The Disability Insurance (DI) program — a vital part of Social Security that pays modest benefits to people who can no longer support themselves by working due to severe medical impairments — has grown rapidly in recent decades. The program’s chief actuary has consistently stated that demographic changes account for the bulk of the program’s growth, while some other analyses appear to tell a different story. These differences largely reflect variations in the measure of DI growth that the studies use, the factors considered, and the time period analyzed. Thus, there is no single correct answer to “how much of DI’s growth stems from demographic factors?”

Our analysis finds that four-fifths of the program’s total enrollment in 2013 — and over two-thirds of the growth in enrollment since 1980 — stems from five easily quantifiable factors: growth in the overall working-age population, the aging of that population, growth in women’s labor force participation, the rise in Social Security’s full retirement age, and the growth in DI receipt among women eligible for benefits to match men’s rate of receipt.

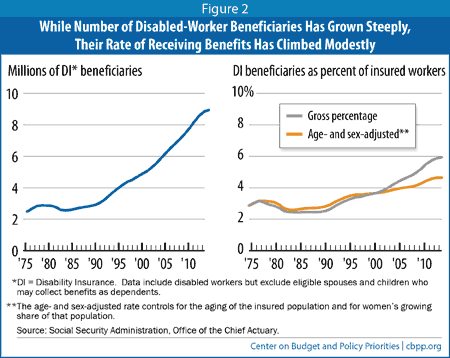

The growth in the number of DI beneficiaries naturally captures policymakers’ and journalists’ attention and is the simplest concept to understand. Some other analyses, though, focus on the percentage of workers who receive DI benefits (known as the rate of DI receipt) rather than the number of DI recipients. The rate of DI receipt has grown much less steeply than the number of DI recipients in recent decades, for a straightforward reason: overall population growth affects the number of recipients but not the rate of receipt. Studies that focus on the rate of receipt ascribe a smaller share — sometimes less than half — of DI’s growth to demographic factors than do studies that examine the number of DI beneficiaries.

It is important to note that ascribing some residual share of DI’s growth to non-demographic factors doesn’t imply that this portion is unexplained or illegitimate. Many of those other factors are well recognized, but their contribution is harder to quantify.

In short, the factors driving DI’s growth are reasonably well understood, were long anticipated, and do not depict a program that is “out of control.”

Some 8.9 million disabled workers were collecting monthly DI benefits at the end of 2013,[1] roughly three times the 1980 figure of 2.9 million. Most of that growth stems from five, primarily demographic, factors.

- Population growth. The working-age population — conventionally defined as people aged 20 through 64 — grew by 43 percent between 1980 and 2013.[2] That alone would lead to more DI beneficiaries. We calculate that population growth — even with no change in the nation’s age composition (see next bullet) — would have generated an extra 1.25 million DI beneficiaries in 2013, compared with 1980.

-

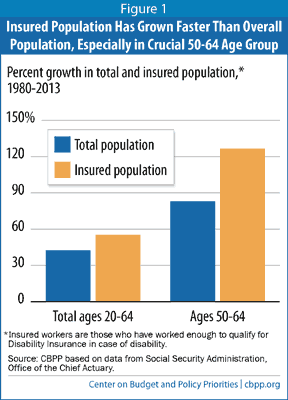

Population aging. The risk of disability rises steeply with age. People are twice as likely to receive DI at age 50 than at age 40, and twice as likely at age 60 than at age 50. Between 1980 and 2013, the growth in the working-age population was concentrated among older adults, as the baby-boom generation — the large cohort born between 1946 and 1964 — aged into its 50s and early 60s (see Figure 1). We estimate that this aging of the population added another 900,000 DI beneficiaries in 2013, compared with 1980.

- Growth in women’s labor force participation. Besides having a severe impairment, applicants for DI benefits must be both fully insured (meaning they have worked for at least one-fourth of their adult life) and disability insured (meaning they have worked for five of the last ten years).[3] Until women joined the work force in huge numbers, relatively few of them met those tests. The rise in women’s labor force participation explains why the number of insured workers has grown much faster than the overall population — especially in the crucial 50-64 age group (see Figure 1).[4] We estimate that the rise in women’s labor force participation added another 900,000 beneficiaries in 2013, compared with 1980.

- Rise in retirement age. When disabled workers reach Social Security’s full retirement age, they begin receiving Social Security retirement benefits rather than DI. The increase in the retirement age from 65 to 66 has delayed that conversion. In December 2013, more than 450,000 people between ages 65 and 66 — over 5 percent of DI beneficiaries — collected DI benefits; under the rules in place until 2003, they would have received retirement benefits instead.[5]

- Increase in women’s rate of receipt. Until the mid-1990s, insured women of any age — that is, women who had worked enough to qualify for DI in the event of disability — were only about three-fourths as likely as insured men to receive DI benefits. Now they’re equally likely to do so. Because this comparison is limited to workers with the required years of employment, this change is not directly due to women’s rising labor force participation. Researchers — who have overwhelmingly focused on what influences men’s enrollment in DI — have not always noted this trend, which is dubbed “women’s catch-up,” and have rarely studied it. [6] Together with the rise in women’s labor force participation, this shift means that, whereas male disabled workers outnumbered female recipients by nearly 2 to 1 as late as the early 1990s, that ratio has fallen to 1.1 to 1. In other words, almost equal numbers of men and women now receive DI.

Whatever the reasons for this trend, we estimate that the growth in DI receipt that results from insured women’s rate of receipt reaching parity with insured men’s added another 650,000 beneficiaries in 2013, compared with 1980.[7]

In sum, these five demographic factors alone would have generated over 4.1 million more DI beneficiaries in 2013 — causing their number to rise from 1980’s 2.9 million to 7 million. The actual number of beneficiaries in 2013 was 8.9 million. Thus, these five factors explain nearly four-fifths of the total number of beneficiaries in 2013, and nearly 70 percent of the growth in beneficiaries since 1980. (As we discuss later, we know many of the reasons for the remaining growth even though we cannot readily quantify them.) These figures amply support the statement that most of the growth in DI enrollment stems from demographic factors.

Whereas lawmakers and the media typically focus on changes in the number of DI beneficiaries, researchers and actuaries generally focus on the rate of DI receipt. Measures of the rate of DI receipt can help put rising enrollment in context, but they require careful interpretation.

Broadly speaking, such measures express DI beneficiaries as a share of the working-age population (typically defined as people aged 20 through 64, or a similarly broad age range). Because only “insured workers” are eligible for DI benefits, some measures focus on this subset of the working-age population.

For instance, the Social Security actuaries publish two figures that confine the comparison to insured workers. One series, the

gross prevalence rate, expresses disabled-worker beneficiaries as a simple percentage of the insured population. Between 1980 and 2013, that rate rose from 2.8 percent to 5.9 percent of the insured population. (If we exclude beneficiaries aged 65 to 66, the figure for 2013 is 5.7 percent.)

[8] As we showed earlier, the insured population — fueled both by overall population growth and by the rise in women’s labor force participation — grew rapidly over this period, driving much of the growth in the DI rolls. That explains why the rate of receipt (which slightly more than doubled over the period) rose substantially less than the number of beneficiaries (which roughly tripled).

The second series, an age- and sex-adjusted prevalence rate, controls for the aging of the insured population and for the mix of men and women in that population. Between 1980 and 2013, this rate rose by about 50 percent, from 3.1 percent to 4.6 percent (see the right panel of Figure 2).[9] That is, it rose only half as much as the gross prevalence rate — indicating that these demographic factors accounted for half of the growth in the rate of DI receipt among insured workers.

Furthermore, the age- and sex-adjusted prevalence rate does not control for the catch-up of women’s rate of DI receipt to men’s. Nor does it reflect the rise in the full retirement age (which hadn’t begun in 2000, the base year used for calculating the rate). If those factors were also taken into account, then these various demographically related factors would comprise an even larger share of the increase in the gross rate of receipt between 1980 and 2013.

When discussing the growth in DI, it is important to understand what is being measured and to distinguish between studies that analyze changes in the number of beneficiaries and those that analyze changes in the rate of DI receipt. In addition to using different measures, studies also use different time periods and consider different factors (see Table 1.)

Table 1

Size of Demographic Contribution to Disability Insurance Growth Depends on Measure, Time Period, and Demographic Factors Considered |

| Measure | Time Period | Age Groupa | Demographic Contributionb |

| Total Number of Beneficiaries | 1980-2013 | 20-full retirement age | 78% |

| Growth in Number of Beneficiaries | 1980-2013 | 20-full retirement age | 68% |

| Growth in Rate of Receiptc | 1980-2011 | 20-full retirement age | 56% |

| Growth in Rate of Receiptd | 1989-2011 | 25-64 | 48% (including women’s catch-up) |

| Growth in Rate of Receipte | 1989-2011 | 25-64 | 40% (excluding women’s catch-up) |

| Growth in Volume of New Awards (“Incidence”)f | 1972-2008 | 16-64 | 90% |

a. Full retirement age was 65 but is now 66.

b. Demographic factors, as defined here, include growth in the population, labor force participation (as it affects DI insured status), the age composition of the population, the rise in the full retirement age, and (except where noted) women’s catch-up to men’s prevalence of DI receipt in 1980.

c. Daly, Lucking, and Schwabish. CBPP estimate, using same approach but using SSA population (as explained in footnote 11), is 61 percent.

d. Comparable to the estimate of Autor and Duggan, with the addition of women’s catch-up (as estimated by CBPP).

e. Autor and Duggan.

f. Pattison and Waldron. |

A study by researchers Mary Daly, Brian Lucking, and Jonathan Schwabish of the Federal Reserve Bank of San Francisco (FRBSF) finds that DI beneficiaries climbed from 2.3 percent to 4.7 percent of the working-age population between 1980 and 2011.[10] They ascribe 56 percent of that growth to four of the five demographic factors we’ve outlined — aging, women’s labor-force participation, women’s catch-up to men’s prevalence rates, and the rise in Social Security’s full retirement age. (The fifth factor, population growth, does not affect the rate of receipt.) The other 44 percent they call “unexplained.”

The FRBSF researchers mostly use Social Security Administration (SSA) data, and the rate of receipt they depict moves roughly in parallel with the SSA actuaries’ gross prevalence rate that we presented above. The FRBSF authors express the rate of DI receipt as a percent of the entire population, rather than the insured population (as the actuaries’ standard measure does). As a result, their total rate of receipt is lower than the actuaries’, but grows slightly faster. They adjust for that fact by treating the rise in women’s labor force participation — which caused the insured population to grow faster than overall population — as an explicit factor affecting the rate of DI receipt. They also treat an aging population, a higher retirement age, and “women’s catchup” as other explicit factors. Mild differences arise because they end their analysis in 2011 (whereas Social Security data are now available through 2013) and use population data from the Bureau of Labor Statistics (rather than SSA).[11]

However, studies like the FRBSF article, which focus on the rate of DI receipt, are easy to misinterpret. For example, a Washington Post editorial recently cited the FRBSF study as “fresh evidence” that “technical and demographic factors such as those cited by defenders of SSDI explained no more than 56 percent of the program’s growth” and ascribed the rest to “structural defects and perverse incentives.”[12] Some Post readers might infer that 56 percent of the growth in the number of beneficiaries reflects demographic factors and that 44 percent is due to “unexplained” (but less legitimate) factors. But as noted, the FRBSF researchers focused on the rate of DI receipt, not the growth in the number of beneficiaries. (As we showed earlier, overall population growth has contributed greatly to the growth in the rolls but is “filtered out” when calculating the rate of receipt.) While the FRBSF research provides new perspectives, it does not differ in fundamental ways from the findings of CBPP and the Social Security actuaries, despite the Post’s implication.

Autor and Duggan Calculations

Economists David Autor of MIT and Mark Duggan of the University of Pennsylvania, who have collaborated on numerous articles and presentations about DI, have criticized statements that demographic changes account for the majority of DI growth.[13] Their conclusions, however, reflect the data and measures they use.

Like the FRBSF researchers, Autor and Duggan focus on the rise in the gross rate of DI receipt, expressed as a percentage of the working-age population. Autor and Duggan confine their analysis to people aged 25 through 64 (very few people under 25 collect DI, and before 2003, nobody over 65 received DI), thereby factoring out the effect of the rise in full retirement age; and they focus on a different time period than some other studies, starting their analysis in 1989 — a year in which, as Figure 2 shows, the rate of DI receipt was relatively low.[14] Finally, Autor and Duggan (unlike the FRBSF researchers) do not consider insured women’s catch-up to men’s rates of DI receipt as a demographic factor.

Autor and Duggan ascribe 40 percent of the growth of the rate of DI receipt since 1989 to the combination of population aging and more women working. Adding women’s catch-up to men’s receipt rate to their analysis would, according to our calculations, boost the share of the growth attributable to demographic factors to 48 percent.

Because Autor and Duggan do not include women’s catch-up or the rise in Social Security’s full retirement age and because they start their analysis in a year in which the rate of DI receipt was relatively low, they attribute a smaller share of program growth to demographic factors than some other studies do.

Pattison and Waldron Calculations

Two SSA researchers, David Pattison and Hilary Waldron, recently analyzed the factors driving the volume of new DI awards over the 1972-2008 period.[15] New awards are a key driver of growth in the disability rolls because once people qualify for benefits, they continue to collect benefits until they die, recover, or convert to Social Security retirement benefits.[16]

Pattison and Waldron find that 90 percent of the growth in the number of new awards (as a share of workers who are insured for DI but don’t already receive it) between 1972 and 2008 reflects three factors: population growth, the growth in the proportion of women insured for disability, and the movement of the large baby-boom generation into disability-prone ages. While both the variables they measure and the time period they examine differ from the studies discussed above, their conclusions underscore the importance of demographic factors in DI growth.

Factors other than demographics also have contributed to the program’s growth, but they are typically not as easy to quantify.[17] They include, for instance:

- Legislative changes. The Disability Benefits Reform Act (DBRA) of 1984 clarified eligibility rules in the wake of a crackdown on DI by the Reagan Administration. Notably, DBRA required SSA to consider the impact of multiple impairments and to issue new regulations for evaluating mental impairments, reflecting Congress’s determination to give fair weight to the full range of medical evidence in complex cases. While some scholars — notably Autor and Duggan — blame DBRA for causing excessive growth in DI, lawmakers at the time intended no such expansion, and it’s impossible to isolate DBRA’s precise contribution, if any.[18]

- Workplace changes. The accelerating pace of globalization and technological change has been particularly unforgiving to older, less-educated workers and those with cognitive impairments. (Further, while work may be less physical than in the past, a significant fraction of jobs — including those performed by older workers — still involves arduous physical demands or difficult working conditions.)

- Lack of health insurance. DI beneficiaries qualify for Medicare after a two-year waiting period. With employer-sponsored health insurance eroding and the individual health insurance market becoming costlier or outright unavailable, Medicare eligibility may loom larger in some workers’ decisions to apply for DI. (This suggests that implementation of the Affordable Care Act might diminish pressures on the DI program.)

- Economic downturn. Some assert that the economic downturn has greatly fueled the program’s growth, but the real impact is less dramatic. Researchers generally conclude — and the program’s actuaries confirm — that a sour economy boosts applications far more than actual awards. They find that while high unemployment rates tend to attract more marginal, partially disabled applicants to seek DI benefits, their applications are more likely to be denied.[19]

- Lower death rates. Death rates for DI beneficiaries remain far higher than for the general population, but they have nonetheless fallen, from about 5 percent of beneficiaries each year in the mid-1980s to about 3 percent today. That means that beneficiaries tend to stay on the rolls longer.[20]

- Recovery rates. Cases in which SSA terminates benefits as individuals return to sustained work or their medical condition improves were never high and have drifted down, partly because Congress has failed to fund medical reviews (known as continuing disability reviews) adequately and SSA has fallen far behind in conducting these reviews.[21]

As the discussion above suggests, there is no single answer to the question, “how much of DI’s growth is due to demographic factors?” The answer depends on the period analyzed and the methods chosen. We calculate, however, that five key factors that can be considered as demographic or demographically related — population growth, population aging, rising women’s labor force participation, the rise in the full retirement age, and the catchup in women’s prevalence rates — explain almost 70 percent of the growth in the number of DI beneficiaries since 1980 and at least three-fifths of the increase in the rate of DI receipt over this period.

Other estimates that ascribe a lower share of DI growth to demographic factors often consider fewer factors or look at different time periods.

Demographic pressures on DI will ease in the future, and the program’s costs will subside slightly as a result. Specifically, DI costs peaked at nearly 0.9 percent of gross domestic product (GDP) in 2010-2013. The actuaries project that DI costs will edge down very slightly over the next few decades and stabilize at a little less than 0.8 percent of GDP in the long run.[22] That’s despite the additional cost pressure that will occur when Social Security’s full retirement age rises from 66 to 67 between 2017 and 2022, which will delay conversions from DI, just as the previous increase in the retirement age from 65 to 66 did. This decline in cost will occur because aging baby boomers will, over the next two decades, leave the DI rolls for the retirement rolls. Thus, cost pressures should moderate even though the actuaries foresee a small further rise in the age- and sex-adjusted prevalence of DI receipt.

Properly understanding the contribution of demographic changes and other factors should help policymakers in making decisions to address the need to shore up the program’s trust fund by 2016.