Pell Grants — a Key Tool for Expanding College Access and Economic Opportunity — Need Strengthening, Not Cuts

End Notes

[1] Spiros Protopsaltis is Visiting Associate Professor and Fellow, College of Education and Human Development, George Mason University and served as the Deputy Assistant Secretary for Higher Education and Student Financial Aid at the U.S. Department of Education from 2015 to 2017.

[2] Department of Education. (2017). “FY 2018 Budget Request: Student Financial Assistance.” Available at https://www2.ed.gov/about/overview/budget/budget18/justifications/o-sfa.pdf

[3] Department of Education. (2016). “New U.S. Department of Education Report Highlights Colleges Increasing Access and Supporting Strong Outcomes for Low-Income Students.” Available at https://www.ed.gov/news/press-releases/new-us-department-education-report-highlights-colleges-increasing-access-and-supporting-strong-outcomes-low-income-students.

[4] The formula also allows for certain applicants to be automatically determined to be eligible for the maximum Pell. For the 2016-17 year, dependent students whose parents’ adjusted gross income was below $25,000 and independent students (and their spouses, if applicable) with dependents with AGI below $25,000, qualify for the maximum Pell award regardless of other financial characteristics.

[5] National Center for Education Statistics. (2015). “Total undergraduate fall enrollment in degree-granting postsecondary institutions, by attendance status, sex of student, and control and level of institution: Selected years, 1970 through 2025.” Available at https://nces.ed.gov/programs/digest/d15/tables/dt15_303.70.asp?current=yes.

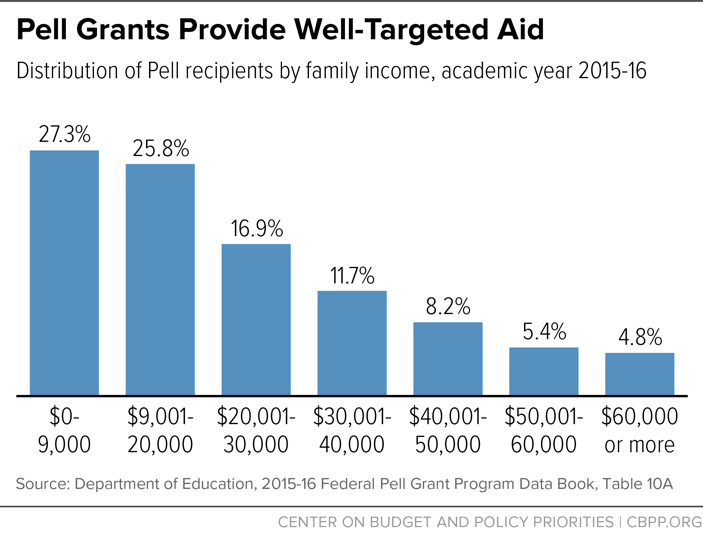

[6] Department of Education. (2017). “Federal Pell Grant Program Data Book, 2015-2016,” Table 10A, calculations by the authors. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html.

[7] Ibid., Table 57A, calculations by the authors.

[8] An independent student meets one or more of the following criteria: at least 24 years old, married, a veteran, a member of the armed forces, an orphan, a ward of the court, someone with legal dependents other than a spouse, an emancipated minor or someone who is homeless or at risk of becoming homeless. Graduate students, who are ineligible for Pell, are also deemed independent students for financial aid purposes, regardless of their age.

[9] Department of Education. (2017). “Federal Pell Grant Program Data Book, 2015-2016,” Tables 11A, 13, and 92, calculations by the authors. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html.

[10] Anthony P. Carnevale. (2015). “Learning While Earning: The New Normal,” Georgetown University Center on Education and the Workforce. Available at https://cew.georgetown.edu/wp-content/uploads/Working-Learners-Report.pdf; Paul Attewell, Scott Heil, and Liza Reisel. (2012). “What is Academic Momentum? And does it Matter?” Educational Evaluation and Policy Analysis, Vol. 34(1); Alexander McCormick, John Moore III, and George Kuh. (2010). “Working during College: Its Relationships to Student Engagement and Education Outcomes,” in Laura Perna (Ed.). “Understanding the Working College student: New Research and Its Implications for Policy and Practice”; Clifford Adelman. (2006). “The Toolbox Revisited: Paths to Degree Completion from High School through College.” U.S. Department of Education. Available at http://www2.ed.gov/rschstat/research/pubs/toolboxrevisit/toolbox.pdf; Lauren Dundes and Jeff Marx. (2006). “Balancing Work and Academics in College: Why do students working 10 to 19 hours per week excel?” Journal of College Student Retention: Research, Theory and Practice, Vol. 8(1); Jacqueline King. (2002). “Crucial Choices: How Students’ Financial Decisions Affect Their Academic Success.” American Council on Education.

[11] National Center of Education Statistics. “2012 National Postsecondary Student Aid Study: Data Lab,” calculations by the authors. Available at https://nces.ed.gov/datalab/.

[12] See, for example: Sara Goldrick-Rab, Robert Kelchen, Douglas Harris, and James Benson. (2015). “Reducing Income Inequality in Educational Attainment: Experimental Evidence on the Impact of Financial Aid on College Completion.” University of Wisconsin-Madison, IRP Discussion Paper No. 1393-12; Ben Castleman and Bridget Terry Long. (2015). “Looking Beyond Enrollment: The Causal Effect of Need-Based Grants on College Access, Persistence, and Graduation.” National Bureau of Economic Research Working Paper No. 19306; Eric Bettinger. (2015). “Need-Based Aid and Student Outcomes: The Effects of the Ohio College Opportunity Grant.” Educational Evaluation and Policy Analysis, Vol. 37(1); Cody Davidson. (2014). “The Effects of a State Need-based Access Grant on Traditional and Non-traditional Student Persistence.” Higher Education Policy, Vol. 28(2);

Susan Dynarski Judith Scott-Clayton. (2013). “Financial Aid Policy: Lessons from Research.” National Bureau of Economic Research Working Paper No. 18710; Donald Heller. (2012). “Testimony before the Committee on Health, Education, Labor, and Pensions United States Senate. Making College Affordability a Priority: Promising Practices and Strategies”; Sandy Baum, Michael McPherson, and Patricia Steele (Eds.). (2008). “The Effectiveness of Student Aid Policies: What the Research Tells Us.” College Board; Bridget Terry-Long. (2008). “What Is Known About the Impact of Financial Aid? Implications for Policy.” National Center for Postsecondary Education Working Paper; Don Hossler, Mary Ziskin, Jacob Gross, Sooyeon Kim, and Osman Cekic. (2007). “Student Aid and Its Role in Encouraging Persistence.” In J.C. Smart, (Ed.), Higher Education: Handbook of Theory and Research, Vol. 24; Donald Heller. (2003). “Informing Public Policy: Financial Aid and Student Persistence.” Western Interstate Commission for Higher Education; Larry Singell. (2001). “Come and Stay a While: Does Financial Aid Effect Enrollment and Retention at a Large Public University?” Cornell Higher Education Research Institute; Susan Dynarski. (1999). “Does Aid Matter? Measuring the Effect of Student Aid on College Attendance and Completion.” National Bureau of Economic Research Working Paper No. 7422; Laura Walter Perna. (1998). “The Contribution of Financial Aid to Undergraduate Persistence.” Journal of Student Financial Aid, Vol. 28(3).

[13] Lindsay Page and Judith Scott-Clayton. (2016). “Improving college access in the United States: Barriers and policy responses,” Economics of Education Review, Vol. 51; Ben Castleman and Bridget Terry Long. (2015). “Looking Beyond Enrollment: The Causal Effect of Need-Based Grants on College Access, Persistence, and Graduation.” National Bureau of Economic Research Working Paper No. 19306; Will Doyle. (2014). “College Affordability: What the Research Says.” Southern Regional Education Board. Available at http://www.sreb.org/sites/main/files/file-attachments/affordability_doyle_dec2014.pdf; Jeffrey Denning. (2014). “College on the Cheap: Costs and Benefits of Community College.” University of Texas at Austin, Job Market Paper. Available at http://www.terry.uga.edu/media/events/documents/Denning_Paper.pdf; Ray Franke. (2014). “Towards the Education Nation? Revisiting the Impact of Financial Aid, College Experience, and Institutional Context on Baccalaureate Degree Attainment for Low-Income Students.” Prepared for Presentation at the Annual Meeting of the American Educational Research Association (AERA), Philadelphia, PA, (April 3-7). [Cited with author’s permission]; David Deming and Susan Dynarski. (2009). “Into College, Out of Poverty? Policies to Increase the Postsecondary Attainment of the Poor.” National Bureau of Economic Research, Working Paper No. 15387; Thomas Kane (2004). “Evaluating the Impact of the D.C. Tuition Assistance Grant Program.” National Bureau of Economic Research, Working Paper 10658; Susan Dynarski. (2003). “Does Aid Matter? Measuring the Effect of Student Aid on College Attendance and Completion.” American Economic Review Vol. 93(1); Thomas Kane. (2003). “A Quasi-Experimental Estimate of the Impact of Financial Aid on College-Going.” National Bureau of Economic Research, Working Paper 9703; Susan Dynarski. (2000). “Hope for Whom? Financial Aid for the Middle Class and Its Impact on College Attendance.” National Tax Journal, Vol. 53(3); Thomas Kane. (1995). “Rising Public College Tuition and College Entry: How Well Do Public Subsidies Promote Access to College?” National Bureau of Economic Research, Working Paper 5164.

[14] Sara Goldrick-Rab, Robert Kelchen, Douglas Harris, and James Benson. (2015). “Reducing Income Inequality in Educational Attainment: Experimental Evidence on the Impact of Financial Aid on College Completion.” University of Wisconsin-Madison, IRP Discussion Paper No. 1393-12.

[15] Ben Castleman and Bridget Terry Long. (2015). “Looking Beyond Enrollment: The Causal Effect of Need-Based Grants on College Access, Persistence, and Graduation.” National Bureau of Economic Research Working Paper No. 19306; Sara Goldrick-Rab, Robert Kelchen, Douglas Harris, and James Benson. (2015). “Reducing Income Inequality in Educational Attainment: Experimental Evidence on the Impact of Financial Aid on College Completion.” University of Wisconsin-Madison, IRP Discussion Paper No. 1393-12.

[16] David Mundel with Lois Rice. (2008). “The Impact of Increases in Pell Grant Awards on College-going among Lower Income Youth: Evidence from a Natural Experiment.” Brookings Institution, Center on Children and Families Brief #40. Available at https://www.brookings.edu/wp-content/uploads/2016/06/12_pell_grants_rice.pdf.

[17] Ibid, p. 2.

[18] Neil Seftor and Sarah Turner. (2002). “Back to School: Federal Student Aid Policy and Adult College Enrollment.” The Journal of Human Resources, Vol. 37(2).

[19] Sigal Alon. (2011). “Who Benefits Most from Financial Aid? The Heterogeneous Effect of Need-Based Grants on Students' College Persistence.” Social Science Quarterly, Vol. 92(3).

[20] Jennie Woo. (2009). “The Impact of Pell Grants on Academic Outcomes for Low-Income California Community College Students.” MPR Associates: p. 3. Available at http://files.eric.ed.gov/fulltext/ED537848.pdf.

[21] Eric Bettinger. (2004). “How Financial Aid Affects Persistence.” National Bureau of Economic Research, Working Paper No. 10242: p. 31. Available at http://www.nber.org/papers/w10242.pdf.

[22] Rina Seung Eun Park and Judith Scott-Clayton. (2017). “The Impact of Pell Grant Eligibility on Community College Students’ Financial Aid Packages, Labor Supply, and Academic Outcomes.” Center for Analysis of Postsecondary Education and Employment: Abstract. Available at http://ccrc.tc.columbia.edu/media/k2/attachments/impact-pell-grant-eligibility-community-college-students.pdf.

[23] Ibid., p. 2.

[24] Ray Franke. (2014). “Towards the Education Nation? Revisiting the Impact of Financial Aid, College Experience, and Institutional Context on Baccalaureate Degree Attainment for Low-Income Students.” Prepared for Presentation at the Annual Meeting of the American Educational Research Association (AERA), Philadelphia, PA, (April 3-7). [Cited with author’s permission].

[25] Ibid., p. 32.

[26] Jeffrey Denning. (2016). “Born Under a Lucky Star: Financial Aid, College Completion, Labor Supply, and Credit Constraints.” Upjohn Institute Working Paper 17-267. Available at http://research.upjohn.org/cgi/viewcontent.cgi?article=1285&context=up_workingpapers.

[27] William Bennett. (1987). “Our Greedy Colleges.” New York Times. Available at http://www.nytimes.com/1987/02/18/opinion/our-greedy-colleges.html.

[28] See, for example: Andrew Kreighbaum. (2017). “The Conservative Approach to Student Loans.” Inside Higher Education. Available at https://www.insidehighered.com/news/2017/02/22/consensus-forms-loan-policies-among-conservative-thinkers; Theodore Bromund. (2016). “Blame Washington for Skyrocketed College Costs.” Heritage Foundation; Lindsay Burke. (2016). “Pertinent Issues Surrounding Reauthorization of the Higher Education Act.” Testimony before Committee on Education and the Workforce, United States House of Representatives, March 2, 2016. Available at http://www1.heritage.org/research/testimony/pertinent-issues-surrounding-reauthorization-of-the-higher-education-act; Neal McCluskey. (2015). “Yet More Empirical Evidence That Yes, Federal Student Aid Fuels College Price Inflation.” Cato Institute. Available at https://www.cato.org/blog/yet-more-empirical-evidence-yes-federal-student-aid-fuels-college-price-inflation; Joseph Lawler (2015). “Republicans Turn a Skeptical Eye on Effects of Federal College Aid.” Washington Examiner. Available at http://www.washingtonexaminer.com/republicans-turn-a-skeptical-eye-on-effects-of-federal-college-aid/article/2573358; Andrew Kelly. (2014). “Paul Ryan and the Emerging Conservative Reform Agenda in Higher Education.” Forbes. Available at https://www.forbes.com/sites/akelly/2014/07/30/paul-ryan-and-the-emerging-conservative-reform-agenda-in-higher-education/#6f46c14f7669; Andrew Gillen. (2012). “Introducing Bennett Hypothesis 2.0.” Center for College Affordability and Productivity. Available at http://files.eric.ed.gov/fulltext/ED536151.pdf; John Healy. (2012). “Republicans applying 'supply side' theory to benefits.” Los Angeles Times. Available at http://articles.latimes.com/2012/apr/30/news/la-ol-supply-side-new-meaning-house-republicans-20120427#; Neal McCluskey. (2008). “Higher Education Policy.” In David Boaz. (Ed.). “Cato Handbook for Policymakers.” 7th Edition, Cato Institute. Available at https://object.cato.org/sites/cato.org/files/serials/files/cato-handbook-policymakers/2009/9/hb111-21.pdf.

[29] Adam Stoll, David Bradley and Shannon Mahan. (2014). “Overview of the Relationship between Federal Student Aid and Increases in College Prices.” Congressional Research Service, R43692: pp. 32-33.

[30] Donald Heller. (2013). “Does Federal Financial Aid Drive Up College Prices?” American Council on Education: p. 18. Available at http://www.acenet.edu/news-room/Documents/Heller-Monograph.pdf.

[31] Robert B. Archibald and David H. Feldman. (2016). “Federal Financial Aid Policy and College Behavior.” American Council on Education; Bridget Terry Long. (2006). “College Tuition Pricing and Federal Financial Aid: Is there a Connection?” Testimony before the U.S. Senate Committee on Finance. Available at https://www.finance.senate.gov/imo/media/doc/120506bltest.pdf; Caroline Hoxby (Ed.). (2004). “College Choices: The Economics of Where to Go, When to Go, and How to Pay For It.” National Bureau of Economic Research: p. 6. Available at http://www.nber.org/chapters/c10096.pdf; Alisa Cunningham, Jane Wellman, Melissa Clinedinst, Jamie Merisotis, and Dennis Carroll (2001). “Study of College Costs and Prices, 1988–89 to 1997–98: Volume 1.” National Center for Education Statistics, NCES 2002–157: p. x. Available at https://nces.ed.gov/pubs2002/2002157.pdf; James Harvey, Roger Williams, Rita Kirshstein, Amy Smith O'Malley, and Jane V. Wellman. (1998). “Straight Talk About College Costs and Prices: Report of The National Commission on the Cost of Higher Education.” American Council on Education and The Oryx Press: p. 1.

[32] Stephanie Riegg Cellini. (2017). February 21, 2017, Letter to The Honorable Bobby Scott, Ranking Member, House Committee on Education and the Workforce, U.S. House of Representatives. Available at http://ticas.org/sites/default/files/u159/cellini_letter_housecommitteeonedworkforce_2-21-2017.pdf.

[33] Congressional Budget Office. (2013). “The Federal Pell Grant Program: Recent Growth and Policy Options.” Available at https://www.cbo.gov/publication/44448.

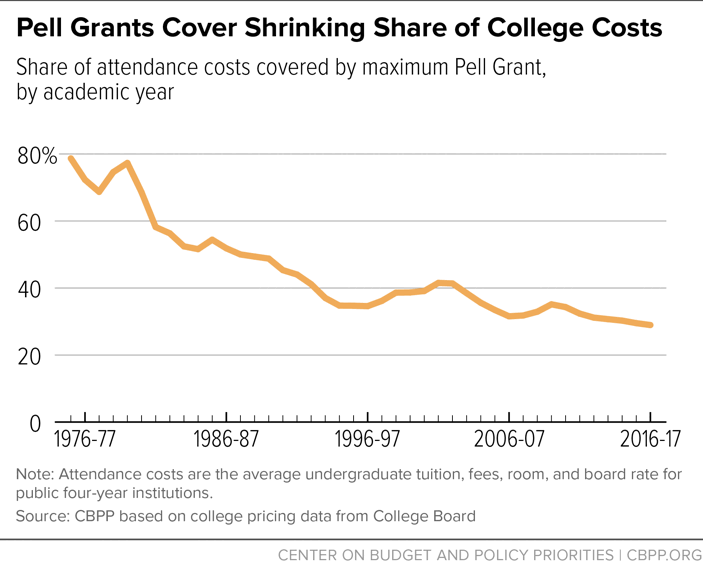

[34] Calculations by the authors, using data provided in: College Board. (2016). “Trends in College Pricing 2016: Figures and Tables.” Available at https://trends.collegeboard.org/sites/default/files/2016-trends-college-pricing-source-data_0.xlsx. Maximum Pell Grants’ purchasing power has decreased from covering 100 percent of public four-year tuition and fees in 2001-02 to 60 percent in 2016-17, and from 42 percent of public four-year tuition, fees, room and board in 2001-02 to 29 percent in 2016-17. According to the College Board, “Until 1985, individual Pell Grants were capped at 50% of the student’s cost of attendance. The cap was raised to 60% of the cost of attendance in 1985-86 and removed entirely in 1993.” (2016). “Trends in Student Aid 2016: Figures and Tables,” Table 8. Available at https://trends.collegeboard.org/sites/default/files/2016-trends-student-aid-source-data_0.xls.

[35] David H. Feldman. (2012). “Myths and Realities about Rising College Tuition.” National Association of Student Financial Aid Administrators. Available at http://www.nasfaa.org/news-item/4565/Myths_and_Realities_about_%20Rising_College_Tuition; Mark Kantrowitz. (2017). “Tuition Inflation.” Available at http://www.finaid.org/savings/tuition-inflation.phtml; College Board. (2017). “Tuition and Fees and Room and Board over Time.” Available at https://trends.collegeboard.org/college-pricing/figures-tables/tuition-fees-room-and-board-over-time.

[36] Huffington Post. (2012). “Cost Of College Degree In U.S. Has Increased 1,120 Percent In 30 Years, Report Says.” Available at http://www.huffingtonpost.com/2012/08/15/cost-of-college-degree-increase-12-fold-1120-percent-bloomberg_n_1783700.html.

[37] Bureau of Labor Statistics. (2016). “College tuition and fees increase 63 percent since January 2006.” Available at https://www.bls.gov/opub/ted/2016/college-tuition-and-fees-increase-63-percent-since-january-2006.htm.

[38] Department of Education. (2016). “Federal Pell Grant Program 2014-2015 End of Year Research Tables,” Table 18, calculations by the authors. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html.

[39] John Quinterno and Viany Orozco. (2012). “The Great Cost Shift: How Higher Education Cuts Undermine the Future Middle Class.” Demos. Available at http://www.demos.org/publication/great-cost-shift-how-higher-education-cuts-undermine-future-middle-class.

[40] State Higher Education Executive Officers. (2017). “State Higher Education Finance: FY 2016.” Available at http://sheeo.org/sites/default/files/SHEEO_SHEF_2016_Report.pdf.

[41] CBPP analysis of data from State Higher Education Executive Officers Association “State Higher Education Finance: FY2016,” April 2017, http://www.sheeo.org/projects/shef-fy16

[42] Ibid. See also: Michael Mitchell, Michael Leachman, and Kathleen Masterson. (2016). “Funding Down, Tuition Up: State Cuts to Higher Education Threaten Quality and Affordability at Public Colleges.” Center on Budget and Policy Priorities. Available at https://www.cbpp.org/research/state-budget-and-tax/funding-down-tuition-up; Michael Mitchell. (2015). “State Higher Ed Cuts Largely Driving Recent Tuition Hikes.” Center on Budget and Policy Priorities. Available at https://www.cbpp.org/blog/state-higher-ed-cuts-largely-driving-recent-tuition-hikes.

[43] Department of Education, “Federal Pell Grant Program 2015-2016 End of Year Research Tables,” Table 1. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html & U.S. Department of Education, “Federal Student Aid.” Available at https://teststudentaid.ed.gov/testise/about/announcements/pell-2016-17

[44] The Institute for College Access and Success. (2014). “Quick Facts About Student Debt” Available at http://ticas.org/sites/default/files/pub_files/Debt_Facts_and_Sources.pdf.

[45] The last award reduction was made in 1990, see: Department of Education. (2016). “Federal Pell Grant Program 2014-2015 End of Year Research Tables,” Table 1. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html.

[46] Calculations by the authors, using data provided in: Department of Education. (2017). “Federal Pell Grant Program Data Book, 2015-2016,” Table 1. Available at https://www2.ed.gov/finaid/prof/resources/data/pell-data.html; Department of Education. (2017). “FY 2018 Budget Request: Student Financial Assistance.” Available at https://www2.ed.gov/about/overview/budget/budget18/justifications/o-sfa.pdf; College Board. (2016). “Trends in Student Aid 2016: Figures and Tables.” Available at https://trends.collegeboard.org/sites/default/files/2016-trends-student-aid-source-data_0.xls.

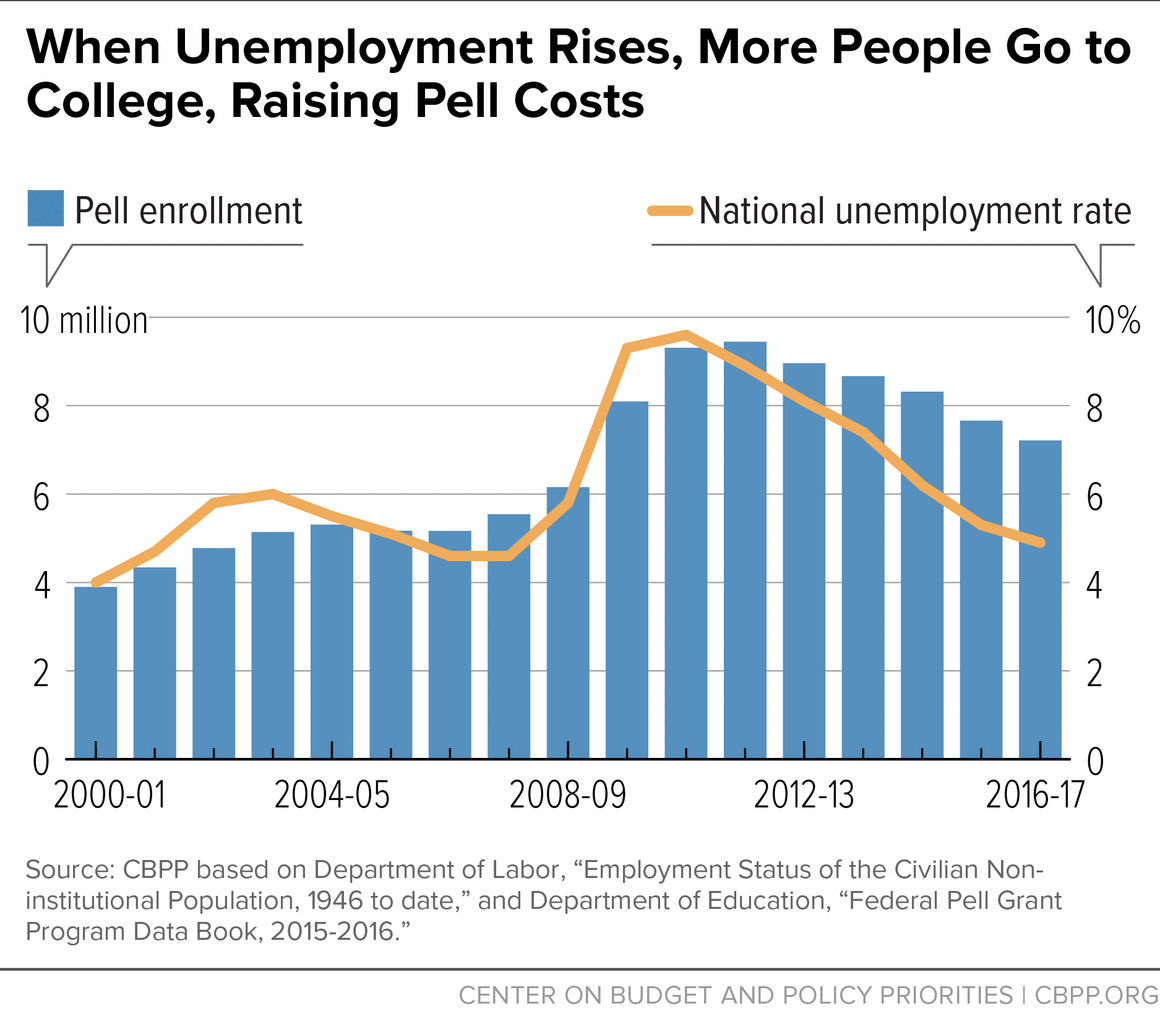

[47] See, for example: Jeffrey Brown and Caroline Hoxby (2015). “How the Financial Crisis and Great Recession Affected Higher Education.” National Bureau of Economic Research. Available at http://papers.nber.org/books/brow12-1; Andrew Barr and Sarah Turner. (2013). “Expanding Enrollments and Contracting State Budgets The Effect of the Great Recession on Higher Education,” The Annals of the American Academy of Political and Social Science Vol. 650(1); Nicholas Hillman and Erica Lee Orians. (2013). “Community Colleges and Labor Market Conditions: How Does Enrollment Demand Change Relative to Local Unemployment Rates?” Research in Higher Education, Vol. 54(7); National Student Research Clearinghouse. (2011). “National Postsecondary Enrollment Trends: Before, During, and After the Great Recession.” Available at https://nscresearchcenter.org/signaturereport1/; Harris Dellas and Plutarchos Sakellaris. (2002). “On the Cyclicality of Schooling: Theory and Evidence,” Oxford Economic Papers Vol. 55(1).

[48] Derek Quizon. (2011). “End of Year-Round Pell Grants Could Lead Many Nontraditional Students to Drop Out.” Chronicle of Higher Education. Available at http://www.chronicle.com/article/End-of-Year-Round-Pell-Grants/127153.

[49] David Reich and Brandon DeBot. (2015). “House Budget Committee Plan Cuts Pell Grants Deeply, Reducing Access to Higher Education.” Center on Budget and Policy Priorities.

[50] Congressional Budget Office. (2017). “The Budget and Economic Outlook: 2017 to 2027,” p. 12. Available at

https://www.cbo.gov/sites/default/files/115th-congress-2017-2018/reports/52370-budeconoutlook.pdf.

[51] Congressional Budget Office. (2017). “Pell Grant Program, Discretionary: Cumulative Shortfall/Surplus – CBO’s June 2017 Baseline.” Available at https://www.cbo.gov/sites/default/files/recurringdata/51304-2017-06-pellgrant.pdf.

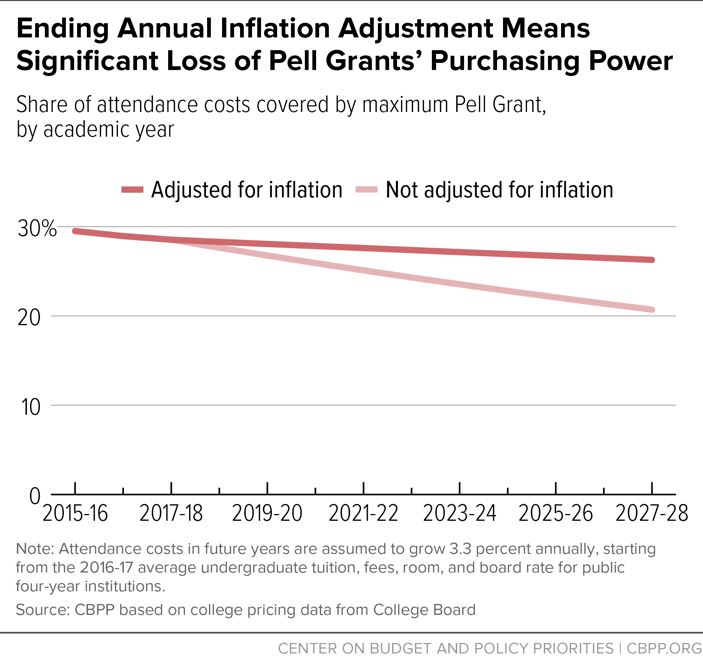

[52] CBPP calculations based on the June 2017 CBO baseline projections for Pell.

[53] If Congress were to continue to rescind an additional $1.3 billion per year, then it would need to increase discretionary appropriations in 2023. And, if Congress rescinds larger balances, as the House Appropriations Committee bill would do, additional discretionary resources will be needed sooner. And, if Congress rescinds larger balances, as the House Appropriations Committee bill would do, additional discretionary resources will be needed sooner.

[54] Annual growth rate in the average costs of tuition, fees, room, and board at public four-year colleges has averaged 5.3 percent over the last 20 academic years, ranging from 2.7 percent to 8.9 percent. For historical data on the increase in college costs, see: College Board. (2016). “Trends in College Pricing 2016: Figures and Tables,” Table 2. Available at https://trends.collegeboard.org/sites/default/files/2016-trends-college-pricing-source-data_0.xlsx.

[55] While some of this increase stemmed from indexing which began in 2013, most of this increase came from two pieces of legislation that raised the maximum grant before indexation began.

[56] See, for example: The Pell Institute for the Study of Opportunity in Higher Education and the University of Pennsylvania Alliance for Higher Education and Democracy. (2016). “Indicators of Higher Education Equity in the United States: 2016 Historical Trend Report.” Available at http://www.pellinstitute.org/downloads/publications-Indicators_of_Higher_Education_Equity_in_the_US_2016_Historical_Trend_Report.pdf; Andrew Nichols. (2015). “The Pell Partnership: Ensuring a Shared Responsibility for Low-Income Student Success.” The Education Trust. Available at https://edtrust.org/wp-content/uploads/2014/09/ThePellPartnership_EdTrust_20152.pdf.

[57] House Education and Workforce Committee. (2017). “Budget Views and Estimates for Fiscal Year 2018.” Available at https://edworkforce.house.gov/uploadedfiles/budget_views_and_estimates_for_fiscal_year_2018_-_final.pdf; House Budget Committee. (2016). “A Balanced Budget for a Stronger America: Fiscal Year 2017 Budget Resolution.” Available at http://budget.house.gov/uploadedfiles/fy2017_a_balanced_budget_for_a_stronger_america.pdf.

[58] CBPP calculations based on the June 2017 CBO baseline projections for Pell; Lindsay Ahlman. (2017). “What the House Republican proposal to cut $77 billion in mandatory Pell Grant funding means for students.” The Institute for College Access and Success. Available at http://ticas.org/blog/what-house-republican-proposal-cut-77-billion-mandatory-pell-grant-funding-means-students.