BEYOND THE NUMBERS

Will the tax plan that the Trump Administration will reportedly release this week meet three principles that key Republicans, including the President and other top Administration officials, have advanced: not reducing overall revenues, not cutting taxes for the wealthy, and focusing its benefits on workers and families? Trump’s campaign tax plan — a fiscally irresponsible tax cut for the nation’s highest-income households — failed all three. If the Administration hasn’t developed a new plan that meets these standards, it will continue to push for a costly giveaway to those who least need a tax cut.

1. Revenue neutrality

The nation faces many challenges in the coming years, including an aging population with health and retirement needs, unmet infrastructure and human capital needs, major security threats, and the difficulty of remaining at the cutting edge of scientific and technological advancement. Each challenge could require increased federal spending. That’s why tax reform should raise revenues and why, by contrast, severely reducing revenues — as the Trump campaign tax plan would have done — would threaten funding for these vital needs.

But at the absolute minimum, tax reform should not lose revenues, a standard that key Republican leaders have put forward:

- House Speaker Paul Ryan: “[W]e’re planning revenue-neutral tax reform, which means you have to take away loopholes and special interest deductions if you’re going to lower tax rates.”

- Senate Majority Leader Mitch McConnell: “[I]f you do revenue-neutral tax reform, and that's what I think it ought to be, you can't do it without going after a lot of [tax] preferences.”

- National Economic Council Director Gary Cohn: “We care about the deficit. We care about revenue.... We're going to have to be deficit neutral over a ten-year period.”

The Trump campaign tax plan badly failed this standard, losing $6.2 trillion in revenue over ten years, according to the Tax Policy Center.

To evaluate whether the Administration’s coming tax plan meets this standard, Congress should use traditional budget estimates, from its Joint Committee on Taxation, that don’t try to quantify the highly uncertain effects of tax changes on the overall size of the economy or rely on dubious estimates of how much tax cuts will increase economic growth.

2. “Mnuchin rule”— no absolute tax cuts for the “upper class”

In an interview shortly after his nomination, Treasury Secretary Steven Mnuchin stated:

Any reductions we have in upper-income taxes will be offset by less deductions, so there will be no absolute tax cut for the upper class. There will be a big tax cut for the middle class, but any tax cuts we have for the upper class will be offset by less deductions that pay for it.

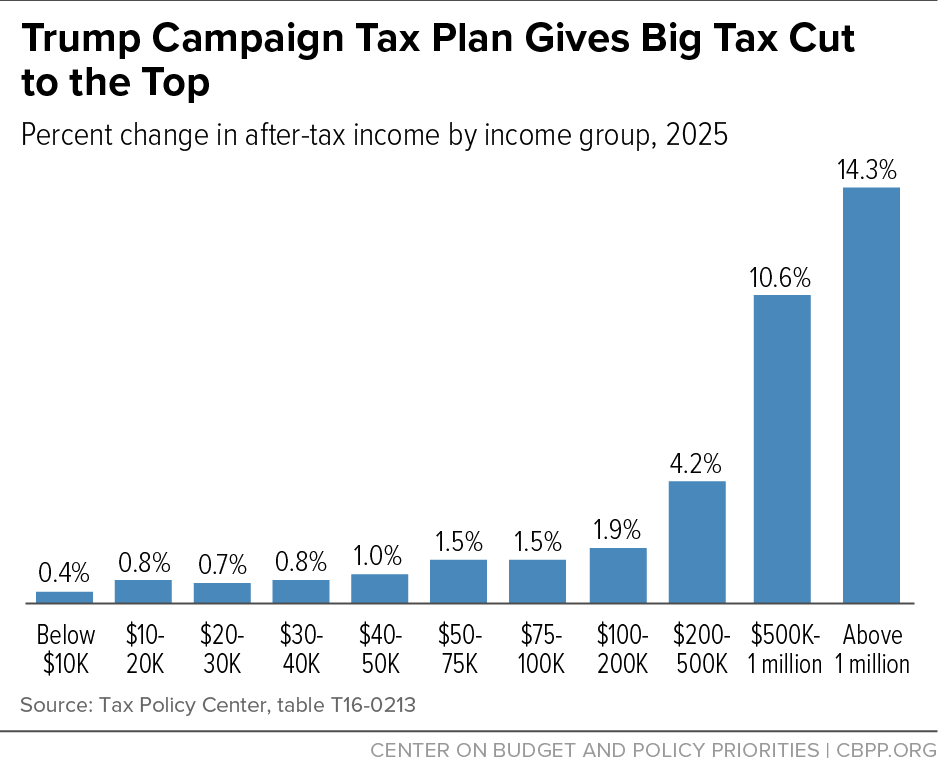

Secretary Mnuchin has reiterated this rule in various forums since then. Yet Trump’s campaign tax plan failed the rule by providing significant tax cuts to those at the top. In fact, those with annual incomes above $1 million would receive tax cuts averaging $387,000 (14.3 percent of their after-tax income) in 2025, while low- and middle-income people would receive relatively little (see chart).

3. Prioritizing workers and families

In his inaugural address, President Trump stated that his “every decision” on taxes would “be made to benefit American workers and American families.” Working-class incomes in America have grown too slowly for far too long and, as a top Administration priority, tax reform should help address this key national challenge.

Yet the Trump campaign tax plan would have boosted the incomes of the very wealthy far more than those of low- and moderate-income families. In the end, in fact, it likely would have left most workers and families worse off because policymakers eventually would likely have paid for its large tax cut for the wealthy by cutting programs on which tens of millions of low- and middle-income families rely.