Older adults (ages 55-64), who are more likely than younger adults to have serious, chronic health conditions, have seen enormous benefits from the Affordable Care Act (ACA). The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes.[1] Older adults also benefit from health coverage improvements in the recent American Rescue Plan. The recovery legislation that Congress has begun crafting should solidify and extend these gains — for older adults and adults of all ages.

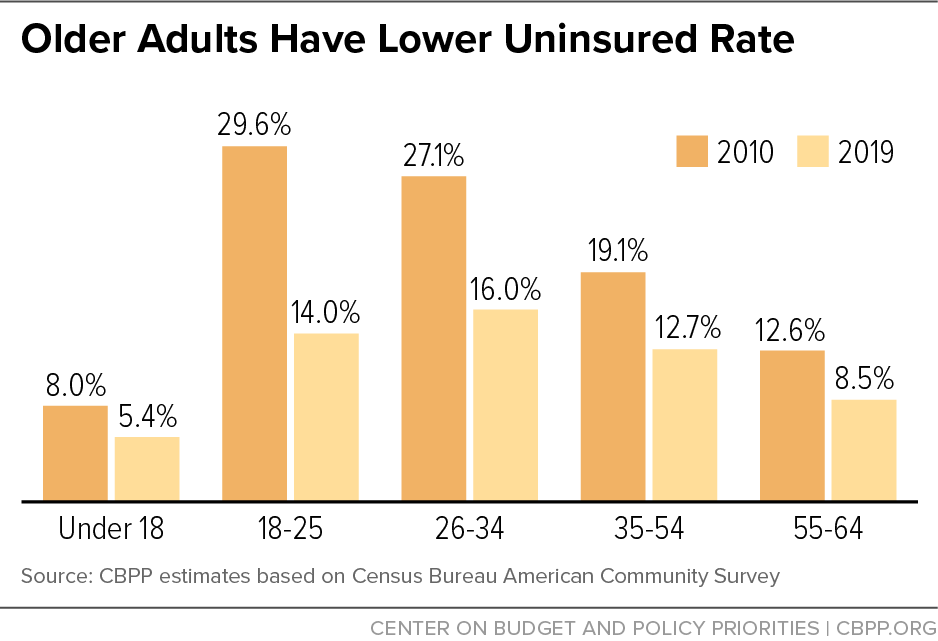

Under the ACA, older adults’ uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they’re now protected from coverage exclusions and cost increases due to pre-existing conditions. In fact, people aged 55-64 have the lowest uninsured rate among non-elderly adults: 8.5 percent in 2019. (See Figure 1.)

The American Rescue Plan includes several provisions that build on the ACA and make comprehensive coverage more affordable and accessible, including for many older people. Its two-year increases in premium tax credits not only eliminate or reduce premiums for millions of marketplace enrollees already eligible for the credits, but also expand eligibility to millions of people with somewhat higher incomes who face high premium burdens. This change provides enormous benefits to older people, who otherwise face premiums three times higher than younger people. The Rescue Plan also includes a new financial incentive for additional states to expand Medicaid.

Future legislation can further the goal of achieving universal coverage by making the Rescue Plan’s premium tax credit improvements permanent, further lowering premiums and cost sharing, and providing a federal health care plan to uninsured people caught in the “coverage gap” in states that haven’t expanded Medicaid. Such changes are acutely needed to improve access to coverage and lower costs for older people, but would also help people at every age.

The ACA’s Medicaid expansion and financial help for people who buy coverage on their own have played a critical role in expanding coverage and improving health outcomes and financial security for older adults, a growing body of research shows.

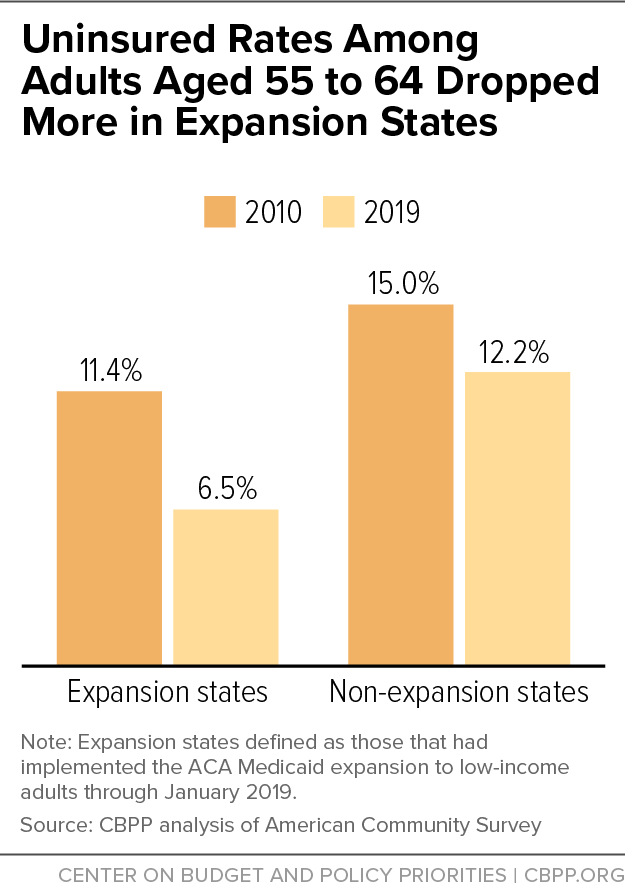

Uninsured rates among non-elderly Americans have dropped across all age groups since the ACA took effect. For people aged 55 to 64, the uninsured rate dropped by a third, from 12.6 percent in 2010 to 8.5 percent in 2019. The gains were greatest in states that expanded Medicaid, where the uninsured rate dropped by 43 percent (from 11.4 percent in 2010 to 6.5 percent in 2019), compared to a 19 percent decline in non-expansion states (from 15 percent to 12.2 percent). (See Figure 2.)

The ACA’s health insurance marketplaces have been a critical source of coverage for older people, who rely on the individual market more than other age groups.[2] As a consequence, older people are over-represented in the marketplace, accounting for nearly 29 percent of marketplace enrollees even though they are only 12.9 percent of the total population.[3]

Improved Health Outcomes and Financial Security

People in their 50s and 60s, especially those with lower incomes, are much more likely than younger adults to have serious, chronic health conditions. Up to 84 percent of people aged 55- 64 have at least one pre-existing condition,[4] and 44 percent have at least one condition that in the past would have led individual-market insurers to deny them coverage.[5] Prior to the ACA, insurers could deny coverage, exclude coverage for certain health conditions, or charge more to people based on their pre-existing condition. This practice is now forbidden across insurers in the ACA-regulated market. (It has never been a feature of Medicaid.)

As more older people with low or moderate incomes have gained coverage, they — along with other non-elderly adults — have seen greater access to health care, better health outcomes, and improved financial security. Under the ACA, the share of people who skipped a test or treatment due to cost fell by about a quarter between 2010 and 2020.[6] The share of people who skipped seeing a medical provider for needed care or didn’t fill a prescription fell by 19 percent. And the share of adults aged 50-64 with incomes in the range covered by the ACA Medicaid expansion or with subsidized marketplace coverage who reported difficulty paying their medical bills dropped by a third in the first year of full ACA implementation, an AARP survey found.[7]

Medicaid expansion’s benefits for older adults are particularly striking. Medicaid expansion is associated with improved access to screenings and treatment for health conditions more prevalent in older adults. These include increases in cancer screenings and early-stage cancer diagnoses, large increases in prescriptions filled for heart disease and diabetes, and decreases in people screening positive for depression.[8] Also, among people aged 50-64, Medicaid expansion is associated with lower rates of gross motor skills difficulties and difficulty performing daily tasks such as dressing and eating.[9]

Moreover, Medicaid expansion prevents thousands of premature deaths each year: it saved the lives of at least 19,200 adults aged 55-64 over the four-year period from 2014 to 2017, a landmark National Bureau of Economic Research study found.[10] Conversely, 15,600 older adults died prematurely over the same period because their state chose not to expand Medicaid. Medicaid expansion has significant lifesaving impacts: an estimated 39 to 64 percent reduction in annual mortality rates for older adults gaining coverage.[11]

Since Medicaid shields people from most out-of-pocket medical expenses, Medicaid expansion also is a powerful anti-poverty tool. The more low-income people gain health coverage, the greater the associated reduction in the poverty rate.[12] Expansion has reduced the number of debt collections and the total amount of debt in third-party debt collections across all age groups.[13]

Several provisions of the American Rescue Plan make comprehensive coverage more affordable and accessible for millions of people, including many older adults.

The plan temporarily lowers net premiums for people who purchase coverage in the ACA’s marketplace by expanding premium tax credits. Specifically, it increases premium tax credits for people with income under 400 percent of poverty; people with income below 150 percent of poverty, for example, pay zero net premium. It also extends the credits to people who were previously ineligible because their income exceeded 400 percent of the poverty line (about $52,000 for a single person) but who face excessive premium burdens ― a pressing problem for older people. (In 2021, the average “sticker price” premium for marketplace coverage ranged from $630 to $1,058 per month for 50- to 64-year-olds, versus $353 to $428 for 21- to 34-year-olds.[14])

This extension of premium tax credits to people above 400 percent of poverty is a significant improvement. While the ACA equalized net premiums across age groups for people with incomes between 100 and 400 percent of poverty by basing premiums on their incomes instead of the age-adjusted sticker price premiums, the premium tax credit ended abruptly once income rose above 400 percent of poverty, requiring people to pay the full premium. This “cliff” particularly affected older people, whose premiums are much higher as a share of income than younger people. Under the Rescue Plan, no marketplace enrollees, irrespective of income, pay more than 8.5 percent of their income in premiums.

In 2021, the average “sticker price” premium for marketplace coverage for 50- to 64-year-olds ranged from $630 to $1,058 per month, far more than the $353- to $428-per-month sticker price premium for 21- to 34-year-olds. Because of the Rescue Plan’s expanded premium tax credits, for example:

- Any eligible marketplace enrollee making $30,000 now pays $85 rather than the previous $195 per month in premiums (3.4 instead of 7.8 percent of income) for a benchmark silver plan or could opt to buy a gold plan with lower cost-sharing charges for $115 per month.[15]

- A 64-year-old making $52,000, just above the prior subsidy cliff, now pays $368 rather than $1,061 per month in premiums (8.5 instead of 24.4 percent of income), saving nearly $8,300 in 2021. (See Appendix Table 1.)

- A 60-year-old couple making $70,000 now pays $496 per month rather than $1,920 (8.5 instead of 33 percent of income) ― a 74 percent decline, which will save them about $17,100 in 2021.(See Appendix Table 1.)

The Rescue Plan also includes a significant additional financial incentive for the 12 states that haven’t expanded Medicaid to do so. States that newly expand Medicaid would receive a 5-pecentage-point increase in the federal share of their Medicaid costs (known as the federal medical assistance percentage, or FMAP) for two years. Those additional federal dollars would exceed the full state cost of covering the expansion group in each of the holdout states for more than three years.[16] Many older adults would benefit from further state take-up of Medicaid expansion. Some 358,000 people aged 55-64 in non-expansion states are uninsured and in the “coverage gap,” meaning their income is too high to qualify for Medicaid but too low to qualify for marketplace subsidies.[17]

Roughly 3.6 million older people remain uninsured.[18] The upcoming recovery legislation should take further steps to provide them — along with the millions of other uninsured people — with access to affordable health coverage.

As noted, about 358,000 older uninsured people have incomes below the poverty line and live in the 12 states that haven’t expanded Medicaid. Despite the Rescue Plan’s significant new financial incentives to adopt expansion, which are on top of expansion’s proven cost savings and reductions in uncompensated care, lawmakers in several states voted against expansion in recent weeks. This is further evidence that the refusal to expand reflects ideology rather than the claimed fiscal constraints. The only way to ensure that adults with incomes below the poverty line have access to health coverage regardless of what state they live in is for federal policymakers to act.[19] Otherwise, the number of uninsured people in the coverage gap — which totaled 2.2 million in 2019 — will likely remain large for many years to come.

Recovery legislation could effectively close the coverage gap by giving people in non-expansion states fully subsidized coverage in the marketplaces or by directing the Centers for Medicare & Medicaid Services (CMS) to run a federalized Medicaid program in those states. The Rescue Plan’s financial incentive would still be available and any holdout state could choose to expand Medicaid at any time.[20]

Recovery legislation could also lock in the Rescue Plan’s premium tax credit improvements, thereby securing the new law’s gains for the 2 million HealthCare.gov enrollees and 1.3 million uninsured people in HealthCare.gov states who are aged 55-64 and eligible for a zero- or low-premium plan.[21] And it could go further by enhancing these improvements so any enrollee with income at twice the poverty line ($25,500 for a single person) could receive a plan with zero net premium.

In addition, recovery legislation could bring down cost sharing, which burdens older people more since they often have higher health needs. For example, in 2019, average out-of-pocket spending for marketplace enrollees was $1,135 for those aged 50-64 but just $600 for those aged 18-49.[22] Raising the value of the cost-sharing reductions and raising the income eligibility limit from 250 percent of poverty to 400 percent would reduce deductibles, copays, and coinsurance for more older people.

| APPENDIX TABLE 1 |

| State |

Monthly net marketplace premiums |

| 64-year-old individual; $52,000 (407% FPL*) |

60-year-old couple; $70,000 (406% FPL*) |

| Prior law |

Under American Rescue Plan |

Difference |

Prior law |

Under American Rescue Plan |

Difference |

| U.S. average |

$1,061 |

$368 |

-$693 |

$1,920 |

$496 |

-$1,424 |

| Alabama |

1,385 |

368 |

-1,017 |

2,506 |

496 |

-2,010 |

| Alaska** |

1,585 |

460 |

-1,125 |

2,867 |

620 |

-2,247 |

| Arizona |

1,024 |

368 |

-656 |

1,852 |

496 |

-1,356 |

| Arkansas |

925 |

368 |

-557 |

1,673 |

496 |

-1,177 |

| California |

1,000 |

368 |

-632 |

1,809 |

496 |

-1,313 |

| Colorado |

824 |

368 |

-456 |

1,491 |

496 |

-995 |

| Connecticut |

1,362 |

368 |

-994 |

2,463 |

496 |

-1,967 |

| Delaware |

1,268 |

368 |

-900 |

2,294 |

496 |

-1,798 |

| DC |

928 |

368 |

-560 |

1,787 |

496 |

-1,291 |

| Florida |

1,073 |

368 |

-705 |

1,941 |

496 |

-1,445 |

| Georgia |

1,070 |

368 |

-702 |

1,937 |

496 |

-1,441 |

| Hawai’i** |

1,122 |

424 |

-698 |

2,030 |

570 |

-1,460 |

| Idaho |

1,162 |

368 |

-794 |

2,102 |

496 |

-1,606 |

| Illinois |

993 |

368 |

-625 |

1,797 |

496 |

-1,301 |

| Indiana |

988 |

368 |

-620 |

1,788 |

496 |

-1,292 |

| Iowa |

1,228 |

368 |

-860 |

2,221 |

496 |

-1,725 |

| Kansas |

1,153 |

368 |

-785 |

2,085 |

496 |

-1,589 |

| Kentucky |

1,117 |

368 |

-749 |

2,022 |

496 |

-1,526 |

| Louisiana |

1,279 |

368 |

-911 |

2,315 |

496 |

-1,819 |

| Maine |

1,033 |

368 |

-665 |

1,869 |

496 |

-1,373 |

| Maryland |

815 |

368 |

-447 |

1,474 |

496 |

-978 |

| Massachusetts |

616 |

368 |

-248 |

1,233 |

496 |

-737 |

| Michigan |

815 |

368 |

-447 |

1,474 |

496 |

-978 |

| Minnesota |

721 |

368 |

-353 |

1,304 |

496 |

-808 |

| Mississippi |

1,078 |

368 |

-710 |

1,950 |

496 |

-1,454 |

| Missouri |

1,124 |

368 |

-756 |

2,034 |

496 |

-1,538 |

| Montana |

1,106 |

368 |

-738 |

2,001 |

496 |

-1,505 |

| Nebraska |

1,641 |

368 |

-1,273 |

2,969 |

496 |

-2,473 |

| Nevada |

923 |

368 |

-555 |

1,669 |

496 |

-1,173 |

| New Hampshire |

838 |

368 |

-470 |

1,516 |

496 |

-1,020 |

| New Jersey |

951 |

368 |

-583 |

1,720 |

496 |

-1,224 |

| New Mexico |

796 |

368 |

-428 |

1,440 |

496 |

-944 |

| New York |

597 |

368 |

-229 |

1,194 |

496 |

-698 |

| North Carolina |

1,211 |

368 |

-843 |

2,192 |

496 |

-1,696 |

| North Dakota |

1,157 |

368 |

-789 |

2,094 |

496 |

-1,598 |

| Ohio |

880 |

368 |

-512 |

1,593 |

496 |

-1,097 |

| Oklahoma |

1,301 |

368 |

-933 |

2,353 |

496 |

-1,857 |

| Oregon |

1,026 |

368 |

-658 |

1,856 |

496 |

-1,360 |

| Pennsylvania |

1,068 |

368 |

-700 |

1,933 |

496 |

-1,437 |

| Rhode Island |

819 |

368 |

-451 |

1,482 |

496 |

-986 |

| South Carolina |

1,117 |

368 |

-749 |

2,022 |

496 |

-1,526 |

| South Dakota |

1,451 |

368 |

-1,083 |

2,625 |

496 |

-2,129 |

| Tennessee |

1,094 |

368 |

-726 |

1,979 |

496 |

-1,483 |

| Texas |

1,024 |

368 |

-656 |

1,852 |

496 |

-1,356 |

| Utah |

957 |

368 |

-589 |

1,915 |

496 |

-1,419 |

| Vermont |

669 |

368 |

-301 |

1,338 |

496 |

-842 |

| Virginia |

1,124 |

368 |

-756 |

2,034 |

496 |

-1,538 |

| Washington |

911 |

368 |

-543 |

1,648 |

496 |

-1,152 |

| West Virginia |

1,535 |

368 |

-1,167 |

2,778 |

496 |

-2,282 |

| Wisconsin |

1,073 |

368 |

-705 |

1,941 |

496 |

-1,445 |

| Wyoming |

1,857 |

368 |

-1,489 |

3,360 |

496 |

-2,864 |