BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP we worked on food assistance, health, the federal budget and taxes, state taxes, Social Security, and the economy.

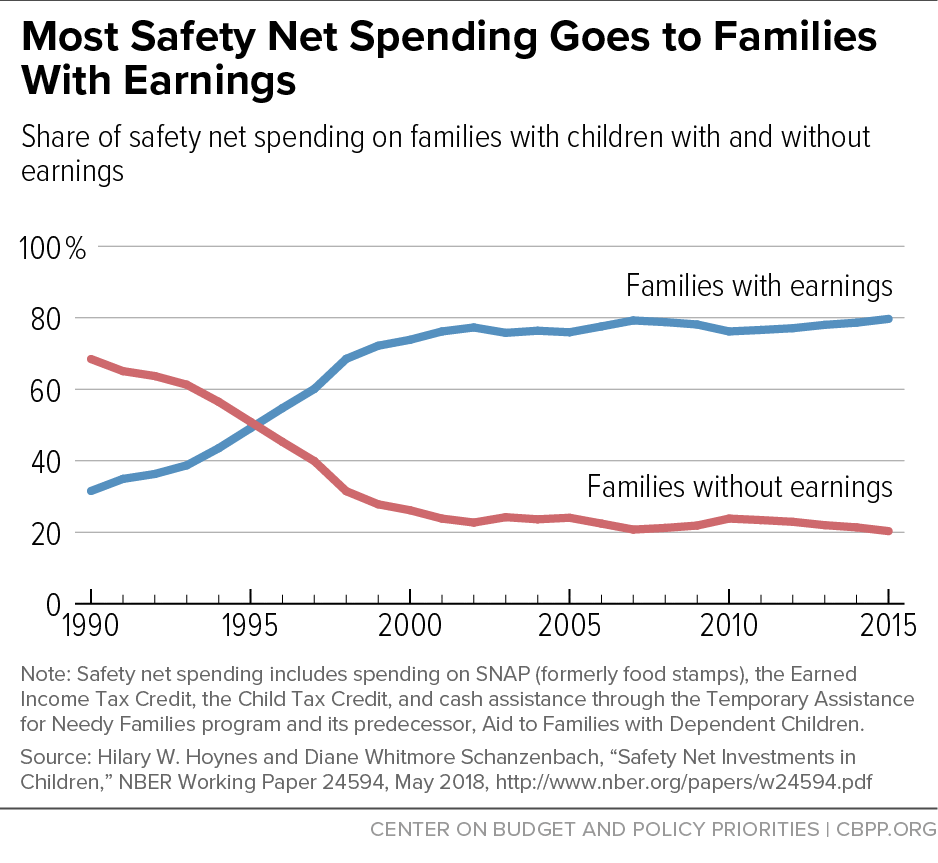

- On food assistance, Robert Greenstein issued a statement saying that the partisan House farm bill would turn the clock back on efforts to reduce hunger and hardship. Elizabeth Wolkomir showed that the bill would cause 1 million low-income households with more than 2 million people to lose their SNAP benefits altogether or have them reduced. She also focused on a harmful provision letting states turn all SNAP operations over to private corporations. Brynne Keith-Jennings cited new research showing that changes in the safety net in recent decades have heavily favored working families. Ed Bolen, Stacy Dean, Dorothy Rosenbaum, and Elizabeth Wolkomir updated their analysis of the Senate Agriculture Committee’s farm bill.

- On health, Robert Greenstein issued a statement explaining that the latest plan to repeal the Affordable Care Act (ACA) would be just as harmful to millions of Americans as the many failed prior attempts. Aviva Aron-Dine noted that the Administration and congressional Republicans made multiple efforts last year to end or weaken key protections for people with pre-existing conditions. Aron-Dine and Matt Broaddus found that the latest Republican ACA repeal plan would have similar harmful impacts on coverage and health as all the other repeal plans. Hannah Katch warned that a House bill partially repealing a ban on using Medicaid funds for care of patients with substance abuse disorders would do more harm than good. Jessica Schubel explained that Medicaid plays a key role in enabling people with disabilities to live in their community rather than an institution.

- On the federal budget and taxes, Robert Greenstein stated that the Trump Administration’s reorganization proposals concerning low-income programs raise serious concerns. He also explained that the House Budget Committee’s 2019 budget continues a trend in Republican congressional budgets of deep cuts to health care and basic assistance for struggling families. Brendan Duke showed that the 2017 tax law’s deduction for “pass-through” business income carries a high cost. He also cited a Tax Policy Center analysis showing that the 2017 tax law could leave most low- and middle-income families worse off after it’s paid for.

- On state taxes, Samantha Waxman explained how a Florida proposal to require a supermajority vote in the state legislature to raise revenues risks worsening the state’s K-12 funding crisis.

- On Social Security, Kathleen Romig reported that Social Security Disability Insurance is shrinking, which improves the program’s finances.

- On the economy, we updated our backgrounder on unemployment compensation.

Chart of the Week: Most Safety Net Spending Goes to Families with Earnings

A variety of news outlets featured CBPP's work and experts recently. Here are some highlights:

Fifty years after Poor People's Campaign, America's once-poorest town still struggles

NBC News

June 22, 2018

GOP Wants Hungry Kids to Fund Tax Cuts

New York Times

June 21, 2018

Trump wants to move food stamps to a new agency. That could make the program easier to overhaul.

Washington Post

June 21, 2018

Work Requirements for Housing Assistance Are a Disaster

Slate

June 20, 2018

Don’t miss any of our posts, papers, or charts – follow us on Twitter, Facebook, and Instagram.