BEYOND THE NUMBERS

The 2017 tax law’s deduction for certain “pass-through” business income — income that owners of businesses such as partnerships, S corporations, and sole proprietorships claim on their individual tax returns instead of paying the corporate tax — will reduce federal revenues by $60 billion in 2021, the Joint Committee on Taxation (JCT) estimates. The deduction will be the seventh-costliest individual tax break in the tax code that year, according to JCT.

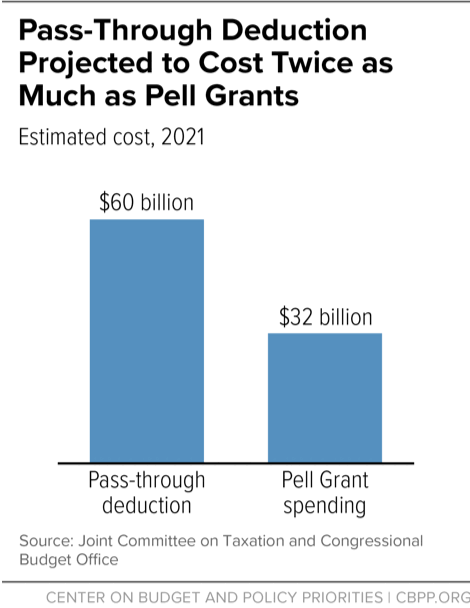

How much is $60 billion? When evaluating the cost of a tax break, it’s often helpful to compare it to federal spending on a program. For instance, the pass-through deduction will eventually cost about twice what the federal government spends each year on Pell Grants, which help 7.7 million low- and moderate-income students pay for college. Pell Grants now cover a small and shrinking share of college costs for students who receive them; in the 2016-2017 academic year, the maximum grant covered just 29 percent of the cost of a public four-year college, the lowest in the program’s four-decade history. (In 1975, it covered almost 80 percent.)

In contrast to Pell Grants, where three-quarters of the program’s cost goes to students with family incomes below $30,000, the pass-through tax break is extremely regressive: a full 61 percent of its benefits are expected to go to the top 1 percent of households by 2024. Further, the tax break is not only expensive but also invites widespread abuse by drawing arbitrary distinctions among different types of income (pass-through income can qualify for the deduction but wage and salary income can’t) and favoring some industries over others (high-income architects are eligible for the deduction but high-income doctors aren’t). And its very existence is based on the misguided argument that pass-through businesses needed a tax cut to maintain parity with corporations.

The pass-through deduction is—like the rest of the tax law — fundamentally flawed. It should be repealed.