- Home

- Federal Tax

- Build Back Better’s Child Tax Credit Cha...

Build Back Better’s Child Tax Credit Changes Would Protect Millions From Poverty — Permanently

Expanded EITC Extended for Adults Without Children

The House Build Back Better legislation would ensure that families continue to get a significantly expanded Child Tax Credit via monthly payments through 2022; and it would permanently make the full credit available to children in families with low or no earnings in a year, locking in substantial expected reductions in child poverty. The expanded credit benefits roughly 9 in 10 children across the country, and already data show signs of success. The vast majority of parents with low incomes are spending their Child Tax Credit payments on basic needs such as food, housing, utility bills, and education, which can help give their children a stronger start in life.[1]

Build Back Better would also extend through 2022 the American Rescue Plan’s expansion of the Earned Income Tax Credit (EITC) for working adults not raising children, boosting the incomes of over 17 million of these working adults. [2] Previously nearly 5.8 million of them were taxed into, or deeper into, poverty in part because their EITC was too low.

Making the full Child Tax Credit available for families with low or no earnings in a year... is expected to generate historic reductions in child poverty compared to what it would have been otherwise.Making the full Child Tax Credit available for families with low or no earnings in a year, often called making it “fully refundable,” is expected to generate historic reductions in child poverty compared to what it would have been otherwise. Before the Rescue Plan made the full Child Tax Credit fully available in 2021, 27 million children in families with low or no income in a year received less than the full credit or no credit at all.[3] Full refundability ensures that children in these families get the same amount of the Child Tax Credit as children in families with higher incomes.[4] This provision is the main driver of the credit expansion’s child poverty reductions:

- Altogether Build Back Better’s Child Tax Credit expansions — full refundability and expanding the maximum credit to $3,600 for children under age 6 and $3,000 for children aged 6-17 — are expected to reduce child poverty by more than 40 percent as compared to what it would be without the expansion. Full refundability drives 87 percent of this anti-poverty impact.

- While policymakers should ensure that the higher credit is made permanent, even if the credit amounts return to their pre-2021 level of $2,000 per child under age 17,[5] making the credit fully available at that level would reduce child poverty by roughly 20 percent.

Build Back Better’s Child Tax Credit expansions — especially permanent full refundability — also represent a significant step toward racial equity: they would permanently eliminate a fundamental design flaw in the credit that had the direct effect of ensuring that disproportionate numbers of Black and Latino children received a partial credit or none at all. Before the Rescue Plan’s expansion, roughly half of Black and Latino children in our country received less than the full Child Tax Credit or no credit at all — compared to roughly 1 in 5 white children — because their families earned too little.[6] Black and Latino families are overrepresented in low-paid work and face worse employment prospects due to historical and ongoing discrimination in education, housing, employment, and criminal justice that have systematically limited opportunity.[7] Build Back Better also would restore eligibility for the credit to children who aren’t eligible for a Social Security number because of their immigration status but can be claimed as tax dependents by using an Individual Tax Identification Number (ITIN).

Full Refundability — the Driver of Child Poverty Reduction — Would Be Permanent

Prior to the Rescue Plan, 27 million children received less than the full Child Tax Credit or no credit at all because their families’ incomes were too low. That included roughly half of all Black and Latino children and half of children who live in rural communities.[8] (See Appendix Table 2 for state-specific estimates, by race and ethnicity.) This upside-down policy gave less help to the children who needed it most. The Rescue Plan temporarily fixed this policy by making the tax credit fully refundable for 2021. Build Back Better, in one of its signature achievements, would make this policy advance permanent.

The Rescue Plan’s Child Tax Credit expansions — and their continuation in Build Back Better — are expected to result in historic reductions in child poverty, with full refundability largely responsible. The Rescue Plan expanded the Child Tax Credit in three ways:

- It increased the maximum credit to $3,600 per child for children through age 5 and $3,000 for children aged 6 to 17;

- It allowed families to newly claim their 17-year-old children; and

- It made the credit fully available to families with children that lacked earnings in a year or had earnings that were too low.

In the absence of the full refundability provision, the first two of those changes would lift an estimated 543,000 children above the poverty line, reducing the child poverty rate by 5 percent.[9] Before the Rescue Plan, most children with incomes below the poverty line received less than the full Child Tax Credit, so raising its maximum amount would have provided them no benefit.

But the two changes plus full refundability stand to raise 4.1 million children above the poverty line (see Appendix Table 1 for state-specific estimates) and cut the child poverty rate by more than 40 percent. (See Figure 1.) In other words, the full refundability feature makes the expansion nearly eight times as effective in reducing child poverty.

The Build Back Better legislation would extend the entire Rescue Plan expansion through 2022, and make full refundability permanent, which would result in a significant reduction in child poverty even if the other aspects of the expansion expire. If the maximum credit amount drops back to $2,000 per child in the coming years and the age range of eligibility for the credit returns to under 17, but full refundability remains permanent, roughly 2 million children would be lifted above the poverty line (as compared to child poverty without the full refundability provision in place). That would reduce child poverty by roughly 20 percent compared to what it would be without the expansion. In future legislation Congress should extend the full Rescue Plan expansion beyond 2022 and, ultimately, make the full expansion permanent.

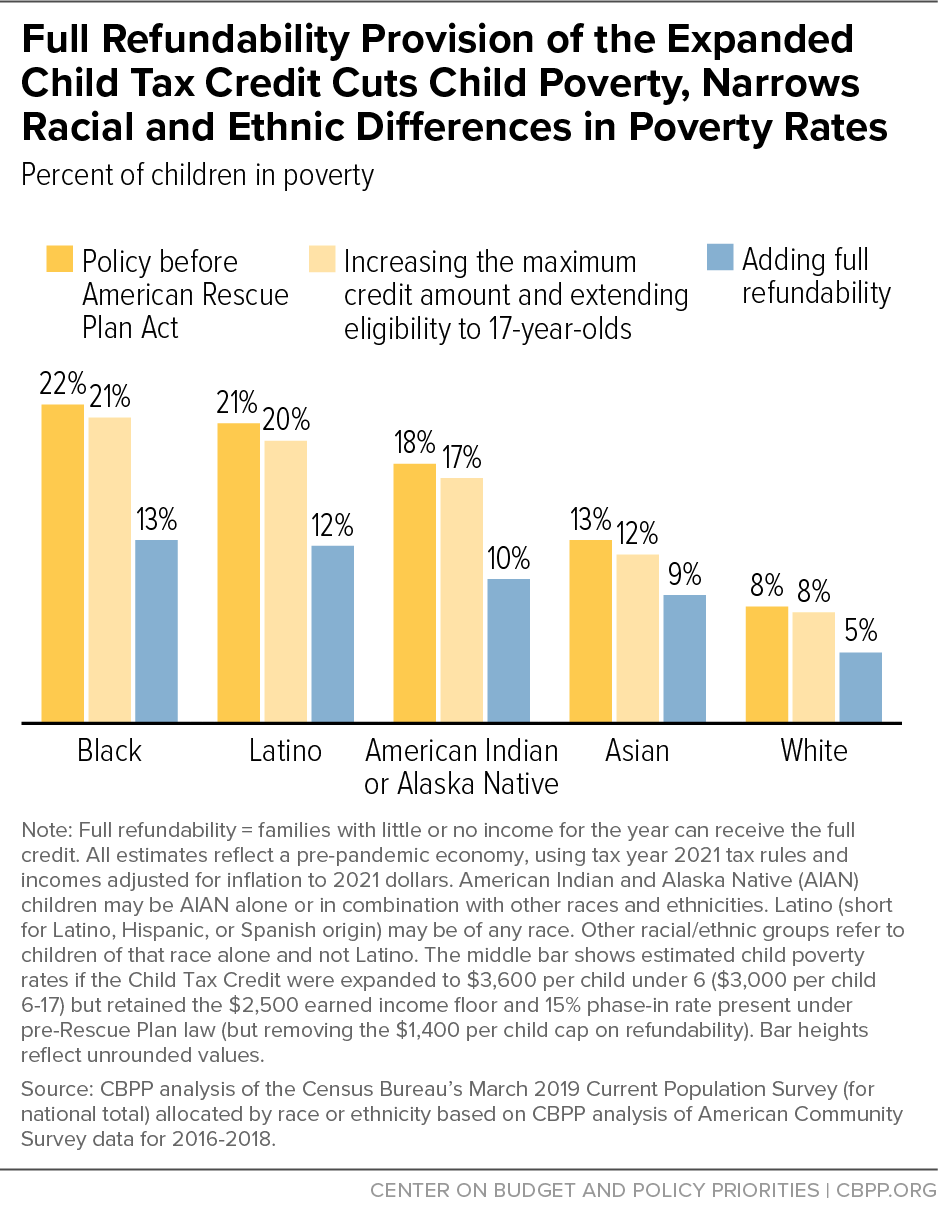

Making the Child Tax Credit fully refundable is particularly important for reducing racial disparities in child poverty. Expanding only the maximum credit amount to Rescue Plan levels and including 17-year-olds (but not making it fully refundable) would reduce Black and Latino child poverty rates by only about 1 percentage point relative to the poverty rate without those expansions, and so would do little to shrink the significant, long-standing gaps in child poverty between Black and white children and between Latino and white children.

But increasing the credit, adding 17-year-olds, and making it fully refundable would reduce Black and Latino child poverty rates by about 9 percentage points — from 22 percent to 13 percent for Black children, and 21 percent to 12 percent for Latino children — and would reduce the white child poverty rate from 8 percent to 5 percent, relative to the unexpanded credit.[10] (See Figure 2.) As a result, these changes would narrow the Black/white and the Latino/white differences in child poverty rates by 44 and 41 percent, respectively. The full expansion of the Child Tax Credit would also reduce the poverty rate for children identified as American Indian and Alaska Native alone or in combination with other races (regardless of Latino ethnicity) from 18 percent to 10 percent, and for Asian children from 13 percent to 9 percent.

Poverty and the hardships that come with it — unstable housing, frequent moves, inadequate nutrition, and high levels of stress in the family — can take a heavy toll on children and are associated with lower levels of educational attainment, poorer health in adulthood, lower earnings, and higher likelihood of being arrested, a 2019 National Academies of Science, Engineering, and Medicine report on reducing child poverty found. “[T]he weight of the causal evidence indicates that income poverty itself causes negative child outcomes, especially when it begins in early childhood and/or persists throughout a large share of a child’s life,” the report concluded.[11]

Making the credit fully available on a permanent basis to families with low incomes would improve children’s lives in the near and long term and benefit society overall, in important ways. (See Figure 3.) Studies show additional income is linked to better outcomes for children in families with low income, including better educational performance and attainment, higher earnings in adulthood, and better health, which can yield benefits for children and their communities over the course of their lives.[12] Additional income provides greater stability for families, with a corresponding reduction in stress for parents and children. And making the credit fully available would boost the incomes of many families who work hard at important but low-paid jobs, including in many positions recognized as essential to our daily life.

Key Child Tax Credit Changes Extended, Some Groups Newly Eligible

Recall that Build Back Better legislation would extend the Rescue Plan’s increase in the maximum Child Tax Credit from $2,000 to $3,600 for children under age 6 and $3,000 for children aged 6-17 (including 17-year-olds for the first time). And as it does under the Rescue Plan, Build Back Better’s increase in the maximum credit would begin to phase down for unmarried tax filers making more than $112,500 and for married couples making over $150,000.[13]

Also under Build Back Better, families could receive the Child Tax Credit as advance monthly payments of $300 per young child ($250 per older child) for the entirety of 2022, with Congress possibly considering a further extension. (Build Back Better allows 12 months of advance monthly payments while the Rescue Plan allowed families to receive six months of advance monthly payments of $300 per young child or $250 per older child, from July to December 2021, in part because the Rescue Plan was enacted partway through the year, in March 2021.[14]) To understand the game-changing potential of this policy advance, consider the following example:

- A single mom, with a toddler and a daughter who is a second-grader, works as a home health aide helping an elderly person meet their basic needs; she makes $12,500 working part time around her kids’ schedule. Prior to the Rescue Plan, this family received a Child Tax Credit of $750 per child per year, but they now get $550 per month — a total $3,600 for the toddler and $3,000 for the second-grader in 2021 — and would in 2022 as well if Build Back Better is enacted.

Families with low and moderate incomes are spending their expanded Child Tax Credits on the most basic household expenses — food, clothing, housing, and utilities — or education. Nine in ten families with lower incomes (less than $35,000) spent their Child Tax Credit on at least one of these needs, Census Bureau data show.[15] More families also report having enough to eat since the Child Tax Credit monthly payments began.

Overall, Build Back Better’s Child Tax Credit expansions are expected to benefit more than 65 million children — nearly 90 percent of all children — across the country, including 31.9 million white children, 17.5 million Latino children, 9.4 million Black children, and 2.8 million Asian children.[16] (See Appendix Table 3 for state-specific estimates.) They are also expected to lift 4.1 million children above the poverty line, of whom 1.6 million are Latino, 1.2 million are white, 930,000 are Black, and 132,000 are Asian. Black and Latino children would disproportionately benefit.[17]

Children With Certain Immigration Statuses Would Again Be Eligible

The Build Back Better framework would also restore eligibility for the credit to children who aren’t eligible for a Social Security number (SSN) because of their immigration status but can be claimed as tax dependents by using an Individual Tax Identification Number (ITIN). A provision in the 2017 tax law denied the credit to such children — even though there is generally broad support to grant legal status or take other steps to encourage them to finish their education and equip them for future success in our communities and economy. The country has a stake in ensuring that these children get the resources they need to realize their potential, and Build Back Better would ensure that children with ITINs have access to the same credit as other children.

Child Tax Credit Expansion Would Greatly Benefit U.S. Territories

The Build Back Better legislation would also provide its Child Tax Credit expansions to all the U.S. territories.[18] Child poverty is much higher there, making these expansions sorely needed. To ensure the Child Tax Credit reaches all eligible families, the territories would need support to make people aware of the expansions, given the steep economic challenges, language barriers, and other obstacles to enrollment they face. The territories face economic challenges that have left local government agencies without the necessary funding and staffing to aid outreach efforts.

One-Year Extension of Expanded EITC for Adults Not Raising Children

The EITC is a powerful wage subsidy, but before the Rescue Plan it largely excluded working adults not raising children at home, providing only a tiny credit to a small number of them, and excluding younger and older workers. Build Back Better would extend for 2022 the Rescue Plan’s EITC expansion, which raised both the maximum credit for these workers (from roughly $540 to roughly $1,500) and the income cap for them to qualify (from about $16,000 to more than $21,000 for unmarried filers and from about $22,000 to more than $27,000 for married couples). It also expanded the age range of eligible workers without children to include younger adults aged 19-24 (excluding students under 24 who are attending school at least part time), as well as people aged 65 and over.

This expansion would continue to boost the incomes of more than 17 million working adults without children who do important work for low pay. (See Appendix Table 4 for state-specific estimates, by race/ethnicity.) They include nearly 5.8 million people aged 19 to 65 whom the federal tax code would otherwise tax into, or deeper into, poverty — the lone group for whom that happens — in large part because their EITC would otherwise be too low.[19] The shares of such people who are Latino and Black workers are disproportionately high (about 26 percent are Latino and 18 percent are Black, compared to their 19 percent and 12 percent respective shares of the overall population) — again reflecting historical and ongoing barriers to economic opportunity that have led to their overrepresentation in low-paid work.

Among those most likely to benefit are people who work as cashiers, food preparers and servers, and home health aides. (See Table 1.) The pandemic has helped the nation better understand and appreciate these workers and millions of others who work for low pay and the essential role they play in keeping this economy running. Build Back Better would ensure that this income boost will continue in 2022. Congress will need to enact a further extension to ensure this important policy remains in place.

| TABLE 1 | ||

|---|---|---|

| Working Adults Without Children in Selected Essential Occupations Who Would Benefit From EITC Expansion in Build Back Better Legislation Relative to without the expansion |

||

| Occupation | Number of workers who would gain | Workers who would gain as a share of all workers aged 19 and older in occupation |

| Cashiers | 1,074,000 | 33% |

| Retail salespersons | 673,000 | 20% |

| Cooks | 660,000 | 30% |

| Janitors and building cleaners | 537,000 | 21% |

| Laborers and freight, stock, and material movers, by hand | 534,000 | 24% |

| Personal and home care aides | 468,000 | 29% |

| Truck and delivery drivers | 412,000 | 10% |

| Nursing, psychiatric, and home health aides | 385,000 | 17% |

| Stock clerks and order fillers | 384,000 | 26% |

| Food preparation workers | 315,000 | 30% |

| Child care workers | 304,000 | 24% |

| First-line supervisors/managers of retail sales workers | 253,000 | 7% |

| Hand packers and packagers | 204,000 | 32% |

| Miscellaneous agricultural workers | 182,000 | 19% |

| Dishwashers | 105,000 | 51% |

| Bus drivers | 71,000 | 11% |

| All occupations | 17,445,000 | 11% |

Note: Workers without children counted as benefiting from the EITC expansion in the Build Back Better legislation are those aged 19 and older (excluding students under age 24 attending school at least part time).

Source: CBPP estimates based on U.S. Census Bureau’s March 2019 Current Population Survey, using tax year 2021 tax rules and incomes adjusted for inflation to 2021 dollars. Estimates reflect a pre-pandemic economy.

Appendix

| APPENDIX TABLE 1 | |||

|---|---|---|---|

| Estimated Number of Children Who Would Benefit From Child Tax Credit Expansion in Build Back Better Legislation, by State Relative to without the expansion |

|||

| State | Children under 18 lifted above poverty line by expansion | Children under 18 who would benefit from expansion | Share of children under 18 who would benefit from expansion |

| Total U.S. | 4,120,000 | 65,560,000 | 89% |

| Alabama | 76,000 | 1,020,000 | 93% |

| Alaska | 11,000 | 166,000 | 89% |

| Arizona | 109,000 | 1,507,000 | 92% |

| Arkansas | 47,000 | 661,000 | 93% |

| California | 582,000 | 7,844,000 | 86% |

| Colorado | 56,000 | 1,106,000 | 87% |

| Connecticut | 30,000 | 604,000 | 81% |

| Delaware | 9,000 | 181,000 | 89% |

| District of Columbia | 9,000 | 93,000 | 75% |

| Florida | 275,000 | 3,833,000 | 91% |

| Georgia | 165,000 | 2,269,000 | 90% |

| Hawai’i | 15,000 | 277,000 | 91% |

| Idaho | 16,000 | 410,000 | 93% |

| Illinois | 150,000 | 2,536,000 | 87% |

| Indiana | 78,000 | 1,452,000 | 92% |

| Iowa | 24,000 | 668,000 | 91% |

| Kansas | 29,000 | 651,000 | 92% |

| Kentucky | 66,000 | 929,000 | 92% |

| Louisiana | 89,000 | 1,027,000 | 92% |

| Maine | 10,000 | 229,000 | 90% |

| Maryland | 56,000 | 1,120,000 | 83% |

| Massachusetts | 57,000 | 1,099,000 | 80% |

| Michigan | 114,000 | 1,968,000 | 90% |

| Minnesota | 43,000 | 1,122,000 | 87% |

| Mississippi | 55,000 | 677,000 | 94% |

| Missouri | 70,000 | 1,260,000 | 91% |

| Montana | 10,000 | 209,000 | 91% |

| Nebraska | 18,000 | 434,000 | 91% |

| Nevada | 38,000 | 634,000 | 92% |

| New Hampshire | 8,000 | 221,000 | 85% |

| New Jersey | 93,000 | 1,599,000 | 81% |

| New Mexico | 32,000 | 454,000 | 93% |

| New York | 250,000 | 3,554,000 | 86% |

| North Carolina | 135,000 | 2,085,000 | 90% |

| North Dakota | 4,000 | 157,000 | 91% |

| Ohio | 128,000 | 2,367,000 | 91% |

| Oklahoma | 59,000 | 894,000 | 93% |

| Oregon | 40,000 | 778,000 | 89% |

| Pennsylvania | 137,000 | 2,363,000 | 89% |

| Rhode Island | 8,000 | 185,000 | 89% |

| South Carolina | 67,000 | 1,025,000 | 93% |

| South Dakota | 9,000 | 196,000 | 91% |

| Tennessee | 92,000 | 1,393,000 | 92% |

| Texas | 489,000 | 6,686,000 | 91% |

| Utah | 32,000 | 859,000 | 92% |

| Vermont | 4,000 | 104,000 | 89% |

| Virginia | 89,000 | 1,586,000 | 85% |

| Washington | 66,000 | 1,433,000 | 87% |

| West Virginia | 22,000 | 346,000 | 93% |

| Wisconsin | 45,000 | 1,158,000 | 90% |

| Wyoming | 4,000 | 128,000 | 93% |

Notes: Estimates reflect a pre-pandemic economy, using tax year 2021 tax rules and incomes adjusted for inflation to 2021 dollars.

Source: CBPP analysis of the March 2019 Current Population Survey (for national total) allocated by state based on CBPP analysis of American Community Survey (ACS) data for 2016-2018. Poverty calculations also use U.S. Census Bureau Supplemental Poverty Measure research files for the ACS.

| APPENDIX TABLE 2 | ||||||

|---|---|---|---|---|---|---|

| Estimated Number of Children Under 17 Left Out of Full $2,000 Child Tax Credit Prior to Rescue Plan, by State and Race/Ethnicity | ||||||

| State | Total | White | Latino | Black | Asian | Another race or multiple races |

| Total U.S. | 27,000,000 | 8,763,000 | 9,904,000 | 5,738,000 | 813,000 | 1,782,000 |

| Alabama | 480,000 | 181,000 | 55,000 | 220,000 | 3,000 | 22,000 |

| Alaska | 53,000 | 15,000 | N/A | N/A | N/A | 27,000 |

| Arizona | 692,000 | 153,000 | 407,000 | 39,000 | 8,000 | 84,000 |

| Arkansas | 323,000 | 157,000 | 56,000 | 86,000 | N/A | 22,000 |

| California | 3,524,000 | 450,000 | 2,480,000 | 227,000 | 221,000 | 146,000 |

| Colorado | 346,000 | 120,000 | 176,000 | 19,000 | 8,000 | 22,000 |

| Connecticut | 199,000 | 53,000 | 92,000 | 37,000 | 7,000 | 10,000 |

| Delaware | 67,000 | 19,000 | 17,000 | 26,000 | N/A | N/A |

| District of Columbia | 53,000 | N/A | 8,000 | 43,000 | N/A | N/A |

| Florida | 1,730,000 | 466,000 | 657,000 | 498,000 | 26,000 | 84,000 |

| Georgia | 1,044,000 | 273,000 | 221,000 | 473,000 | 21,000 | 57,000 |

| Hawai’i | 92,000 | 9,000 | 19,000 | N/A | 16,000 | 47,000 |

| Idaho | 153,000 | 95,000 | 46,000 | N/A | N/A | 10,000 |

| Illinois | 982,000 | 295,000 | 352,000 | 265,000 | 26,000 | 44,000 |

| Indiana | 558,000 | 307,000 | 96,000 | 107,000 | 11,000 | 36,000 |

| Iowa | 197,000 | 120,000 | 32,000 | 24,000 | 5,000 | 16,000 |

| Kansas | 218,000 | 106,000 | 65,000 | 23,000 | 4,000 | 20,000 |

| Kentucky | 422,000 | 292,000 | 38,000 | 59,000 | 5,000 | 27,000 |

| Louisiana | 530,000 | 160,000 | 41,000 | 296,000 | 5,000 | 28,000 |

| Maine | 75,000 | 62,000 | N/A | N/A | N/A | 6,000 |

| Maryland | 352,000 | 82,000 | 85,000 | 148,000 | 13,000 | 24,000 |

| Massachusetts | 356,000 | 119,000 | 146,000 | 50,000 | 21,000 | 22,000 |

| Michigan | 810,000 | 406,000 | 97,000 | 232,000 | 16,000 | 60,000 |

| Minnesota | 322,000 | 133,000 | 57,000 | 74,000 | 23,000 | 36,000 |

| Mississippi | 351,000 | 103,000 | 16,000 | 215,000 | N/A | 15,000 |

| Missouri | 502,000 | 296,000 | 46,000 | 112,000 | 5,000 | 43,000 |

| Montana | 78,000 | 51,000 | N/A | N/A | N/A | 21,000 |

| Nebraska | 141,000 | 65,000 | 47,000 | 13,000 | 5,000 | 11,000 |

| Nevada | 271,000 | 53,000 | 142,000 | 42,000 | 10,000 | 23,000 |

| New Hampshire | 52,000 | 40,000 | N/A | N/A | N/A | N/A |

| New Jersey | 561,000 | 144,000 | 252,000 | 122,000 | 23,000 | 20,000 |

| New Mexico | 245,000 | 34,000 | 166,000 | 3,000 | N/A | 42,000 |

| New York | 1,552,000 | 471,000 | 574,000 | 316,000 | 123,000 | 69,000 |

| North Carolina | 926,000 | 300,000 | 241,000 | 300,000 | 18,000 | 66,000 |

| North Dakota | 39,000 | 20,000 | N/A | N/A | N/A | 12,000 |

| Ohio | 950,000 | 512,000 | 91,000 | 249,000 | 11,000 | 88,000 |

| Oklahoma | 398,000 | 153,000 | 100,000 | 51,000 | 4,000 | 90,000 |

| Oregon | 291,000 | 146,000 | 102,000 | 10,000 | 8,000 | 25,000 |

| Pennsylvania | 893,000 | 428,000 | 192,000 | 196,000 | 25,000 | 54,000 |

| Rhode Island | 67,000 | 22,000 | 30,000 | 8,000 | N/A | N/A |

| South Carolina | 476,000 | 156,000 | 66,000 | 220,000 | 4,000 | 30,000 |

| South Dakota | 67,000 | 28,000 | 6,000 | N/A | N/A | 30,000 |

| Tennessee | 635,000 | 314,000 | 93,000 | 188,000 | 7,000 | 33,000 |

| Texas | 3,086,000 | 476,000 | 2,040,000 | 430,000 | 60,000 | 79,000 |

| Utah | 233,000 | 129,000 | 74,000 | N/A | 4,000 | 19,000 |

| Vermont | 30,000 | 26,000 | N/A | N/A | N/A | N/A |

| Virginia | 532,000 | 194,000 | 102,000 | 179,000 | 17,000 | 39,000 |

| Washington | 477,000 | 191,000 | 173,000 | 32,000 | 20,000 | 61,000 |

| West Virginia | 170,000 | 145,000 | 4,000 | 9,000 | N/A | N/A |

| Wisconsin | 366,000 | 171,000 | 75,000 | 73,000 | 13,000 | 34,000 |

| Wyoming | 35,000 | 22,000 | 8,000 | N/A | N/A | 4,000 |

Notes: Figures are rounded to the nearest 1,000 and may not sum to totals. N/A indicates reliable data are not available due to small sample size. Estimates reflect a pre-pandemic economy, using tax year 2021 tax rules and incomes adjusted for inflation to 2021 dollars. Children left out in prior law received less than the full $2,000 per child because their families lacked earnings or had earnings that were too low. Racial and ethnic categories do not overlap; figures for each racial group such as Black, white, or Asian do not include individuals who identify as multiracial or people of Latino ethnicity. Latino includes all people of Hispanic, Latino, or Spanish origin regardless of race. Due to limitations of the Census data, the figures do not reflect IRS rules that require children to have a Social Security number to qualify for the Child Tax Credit. This omission likely has little effect on most of the estimates shown here; the Latino share of children left out, however, may be somewhat overstated.

Source: Tax Policy Center national estimate allocated by state and by race or ethnicity based on CBPP analysis of American Community Survey (ACS) data for 2016-2018.

| APPENDIX TABLE 3 | |||||||

|---|---|---|---|---|---|---|---|

| Estimated Number of Children Under 18 Who Would Benefit From Child Tax Credit Expansion in Build Back Better Legislation, by State and Race/Ethnicity Relative to without the expansion |

|||||||

| State | Total | White | Latino | Black | Asian | Another race or multiple races | |

| Total U.S. | 65,560,000 | 31,912,000 | 17,548,000 | 9,377,000 | 2,759,000 | 3,964,000 | |

| Alabama | 1,020,000 | 575,000 | 78,000 | 316,000 | 12,000 | 39,000 | |

| Alaska | 166,000 | 78,000 | 16,000 | 4,000 | 9,000 | 59,000 | |

| Arizona | 1,507,000 | 563,000 | 695,000 | 69,000 | 34,000 | 146,000 | |

| Arkansas | 661,000 | 412,000 | 84,000 | 120,000 | 8,000 | 38,000 | |

| California | 7,844,000 | 1,756,000 | 4,473,000 | 411,000 | 771,000 | 434,000 | |

| Colorado | 1,106,000 | 591,000 | 377,000 | 48,000 | 31,000 | 59,000 | |

| Connecticut | 604,000 | 305,000 | 166,000 | 77,000 | 24,000 | 32,000 | |

| Delaware | 181,000 | 88,000 | 30,000 | 48,000 | 6,000 | 10,000 | |

| District of Columbia | 93,000 | 10,000 | 15,000 | 63,000 | N/A | N/A | |

| Florida | 3,833,000 | 1,536,000 | 1,227,000 | 790,000 | 88,000 | 193,000 | |

| Georgia | 2,269,000 | 942,000 | 348,000 | 790,000 | 73,000 | 115,000 | |

| Hawai’i | 277,000 | 36,000 | 53,000 | 3,000 | 66,000 | 120,000 | |

| Idaho | 410,000 | 307,000 | 77,000 | N/A | 4,000 | 19,000 | |

| Illinois | 2,536,000 | 1,231,000 | 682,000 | 410,000 | 106,000 | 107,000 | |

| Indiana | 1,452,000 | 1,025,000 | 166,000 | 164,000 | 27,000 | 71,000 | |

| Iowa | 668,000 | 520,000 | 69,000 | 31,000 | 16,000 | 33,000 | |

| Kansas | 651,000 | 427,000 | 125,000 | 39,000 | 15,000 | 46,000 | |

| Kentucky | 929,000 | 726,000 | 56,000 | 86,000 | 14,000 | 47,000 | |

| Louisiana | 1,027,000 | 502,000 | 70,000 | 391,000 | 13,000 | 50,000 | |

| Maine | 229,000 | 202,000 | 6,000 | 7,000 | N/A | 12,000 | |

| Maryland | 1,120,000 | 430,000 | 187,000 | 373,000 | 57,000 | 73,000 | |

| Massachusetts | 1,099,000 | 628,000 | 236,000 | 109,000 | 63,000 | 62,000 | |

| Michigan | 1,968,000 | 1,299,000 | 168,000 | 329,000 | 53,000 | 119,000 | |

| Minnesota | 1,122,000 | 760,000 | 103,000 | 115,000 | 62,000 | 82,000 | |

| Mississippi | 677,000 | 323,000 | 30,000 | 296,000 | 6,000 | 23,000 | |

| Missouri | 1,260,000 | 905,000 | 86,000 | 172,000 | 20,000 | 78,000 | |

| Montana | 209,000 | 163,000 | 12,000 | N/A | N/A | 33,000 | |

| Nebraska | 434,000 | 297,000 | 79,000 | 23,000 | 11,000 | 24,000 | |

| Nevada | 634,000 | 213,000 | 270,000 | 63,000 | 35,000 | 53,000 | |

| New Hampshire | 221,000 | 188,000 | 15,000 | 4,000 | 6,000 | 8,000 | |

| New Jersey | 1,599,000 | 683,000 | 487,000 | 241,000 | 123,000 | 66,000 | |

| New Mexico | 454,000 | 102,000 | 281,000 | 5,000 | 5,000 | 61,000 | |

| New York | 3,554,000 | 1,592,000 | 955,000 | 582,000 | 265,000 | 160,000 | |

| North Carolina | 2,085,000 | 1,047,000 | 354,000 | 487,000 | 55,000 | 142,000 | |

| North Dakota | 157,000 | 122,000 | 8,000 | N/A | N/A | 19,000 | |

| Ohio | 2,367,000 | 1,674,000 | 146,000 | 355,000 | 44,000 | 148,000 | |

| Oklahoma | 894,000 | 465,000 | 157,000 | 72,000 | 15,000 | 185,000 | |

| Oregon | 778,000 | 484,000 | 185,000 | 17,000 | 28,000 | 64,000 | |

| Pennsylvania | 2,363,000 | 1,549,000 | 303,000 | 320,000 | 75,000 | 116,000 | |

| Rhode Island | 185,000 | 102,000 | 50,000 | 14,000 | 6,000 | 12,000 | |

| South Carolina | 1,025,000 | 542,000 | 96,000 | 319,000 | 14,000 | 54,000 | |

| South Dakota | 196,000 | 140,000 | 11,000 | 6,000 | N/A | 37,000 | |

| Tennessee | 1,393,000 | 893,000 | 136,000 | 274,000 | 23,000 | 65,000 | |

| Texas | 6,686,000 | 1,939,000 | 3,488,000 | 803,000 | 242,000 | 215,000 | |

| Utah | 859,000 | 629,000 | 156,000 | 10,000 | 13,000 | 50,000 | |

| Vermont | 104,000 | 94,000 | N/A | N/A | N/A | N/A | |

| Virginia | 1,586,000 | 818,000 | 230,000 | 336,000 | 83,000 | 119,000 | |

| Washington | 1,433,000 | 791,000 | 332,000 | 59,000 | 85,000 | 165,000 | |

| West Virginia | 346,000 | 306,000 | 8,000 | 13,000 | N/A | 17,000 | |

| Wisconsin | 1,158,000 | 807,000 | 143,000 | 104,000 | 37,000 | 67,000 | |

| Wyoming | 128,000 | 99,000 | 19,000 | N/A | N/A | 9,000 | |

Notes: Figures are rounded to the nearest 1,000 and may not sum to totals. N/A indicates reliable data are not available due to small sample size. Estimates reflect a pre-pandemic economy, using tax year 2021 tax rules and incomes adjusted for inflation to 2021 dollars. Racial and ethnic categories do not overlap; figures for each racial group such as Black, white, or Asian do not include individuals who identify as multiracial or people of Latino ethnicity. Latino includes all people of Hispanic, Latino, or Spanish origin regardless of race. Due to limitations of the Census data, the figures do not reflect IRS rules that require children to have a Social Security number to qualify for the Child Tax Credit. This omission likely has little effect on most of the estimates shown here; the Latino share of children benefiting, however, may be somewhat overstated.

Source: CBPP analysis of the U.S. Census Bureau’s March 2019 Current Population Survey (for national total) allocated by state and by race or ethnicity based on CBPP analysis of American Community Survey (ACS) data for 2016-2018.

| APPENDIX TABLE 4 | ||||||

|---|---|---|---|---|---|---|

| Estimated Number of Working Adults Without Children Who Would Benefit From EITC Expansion in Build Back Better Legislation, by State and Race/Ethnicity Relative to without the expansion |

||||||

| State | Total | White | Latino | Black | Asian | Another race or multiple races |

| Total U.S. | 17,445,400 | 9,658,700 | 3,639,600 | 2,739,300 | 815,700 | 592,100 |

| Alabama | 274,300 | 157,100 | 15,200 | 92,000 | 4,000 | 6,000 |

| Alaska | 38,900 | 20,400 | N/A | N/A | 3,100 | 10,500 |

| Arizona | 385,200 | 196,800 | 130,900 | 22,700 | 10,800 | 24,000 |

| Arkansas | 173,700 | 118,500 | 12,800 | 34,200 | 2,800 | 5,300 |

| California | 2,070,100 | 668,800 | 941,300 | 138,100 | 247,600 | 74,300 |

| Colorado | 293,300 | 197,700 | 61,600 | 15,200 | 8,900 | 10,000 |

| Connecticut | 160,900 | 88,700 | 37,100 | 23,800 | 6,100 | 5,300 |

| Delaware | 46,500 | 25,500 | 4,600 | 13,200 | 1,500 | 1,700 |

| District of Columbia | 33,200 | 9,100 | 4,500 | 17,300 | N/A | N/A |

| Florida | 1,323,000 | 629,200 | 401,300 | 232,400 | 30,500 | 29,700 |

| Georgia | 569,900 | 261,700 | 62,700 | 214,600 | 18,600 | 12,300 |

| Hawai’i | 71,700 | 17,100 | 7,300 | N/A | 24,100 | 21,700 |

| Idaho | 104,300 | 86,200 | 13,100 | N/A | N/A | 3,500 |

| Illinois | 620,700 | 353,100 | 113,500 | 113,100 | 28,800 | 12,300 |

| Indiana | 367,100 | 273,700 | 27,100 | 47,900 | 8,000 | 10,500 |

| Iowa | 171,400 | 146,200 | 9,000 | 9,400 | 3,100 | 3,600 |

| Kansas | 163,700 | 118,900 | 20,100 | 15,700 | 2,900 | 6,100 |

| Kentucky | 256,000 | 205,600 | 11,200 | 30,600 | 2,900 | 5,700 |

| Louisiana | 281,900 | 137,600 | 17,800 | 115,900 | 4,900 | 5,700 |

| Maine | 85,300 | 79,400 | N/A | N/A | N/A | 2,400 |

| Maryland | 263,300 | 115,400 | 36,600 | 87,600 | 16,200 | 7,400 |

| Massachusetts | 299,500 | 197,200 | 46,500 | 26,800 | 19,500 | 9,500 |

| Michigan | 571,000 | 407,600 | 33,300 | 98,900 | 13,700 | 17,700 |

| Minnesota | 276,300 | 210,800 | 17,900 | 23,100 | 11,700 | 12,800 |

| Mississippi | 166,500 | 79,600 | 6,500 | 76,400 | 1,900 | 2,200 |

| Missouri | 338,800 | 257,400 | 15,800 | 50,500 | 6,500 | 8,600 |

| Montana | 77,900 | 67,800 | 2,600 | N/A | N/A | 6,100 |

| Nebraska | 101,000 | 75,900 | 11,900 | 7,300 | N/A | 3,600 |

| Nevada | 175,300 | 78,100 | 53,500 | 20,100 | 14,400 | 9,100 |

| New Hampshire | 66,400 | 59,900 | N/A | N/A | N/A | N/A |

| New Jersey | 388,400 | 168,600 | 116,700 | 69,300 | 25,200 | 8,700 |

| New Mexico | 132,000 | 48,500 | 64,100 | 4,300 | 1,800 | 13,300 |

| New York | 982,700 | 463,500 | 235,500 | 158,900 | 98,100 | 26,600 |

| North Carolina | 593,900 | 334,300 | 63,800 | 161,200 | 13,800 | 20,700 |

| North Dakota | 39,300 | 29,100 | 2,900 | N/A | N/A | 3,300 |

| Ohio | 651,600 | 473,900 | 27,500 | 119,200 | 13,000 | 17,900 |

| Oklahoma | 229,200 | 141,900 | 26,500 | 25,100 | 3,700 | 32,000 |

| Oregon | 255,300 | 191,100 | 35,700 | 6,200 | 9,900 | 12,300 |

| Pennsylvania | 662,700 | 475,200 | 59,000 | 93,700 | 21,200 | 13,500 |

| Rhode Island | 47,600 | 32,300 | 9,300 | 2,500 | N/A | N/A |

| South Carolina | 303,300 | 164,800 | 21,600 | 104,600 | 4,800 | 7,400 |

| South Dakota | 49,800 | 37,500 | N/A | N/A | N/A | 8,200 |

| Tennessee | 381,400 | 262,100 | 25,100 | 80,500 | 6,300 | 7,400 |

| Texas | 1,505,300 | 532,800 | 674,800 | 212,800 | 55,100 | 29,700 |

| Utah | 142,300 | 103,600 | 26,100 | N/A | 4,700 | 5,800 |

| Vermont | 37,200 | 34,000 | N/A | N/A | N/A | N/A |

| Virginia | 415,700 | 230,000 | 46,600 | 105,000 | 20,900 | 13,300 |

| Washington | 358,300 | 233,300 | 54,600 | 19,500 | 24,800 | 26,100 |

| West Virginia | 102,900 | 90,200 | 2,700 | 7,300 | N/A | 1,700 |

| Wisconsin | 303,700 | 240,700 | 18,500 | 28,300 | 6,600 | 9,600 |

| Wyoming | 35,500 | 30,400 | 2,900 | N/A | N/A | 1,700 |

Note: Figures are rounded to the nearest 100 and may not sum to totals. N/A indicates reliable data are not available due to small sample size. Estimates reflect a pre-pandemic economy, using tax year 2021 tax rules and incomes adjusted for inflation to 2021 dollars. Workers without children counted as benefiting from the EITC expansion in the Build Back Better legislation are those aged 19 and older (excluding students under age 24 attending school at least part time). Racial and ethnic categories do not overlap; figures for each racial group such as Black, white, or Asian do not include individuals who identify as multiracial or people of Latino ethnicity. Latino includes all people of Hispanic, Latino, or Spanish origin regardless of race. Due to limitations of the Census data, the figures do not reflect IRS rules that require all EITC family members to have a Social Security number. This omission likely has little effect on most of the estimates shown here; the Latino share of those benefiting, however, may be somewhat overstated.

Source: CBPP analysis of the March 2019 Current Population Survey (for national total) allocated by state and by race or ethnicity based on CBPP analysis of American Community Survey (ACS) data for 2016-2018.

End Notes

[1] Claire Zippel, “9 in 10 Families with Low Incomes Are Using Child Tax Credits to Pay for Necessities, Education,” CBPP, October 21, 2021, https://www.cbpp.org/blog/9-in-10-families-with-low-incomes-are-using-child-tax-credits-to-pay-for-necessities-education.

[2] The American Rescue Plan is Public Law 117-2.

[3] Chuck Marr et al., “Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent,” CBPP, May 24, 2021, https://www.cbpp.org/research/federal-tax/congress-should-adopt-american-families-plans-permanent-expansions-of-child.

[4] Making the credit fully refundable eliminates the previous earnings threshold, phase-in structure, and cap on the refundable amount.

[5] Prior to the Rescue Plan, the maximum Child Tax Credit was $2,000 per child and was available to children under age 17. Under Build Back Better, the credit would return to this maximum amount, and families would not be able to claim 17-year-olds for the credit, for tax years 2023 through 2025.

[6] Sophie Collyer, David Harris, and Christopher Wimer, “Left behind: The one-third of children in families who earn too little to get the full Child Tax Credit,” Center on Poverty & Social Policy at Columbia University, May 14, 2019, https://www.povertycenter.columbia.edu/news-internal/leftoutofctc.

[7] Danilo Trisi and Matt Saenz, “Economic Security Programs Reduce Overall Poverty, Racial and Ethnic Inequities,” CBPP, January 28, 2021, https://www.cbpp.org/research/poverty-and-inequality/economic-security-programs-reduce-overall-poverty-racial-and-ethnic. Even in the relatively strong pre-pandemic economy, 1 in 3 Black (33 percent) and Latino (34 percent) workers earned below-poverty wages, as did nearly 1 in 5 white workers (19 percent). Economic Policy Institute, State of Working America Data Library, “Poverty-level wages,” 2019, https://www.epi.org/data/#?subject=povwage.

[8] Marr et al., op. cit.

[9] Chuck Marr, Kris Cox, and Arloc Sherman, “Recovery Package Should Permanently Include Families With Low Incomes in Full Child Tax Credit,” CBPP, September 7, 2021, https://www.cbpp.org/research/federal-tax/recovery-package-should-permanently-include-families-with-low-incomes-in-full. The poverty reduction estimates in this report come from policy simulations — that is, calculating after-tax income for a representative sample of families in Census data under different Child Tax Credit scenarios, with and without expansion provisions. This may not equal the reduction in poverty that will be observed between one year and another, which will be influenced by additional factors such as the economy and the expiration of other relief measures.

[10] Danilo Trisi et al., “House Build Back Better Legislation Advances Racial Equity,” CBPP, September 27, 2021, https://www.cbpp.org/research/poverty-and-inequality/house-build-back-better-legislation-advances-racial-equity.

[11] National Academies of Science, Engineering and Medicine, “A Roadmap to Reducing Child Poverty,” 2019, https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty.

[12] Arloc Sherman et al., “Recovery Proposals Adopt Proven Approaches to Reducing Poverty, Increasing Social Mobility,” CBPP, August 5, 2021, https://www.cbpp.org/research/poverty-and-inequality/recovery-proposals-adopt-proven-approaches-to-reducing-poverty.

[13] For tax year 2022, as with 2021, the credit would phase down in two steps. First, the credit increase would start to phase down at $112,500 for heads of household ($150,000 for married couples). Second, the final $2,000 of the credit would start to phase down at $200,000 ($400,000 if married). A couple with two children and income between $400,000 and $440,000 would receive a partial credit.

[14] Build Back Better allows families to receive advance monthly payments if their income is below $112,500 for a head of household, or $150,000 for a married couple, and families with higher incomes will claim their Child Tax Credit at tax time. The Rescue Plan allowed any family eligible for the Child Tax Credit to receive monthly payments, including those with higher incomes.

[15] Zippel, op. cit.

[16] Among the 1.6 million U.S. children identified in Census Bureau data as American Indian or Alaska Native (AIAN), either alone or in combination with other races and ethnicities, an estimated 1.5 million would benefit from this Child Tax Credit expansion. (If we apply the non-overlapping race-ethnic categories this report uses for other groups, 555,000 children are considered AIAN alone, not Latino; about 524,000 of them would benefit from this expansion.)

CBPP analysis of the U.S. Census Bureau’s March 2019 Current Population Survey (for national total) allocated by race or ethnicity based on CBPP analysis of American Community Survey (ACS) data for 2016-2018, using 2021 tax parameters and incomes adjusted for inflation to 2021 dollars.

[17] The credit would lift above the poverty line an estimated 9.4 percent of Black children, 8.5 percent of Latino children, and 3.3 percent of white children.

[18] For families in Puerto Rico, monthly payments will be available from July to December 2022.

[19] Marr et al., op. cit.

More from the Authors

Areas of Expertise

Recent Work:

Areas of Expertise

Recent Work: