- Home

- Federal Budget

- Republican Plans To Cut Taxes Now, Cut P...

Republican Plans to Cut Taxes Now, Cut Programs Later Would Shortchange Infrastructure Investments

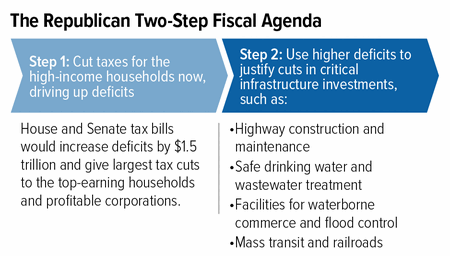

Congressional Republicans this fall are poised to launch step one of a likely two-step tax and budget agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then paying for them later through program cuts. Investments in infrastructure would likely end up bearing part of the cost.

Congress appears headed toward crafting a tax-cut bill that would largely benefit the top 1 percent of households and profitable corporations, while increasing deficits by $1.5 trillion over the next decade. (And the true cost, with no budget gimmicks, could be even higher.) Tax cuts will lead to larger deficits — claims that tax cuts pay for themselves fly in the face of decades of experience and credible, mainstream economic research.

When deficits rise, those who supported the tax cuts will likely label these deficits as unacceptable and point to spending as the culprit. When that happens, they presumably will call for the kinds of deep cuts they’ve already proposed in their long-range budget plans, which would hit infrastructure as well as education, basic assistance for struggling families, health care, and other key investments. Those cuts could happen as soon as next year.

Congressional Republicans could have chosen to write a single bill with both the tax cuts they favor and the program cuts or tax increases to pay for them. This would have enabled the public and policymakers to evaluate the tradeoffs and make an informed decision. Instead, they have chosen to obscure this tradeoff by splitting their agenda into two parts. But this doesn’t change the reality: the wealthy would win large tax cuts while everyone else would pay the tab.

When Tax Cuts Ultimately Are Paid For, Infrastructure Investments

Will Likely Shrink

President Trump and congressional leaders have been very clear on the areas they want to cut. The Trump and congressional budget plans for the next decade would cut basic assistance and health care for millions of low- and moderate-income people as well as investments and services in areas such as infrastructure, community development, education, job training, and environmental protection. Indeed, the Administration and congressional leaders have already pointed to existing projected deficits — even before $1.5 trillion in deficit-increasing tax cuts are made — to justify these cuts. Once a tax bill is law and deficits grow, they will likely argue that the resulting higher deficits make cuts in a range of areas necessary. These cuts likely will include investments in highways, transit, drinking water and wastewater treatment systems, and other infrastructure needs.

Adequate, well-functioning public infrastructure is crucial to a strong economy and good quality of life. Yet, as numerous studies demonstrate, our nation’s infrastructure falls short. In its most recent “report card” on the state of U.S. infrastructure, the American Society of Civil Engineers gave it an overall grade of D+ and cited investment needs of $2 trillion. The $1.5 trillion revenue loss from tax cuts would greatly hamper the federal government’s ability to address this problem.

-

Highway Trust Fund programs. The cost of tax cuts would make it harder to deal with the chronic financing problems facing the Highway Trust Fund, the source of most federal investments in highways and mass transit. The trust fund is mainly financed through taxes on gasoline and other fuels, which have remained constant in cents-per-gallon since 1993, resulting in steady erosion of their purchasing power. To provide more adequate funding, Congress has periodically made transfers into the trust fund from other sources, but future transfers would be more difficult as deficits rise because of the tax-cut bill.

The congressional budget plan clearly envisions reduced federal investment in highway and mass transit infrastructure in the future. Similar to other recent congressional budgets, the budget resolution adopted in October calls for a $190 billion (33 percent) cut below current-law levels over the next ten years in funding for mandatory transportation programs. This budget category, which largely consists of the Highway Trust Fund, is already scheduled to decline in 2020 under current law.

The Trump budget also calls for cutting the Highway Trust Fund. While it includes a separate proposal to increase infrastructure spending by $200 billion over the next decade, the details remain vague and there has been little movement in Congress to create this new funding stream.

-

Appropriated programs. Many other federal infrastructure investments are funded though annual appropriations, and both the Trump and congressional budget plans would cut that category deeply — on top of cuts already imposed since 2010. By 2027, funding for non-defense discretionary (NDD) programs under the congressional budget plan would be 18 percent below its 2017 level and 29 percent below its 2010 level, after adjusting for inflation. The Trump budget’s cuts are considerably deeper. Under both plans, by 2027 NDD spending would fall as a share of the economy to levels likely not seen since the Hoover Administration. Overall cuts of this magnitude would almost certainly affect federal assistance for infrastructure — and the Trump budget and congressional appropriations bills in fact propose cuts in a number of these programs in 2018:

- Drinking water and wastewater treatment. The Environmental Protection Agency (EPA) and the Agriculture Department’s rural development programs help states and localities finance safe drinking water and wastewater treatment infrastructure. Despite large investment needs — $655 billion over 20 years, according to the EPA — federal water infrastructure funding has generally been decreasing. EPA infrastructure appropriations in 2017 were 35 percent below the 2001 level and 13 percent below the 2011 level, after adjusting for inflation, but for 2018 neither the Trump budget nor the congressional appropriations provide even an inflation adjustment. The House-passed appropriations bills for 2018 would cut the rural development programs by 19 percent, adjusted for inflation, while the Trump budget for 2018 would eliminate them entirely.

- Water resources. Almost $6 billion in annual federal infrastructure funding comes through the civil works programs of the Army Corps of Engineers, which builds, maintains, and operates dams, levees, locks, harbors, and other facilities for waterborne commerce and flood control. While these programs have not recently received large cuts, that could change if overall NDD funding shrinks as the Trump and congressional budget plans envision. In fact, the Trump budget for 2018 reduces Corps civil works funding by about one-fifth.

- Mass transit. Federal investments to increase mass transit capacity are provided through annual appropriations, which totaled $2.4 billion in 2017. For 2018, the Trump budget cuts this funding roughly in half, while the House appropriations bill cuts it by 29 percent, after adjusting for inflation.

- Railroads. The federal government provides capital and operating support for Amtrak, as well as assistance for various other rail projects. Amtrak appropriations have dropped by 15 percent since 2010, adjusted for inflation. The Trump budget would impose an additional 50 percent inflation-adjusted cut in 2018, while the House appropriations bill proposes a 7 percent cut.

- Effect on state budgets. State and local governments finance roughly three-quarters of public infrastructure spending. The congressional budget plan would likely weaken their capacity to support infrastructure projects because its cuts in areas like Medicaid and education would strain state and local budgets. Limiting federal income tax deductions for state and local taxes, as the tax bill proposed by House Ways and Means Chairman Kevin Brady would do, could make it still harder for states and localities to raise funds for these important investments.

The Bottom Line: High-End Tax Cuts Set Stage for Infrastructure Cuts

The GOP tax framework released in late September and the tax bill from Chairman Brady would provide very large tax cuts to the wealthiest Americans and profitable corporations, while providing only modest or no modest help to millions of low- and moderate-income households. When Congress turns its attention to paying for those tax cuts, a broad set of investments — including in our nation’s infrastructure — is likely to be shortchanged.