BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on the federal budget, health, housing, state budgets and taxes, food assistance, poverty and inequality, and the economy.

- On the federal budget, Sharon Parrott, Aviva Aron-Dine, Jacob Leibenluft, David Reich, and Chad Stone outlined five things to look for in the President’s upcoming 2019 budget. Richard Kogan and Guillermo Herrera argued that low-income mandatory programs are not to blame for the long-term deficit problem. David Reich explained that while the bipartisan budget deal increases non-defense discretionary funding, it remains below its level eight years ago in inflation-adjusted terms.

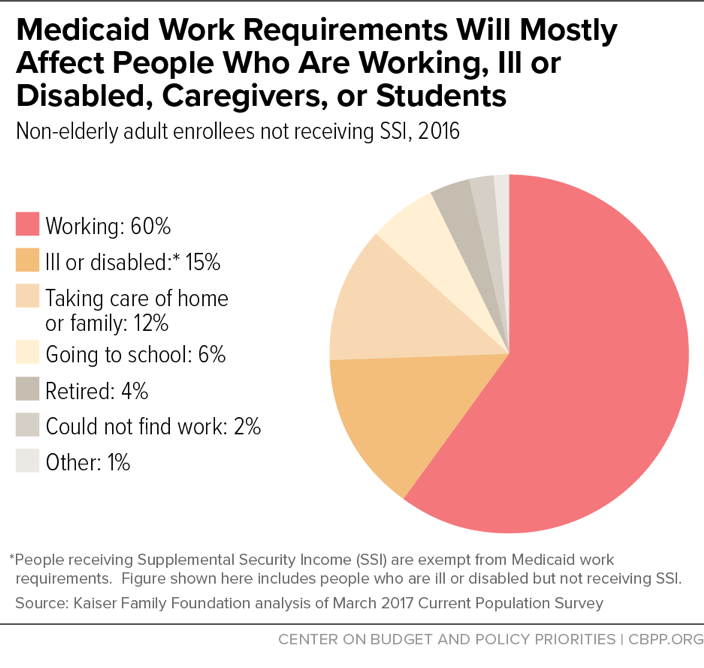

- On health, Hannah Katch, Jennifer Wagner, and Aron-Dine analyzed how Medicaid work requirements will reduce low-income families’ access to care and worsen health outcomes, and summarized these findings. We released a Medicaid brief on how work requirements will harm people with substance use disorders. Sarah Lueck detailed why skimpy health plans put consumers and insurance markets at risk, and called on policymakers to craft reinsurance proposals to lower premiums and help more people. Shelby Gonzales pointed out that some consumers still have time to select a 2018 health insurance plan.

- On housing, Barbara Sard, Mary K. Cunningham, and Robert Greensteinargued that creating a new type of rental voucher could help young children move out of poverty and address the housing voucher shortage. Douglas Rice outlined the five things to look for in the President's 2019 budget for the Department of Housing and Urban Development. Will Fischer warned that President Trump’s plan to allow work requirements for rental assistance will hurt families, not support work. Fischer also explained that Trump’s new rent plan would raise rents on many low-wage workers and others already struggling to afford housing. We released a new chart book on employment and earnings for households receiving federal rental assistance.

- On state budgets and taxes, Erica Williams and Samantha Waxman called for states to adopt or expand Earned Income Tax Credits (EITCs), and noted that state policymakers can help build an economy that works for everyone by strengthening these EITCs and state minimum wages. Williams highlighted how state-level EITCs continue to gain momentum. We updated our policy basic on states with supermajority requirements for raising revenues.

- On food assistance, Ed Bolen and Stacy Dean explained that waivers add important state flexibility to SNAP’s harsh three-month time limit. We updated our quick guide to SNAP eligibility and benefits.

- On poverty and inequality, Danilo Trisi showed how economic security and health programs reduce poverty and hardship, resulting in long-term benefits.

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the Week: Medicaid Work Requirements Will Mostly Affect People Who Are Working, Ill or Disabled, Caregivers, or Students

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Why Congress’s new spending deal gets the (cautious) support of a leading liberal budget wonk

Vox

February 8, 2018

Trump Administration: Let States Decide if Health Plans Have Enough Doctors

Stateline

February 6, 2018

Trump may push work requirements for federal housing assistance

NBC News

February 6, 2018

In defense of Social Security Disability Insurance

Vox

February 6, 2018

The Real Lessons From Bill Clinton's Welfare Reform

The Atlantic

February 5, 2018

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.