BEYOND THE NUMBERS

As The New York Times reports, the number of applicants for Social Security Disability Insurance (SSDI) has fallen even faster since 2015 than the Social Security Administration (SSA) expected. In fact, disability applications and benefit awards have fallen for nearly a decade, even if some government officials haven’t acknowledged it. But the shift is significant, and it’s good news for SSDI’s finances.

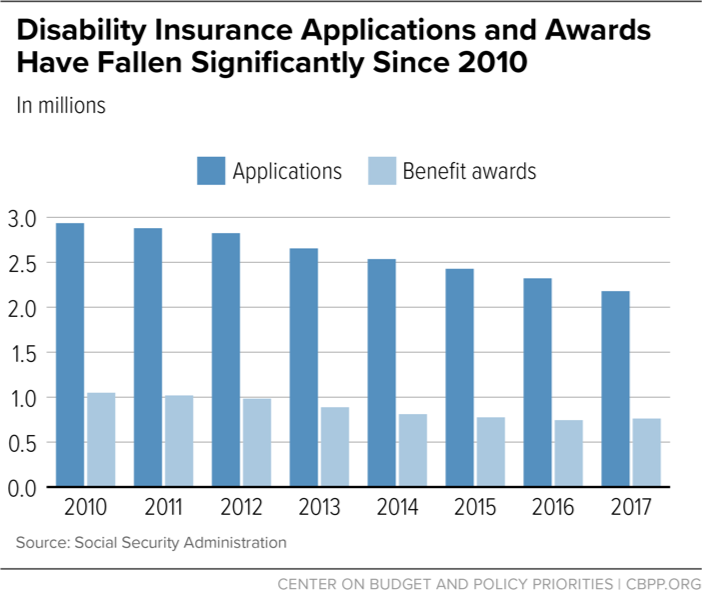

SSDI applications and awards have fallen by over 25 percent since 2010 (see chart), while the number of beneficiaries has dropped by over 600,000 over the past four years. And Social Security’s trustees project that the share of Americans receiving SSDI will remain flat over the next 20 years.

SSA’s actuaries and other experts predicted this downward trend. Though the number of beneficiaries grew for most of SSDI’s history, that mostly reflected demographic factors: the population increased; baby boomers aged into late middle age, when the odds of becoming disabled rise sharply; and more women joined the workforce, paid into Social Security, and earned coverage. Meanwhile, the rise in Social Security’s retirement age to 66 means that workers who become disabled remain in SSDI longer before switching into retirement benefits. Then the Great Recession and slow recovery caused a surge in SSDI applications (though most applicants are denied benefits), while the program received less tax income than previously projected.

The receipt of SSDI benefits as well as program costs have since fallen as demographic and economic pressures eased. As more boomers reach retirement, the number of workers receiving SSDI declined. Men and women now qualify for benefits in nearly equal numbers. Likewise, SSDI applications fell significantly as the economy recovered.

In the last few years, SSDI applications and awards have fallen even faster than predicted. Social Security’s actuaries note that the drop in the number of beneficiaries has been steeper than in past economic recoveries, and they’re trying to understand why. One factor is SSA budget cuts, which forced field office closures that led to “large and persistent reductions” in the number of disability beneficiaries. The cuts also contributed to a record-breaking backlog in disability appeals, which may deter applicants. Another factor is falling allowance rates for disability appeals. The trustees have been rightly cautious in interpreting short-term trends, and they assume that the declines will taper off in the next several years.

SSDI’s financial outlook has improved significantly as a result of declining enrollment. As the program shrank, its costs fell as a share of taxable payroll, and that share is expected to remain stable over the long term. This month’s Social Security trustees’ report projects that SSDI’s trust fund will remain fully funded through 2032 — a full decade later than the 2022 date that the trustees projected three years ago.

SSDI’s financial improvement means that policymakers have time to develop a comprehensive plan to address Social Security’s long-term funding shortfall before the combined reserves for the retirement and disability programs are depleted in 2034 — that is, a plan that protects the millions of workers who rely on earned disability benefits when they become too sick or hurt to work and support their families.