BEYOND THE NUMBERS

Unless the President and Congress act to replenish the Social Security Disability Insurance (DI) trust fund, beneficiaries face a 20 percent benefit cut next year. As we’ve explained, DI is a critical part of Social Security that serves as a lifeline for workers who can no longer support themselves because of a life-changing illness or injury. But there’s lots of confusion about this vital program. To clear things up, we’ve written a fact sheet and a series of blogs, summed up here:

-

The need to replenish DI was long anticipated and has a simple solution: reallocating payroll tax revenues between Social Security’s two trust funds.

-

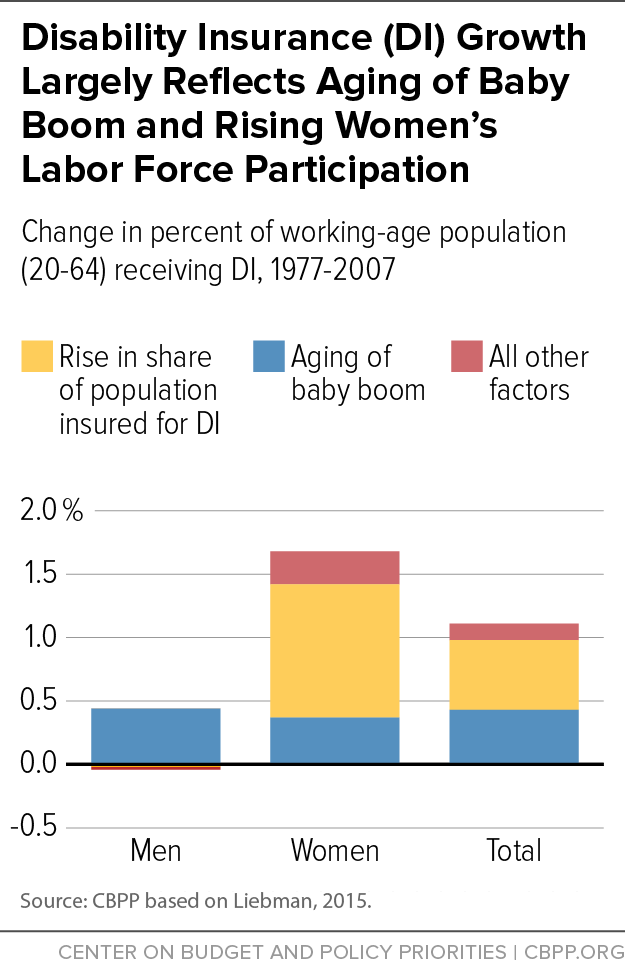

Demographics explain the bulk of DI’s growth. DI has grown over the past few decades, largely reflecting population growth, the aging of Baby Boomers, and women’s rising labor force participation (see chart).

-

It’s hard to qualify for DI. Criteria are strict: applicants need a solid work history, severe impairment, and inability to do substantial work to qualify. Even in recessions, DI is hard to get. Economic downturns can spur more applications for DI benefits, but have a much smaller effect on awards, due to strict qualification criteria.

-

Most people on DI can’t work, statistics and studies show. DI permits and encourages beneficiaries to work, but most DI recipients can’t make enough to sustain themselves.

-

Most DI beneficiaries are older, and many are eligible for retirement. The risk of disability rises with age, and most DI beneficiaries are older. In fact, most DI recipients are close to or past 62, the age at which Social Security beneficiaries can receive early retirement benefits.

-

DI provides critical help for the few young workers who can qualify. For young workers, DI standards are especially strict and average DI benefits are much smaller.

-

DI allowance rates are falling as Social Security strengthens oversight. The rate at which Social Security administrative law judges approve claims for disability benefits dropped for the fifth straight year in 2014.

-

Social Security works hard to fight the rare cases of disability fraud. DI has many safeguards against fraud and abuse. Policymakers should fund further steps to preserve DI’s integrity.

-

DI benefits are modest. An average disabled worker receives $1,165 each month, less than the average Social Security retired worker or aged survivor. Annually, that’s only a little over the poverty line. U.S. disability costs are also modest by international standards. The United States already spends far less on disability benefits than comparable nations do.

-

The recession hurt DI mostly by reducing revenues, not increasing benefits. The Great Recession, and the slow and painful recovery, affected DI’s financing — but not mainly by swelling benefit payments. Instead, the main damage was on the income side, in the form of lower tax revenues and less interest income.