BEYOND THE NUMBERS

Strong Rainy Day Funds Can Help Mitigate Damage From Economic Downturns

Many recent economic signs are encouraging but don’t preclude a possible recession soon, and in the face of this uncertainty states should closely examine the strength of their rainy day funds. More states should join the commendable savings efforts that many states are already engaged in, and all states can explore improving the processes behind building and using their funds. That way states can ensure they’ll have fiscal flexibility to protect families, jobs, and public services from the harms of an economic slowdown, while continuing to make investments that address the current needs of people and communities.

A turbulent past few years for states — the pandemic recession and recovery and uneven economic growth overall in 2022 — has meant that significant needs for current investment remain. That’s especially true for people whom public and private investment have historically excluded, including low-income people and many communities of color. Helping them meet their immediate needs is a high priority, for example by enacting targeted tax credits, boosting support for colleges and K-12 public schools, expanding access to health care and child care, and rejecting misguided tax cuts that sap the revenue such services depend on.

At the same time, a possible economic downturn poses some significant risks that state policymakers should factor into their budget decisions this year. When the economy slows, consumer spending goes down and jobs are lost. That creates more pressure on state unemployment insurance programs and increases demand on many other state services that provide temporary help to workers and families, such as Medicaid, cash assistance to families with low incomes, and behavioral health services. Most state revenues are closely tied to the strength of the economy and typically decline during slowdowns, making it even harder for states to meet rising needs.

That’s among the reasons why states early in 2023 should be prioritizing revenues so that their fiscal houses and economies are well prepared both to meet people’s current needs and to guard against further harm. One way states can do that is to halt — and reverse — the harmful wave of income tax cuts and other reckless tax policies many of them enacted over the past two years, and instead strive to protect revenues and raise new ones to promote shared economic prosperity.

Another way states can ensure they’re well prepared is by ensuring their rainy day funds are sound. These reserve accounts are designed to be built up in good times and drawn from in difficult times, so that states can avoid harmful cuts as they move to keep their budgets balanced, which they must do even amid severe shocks such as a recession or environmental disaster. Robust rainy day funds help states avoid layoffs and cuts, thereby mitigating the inequitable harms that result from recessions. They’re an essential component of strong revenue systems that can endure economic ups and downs and preserve stability, especially during difficult times when they’re needed most.

Cash reserves are no substitute for permanent, meaningful investments that support families and communities and broaden opportunity. But strong rainy day funds buy time to strategically enact polices that limit the harm a downturn can cause for people and help keep the economic engine of the state running by minimizing layoffs and furloughs for teachers, health and child care workers, and other frontline workers.

Fortunately, states in recent years have done a much better job than in the past to buoy these funds. Aided by a stronger-than-expected economic bounce-back from the COVID-19 recession and the large influx of federal relief funds, state cash reserves have grown threefold over the last two years, to $343 billion. That’s nearly one-third of total state general fund expenditures.

Some state policymakers may question the need to have weightier nest eggs over cutting taxes or placing their sole focus on new investments. But according to a recent Moody’s Analytics forecast, only 18 states have enough reserves to adequately respond to a moderate recession without cutting services or raising taxes. That means if a downturn does materialize, communities and families in most states could face layoffs and spending cuts that risk making a recession only deeper and longer.

Tax cuts threaten states’ ability to respond to unforeseen economic turmoil, and the current levels of cash reserves can be misleading. The discrepancy between high overall reserves and states’ preparedness is due to some tricky dynamics of how state reserve funds work. For one, less than half of the total cash reserves, or $135 billion, are explicitly rainy day funds available to empower state policymakers to limit the damage of a recession. Much of the remaining reserves are already earmarked, obligated for specific uses, or — as state aid provided under the American Rescue Plan — are prohibited from being deposited into rainy day funds.

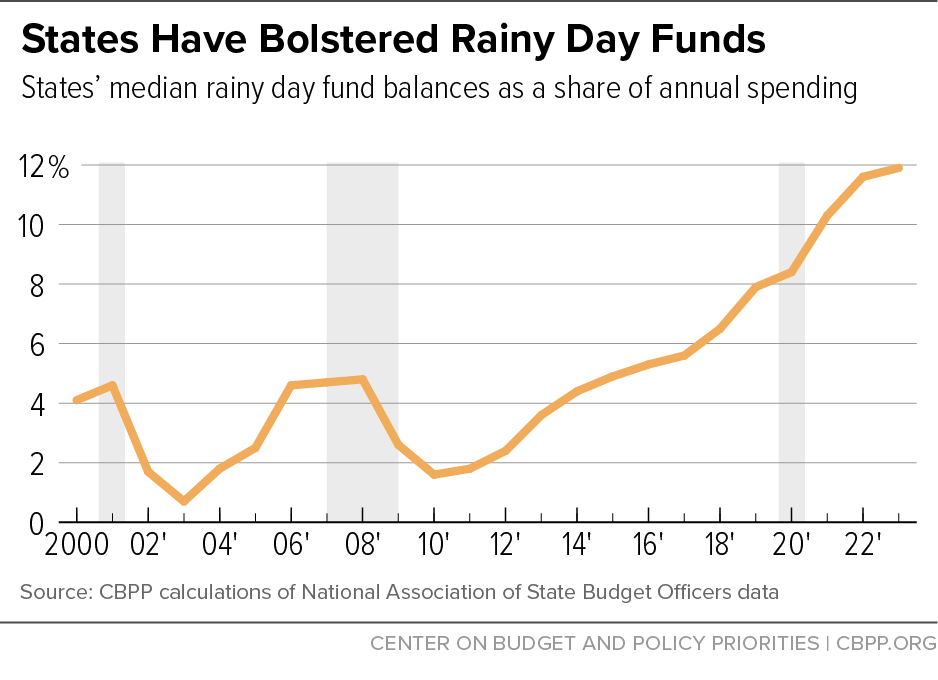

Median state rainy day balances in 2022 are estimated to be about 11.6 percent of total state spending (see first chart), or just about 42 days’ worth of funding for health services, education, emergency response, and transportation infrastructure. While states would benefit from having more, that level is far better than it was before the Great Recession, when inadequate savings weren’t enough to prevent deep and harmful cuts in most states.

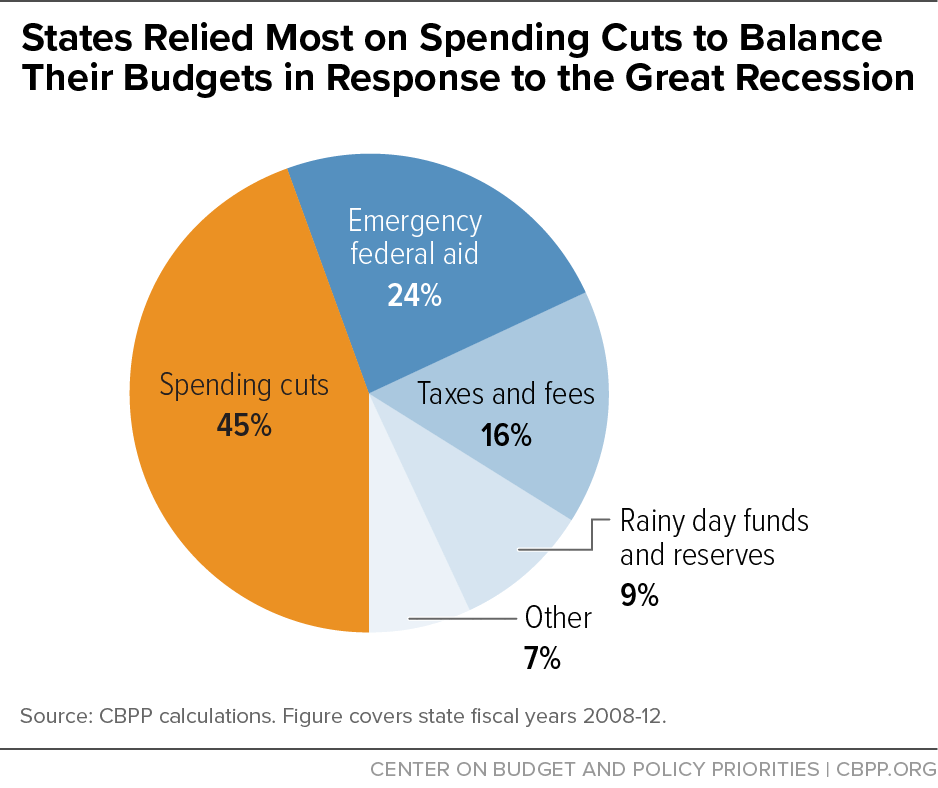

During that period, states were able to mitigate roughly $60 billion in revenue losses by tapping their rainy day funds. States’ primary response to budget shortfalls was to make nearly $300 billion in cuts. Those cuts affected education, health care, public safety, transportation infrastructure, and other state services between 2008 and 2012. We know now that if states had adequately built up their rainy day funds and made them easier to replenish in the good times, and if the federal response to that recession had been more robust, an accelerated recovery would likely have resulted, preventing many people from struggling as they did.

To avoid similar service cuts or tax increases on those who can least afford it, if and when the next downturn hits, states can take some concrete steps on their rainy day funds this legislative session — alongside any of their other efforts to meet their residents’ more immediate needs.

States that didn’t make as much progress saving in recent years should act now to increase their rainy day funds. And all states can consider some sensible reforms to remove restrictions on building up those reserves and to give policymakers broader discretion over how to use the funds in an emergency.

For instance, many states’ rainy day funds have built-in restrictions that make it hard to quickly access them when needed. And some states cap their funds at levels that are less than 10 percent of the budget, while others have spending limits and supermajority requirements that create needless roadblocks to using the funds when they’re needed most. States should roll back these arbitrary restrictions, increase the target size of their funds, and perform stress tests to determine their adequacy. States with rigid, out-of-date rules should improve the design of their rainy day funds by instituting new guidelines to strategically build up their rainy day funds once core state budget needs are satisfied.

Whether or not the direst economic forecasts materialize, states would be better safe than sorry when it comes to their rainy day funds. Revenues are already beginning to slow. And a banner year for harmful, revenue-losing state tax cuts in 2022, with the bulk of them flowing to wealthier households and business, only adds urgency to states getting their fiscal houses in order and reinforcing their toolbox for helping people and communities thrive, both now and down the road.