BEYOND THE NUMBERS

Retirement accounts provide at best a modest supplement to Social Security, new Federal Reserve data show. A minority of mostly wealthy Americans have saved very large amounts — many times what middle- and low-income Americans have, if they own accounts at all — making Social Security, which covers nearly everyone, a key program to protect and improve.

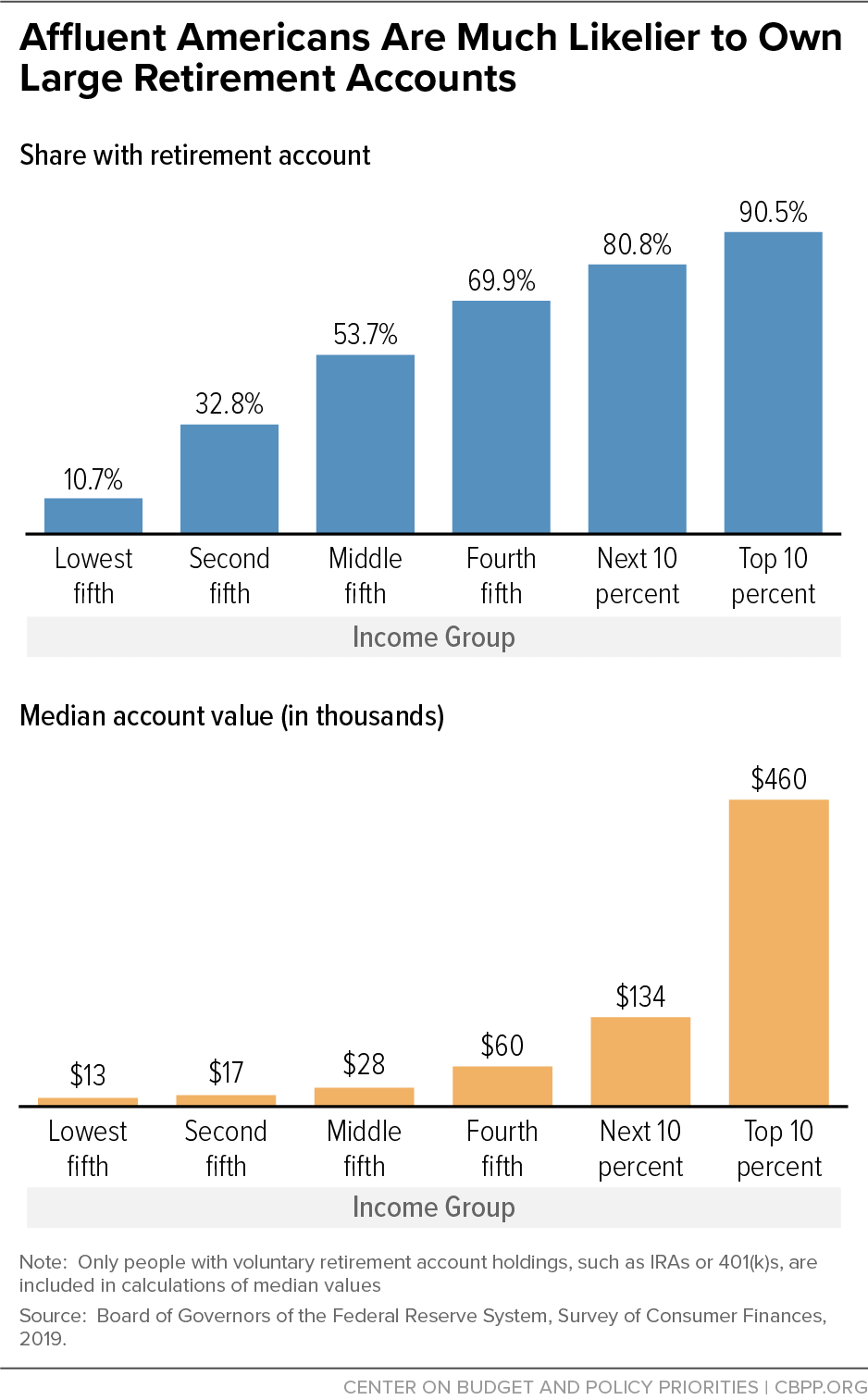

Half of all households owned retirement accounts — voluntary plans like Individual Retirement Accounts (IRAs) or 401(k)s and similar plans that many employers offer — the latest Survey of Consumer Finances, for 2019, shows. For those with them, the accounts’ median value was $65,000. But ownership and balances in these accounts differ sharply by:

- Education. Nearly three-fourths of households headed by someone with a college degree had retirement accounts (with a median value of $119,000), while just 41 and 45 percent, respectively, of people with only a high school diploma or some college had them (median value about $40,000).

- Race and ethnicity. Some 57 percent of white non-Hispanic-headed households had accounts (median value $80,000), compared with a third of Black non-Hispanic households ($35,000) and a quarter of Hispanic households ($31,000).

- Income. More than 90 percent of the richest one-tenth of households had retirement accounts, with a median value of nearly half a million dollars. That’s nearly twice the participation — and 16 times the value — of middle-income households; the contrast with lower-income families is even starker (see graph).

What about people near retirement age, when account balances should peak? Slightly over half of households headed by someone aged 55-64 have retirement accounts, and their median value is $134,000. That translates into a welcome but modest income of about $7,500 a year for men, and about 7 percent less for women (who on average live longer), if retirees draw the accounts down gradually starting at 65. But, in practice, less-affluent owners exhaust their accounts early while richer owners keep accumulating funds until they are at least in their 70s, research suggests. Meanwhile, nearly half of retirees get nothing.

That’s far from the rosy picture that the Organisation for Economic Cooperation and Development (OECD) paints in its country comparisons. The United States, asserts the OECD, has modest public pensions — Social Security ranks near the bottom third among advanced countries — but supposedly robust amounts when adding private sources. The OECD assumes, though, that Americans save 9 percent of their pay every year from age 22 through Social Security’s retirement age for receiving “full” benefits (now 66, soon to be 67). That’s enough to eventually replace nearly a third of their earnings, but it’s a far cry from what the Federal Reserve data actually show.

In reality, retirement accounts — which enjoy significant tax breaks — are a skewed and inadequate source of income for seniors. They’re just no substitute for protecting and improving Social Security.