BEYOND THE NUMBERS

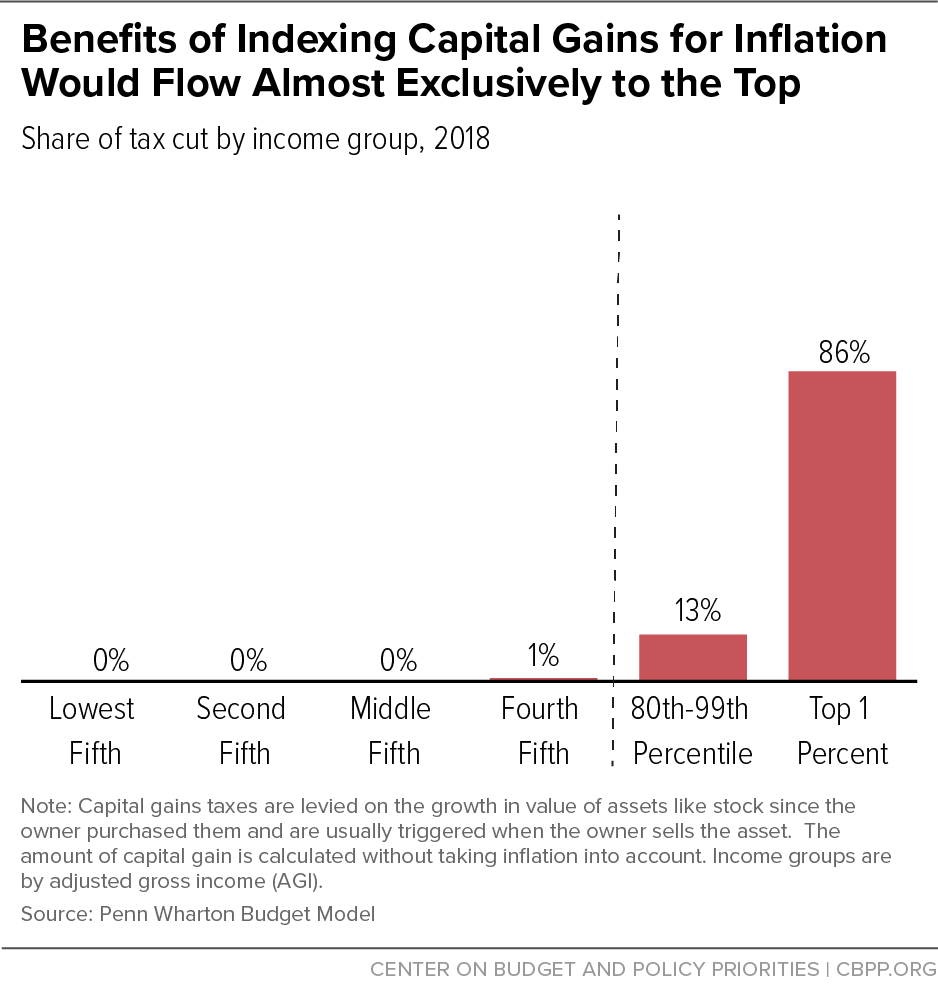

President Trump’s Treasury Department is reportedly considering issuing a regulation to index capital gains for inflation, which would cost perhaps $100 to $200 billion in the first decade and deliver 86 percent of its benefits to the top 1 percent of tax filers. Along the same lines, House Ways and Means Chairman Kevin Brady stated last week that he may add legislation indexing capital gains for inflation, sponsored by Rep. Devin Nunes, to House Republicans’ “Tax Reform 2.0” framework (which the House may consider in September). Like the 2017 tax law and the core of the “2.0” tax framework, indexing capital gains would increase budget deficits, disproportionately benefit the very well-off, and create new opportunities for wealthy filers to avoid taxes by gaming the tax code. That would be true whether policymakers tried to index capital gains through regulation or legislation.

Capital gains taxes are levied on the growth in the value of assets, like stock, since the owner bought them and are usually imposed when the owner sells the asset. The capital gain is calculated without taking inflation into account, but the top tax rates on long-term capital gains are far below the top tax rate on earnings from work. Indexing capital gains for inflation — that is, applying the tax only to the growth in assets above the rate of inflation — would cut taxes for filers with capital gains by shrinking the difference between the original purchase price and the selling price.

-

Indexing capital gains for inflation would cost perhaps $100 billion to $200 billion in federal revenues over the first decade, Tax Policy Center (TPC) and Penn Wharton Budget Model estimates suggest. It could also cost state governments billions in lost revenue, as most states base their income taxes on the federal definition of capital gains. This would leave less state revenue to invest in public education, health care, public safety, and human services.

-

More than 86 percent of the benefit would go to the top 1 percent of households, estimates from the Penn Wharton Budget Model suggest. (See chart.) That’s because capital gains are heavily concentrated among wealthy households. For example, just 4 percent of households in the bottom 60 percent report positive long-term capital gains income (i.e., income on assets held for more than one year), compared to 59 percent of households in the top 1 percent, TPC estimates. Proponents claim that low- and moderate-income households would gain substantially from indexing through their retirement savings, but these estimates take retirement plans into account.

-

Indexing capital gains for inflation but not other parts of the tax code, such as the deduction for interest payments, would create an opportunity for wealthy filers to cut their taxes by setting up transactions that have little or no economic impact and exploit this disparity in the tax code’s treatment of inflation to generate large tax-cut gains, as we’ve explained.

The regulatory approach has an added fatal flaw: the Administration almost certainly lacks the legal authority to do it, as a rigorous legal analysis that the Treasury Department and Department of Justice conducted in 1992 firmly concluded. While proponents of indexing capital gains argue that developments since 1992 bolster their argument that the Treasury Department has the legal authority, an important analysis by law professors Daniel Hemel of the University of Chicago and David Kamin of New York University explains that those arguments are baseless. If anything, they note, the case that Treasury has this authority is even weaker than in 1992.