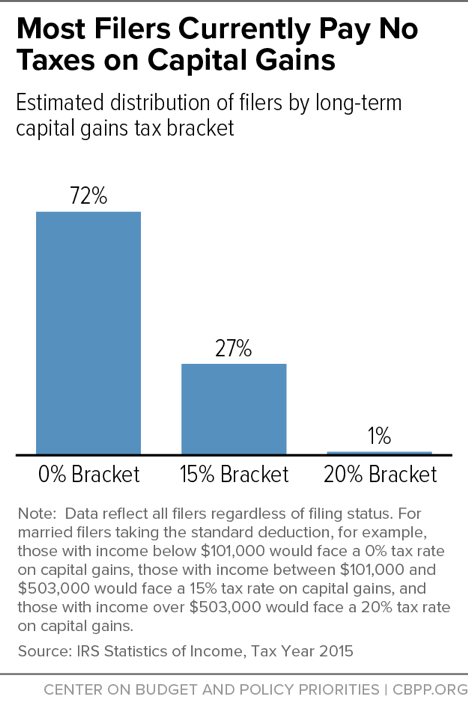

[19] TPC Table T17-0082. In 2018, only 8 percent of households in the middle 60 percent of the income distribution reported any long-term capital gains that might face potential taxes on capital gains, compared to 59 percent of households in the top 1 percent, according to TPC Table T18-0053.

[20] Brendan Duke, “Universal Savings Account Proposal in House Republican Tax Framework Is Ill-Conceived,” CBPP, August 14, 2018, https://www.cbpp.org/research/federal-tax/universal-savings-account-proposal-in-house-republican-tax-framework-is-ill.

[21] Internal Revenue Service, Table 3.4: All Returns: Tax Classified by Both the Marginal Rate and Each Rate at Which Tax Was Computed, by Marital Status, Tax Year 2015 (Filing Year 2016), https://www.irs.gov/statistics/soi-tax-stats-individual-statistical-tables-by-tax-rate-and-income-percentile. The 2017 tax law’s capital gains tax brackets were designed to almost exactly replicate the ordinary income tax brackets that were previously used to set capital gains tax brackets. This means that the proportion of households in the 0 percent bracket under the 2017 tax law should be roughly the same as for tax year 2015.

[22] Ibid.

[23] Nicholas Johnson, “State and Local Tax Systems Disproportionately Burden Lower-Income Families,” CBPP, January 30, 2013, https://www.cbpp.org/blog/state-and-local-tax-systems-disproportionately-burden-lower-income-families

[24] Larry Kudlow, “Index capital gains for inflation, Mr. President,” CNBC, August 11, 2017, https://www.cnbc.com/2017/08/11/index-capital-gains-for-inflation-mr-president.html.

[25] Chuck Marr and Chye-Ching Huang, “Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits,” CBPP, September 19, 2012, https://www.cbpp.org/research/raising-todays-low-capital-gains-tax-rates-could-promote-economic-efficiency-and-fairness.

[26] Chye-Ching Huang, “Research Note: New Paper Sets Out Policy and Legal Case Against Indexing Capital Gains by Regulation,” CBPP, June 11, 2018, https://www.cbpp.org/research/federal-tax/research-note-new-paper-sets-out-policy-and-legal-case-against-indexing-capital.

[27] Ryan Ellis, “Not just Mr. Moneybags: Ending the capital gains inflation tax helps ordinary Americans too,” Washington Examiner, August 8, 2018, https://www.washingtonexaminer.com/opinion/not-just-mr-moneybags-ending-the-capital-gains-inflation-tax-helps-ordinary-americans-too; Jane G. Gravelle, “Indexing Capital Gains Taxes for Inflation,” Congressional Research Service, July 24, 2018, https://fas.org/sgp/crs/misc/R45229.pdf.

[28] Chuck Marr and Chye-Ching Huang, “Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits,” CBPP, September 12, 2012, https://www.cbpp.org/research/raising-todays-low-capital-gains-tax-rates-could-promote-economic-efficiency-and-fairness.

[29] Corbett Daly, “Warren Buffet wants to pay higher taxes,” CBS, August 15, 2011, https://www.cbsnews.com/news/warren-buffett-wants-to-pay-higher-taxes/.

[30] Burman, 2018; Ricco, Berkovich, and Prisinzano.

[31] Chad Stone, “Economic Growth: Causes, Benefits, and Current Limits,” CBPP, April 27, 2017, https://www.cbpp.org/economy/economic-growth-causes-benefits-and-current-limits.

[32] Len Burman, “Mitt Romney’s Teachable Moment on Capital Gains,” Forbes, January 18, 2012, https://www.forbes.com/sites/leonardburman/2012/01/18/mitt-romneys-teachable-moment-on-capital-gains/#3a9303ce7a4e.

[33] Ibid.

[34] Timothy E. Flanigan, “Legal Authority of the Department of the Treasury to Issue Regulations Indexing Capital Gains for Inflation,” September 1, 1992, https://www.justice.gov/file/20536/download.

[35] Associate Professor Daniel Hemel (University of Chicago Law School) and Professor David Kamin (New York University School of Law), “The False Promise of Presidential Indexation,” SSRN, May 24, 2018, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3184051.