How Does Household Food Assistance in Puerto Rico Compare to the Rest of the United States?

End Notes

[1] Elizabeth Wolkomir wrote an earlier version of this paper, published November 27, 2017.

[2] Guam and the Virgin Islands participate in SNAP. American Samoa and the Commonwealth of the Northern Mariana Islands also receive nutrition assistance block grants in lieu of SNAP.

[3] This paper largely describes NAP and SNAP prior to the COVID-19 pandemic. The far-reaching impacts of the public health and economic crises may affect the programs in various ways, including increasing need, changing procedures at least temporarily to comply with social distancing requirements, and temporary federal funding increases provided in response.

[4] General Accounting Office (GAO), “Nutrition Conditions and Program Alternatives in Puerto Rico,” July 1992, http://www.gao.gov/assets/160/151923.pdf.

[5] For example, President Reagan’s fiscal year 1982 budget proposed other deep cuts to the Food Stamp Program, along with cuts to Medicaid, child nutrition programs, and income assistance programs such as the Aid for Families to Dependent Children. The budget originally proposed replacing all food assistance programs in Puerto Rico including child nutrition programs with a block grant. See Congressional Budget Office, “An Analysis of President Reagan's Budget Revisions for Fiscal Year 1982,” March 1981, https://www.cbo.gov/sites/default/files/97th-congress-1981-1982/reports/81doc11b.pdf. The 1981 Omnibus Reconciliation Package included many proposed cuts.

[6] “Evaluation of the Nutrition Assistance Program in Puerto Rico, Volume I: Environment, participation, administrative costs, and program integrity,” Mathematica Policy Research, 1985a, https://www.mathematica.org/our-publications-and-findings/publications/evaluation-of-the-nutrition-assistance-program-in-puerto-rico-volume-i-environment-participation-administrative-cost-and-program-integrity-formerly-referred-to-as-the-puerto-rico-nutrition-evaluation-i

[7] Ibid.

[8] “Evaluation of the Nutrition Assistance Program in Puerto Rico, Volume II: Effects on food expenditures and diet quality,” Mathematica Policy Research, 1985b, https://www.mathematica.org/our-publications-and-findings/publications/evaluation-of-the-nutrition-assistance-program-in-puerto-rico-volume-ii-effects-on-food-expenditures-and-diet-quality.

[9] These are poverty rates measured in the American Community Survey and the Puerto Rico Community Survey, the equivalent survey conducted in Puerto Rico by the U.S. Census Bureau. These differ in some respects from official poverty rates collected as part of the Current Population Survey Annual Social and Economic Supplement. Brian Glassman, “A Third of Movers From Puerto Rico to the Mainland United States Relocated to Florida in 2018,” U.S. Census Bureau, September 26, 2019, https://census.gov/library/stories/2019/09/puerto-rico-outmigration-increases-poverty-declines.html?utm_campaign=20190926msacos3ccstors&utm_medium=email&utm_source=govdelivery. For more on the differences between the methodologies used in the surveys to estimate poverty, see “Fact Sheet: Differences Between the American Community Survey (ACS) and the Annual Social and Economic Supplement to the Current Population Survey (CPS ASEC),” U.S. Census Bureau, https://www.census.gov/topics/income-poverty/poverty/guidance/data-sources/acs-vs-cps.html. For more on the differences between the American Community Survey and the Puerto Rico Community Survey, see “A Comparison of the American Community Survey and the Puerto Rico Community Survey,” U.S. Census Bureau, https://www.census.gov/content/dam/Census/programs-surveys/acs/Library/OutreachMaterials/ACSFlyers/A%20Comparison%20of%20the%20ACS%20and%20the%20PRCS.pdf.

[10] Myribel Santiago Torres et al., “Seguridad Alimentaria en Puerto Rico,” Instituto de Estadísticas de Puerto Rico, June 2019, https://estadisticas.pr/files/Publicaciones/Seguridad%20Alimentaria%20en%20Puerto%20Rico%20-%20Final%20%28300519%29.pdf.

[11] Every year USDA estimates household-level food insecurity prevalence rates based on a survey conducted by the U.S. Census Bureau as a supplement to the Current Population Survey (CPS). (See Alisha Coleman-Jensen et al., “Household Food Security in the United States in 2017,” U.S. Department of Agriculture Economic Research Service, September 2018, https://www.ers.usda.gov/webdocs/publications/90023/err-256.pdf?v=0.) While the survey used in the Puerto Rico analysis used some of the same survey questions, there were several methodological differences, as explained in Santiago Torres et al. For example, the Puerto Rico food security study used individual adults as its unit of analysis, used a modified survey as compared to that used in the CPS supplement, and was administered using different methods. Santiago Torres et al. estimated using the CPS data that while not directly comparable, the 2015 individual rate of food insecurity among adults in the U.S. was 12.4 percent, compared to 33.2 percent in Puerto Rico.

[12] Santiago Torres et al.

[13] Javier Balmaceda, “Long in Recession, Puerto Rico Needs More Than Just COVID-19 Relief to Overcome Its Crises,” CBPP, May 7, 2020, https://www.cbpp.org/research/economy/long-in-recession-puerto-rico-needs-more-than-just-covid-19-relief-to-overcome-its.

[14] Judith Solomon, “Puerto Rico’s Medicaid Program Needs an Ongoing Commitment of Federal Funds,” CBPP, April 22, 2019, https://www.cbpp.org/research/health/puerto-ricos-medicaid-program-needs-an-ongoing-commitment-of-federal-funds.

[15] The Medicare Savings Program, which assists low-income seniors with their Medicare premiums and cost sharing, does not operate in Puerto Rico, and many seniors pay their own Part B premiums. There is also no Low-Income Subsidy program to help with the cost of prescription drugs, although Puerto Rico gets a separate allotment of funds to provide assistance with prescription drugs for some seniors. For more, see Annie Mach, “Puerto Rico and Health Care Finance: Frequently Asked Questions,” Congressional Research Service, June 27, 2016, https://fas.org/sgp/crs/row/R44275.pdf.

[16] U.S. Government Accountability Office, “Information on How Statehood Would Potentially Affect Selected Federal Programs and Revenue Sources,” March 2014, https://www.gao.gov/assets/670/661334.pdf, and Congressional Research Service, “Cash Assistance for the Aged, Blind, and Disabled in Puerto Rico,” October 26, 2016, https://fas.org/sgp/crs/row/cash-aged-pr.pdf.

[17] GAO, 2014.

[18] CBPP calculation using data from the Office of Family Assistance of the Department of Health and Human Services for TANF participants (Total Families, TANF and SSP-MOE Combined, 2017, https://www.acf.hhs.gov/ofa/resource/tanf-caseload-data-2017), and total families in poverty from the U.S. Census Bureau Puerto Rico Community Survey, Table C17010, “Poverty Status in the Past 12 Months of Families by Family Type by Presence of Related Children Under 18 Years,” 2016 and 2017 American Community Survey 1-Year Estimates. To see estimates that measure the reach of TANF in the states, see Ife Floyd, Ashley Burnside, and Liz Schott, “TANF Reaching Few Poor Families,” Center on Budget and Policy Priorities, updated November 28, 2018, https://www.cbpp.org/research/food-assistance/how-is-food-assistance-different-in-puerto-rico-than-in-the-rest-of-the.

[19] Javier Balmaceda, “Puerto Rico on Verge of Implementing an EITC,” CBPP, December 10, 2018, https://www.cbpp.org/blog/puerto-rico-on-verge-of-implementing-an-eitc.

[20] Anne Peterson et al., “Implementing Supplemental Nutrition Assistance Program in Puerto Rico: A Feasibility Study,” June 2010, https://www.fns.usda.gov/snap/implementing-supplemental-nutrition-assistance-program-puerto-rico-feasibility-study. The share of the population and share of people in poverty receiving NAP have expanded since 2009, the year of the USDA analysis, due to factors including declining population in Puerto Rico and a recent expansion of eligibility criteria. As a result, the costs of implementing SNAP in Puerto Rico currently may differ compared to this original estimate.

[21] Some functions that are performed by the federal government in SNAP are performed by Puerto Rico in NAP, and therefore funding comes from NAP administrative expenses split with the federal government, rather than being fully funded at the federal level. For example, USDA investigates retailers and monitors them for compliance, a function that Puerto Rico performs and is included in administrative costs.

[22] GAO, op. cit.

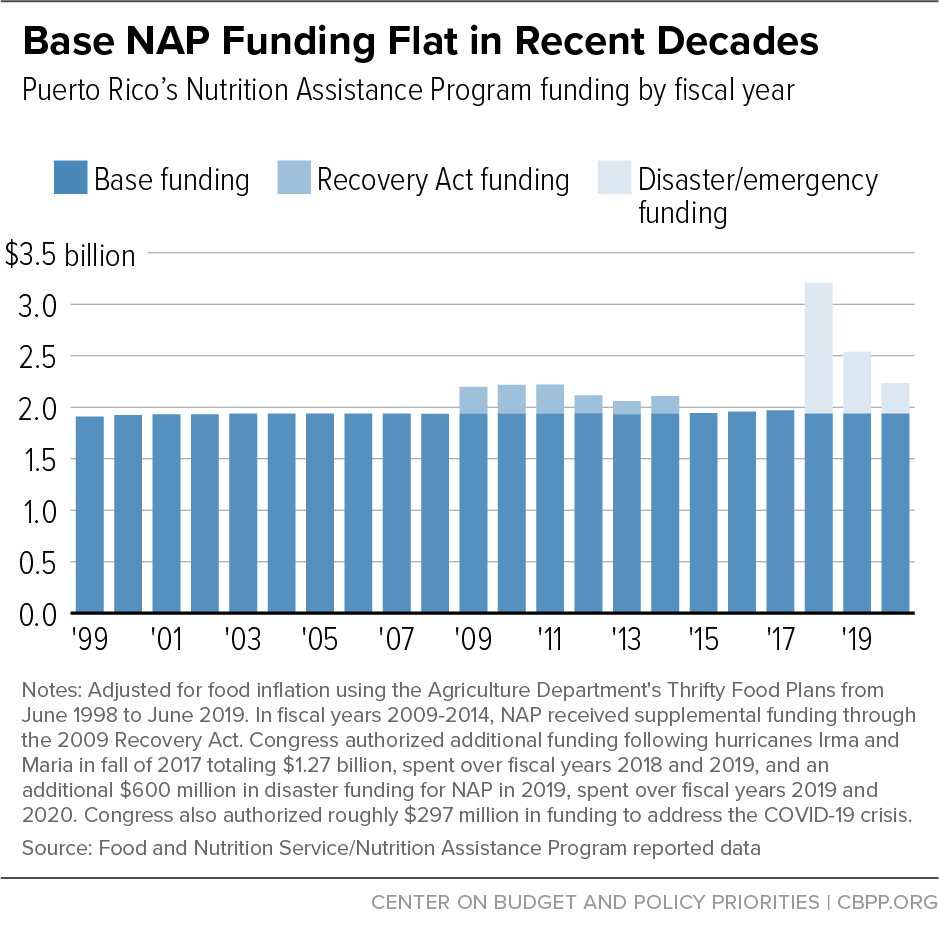

[23] As SNAP benefits are, the block grant is adjusted annually by the percentage change of the USDA’s Thrifty Food Plan from the preceding June.

[24] As described in the box, “Disaster Funding After Hurricanes Irma and Maria and Emergency COVID-19 Funding,” Congress has passed two temporary NAP funding increases since Hurricanes Irma and Maria, one of $1.27 billion that funded increased benefits from March 2018 through February 2019, and the second, for $600 million, that the Commonwealth is spending to boost benefits again for approximately one year that began in August 2019.

[25] USDA Office of Inspector General, “Review of FNS’ Nutrition Assistance Program Disaster Funding to Puerto Rico as a Result of Hurricanes Irma and Maria,” Audit Report 27702-0001-22, October 2019, https://www.usda.gov/oig/webdocs/27702-0001-22.pdf.

[26] Households with an elderly or disabled member need not meet this limit.

[27] States have flexibility to lift the income limits and lift or eliminate the asset test for households that are categorically eligible for SNAP. For more information, see Dottie Rosenbaum, “SNAP’s ‘Broad-Based Categorical Eligibility’ Supports Working Families and Those Saving for the Future,” CBPP, updated July 30, 2019, https://www.cbpp.org/research/food-assistance/snaps-broad-based-categorical-eligibility-supports-working-families-and.

[28] While both programs use “net income” to determine eligibility, there are several key differences. Each program defines household composition differently. SNAP considers earned income from wages, salaries, tips, commissions, self-employment, and independent contracting, as well as unearned income. NAP considers similar categories of income but applies more exemptions and exclusions to some income categories. For example, NAP rules only count a portion of the Social Security income for some units, such as those consisting solely of elderly members or those with disabilities, which can substantially lower their net income, allowing them to qualify for higher benefits. Both programs have deductions to reflect disposable income, but those deductions differ. For example, SNAP allows participants to deduct excess housing costs, which NAP does not, but NAP has specific deductions for groups such as some farmers and producers of specific agricultural products, the elderly, people with disabilities, and the terminally ill. See Peterson et al.

[29] For example, a 2013 report on the 2007 Puerto Rico Survey of Consumer Finances found that only about one-third of families in the bottom quintile of income had financial assets such as bank accounts, and of those who did, the average value was about $500. See Harold J. Toro-Tulla, “Puerto Rico Survey of Consumer Finances: Top-line Report,” Center for a New Economy, November 2013, https://grupocne.org/wp-content/uploads/2013/11/TopLine-Report-FINAL.for_.web_.pdf.

[30] In SNAP, students ages 18 through 49 enrolled in higher education institutions more than half time are ineligible for SNAP unless they meet certain exemptions, such as if they are employed 20 hours per week or more, participate in a work study program, or are taking care of young children or older children without access to child care. NAP does not limit college student eligibility beyond other income eligibility rules, and full-time college students can deduct $100 from their gross income.

[31] A recent Trump Administration rule would have tightened the requirements for waivers from the time limit. See Robert Greenstein, “New SNAP Rule Would Cost Many of Nation’s Poorest Their Food Aid,” Center on Budget and Policy Priorities, December 4, 2019, https://www.cbpp.org/press/statements/new-snap-rule-would-cost-many-of-nations-poorest-their-food-aid. A federal court struck down this rule in October 2020. See Ed Bolen, “Court Decision Against Trump Rule Preserves SNAP for 700,000 Jobless,” CBPP, October 20, 2020, https://www.cbpp.org/blog/court-decision-against-trump-rule-preserves-snap-for-700000-jobless.

[32] For more, see Ed Bolen and Stacy Dean, “Waivers Add Key State Flexibility to SNAP’s Three-Month Time Limit,” CBPP, updated February 6, 2018, https://www.cbpp.org/research/food-assistance/waivers-add-key-state-flexibility-to-snaps-three-month-time-limit.

[33] In the 2020 State Plan of Operations, ADSEF indicated that the agency was working to reach an agreement with the Financial Oversight and Management Board of Puerto Rico on an implementation plan for a policy to take away food assistance from participants who are not working or in training a set number of hours, which the Board has recommended, but as of October 2020 has not implemented this requirement due to limited staff and other resources.

[34] See Dottie Rosenbaum et al., “USDA, States Must Act Swiftly to Deliver Food Assistance Allowed by Families First Act,” CBPP, April 7, 2020, https://www.cbpp.org/research/food-assistance/usda-states-must-act-swiftly-to-deliver-food-assistance-allowed-by-families.

[35] Average SNAP benefits have generally been similar to NAP benefits in recent years, before the increase from disaster funding, but this comparison does not capture the disparity due to differences in benefit calculation. If NAP participants received benefits based on the same benefit calculation as in SNAP, average benefits would be higher than in SNAP for many households. This is because the SNAP benefit calculation gives households with lower incomes higher benefits, and NAP households have incomes that are significantly lower than in SNAP. For example, in 2018, about 65 percent of NAP households had income at or below half the federal poverty line, compared to 38 percent of SNAP households. Because of differences in how benefits are calculated, not all NAP participants would necessarily receive higher benefits under SNAP. For example, some households with elderly individuals could receive lower benefits in SNAP compared to NAP due to the NAP benefit structure, which targets higher benefits to those households.

[36] Steven Carlson, “More Adequate SNAP Benefits Would Help Millions of Participants Better Afford Food,” CBPP, July 30, 2019, https://www.cbpp.org/research/food-assistance/more-adequate-snap-benefits-would-help-millions-of-participants-better.

[37] For more on the SNAP benefit calculation, see “A Quick Guide to SNAP Eligibility and Benefits,” CBPP, updated November 1, 2019, https://www.cbpp.org/research/food-assistance/a-quick-guide-to-snap-eligibility-and-benefits.

[38] It is difficult to precisely model how much households in Puerto Rico would receive under SNAP rules, particularly maximum benefits for Puerto Rico, due to limited food price data in Puerto Rico, as well as what state options in SNAP Puerto Rico would choose. But, a USDA model of the impacts on both participation and benefits found that likely NAP participants under SNAP would receive benefits on average about 10 percent higher than in NAP, and more for lower-income households, but households comprising only elderly members would receive benefits on average about 10 percent lower with SNAP than under NAP. (This study also found that a transition to SNAP would increase participation by about 15 percent, but due to NAP’s increase in income eligibility limits and population decline in Puerto Rico, this increase may have changed.) Unpublished CBPP analysis of NAP administrative data also found that overall, most but not all households would receive higher benefits under SNAP, with lower-income households seeing larger increases. Due to NAP’s targeting of benefits to elderly individuals through program rules, CBPP analysis also found that many, and under some assumptions most, elderly households could receive lower benefits under SNAP than under NAP.

[39] Puerto Rico calculates a base benefit based on household size and net income. The regulations provide that elderly individuals receive a 20 percent increase applied to this base benefit, corresponding to a household of the same size with zero net income. In addition to this supplement, NAP also disregards some Social Security and other retirement income, lowering elderly households’ net income and thus allowing them to qualify for higher benefits, and allows them to apply as separate households.

[40] In collaboration with Dr. Hector Cordero-Guzman, CBPP obtained public use, de-identified NAP/PAN administrative data from the SAIC database from the Puerto Rico Department of Family through a public records request to the Puerto Rico Institute of Statistics.

[41] Due to differences in net income calculation (as explained in footnote 28), not all NAP households that receive the maximum benefit under NAP program rules would receive the maximum benefit in SNAP. Because benefits decline at different rates as net income increases in each program, the differences between the maximum benefits are not representative of the overall or average benefits in each program. Households eligible for less than the maximum benefit under NAP rules generally face less of a disparity in benefits compared to what they would receive in SNAP.

[42] For more information, see Dottie Rosenbaum, “Many SNAP Households Will Experience Long Gap Between Monthly Benefits Despite End of Shutdown,” CBPP, updated February 4, 2019, https://www.cbpp.org/research/food-assistance/many-snap-households-will-experience-long-gap-between-monthly-benefits.

[43] “Fiscal Year 2018 Year End Summary,” Food and Nutrition Service, USDA, https://fns-prod.azureedge.net/sites/default/files/media/file/2018SNAPRetailerManagementYearEndSummary.pdf.

[44] USDA Food and Nutrition Service, “Examination of Cash Nutrition Assistance Program Benefits in Puerto Rico,” August 2015, https://fns-prod.azureedge.net/sites/default/files/ops/PuertoRico-Cash.pdf.

[45]From 2001 through 2016, 25 percent of the NAP benefit could be drawn as cash, but the 2014 farm bill mandated a gradual phase-out of the cash portion of the benefit by 2021. In 2019, 10 percent of the benefit was redeemable as cash, which fell to 5 percent on October 1, 2019, and by October 1, 2020, the Commonwealth had phased out the cash option. Sec. 19(e)(3) of the Food and Nutrition Act permits the Secretary of Agriculture to approve a plan to maintain a cash benefit for participants or categories of participants if they determine discontinuation could have significant adverse effects.

[46] Stacy Dean, “Program Integrity for the Supplemental Nutrition Assistance Program,” CBPP, May 9, 2018, https://www.cbpp.org/food-assistance/program-integrity-for-the-supplemental-nutrition-assistance-program.

[47] For more detail, see Peterson et al.

[48] USDA Food and Nutrition Service, “Puerto Rico Nutrition Assistance Program,” https://www.fns.usda.gov/pd/puerto-rico-nutrition-assistance-program.

[49] Nutrition education programs are funded through 100 percent federally funded grants in SNAP, whereas the cost of administering nutrition education in Puerto Rico is considered an administrative cost and is therefore split between the federal government and Puerto Rico.

[50] States receive 100 percent federally funded grants to administer these programs. They can also receive matching funds for additional costs and to provide supportive services to participants in the programs, such as child care or transportation costs.