BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on the federal budget and taxes, state budgets and taxes, health, food assistance, housing, and the economy.

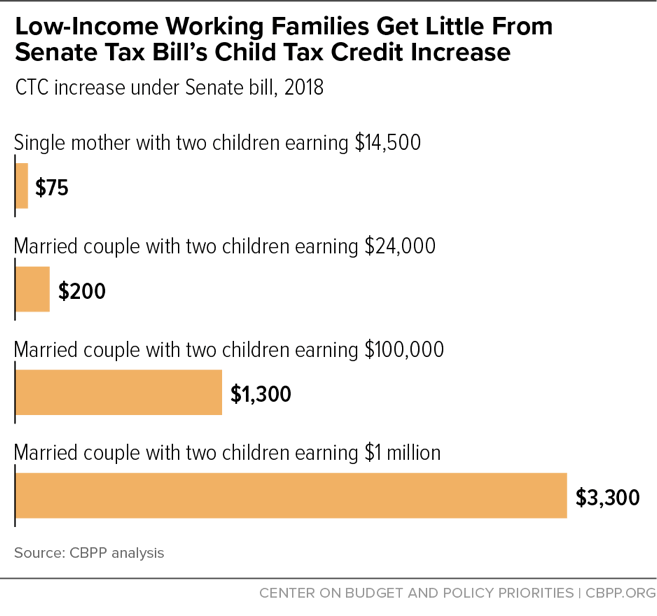

- On the federal budget and taxes, Sharon Parrott explained why the Senate tax bill has the same basic flaws as the House bill. Chuck Marr, Chye-Ching Huang, Arloc Sherman, and Emily Horton detailed state by state the number of children from low-income working families who would be left out of the House tax bill’s Child Tax Credit (CTC) increase. Marr summarized these findings, and explained that the Senate tax bill would limit the CTC for low-income children while extending it to wealthy households. Jacob Leibenluft pointed out that the House tax bill’s Social Security Number requirement for the CTC would hurt 3 million children in low-income working families. Huang showed that the Senate’s plan to double the estate tax exemption would give a windfall to the heirs of wealthiest estates.

Huang and Guillermo Herrera analyzed the Joint Committee on Taxation’s distribution tables on the House tax bill, which show the bill overwhelmingly benefits the rich. Aviva Aron-Dine explained that House Republicans are considering including a repeal of the Affordable Care Act’s (ACA) individual mandate in their tax bill, which would increase the number of uninsured by millions and raise premiums. We updated our brief detailing how the Senate budget plan threatens health programs.

We released and updated several budget briefs that explain the effects of the two-step Republican agenda — enacting major tax cuts now for corporations and the wealthy, then paying for them later by cutting programs that mostly help low- and middle-income families. We released briefs describing how these tax cuts will leave workers, women, African Americans, and Latinos worse off. We also added one explaining how the tax cuts would shortchange infrastructure investments. We updated our briefs describing how these tax cuts would harm students and schools, the elderly, children, and people with disabilities. Finally, we updated our briefs detailing how these cuts would threaten SNAP (formerly food stamps) and increase homelessness and hardship. - On state budgets and taxes, Michael Leachman warned that the Senate’s plan to eliminate the federal deduction for state and local taxes is a bad trade for most Americans.

- On health, Jesse Cross-Call argued that Maine should move quickly to implement the ACA Medicaid expansion that voters approved by ballot initiative on Tuesday. Sarah Lueck warned that the Trump Administration’s proposed changes to the ACA’s Essential Health Benefits standard would seriously threaten comprehensive coverage. Jessica Schubel explained why granting Iowa a waiver to eliminate Medicaid’s retroactive coverage harms beneficiaries and providers.

- On food assistance, Lexin Cai broke down how 1.5 million low-income veterans, including thousands in every state, benefit from SNAP.

- On housing, Alicia Mazzara reported that federal rental assistance plays a vital role in urban, suburban, and rural communities alike, and summarized those findings in a blog. Lissette Flores detailed the impressive success of the Department of Housing and Urban Development-Veterans Affairs Supportive Housing program in helping homeless veterans secure stable and affordable homes.

- On the economy, we updated our chartbook on the Great Recession.

Chart of the Week – Low-Income Working Families Get Little or Nothing From Senate Tax Bill’s Child Tax Credit Increase

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Mainers voted for health care. They deserve more than LePage’s obstruction.

Bangor Daily News

November 8, 2017

A Math 'Gimmick'? GOP Proposes Creating New Tax Policies, Then Letting Them Expire

NPR

November 7, 2017

No doubt about who wins under the GOP tax plan

The Washington Post

November 6, 2017

The Republican tax bill, explained with a bowl of cartoon cereal

Vox

November 6, 2017

How Much Would Families Save Under the GOP Tax Bill?

NBC News

November 3, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram