Chairman Brat, Ranking Member Evans, and other members of the Committee, thank you for this opportunity to testify today about the causes of economic growth, the benefits associated with economic growth, and current limits on economic growth in the United States. These are important topics to understand better if we are to evaluate properly President Trump’s bold claim that his policies will supercharge the economy and return us to the higher rates of growth we enjoyed in an earlier era.

My testimony makes four essential points:

- Growth matters both for fiscal stabilization and for raising living standards.

- Economic growth over the next decade will be much closer to the 2 percent average annual rate the Congressional Budget Office (CBO) projects than to the 3 percent or better the Trump Administration is promising.

- Large tax cuts are far from a surefire way to spur growth, higher taxes don’t preclude growth, and tax cuts can harm growth if they add to the budget deficit or are paired with cuts to productive public investments.

- Small businesses are an important piece of the American economy, but in evaluating sources of growth, it’s new businesses rather than small businesses per se that matter.

Faster growth in gross domestic product (GDP) expands the overall size of the economy and strengthens fiscal conditions. Broadly shared growth in per capita GDP increases the typical American’s material standard of living. But GDP is not meant to be a measure of economic welfare, and other considerations are important in fully assessing the costs and benefits of policy changes.

Estimates from both the Office of Management and Budget and CBO suggest that faster economic growth would improve the fiscal outlook. They find that a 0.1 percentage point increase in annual economic growth would reduce deficits by roughly $300 billion over a decade, mostly through higher revenues.[1] While actually boosting economic growth does reduce future budget deficits, all other things equal, making unrealistic growth claims for one’s policies as a way to offset their cost will understate the adverse impact of those policies on actual future deficits.

Broadly speaking, there are two main sources of economic growth: growth in the size of the workforce and growth in the productivity (output per hour worked) of that workforce. Either can increase the overall size of the economy but only strong productivity growth can increase per capita GDP and income. Productivity growth allows people to achieve a higher material standard of living without having to work more hours or to enjoy the same material standard of living while spending fewer hours in the paid labor force.

GDP measures the market value of goods and services produced in the country, but it captures only market activity and is not designed to be a measure of economic welfare. A parent in the paid labor force contributes to GDP; one who stays home to take care of children or an aging family member does not, but, if the family hires someone to perform these same duties, that labor would contribute to GDP. Health, safety, and environmental regulations can impose costs on businesses that may slow measured GDP growth, but any such costs must be compared with the benefits of better health, safer workplaces, and a cleaner environment that may not be captured in GDP.

Finally, a full assessment of the benefits of economic growth requires consideration of how widely Americans share in that economic growth. There’s a big difference between growth like that we experienced between 1948 and 1973, which doubled living standards up and down the income distribution, and the growth accompanied by widening income inequality we’ve experienced since.[2]

CBO projects that, under current laws and policies, the economy will grow 2.3 percent this year but that growth will average just 1.9 percent a year between now and 2027.[3] As a candidate, President Trump boasted that his economic plan “would conservatively boost growth to 3.5 percent per year on average . . . with the potential to reach a 4% growth rate.”[4] And Treasury Secretary Steven Mnuchin has said that under President Trump’s policies, economic growth will pick up to “3 percent or higher.”[5] Last week, Mnuchin said the President’s economic plan would pay for itself with growth.[6]

It is not unusual for an administration’s economic forecast to be somewhat more optimistic than CBO’s, since the administration is presumably proposing policies it expects will improve economic performance over current laws and policies. But the gap between CBO’s forecast and the numbers we are hearing from the Trump Administration is unusually large.

An economy recovering from a recession can temporarily achieve relatively high rates of “catch-up” growth as demand for goods and services rebounds from weak recession levels. Businesses can readily meet the rise in demand for their output by hiring unemployed workers and more fully utilizing productive capacity that had been idled by the recession. Once excess unemployment has been eliminated and capacity utilization is back to normal, however, the economy’s growth rate is constrained by growth in its ability to supply goods and services.

Economists use the term “potential output” or “potential GDP” to describe the economy’s maximum sustainable level of economic activity. Growth in potential GDP is determined by growth in the potential labor force (the number of people who want to be working when the labor market is strong) and growth in potential labor productivity. The potential labor force, in turn, grows through native population growth and immigration, while potential labor productivity grows through business investment in tangible capital (machines, factories, offices, and stores) as well as investments in R&D and other intangible capital. Improvements in labor quality due to education and training can also boost productivity, as can improvements in managerial efficiency or technology that allow businesses to produce more with the same amount of labor and capital.

Well-conceived tax, regulatory, and public investment policies can complement labor force growth and private investment in expanding potential GDP. They can also reap public benefits that GDP does not necessarily capture, such as distributional fairness and health and safety protections. Poorly conceived policies, of course, can impede growth and hurt national economic welfare.

Potential GDP represents the economy’s maximum sustainable level of economic activity. Actual GDP falls short of potential GDP in a recession, when aggregate demand is weak; it can temporarily exceed potential GDP in a boom, when aggregate demand is strong. But, over longer periods, actual GDP and potential GDP tend to grow together.

The Great Recession produced a large output gap between actual and potential GDP, which narrowed only slowly over the next several years as the economy recovered from the recession. CBO projects that the remaining gap will be closed by the end of 2018 and that the major constraint on economic growth going forward will be the growth rate of potential output rather than weak aggregate demand.

CBO estimates that potential GDP will grow at an average annual rate of a little under 1.9 percent over the next decade. About 0.5 percentage points of that growth comes from increases in the potential labor force and about 1.3 percentage points comes from increases in labor productivity. These projections of labor force and productivity growth are each lower than those that produced 3.2 percent average annual growth in potential GDP between 1950 and 2016 (see Figure 1).

Conditions are different now. The population is aging and, without more immigration, the potential labor force will grow much more slowly than when baby boomers were flooding the labor market. Productivity also grew much faster during the “golden age” of economic growth in the generation after World War II and in the late 1990s than CBO projects it will grow in coming years — and the benefits of that productivity growth were shared more equally than they have been recently. Trump policies would have to produce some combination of stronger labor force participation and productivity growth totaling 1.4 percentage points to match the 3.2 percent historical average.

Economist Edward Lazear, Chairman of President George W. Bush’s Council of Economic Advisers, attempted in a recent Wall Street Journal op-ed to explain how this might happen.[7] Like the Trump team, Lazear touted the purported benefits of “investment-friendly tax policy” and business relief from “burdensome” regulations. However, he concluded that achieving such a high growth rate is “unlikely.”

Tax Cuts and Economic Growth

Exaggerated claims for the economic growth benefits of large tax cuts have been around since the emergence of supply-side economics in the late 1970s and persist to this day. But there’s scant evidence to support, for example, House Speaker Paul Ryan’s claim that cutting tax rates across the board is the “secret sauce” that generates faster economic growth, more upward mobility, and faster job creation or Treasury Secretary Mnuchin’s claim that the Trump economic plan will pay for itself through growth. What the evidence shows is that tax cuts — particularly for high-income people — are an ineffective way to spur economic growth, and they’re likely to harm the economy if they add to the deficit or are paired with cuts to investments that support the economy and working families.[8]

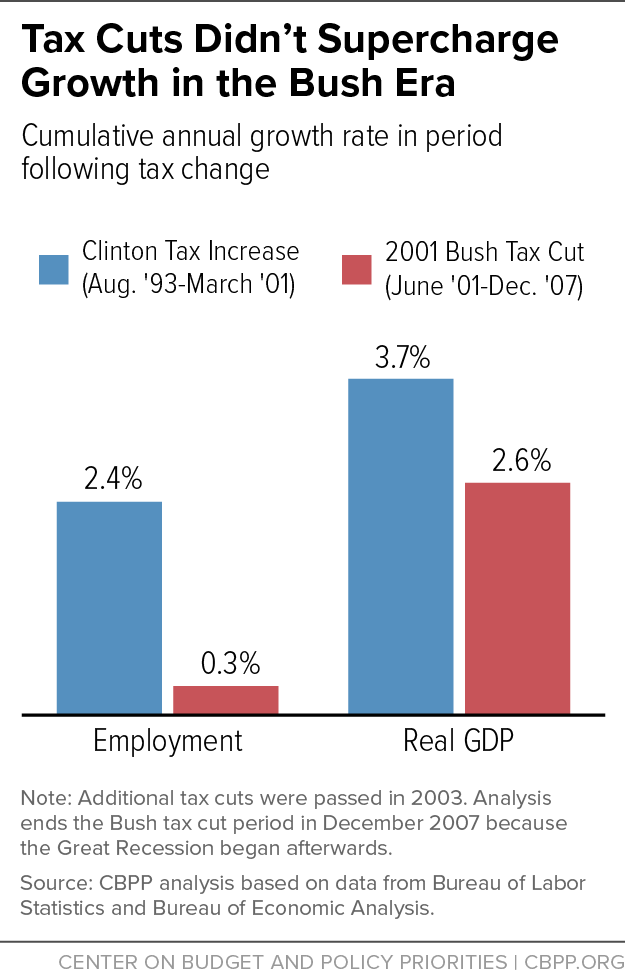

History shows that tax cuts for the rich are far from a surefire way to boost growth — and that higher taxes don’t preclude robust economic and job growth. Compare, for example, changes in employment and economic growth following the Bush tax cuts of 2001 with those following the Clinton tax increases on high-income taxpayers in 1993, which supply-siders were certain would lead to slower growth and large job losses (see Figure 2). Small business job-creation was also more robust under Clinton. After the Bush tax cuts for the very highest-income households expired at the end of 2012, the economy continued to grow and add jobs steadily.

In a comprehensive review of the literature, economists Bill Gale and Andrew Samwick conclude that “growth rates over long periods of time in the U.S. have not changed in tandem with the massive changes in the structure and revenue yield of the tax system that have occurred.”[9]

When Kansas enacted large tax cuts overwhelmingly for the wealthy, Gov. Sam Brownback claimed the tax cuts would act “like a shot of adrenaline into the heart of the Kansas economy.” But rather than seeing an economic boom since the tax cuts, Kansas’ growth — including small business job growth, economic growth, and growth in small business formation — has lagged behind the country as a whole.[10]

These simple relationships are not controlled experiments to isolate the effect of tax cuts on growth, but they are a warning against credulous acceptance of supply-side claims. Careful economic research reinforces that conclusion. It finds that tax cuts on high-income people’s earnings or their income from wealth (such as capital gains and dividends) don’t substantially boost work, saving, and investment.

They are likely to hurt growth if they increase deficits or are paired with cuts to investments that help working families and the economy. CBO, which aims to provide objective, impartial, and non-partisan analysis reflecting expert opinion, finds that even tax cuts that increase incentives to work, save, and invest with potentially positive effects on growth are a net drag on growth if they increase the budget deficit.

Financing tax cuts for the rich by cutting productive public investments that help support growth, such as education, research, and infrastructure, are also harmful. Finally, a growing body of research suggests that investments in children in low-income families not only reduce poverty and hardship in the near term, but can have long-lasting positive effects on their health, education, and earnings as adults.

Unless it is dramatically different from candidate Trump’s tax plan or the House “Better Way” plan, the tax plan President Trump is working on will provide massive tax cuts that overwhelmingly benefit high-income taxpayers and lose huge amounts of revenue. That’s certainly true under conventional revenue-estimating methods used by Congress’s official budget scorekeepers, CBO and the Joint Committee on Taxation (JCT).

It’s also true under most “dynamic scoring” that takes into account macroeconomic feedback effects on economic growth and revenues. The Tax Foundation, to whose analysis supply-siders gravitate, is an outlier with respect to dynamic scoring.[11] It tends to find significantly larger dynamic effects for tax proposals than CBO or JCT have found in their own past analyses, and significantly larger effects than the Tax Policy Center/Penn Wharton model finds in its analyses of the Trump[12] and Better Way[13] proposals. But even the Tax Foundation’s Alan Cole rejects the idea that Trump tax policies could produce enough economic growth to pay for themselves.[14]

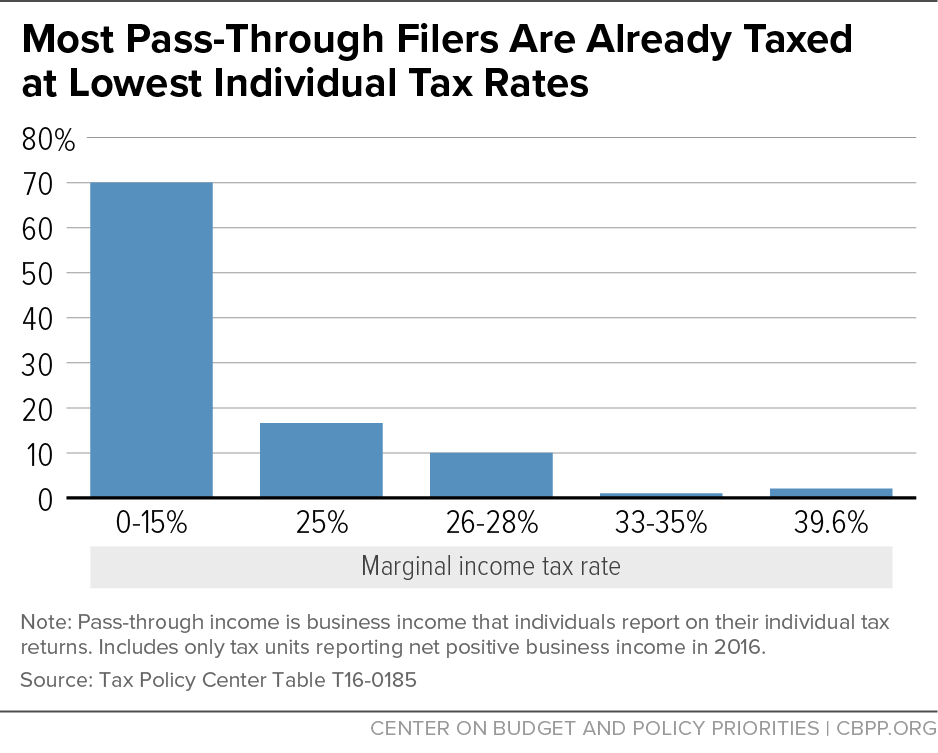

A centerpiece of President Trump’s campaign tax proposal and the Better Way tax plan is a special, much lower top rate for “pass-through” business income — which is currently taxed at owners’ individual income tax rates rather than the corporate rate and as dividend income in the hands of shareholders. About half of pass-through income flows to the top 1 percent of households, while only about 27 percent goes to the bottom 90 percent of households.[15]

These proposals would cut the top rate on pass-through income below the top rate on ordinary income (to 15 percent and 25 percent respectively), giving wealthy individuals a strong incentive to reclassify their wage and salary income as “business income” to get the lower pass-through rate. This would produce a substantial loss in revenue, while providing no benefit to the vast majority of small businesses, whose tax rate would be unaffected (see Figure 3).

The beneficiaries don’t fit anyone’s reasonable definition of a small business. They include hedge fund managers, consultants, and investment managers, who are among the pass-through business owners currently in the 39.6 percent tax bracket; the 400 highest-income taxpayers in the country, who have annual incomes exceeding $300 million each and receive about one-fifth of their income from pass-throughs; and business owners like President Trump, who owns about 500 pass-through businesses, according to his attorneys.

Kansas Gov. Sam Brownback exempted pass-through income from all state income taxes as part of his aggressive supply-side tax cutting in 2012. As I’ve already noted, this did nothing for the Kansas economy, but it wreaked havoc on the state’s budget, with the pass-through exemption alone costing $472 million in 2014, leading Kansas to cut services, drain “rainy day” funds, delay road projects, and turn to budget gimmicks. Two bond rating agencies have downgraded the state due to its budget problems. The Kansas legislature recently passed bipartisan legislation to close the loophole, although Gov. Brownback vetoed the bill.

That’s an object lesson in how not to do tax reform, but what should we do? In broad strokes, well-designed tax reform could spur growth by eliminating or scaling back inefficient tax subsidies and raising additional revenues to invest in national priorities and reduce deficits. At a minimum, it must not lose revenues.[16]

As I’m sure many on this committee are aware, research over the last several years has modified the longstanding claim that small businesses are the engine of job growth. This research shows that the age of a business matters more than its size as a contributor to job growth, although new companies are typically small to start with. Every year there is huge turnover in the population of small businesses as firms fail or go out of business and new firms start up. To quote one of the pioneers in this research:

Most entrants fail… [M]ost surviving young businesses don’t grow. But a small fraction of surviving young businesses contribute enormously to job growth. A challenge of modern economies is having an environment that allows such dynamic, high-growth businesses to succeed. [17]