- Home

- Republican Plans To Cut Taxes Now, Cut P...

Republican Plans to Cut Taxes Now, Cut Programs Later Would Harm Students and Schools

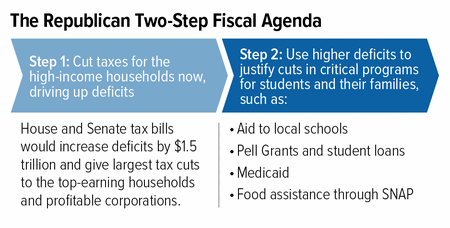

Congressional Republicans this fall are poised to launch step one of a likely two-step tax and budget agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then paying for them later through program cuts mostly affecting low- and middle-income families. Schoolchildren, parents, college students, and others with a stake in education would end up bearing part of the cost.

Congress appears headed toward crafting a tax-cut bill that would largely benefit the top 1 percent of households and profitable corporations, while increasing deficits by $1.5 trillion over the next decade. (And the true cost, with no budget gimmicks, could be even higher.) Tax cuts will lead to larger deficits — claims that tax cuts pay for themselves fly in the face of decades of experience and credible, mainstream economic research.

When deficits rise, those who supported the tax cuts will likely label these deficits as unacceptable and point to spending as the culprit. When that happens, they presumably will call for the kinds of deep cuts they’ve already proposed in their long-range budget plans, which would hit education, basic assistance for struggling families, health care, and other key investments. Those cuts could happen as soon as next year.

Congressional leaders could have chosen to write a single bill with both the tax cuts they favor and the program cuts or tax increases to pay for them. This would have enabled the public and policymakers to evaluate the tradeoffs and make an informed decision. Instead, they have chosen to obscure this tradeoff by splitting their agenda into two parts. But this doesn’t change the reality: the wealthy would win large tax cuts while everyone else would pay the tab.

When Tax Cuts Are Ultimately Paid For, Education Investments Will Likely Shrink

President Trump and congressional leaders have been very clear on the areas they want to cut. The Trump and congressional budget plans for the next decade all would cut basic assistance and health care for millions of low- and moderate-income families with children, along with investments and services in areas such as education, job training, infrastructure, and environmental protection. Indeed, the Administration and congressional leaders have already pointed to existing projected deficits — even before $1.5 trillion in deficit-increasing tax cuts are made — to justify these cuts. Once a tax bill is law and deficits grow, they will likely argue that the resulting higher deficits make cuts in a range of areas, including elementary and secondary (K-12) education and financial aid for college students, even more urgent.

The federal government provides modest but important support for K-12 education, about three-quarters of it through two large formula grant programs aimed at helping low-income and disadvantaged students and students with disabilities. Education aid is part of the non-defense discretionary (NDD) budget category, which the Trump and congressional budget plans would cut deeply, on top of cuts already imposed since 2010.

By 2027, NDD funding under the congressional plan would be 18 percent below its 2017 level and 29 percent below its 2010 level, after adjusting for inflation. The Trump plan’s cuts are deeper still. Under both plans, by 2027 NDD spending would fall as a share of the economy to levels likely not seen since the Hoover Administration.

Cuts of this magnitude would almost certainly affect aid to local schools. Although the budget plans are vague about what they intend to cut in future years, education seems an especially likely target because it has already been a target of congressional Republicans and the Trump Administration:

- The House-passed 2018 funding bill would cut K-12 funding by $2.3 billion, bringing the total inflation-adjusted cut since 2010 to 20 percent. The bill would eliminate grants to school districts for recruiting, training, supporting, and retaining high-quality teachers and cut support for after-school programs in high-need schools, among other things.

- The Trump budget for 2018 calls for an even deeper cut of $3.6 billion, which would leave K-12 funding 23 percent below the 2010 level, after adjusting for inflation.

Under the congressional budget plan, if K-12 education is cut by the same percentage as overall NDD funding, by 2027 it would be 29 percent below the 2010 level in inflation-adjusted dollars — nearly a one-third drop. The cuts would be even larger under the Trump plan.

Financial aid for college students is similarly at risk, including Pell Grants, which help more than 7 million low- and moderate-income students pay tuition, fees, room, and board. At least three-quarters of Pell spending falls into the NDD budget category, so the large cuts in overall NDD funding in the Republican budget plans could well lead to cuts in Pell Grant amounts or eligibility. Also, prior congressional proposals have called for eliminating Pell’s other funding source (“mandatory” funding), almost inevitably shrinking the maximum grant from $5,920 to $4,860 or less. The congressional budget plan calls for steep cuts in the part of the budget that funds this mandatory Pell funding and student loans.

Pell Grants cover a much smaller share of college costs than they used to, as grant levels have failed to keep up with costs, and Republican budget priorities would likely worsen the problem. Last year, the maximum grant covered just 29 percent of the average cost of tuition, fees, room, and board at a public four-year college — the lowest share in the program’s history and less than half the 79 percent share covered in 1975-76. That percentage will likely drop further when annual adjustments in grant amounts to compensate for general inflation stop next year.

Federal student loan programs are also at risk. The Trump budget calls for cuts that would increase borrowers’ costs and the congressional budget plan, while providing fewer specifics, also calls for cuts in this area.

The Bottom Line: Program Cuts Would Outweigh Most Families’ Tax Cuts

The GOP tax framework released in late September and the tax bill proposed by House Ways and Means Chairman Kevin Brady would provide very large tax cuts to the wealthiest Americans and profitable corporations, while providing only modest or no modest help to millions of low- and moderate-income families with children. Indeed, under the House plan, 10 million children in low-income working families would not benefit at all from the proposed expansion in the Child Tax Credit and 13 million additional children would receive less than the full $600-per-child increase available to higher-income families. When Congress turns its attention to paying for those tax cuts, low- and middle-income families would lose school funding and college aid — as well as health care, food and housing assistance, and other supports — that they need to thrive now and in the future.