The American Rescue Plan, enacted in March 2021, increased the Child Tax Credit for more than 65 million U.S. children — roughly 90 percent of children — and established advance monthly payments. The enhanced tax credit has enabled parents across the country to pay for food, clothing, housing, and other basic necessities and is expected to lower the number of children experiencing poverty by more than 40 percent as compared to child poverty levels in the absence of the expansion. But Congress must pass the Build Back Better bill to maintain this progress. If Congress fails to act, monthly Child Tax Credit payments will not be made on January 15, and many families will struggle to make ends meet. Moreover, failing to pass Build Back Better would take away the entire credit from many children who would no longer qualify at all and would cut the amount of the credit for millions more. (See Appendix Table 1 for state-specific estimates of the number of children benefiting from the expansion.)

The Build Back Better legislation would extend the Rescue Plan’s temporary expansions of the Child Tax Credit, which changed the credit parameters in three main ways for 2021. First, it made the full credit available to families with low or no earnings in a given year, often called making the credit “fully refundable.” Previously, 27 million children — including roughly half of Black and Latino children and half of children in rural communities — received less than the full credit amount, which higher-income children received, because their parents’ income were too low. This change drives most of the significant reduction in child poverty expected from the enhanced Child Tax Credit. Build Back Better would permanently make the credit fully available to children in families with low incomes.

Second, the Rescue Plan increased the maximum credit amount from $2,000 per child to $3,600 for a child under age 6 ($3,000 for a child aged 6-17) for head of household tax filers making less than $112,500 and married tax filers making less than $150,000. Third, it allowed families to claim their 17-year-old children for the credit for the first time. Build Back Better would extend these improvements for one year.

The Rescue Plan also authorized the Treasury Department to issue advance payments of one-half of the credit to families on a monthly basis from July to December of this year, rather than solely as a lump sum next year at tax time. (Families can claim the remaining credit amount when they file their 2021 taxes.) In November, Treasury sent a monthly payment to the families of roughly 61 million children; under Build Back Better, monthly payments would continue for most of these families in 2022, and would be provided monthly for the full year (rather than during only half the year under the Rescue Plan).[1]

If the enhanced credit is allowed to expire, Treasury would stop delivering the credit on a monthly basis, which boosts families’ incomes throughout the year. Families need to pay the rent each month, and they also need to pay for electricity, food, child care, and transportation throughout the year. When families struggle to keep up with monthly expenses, they often have to take on debt to make ends meet; a monthly benefit eases that strain.

If Build Back Better isn’t enacted, the maximum credit per child would fall by $1,000 for school-age children and $1,600 for young children. All families now getting the expanded Child Tax Credit would lose out, but the cut would be largest for low-income children.

- A mother with two children, one a toddler and one in elementary school, who works full-time at the federal minimum wage is currently receiving $6,600 in the Child Tax Credit. Without enactment of Build Back Better, that credit amount would fall by $4,800, to just $1,800.

- A middle-income family with two children, one younger and one older, would see their credit cut by $2,600 — a significant loss but less than the loss to the low-income family.

In short, if Build Back Better isn’t enacted, the Child Tax Credit would revert to providing the least help to the children who need it most — and some 27 million children would once again get a partial credit or none at all because their families’ incomes are too low. (See Appendix Table 2 for state-specific estimates of payments sent in October, the most recent state data available.)

Policymakers should enact Build Back Better legislation expeditiously to extend the Rescue Plan’s increase in the credit amount for children through age 17, to continue monthly payments to families in 2022, and to make the full credit permanently available to families with low or no incomes, protecting the most vulnerable children from the higher poverty that would result if the expanded credit is taken away or substantially reduced.

The vast majority of families with incomes under $35,000 spent some or all of their new monthly payments on basic necessities — housing, food, clothing, and utilities — and education, recent data show.[2] (See Figure 1 and Appendix Table 3, which includes state-specific estimates.) A sizeable share of U.S. households with incomes above $35,000 also spent the credit on necessities, but a smaller share did so than lower-income families, who face more difficulties affording the basics.

Data on how families are spending their Child Tax Credit are consistent with evidence from Canada, where parents — particularly those with low incomes — spend their child allowances on essentials and education expenses. If monthly payments are taken away from U.S. families beginning in January, the families of tens of millions of children may struggle to make ends meet and food and housing hardship may rise.

To see what taking away the Child Tax Credit expansion could mean to individual families, consider these examples:

- A single mother with a toddler and a daughter in second grade, who works as a home health aide helping an elderly person meet their basic needs, earns $12,500 working part-time around her kids’ schedule. Prior to the Rescue Plan, this family received a Child Tax Credit of $750 per child per year, but now they get $550 per month — a total $3,600 for the toddler and $3,000 for the second grader in 2021. If Congress fails to act, this family will not receive its expected $550 payment in January and their income would take a significant hit when the Rescue Plan expansions expire — a loss of $5,100 per year.

- One spouse in a married couple earns $20,000 as a short-order cook and the other cares for their 3-year-old son and 7-year-old daughter. With the credit expansion they received the full Child Tax Credit of $3,600 for their son and $3,000 for their daughter in 2021, or $550 per month. If the current credit expansions expire, this family would receive a total credit of $2,625 — a loss of roughly $3,975 per year.

- A single mother with a 4-year-old daughter and 8-year-old son, and who is out of work due to a health condition, will receive the full Child Tax Credit of $3,600 for her daughter and $3,000 for her son to help with the children’s expenses in 2021. If the current provision making the credit fully available in 2021 expires, this family would receive no Child Tax Credit at all in 2022 — losing their monthly payment of $550 and adding to their financial insecurity. The Build Back Better legislation proposes that this family be permanently eligible for the maximum credit amount — the same amount that families with higher incomes receive — even if that maximum credit amount drops back to $2,000 per child after 2022.

Middle-income families would also see a large cut in their Child Tax Credit if the Rescue Plan expansion expires, though they would lose less than many low-income families. For instance, a married couple with 8-year-old twin daughters and a combined income of $125,000, where one spouse makes $75,000 as a dental hygienist and the other makes $50,000 as a property manager, will receive an expanded Child Tax Credit of $6,000 in 2021, or $500 per month. If the current credit expansions expire, this family would receive a total credit of $4,000 — a loss of $2,000 per year.

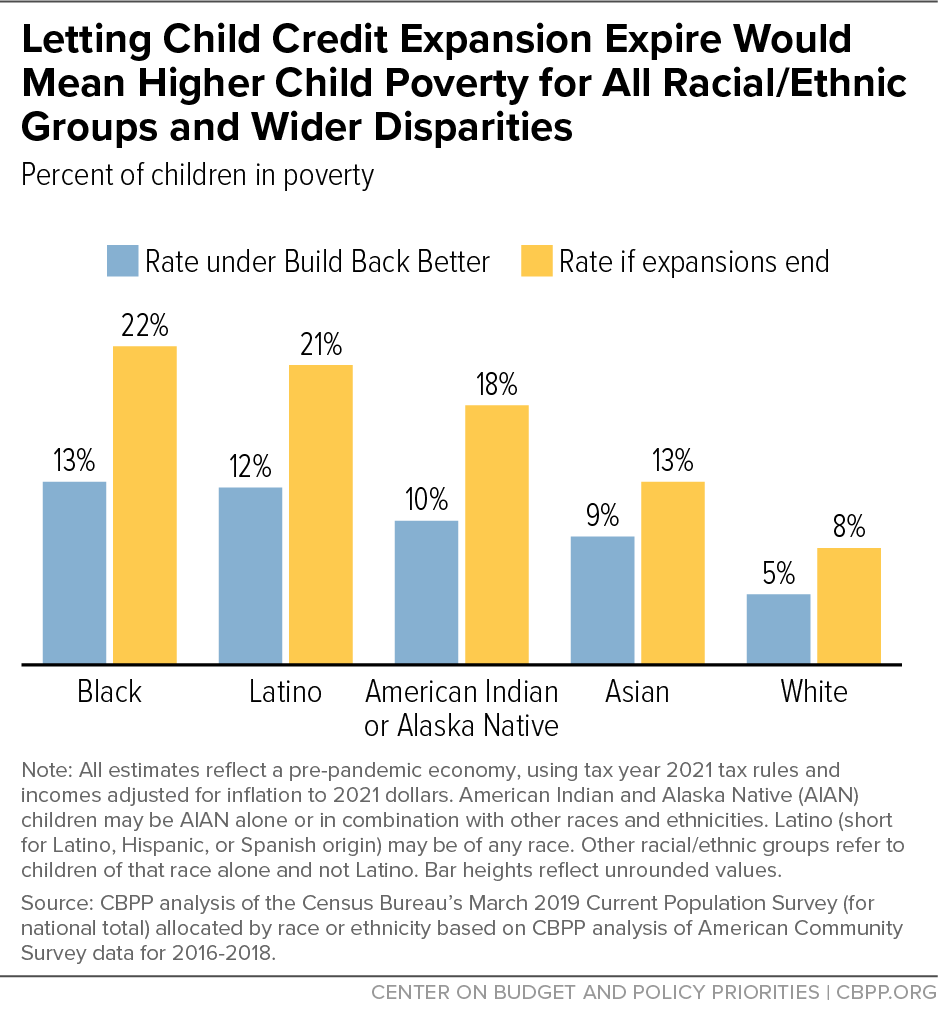

The Child Tax Credit expansions have been projected to reduce annual child poverty by more than 40 percent as compared to child poverty in the absence of the expansions. This historic reduction is driven by the provision making the credit fully refundable.[3] If the expansions end in 2021, this historic progress would be reversed, driving child poverty up substantially.[4] An estimated 9.9 million children are at risk of slipping back below the poverty line or deeper into poverty if the expansion is not extended. (See Appendix Table 1 for state-specific estimates of the number of children benefiting from the expansion.) These include 3.8 million Latino, 2.9 million white, 2.1 million Black, 426,000 Asian, and 280,000 American Indian or Alaska Native (AIAN) children.[5]

This year’s credit expansions are taking important steps to reduce racial disparities in income rooted in this nation’s long history of racism and discrimination, which has created large gaps in both opportunities and outcomes in education, employment, health, and housing.[6]

If the credit’s expansions are taken away, poverty rates among Black, Latino, and AIAN children would be an estimated 8 to 9 percentage points higher than what they would have been with the expansions still in place — 22 percent rather than 13 percent for Black children, 21 percent rather than 12 percent for Latino children, and 18 percent rather than 10 percent for AIAN children.[7] Poverty among white and Asian children would also rise, but by less. (See Figure 2.)

Progress in narrowing differences in child poverty rates by race and ethnicity would also be reversed. Without the expansion, the differences in child poverty rates between Latino and white children would grow by 70 percent, between Black and white children by 78 percent, and between AIAN and white children by 86 percent, we estimate.

Children in Puerto Rico and other U.S. Territories — Guam, the Virgin Islands, American Samoa, and the Northern Mariana Islands — would also suffer if the credit expansions are taken away. Child poverty is much higher in the territories, making the credit expansions sorely needed.[8]

Poverty and the hardships that come with it — unstable housing, frequent moves, inadequate nutrition, and high levels of family stress — can take a heavy toll on children and are associated with lower levels of educational attainment, poorer health in adulthood, lower earnings, and higher likelihood of being arrested, a 2019 National Academies of Sciences, Engineering, and Medicine report on reducing child poverty found. “[T]he weight of the causal evidence indicates that income poverty itself causes negative child outcomes, especially when it begins in early childhood and/or persists throughout a large share of a child’s life,” the report concluded.[9]

Extending the expanded credit and making the Child Tax Credit fully available on a permanent basis to families with low incomes would improve children’s lives in the near and long term and benefit society overall in important ways. Additional income is linked to better outcomes for children in families with low income, including better educational performance and attainment, higher earnings in adulthood, and better health, which can yield benefits for children and their communities over the course of their lives, studies show.[10] Additional income provides greater stability for families, with a corresponding reduction in stress for parents and children.

| APPENDIX TABLE 1 |

| State |

Children under 18 who would lose out if expansion not extended |

Share of children under 18 who would lose out if expansion not extended |

Children under 18 at risk of slipping back below the poverty line or deeper into poverty if expansion not extended |

| Total U.S. |

65,560,000 |

89% |

9,894,000 |

| Alabama |

1,020,000 |

93% |

162,000 |

| Alaska |

166,000 |

89% |

21,000 |

| Arizona |

1,507,000 |

92% |

238,000 |

| Arkansas |

661,000 |

93% |

94,000 |

| California |

7,844,000 |

86% |

1,690,000 |

| Colorado |

1,106,000 |

87% |

132,000 |

| Connecticut |

604,000 |

81% |

80,000 |

| Delaware |

181,000 |

89% |

24,000 |

| District of Columbia |

93,000 |

75% |

25,000 |

| Florida |

3,833,000 |

91% |

700,000 |

| Georgia |

2,269,000 |

90% |

353,000 |

| Hawai’i |

277,000 |

91% |

44,000 |

| Idaho |

410,000 |

93% |

37,000 |

| Illinois |

2,536,000 |

87% |

338,000 |

| Indiana |

1,452,000 |

92% |

175,000 |

| Iowa |

668,000 |

91% |

49,000 |

| Kansas |

651,000 |

92% |

58,000 |

| Kentucky |

929,000 |

92% |

143,000 |

| Louisiana |

1,027,000 |

92% |

187,000 |

| Maine |

229,000 |

90% |

21,000 |

| Maryland |

1,120,000 |

83% |

159,000 |

| Massachusetts |

1,099,000 |

80% |

161,000 |

| Michigan |

1,968,000 |

90% |

249,000 |

| Minnesota |

1,122,000 |

87% |

85,000 |

| Mississippi |

677,000 |

94% |

115,000 |

| Missouri |

1,260,000 |

91% |

153,000 |

| Montana |

209,000 |

91% |

21,000 |

| Nebraska |

434,000 |

91% |

36,000 |

| Nevada |

634,000 |

92% |

86,000 |

| New Hampshire |

221,000 |

85% |

20,000 |

| New Jersey |

1,599,000 |

81% |

257,000 |

| New Mexico |

454,000 |

93% |

71,000 |

| New York |

3,554,000 |

86% |

681,000 |

| North Carolina |

2,085,000 |

90% |

306,000 |

| North Dakota |

157,000 |

91% |

10,000 |

| Ohio |

2,367,000 |

91% |

277,000 |

| Oklahoma |

894,000 |

93% |

114,000 |

| Oregon |

778,000 |

89% |

92,000 |

| Pennsylvania |

2,363,000 |

89% |

310,000 |

| Rhode Island |

185,000 |

89% |

23,000 |

| South Carolina |

1,025,000 |

93% |

151,000 |

| South Dakota |

196,000 |

91% |

19,000 |

| Tennessee |

1,393,000 |

92% |

211,000 |

| Texas |

6,686,000 |

91% |

1,078,000 |

| Utah |

859,000 |

92% |

69,000 |

| Vermont |

104,000 |

89% |

8,000 |

| Virginia |

1,586,000 |

85% |

249,000 |

| Washington |

1,433,000 |

87% |

159,000 |

| West Virginia |

346,000 |

93% |

50,000 |

| Wisconsin |

1,158,000 |

90% |

93,000 |

| Wyoming |

128,000 |

93% |

11,000 |

| APPENDIX TABLE 2 |

| State |

Number of Children |

Number of Payments to Families |

| Total |

61,117,000 |

36,001,000 |

| Alabama |

930,000 |

560,000 |

| Alaska |

155,000 |

83,000 |

| Arizona |

1,388,000 |

794,000 |

| Arkansas |

599,000 |

348,000 |

| California |

7,090,000 |

4,271,000 |

| Colorado |

1,028,000 |

600,000 |

| Connecticut |

581,000 |

360,000 |

| Delaware |

176,000 |

106,000 |

| District of Columbia |

93,000 |

60,000 |

| Florida |

3,647,000 |

2,283,000 |

| Georgia |

2,108,000 |

1,265,000 |

| Hawai’i |

256,000 |

150,000 |

| Idaho |

402,000 |

208,000 |

| Illinois |

2,303,000 |

1,360,000 |

| Indiana |

1,329,000 |

757,000 |

| Iowa |

621,000 |

343,000 |

| Kansas |

584,000 |

321,000 |

| Kentucky |

858,000 |

503,000 |

| Louisiana |

887,000 |

541,000 |

| Maine |

214,000 |

130,000 |

| Maryland |

1,123,000 |

683,000 |

| Massachusetts |

1,071,000 |

665,000 |

| Michigan |

1,775,000 |

1,021,000 |

| Minnesota |

1,096,000 |

602,000 |

| Mississippi |

594,000 |

365,000 |

| Missouri |

1,157,000 |

660,000 |

| Montana |

199,000 |

110,000 |

| Nebraska |

411,000 |

223,000 |

| Nevada |

594,000 |

352,000 |

| New Hampshire |

216,000 |

132,000 |

| New Jersey |

1,617,000 |

984,000 |

| New Mexico |

395,000 |

232,000 |

| New York |

3,309,000 |

2,011,000 |

| North Carolina |

1,960,000 |

1,183,000 |

| North Dakota |

153,000 |

83,000 |

| Ohio |

2,159,000 |

1,251,000 |

| Oklahoma |

812,000 |

457,000 |

| Oregon |

719,000 |

419,000 |

| Pennsylvania |

2,211,000 |

1,304,000 |

| Rhode Island |

173,000 |

109,000 |

| South Carolina |

963,000 |

577,000 |

| South Dakota |

183,000 |

97,000 |

| Tennessee |

1,291,000 |

762,000 |

| Texas |

6,258,000 |

3,598,000 |

| Utah |

804,000 |

392,000 |

| Vermont |

98,000 |

60,000 |

| Virginia |

1,575,000 |

937,000 |

| Washington |

1,381,000 |

797,000 |

| West Virginia |

304,000 |

180,000 |

| Wisconsin |

1,060,000 |

601,000 |

| Wyoming |

115,000 |

63,000 |

| Other Areas |

90,000 |

48,000 |

| APPENDIX TABLE 3 |

| State |

Basic Needs (Food, Clothing, Rent, Mortgage, Utilities) |

Basic Needs and/or Education Costs |

| Total U.S. |

88% |

91% |

| Alabama |

91% |

95% |

| Alaska |

91% |

93% |

| Arizona |

90% |

92% |

| Arkansas |

95% |

96% |

| California |

87% |

89% |

| Colorado |

84% |

86% |

| Connecticut |

93% |

93% |

| Delaware |

96% |

96% |

| District of Columbia |

96% |

97% |

| Florida |

88% |

90% |

| Georgia |

96% |

96% |

| Hawai'i |

83% |

84% |

| Idaho |

85% |

88% |

| Illinois |

83% |

86% |

| Indiana |

79% |

81% |

| Iowa |

88% |

90% |

| Kansas |

90% |

91% |

| Kentucky |

91% |

91% |

| Louisiana |

91% |

93% |

| Maine |

86% |

88% |

| Maryland |

90% |

93% |

| Massachusetts |

93% |

94% |

| Michigan |

91% |

94% |

| Minnesota |

85% |

86% |

| Mississippi |

90% |

94% |

| Missouri |

90% |

90% |

| Montana |

82% |

86% |

| Nebraska |

84% |

87% |

| Nevada |

87% |

90% |

| New Hampshire |

75% |

75% |

| New Jersey |

87% |

89% |

| New Mexico |

89% |

92% |

| New York |

86% |

86% |

| North Carolina |

87% |

93% |

| North Dakota |

91% |

93% |

| Ohio |

87% |

90% |

| Oklahoma |

91% |

92% |

| Oregon |

87% |

89% |

| Pennsylvania |

89% |

93% |

| Rhode Island |

87% |

89% |

| South Carolina |

91% |

93% |

| South Dakota |

89% |

89% |

| Tennessee |

89% |

91% |

| Texas |

87% |

93% |

| Utah |

82% |

85% |

| Vermont |

81% |

83% |

| Virginia |

86% |

88% |

| Washington |

87% |

89% |

| West Virginia |

90% |

91% |

| Wisconsin |

91% |

92% |

| Wyoming |

92% |

94% |