off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

In Case You Missed It…

| By

CBPP

This week at CBPP we focused on federal taxes, health care, the federal budget, state budgets and taxes, food assistance, housing, and the economy.

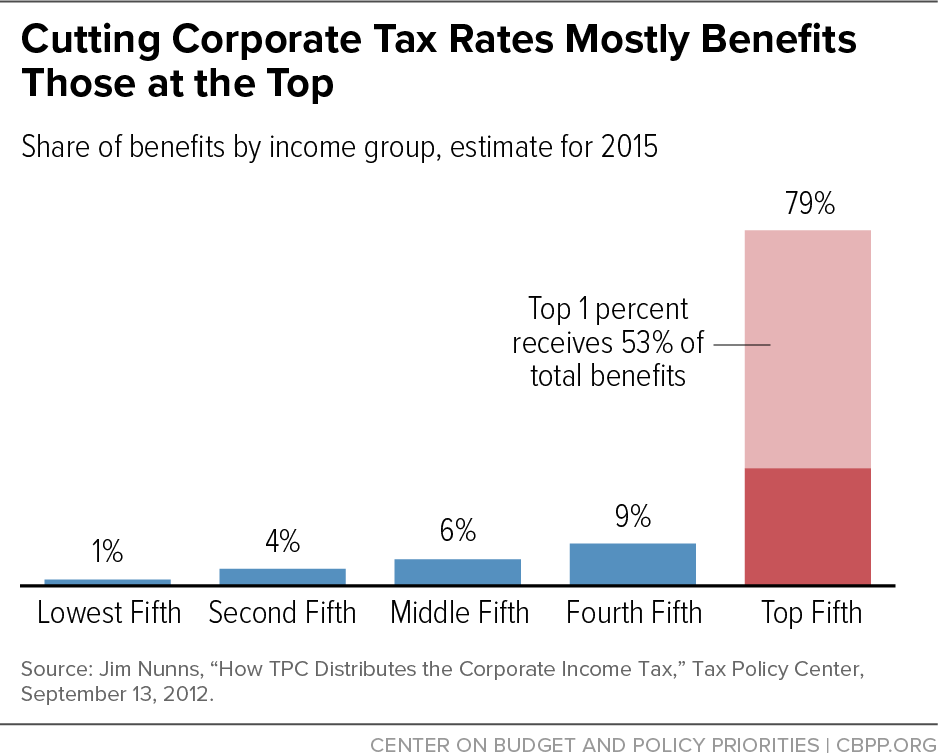

- On federal taxes, ahead of the announcement of President Trump’s tax plan, Chye-Ching Huang rounded up key tax policy resources and Chuck Marr questioned whether the new Trump plan would reflect the GOP’s own stated tax reform principles. After the announcement, Marr emphasized that the plan details costly tax cuts for the wealthy and corporations, while presenting only fuzzy promises for working families. Huang pointed out that President Trump’s new tax plan still fails to meet GOP leaders’ tax reform principles and explained that the historical record and careful, mainstream economic research show that huge tax cuts for those at the top don’t boost growth substantially. Emily Horton outlined how egregious employment tax evasion grows as IRS enforcement funding shrinks. In two tax policy briefs, we explained how the Trump campaign and House GOP tax plans both violated Treasury Secretary Steven Mnuchin’s standard that there will be no absolute tax cut for the upper class and outlined why tax reform should raise revenues and certainly not lose them. In two tax policy briefs on corporate taxes, we cautioned that corporate rate cuts are a poor way to help the economy and workers and clarified that actual U.S. corporate tax rates are in line with comparable countries.

- On health care, Aviva Aron-Dine, Edwin Park, and Jacob Leibenluft warned that an amendment from Reps. MacArthur and Meadows to the House Republican bill to repeal the Affordable Care Act (ACA) would gut protections for people with pre-existing conditions, while making no changes to address the flaws in the underlying bill. Aron-Dine fact checked claims about the new amendment. Park recounted how the combination of eliminating the ACA’s essential health benefit requirement and the House GOP’s bill’s inadequate tax credits would likely lead to rampant fraud and insurer abuses. Tara Straw and Matt Broaddus detailed how the House Republican plan would cut tax credits and raise costs for consumers in California. We rounded up resources about the House Republican plan’s flaws. Judy Solomon warned that Maine’s new proposal for a Medicaid waiver seeks unprecedented changes that would likely leave many without access to needed health care. Solomon also explained why Wisconsin’s Medicaid proposals don’t warrant federal approval. Jesse Cross-Call noted that states that have expanded Medicaid saw the greatest gains in veterans’ health coverage.

- On the federal budget, Sharon Parrott and Aviva Aron-Dine cautioned that at nearly 100 days in office, President Trump has begun to define and implement an agenda that would harm the families he says he wants to help — those struggling in today’s economy — often to help drive policies that would benefit very high-income households and corporations.

- On state budgets and taxes, we outlined how constitutional revenue limits and tight expenditure limits can hurt state economies. Eric Figueroa discussed a new study showing that young undocumented immigrants pay a larger share of their income in state and local taxes than the top 1 percent of taxpayers. We updated our backgrounder on where our state tax dollars go.

- On food assistance, Brynne Keith-Jennings pointed out that SNAP caseloads continue to fall. Keith-Jennings also introduced our This Is Snap campaign, designed to help you get to know SNAP (formerly food stamps) a little better. We updated our backgrounder on the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

- On housing, we discussed why scarce funds for housing subsidies should not be spent to expand subsidies to middle-income households. In our continuing “Housing Vouchers Work” blog series, Douglas Rice showed how vouchers strengthen both families and communities and Barbara Sard explained that vouchers are effective for all types of people and places.

- On the economy, Chad Stone testified before the U.S. House of Representatives Committee on Small Business Subcommittee on Economic Growth, Tax, and Capital Access, highlighting the various causes, benefits, and limits of economic growth. We updated our chart book on the legacy of the Great Recession.

Chart of the Week: Cutting Corporate Tax Rates Mostly Benefits Those at the Top

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Trump tax plan could save him millions under guise of helping small businesses

Guardian

April 27, 2017

Trump Wants to Give Himself a Tax Cut and Undermine the Tax Code

New Yorker

April 26, 2017

Trump’s “tax plan” isn’t a real plan

Vox

April 26, 2017

Four reasons Trump is messing up corporate tax reform

Washington Post

April 26, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.

Stay up to date

Receive the latest news and reports from the Center