BEYOND THE NUMBERS

With the Bureau of Labor Statistics reporting that overall consumer prices rose 0.6 percent in January, policymakers should pay particular attention to even larger price increases in two key areas: food and electricity prices rose 1.0 and 4.2 percent, respectively. While affluent people can largely absorb such rising costs of basic needs, higher food and utility bills put tremendous pressure on people with low incomes and limited budgets. Families with lower incomes spend a much higher share of their incomes on groceries and electricity than families with higher incomes, and they have much smaller financial cushions when such costs rise.

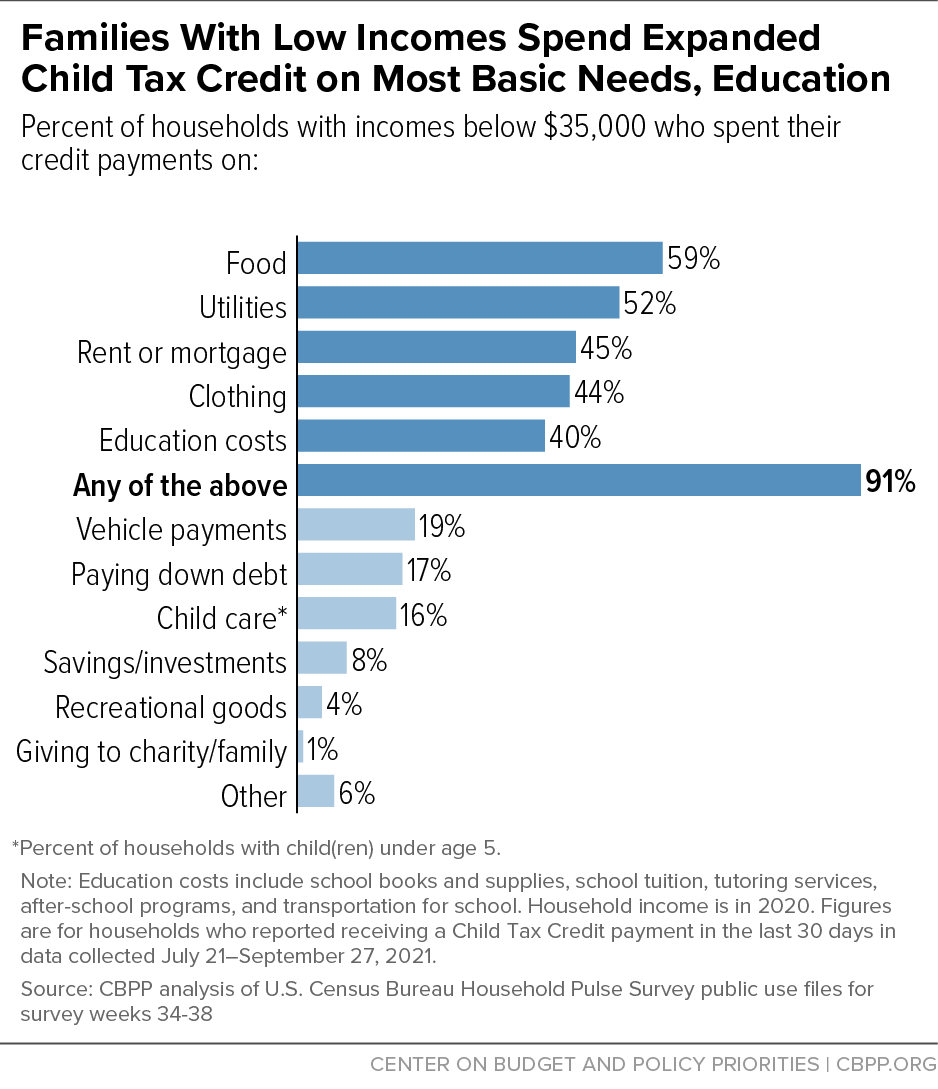

As the chart below shows, these are precisely the expenses that, in the latter half of 2021, families with low incomes were using their monthly Child Tax Credit deposits to help meet. Food costs and utility bills were the two top uses of the monthly Child Tax Credit for people with incomes below $35,000, according to Census data. At the very moment that these costs are spiking, however, policymakers let the monthly expanded Child Tax Credit — enacted as part of the 2021 American Rescue Plan — expire at year-end. January’s inflation report underscores the urgency for lawmakers to extend the Child Tax Credit’s successful expansion.

Moreover, policymakers should not take comfort that rental prices rose 0.5 percent, a bit lower than overall prices. For technical reasons, rental price changes tend to appear in monthly inflation reports on a lagged basis. In fact, we know that rents are rising fast from headlines such as this recent one from the Washington Post: “Rents are up more than 30 percent in some cities, forcing millions to find another place to live.” Per the chart, housing costs were the third most common use of monthly Child Tax Credit deposits for low-income families.

Rising prices are no reason for policymakers to delay or avoid taking action on critical policies such as extending the Child Tax Credit expansion. For struggling families, in fact, they make the task more urgent. The Rescue Act’s expansion of the Child Tax Credit would amount to roughly 0.5 percent of gross domestic product. It would provide extremely meaningful income support for millions of low-income families, but it would generate little or no inflationary pressure at a time when much larger fiscal stimulus is ending as the Rescue Plan, CARES Act, and other COVID-19 relief spending and tax cuts expire. As Federal Reserve Board Chairman Jerome Powell said recently, “fiscal policy is going to be less supportive of … growth this year.”

Renewing the successful Child Tax Credit monthly payments — financed through higher taxes on upper-income people and corporations — is what families with low incomes need to help them meet the rising costs of basic necessities. Policymakers need to act.