- Home

- Republican Plans To Cut Taxes Now, Cut P...

Republican Plans to Cut Taxes Now, Cut Programs Later Would Increase Homelessness and Hardship

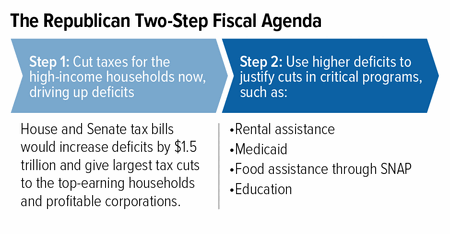

Congressional Republicans this fall are poised to launch step one of a likely two-step tax and budget agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then paying for them later through program cuts mostly affecting low- and middle-income families. Most individuals and families would lose more from the program cuts than they would gain from the tax cuts.

Congress appears headed toward crafting a tax-cut bill that would largely benefit the top 1 percent of households and profitable corporations, while increasing deficits by $1.5 trillion over the next decade. (And the true cost, with no budget gimmicks, could be even higher.) Tax cuts will lead to larger deficits — claims that tax cuts pay for themselves fly in the face of decades of experience and credible, mainstream economic research.

When deficits rise, those who supported the tax cuts will likely label these deficits as unacceptable and point to spending as the culprit. When that happens, they presumably will call for the kinds of deep cuts they’ve already proposed in their long-range budget plans, which would hit housing and other basic assistance for struggling families, health care and education, and other key investments. Those cuts could happen as soon as next year.

Congressional leaders could have chosen to write a single bill with both the tax cuts they favor and the program cuts or tax increases to pay for them. This would have enabled the public and policymakers to evaluate the tradeoffs and make an informed decision. Instead, they have chosen to obscure this tradeoff by splitting their agenda into two parts. But this doesn’t change the reality: the wealthy would win large tax cuts while everyone else would pay the tab.

When Tax Cuts Are Ultimately Paid For, Rental Assistance for Vulnerable Families a Likely Target

President Trump and congressional leaders have been very clear on the areas they want to cut. The Trump and congressional budget plans for the next decade would cut basic housing, food, and other assistance, as well as health care for millions of low- and moderate-income families with children, making it harder for them to keep a roof over their heads, get health care, and meet other basic needs. The budget plans also would cut key investments in areas such as education. Indeed, the Administration and congressional leaders have already pointed to current deficit projections — even without $1.5 trillion in new, deficit-increasing tax cuts — to justify these cuts. Once a tax bill is law and deficits grow, they will likely argue that the resulting higher deficits make cuts in housing aid and other basic assistance even more urgent.

- The Trump and congressional budget plans would deeply cut non-defense discretionary (NDD) funding, the budget area that includes a broad range of investments and public services, from housing assistance to education to scientific research and transportation. These cuts would come on top of cuts imposed since 2010. By 2027, under the congressional budget plan, overall NDD funding would be 18 percent below its 2017 level and 29 percent below its 2010 level, after adjusting for inflation. The cuts under the Trump plan are even deeper. Under both plans, by 2027 NDD spending would fall as a share of the economy to levels likely not seen since the Hoover Administration.

- While the congressional budget plan doesn’t say where its NDD cuts would come from, early evidence comes from the President’s 2018 budget, which would hit housing assistance hard. The President’s proposal for 2018, when his cuts would be far less deep than those in 2027 under both the Trump and congressional budget plans, would:

-

Eliminate Housing Choice Vouchers for 250,000 low-income households. Because the program mainly helps extremely low-income seniors, people with disabilities, and working families with children, the cuts would hit these groups hardest, increasing homelessness and other hardships and undermining the housing stability that children need to thrive and succeed.

-

Slash public housing by $1.8 billion or 29 percent. Public housing already faces more than $26 billion in repair needs, such as fixing leaky roofs or replacing outdated heating systems. Such massive cuts — on top of the 22 percent cut from 2010 to 2017 — would further jeopardize the health and safety of public housing’s 2.2 million residents. The cuts would also sharply accelerate the loss of affordable units.

-

Cut $133 million from homeless assistance grants. These grants are essential to community efforts to prevent homelessness, help homeless families move quickly out of shelters and into stable homes, and reduce long-term or repeated homelessness among people with mental illness and other disabilities.

-

Eliminate flexible aid to poor rural and urban communities through the HOME, Community Development Block Grant, and Choice Neighborhoods programs. Altogether, poor communities would lose more than $4.1 billion a year to improve basic infrastructure (such as streets and sewer lines), provide life-enriching services to youth and seniors, build and rehabilitate affordable housing for low-income residents, and promote economic development. Rather than boost states’ and localities’ ability to help their residents live healthy and productive lives, the budget abandons communities that need federal resources.

-

-

The budget plans would likely force much deeper cuts in housing aid over time. If the NDD cuts were imposed proportionally, an estimated 900,000 low-income households would lose rental assistance by 2027 under the congressional budget plan, for example. Well over half of the households losing aid would include seniors or people with disabilities, and more than a third would include children, based on current program participation.

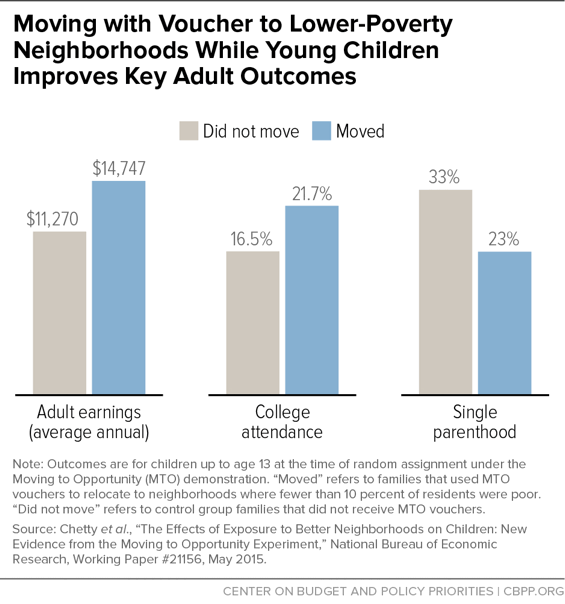

The proposed cuts would worsen homelessness, poverty, and other hardships. Homeless families without rental assistance are likelier to face homelessness and housing instability again in the future, for example. They also are likelier to be food insecure, and their children are likelier to be separated from the family. Cuts in housing vouchers — the largest federal rental assistance program — can also harm children’s chances of future success. Research shows that children whose families use vouchers to move to low-poverty neighborhoods with quality schools and other opportunities are likelier to attend college and less likely to become single parents; they also earn more as adults (see chart).

The Bottom Line: High-End Tax Cuts Set Stage for Large Housing Cuts

The GOP tax framework released in late September and the tax bill proposed by House Ways and Means Chairman Kevin Brady would provide very large tax cuts to the wealthiest Americans and profitable corporations, while providing only modest or no help to millions of low- and moderate-income families with children. Indeed, under the House plan, 10 million children in low-income working families would not benefit at all from the proposed expansion in the Child Tax Credit and 13 million additional children would receive less than the full $600-per-child benefit available to higher-income families. When Congress turns its attention to paying for those tax cuts, struggling families, seniors, and people with disabilities would likely lose far more in housing, health care, food assistance, and public services — including educational opportunities — than they would gain from the heavily skewed tax cuts.