SNAP Caseload and Spending Declines Have Accelerated in Recent Years

End Notes

[1] Unless otherwise noted, all years presented here are fiscal years and participation figures are for an average month.

[2] These figures refer to nominal spending, not adjusted for inflation. The 2018 figures on SNAP participation and spending exclude additional SNAP spending in areas affected by natural disasters and make several other technical adjustments to accurately represent the trends in regular SNAP participation and spending. See box, “2018 Figures Adjusted to Better Reflect Trends in the ‘Regular’ SNAP Program.”

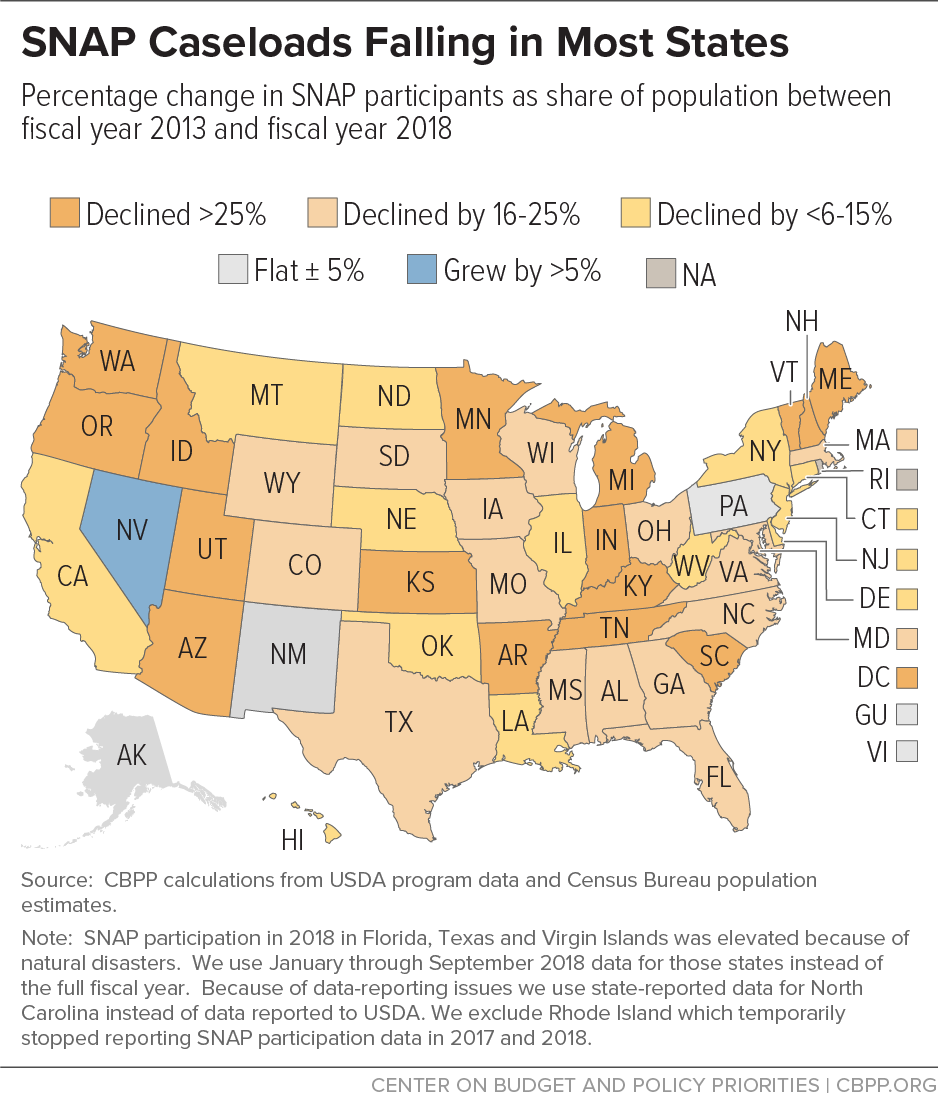

[3] The remainder of this section analyzes the number of SNAP participants as a share of state population in order to more accurately represent SNAP caseload changes in the states where population is growing or shrinking substantially.

[4] There are 53 “states” in SNAP because the District of Columbia, Guam, and the Virgin Islands operate SNAP programs. (Puerto Rico receives a nutrition block grant and is not included in these figures.)

[5] In four states (Arkansas, Indiana, Kentucky, and North Dakota), the share of the population participating in SNAP in fiscal year 2018 was the same or below the share participating in 2007. In six more states (District of Columbia, Maine, Michigan, Missouri, South Carolina, and Tennessee), the share was less than 10 percent above its 2007 level.

[6] Riley Snyder, “Despite booming economy, Nevada food stamp enrollment remains high,” Nevada Independent, July 8, 2018, https://thenevadaindependent.com/article/despite-booming-economy-nevada-food-stamp-enrollment-remains-high/.

[7] For more detail on the relationship between the economy and SNAP caseloads, see Dorothy Rosenbaum and Brynne Keith-Jennings, “SNAP Costs and Caseloads Declining,” Center on Budget and Policy Priorities, March 8, 2016, https://www.cbpp.org/research/food-assistance/snap-costs-and-caseloads-declining.

[8] Congressional Budget Office, “The Supplemental Nutrition Assistance Program,” April 2012.

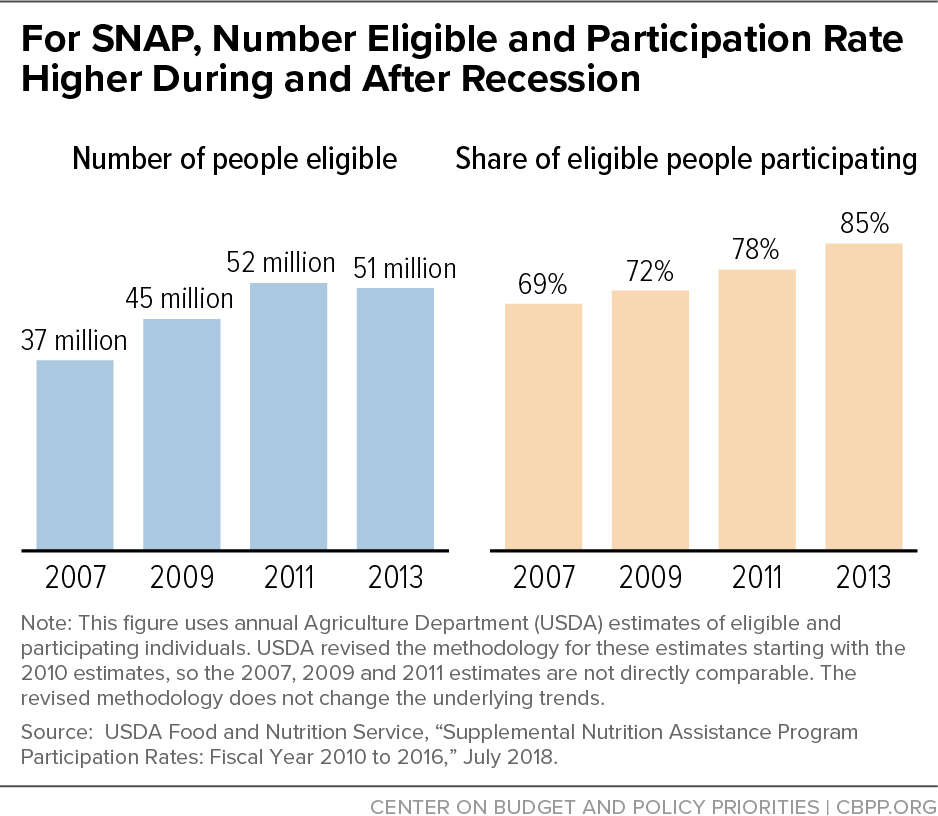

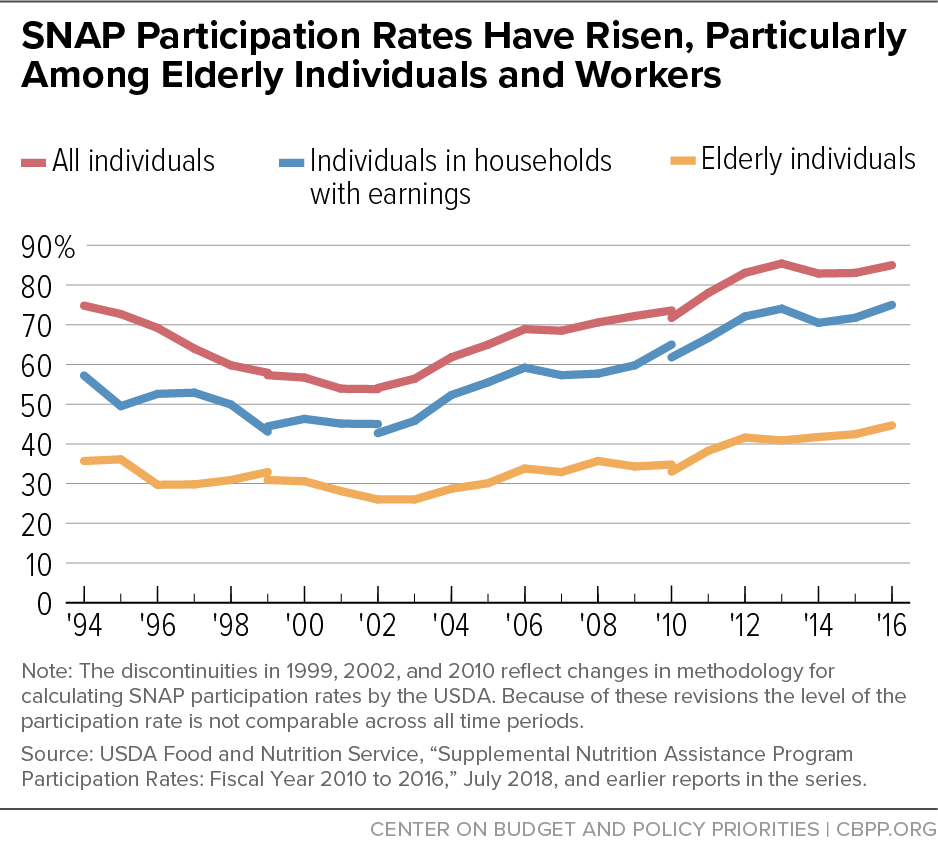

[9] Kelsey Farson Gray and Karen Cunnyngham, “Trends in Supplemental Nutrition Assistance Program Participation Rates: Fiscal Years 2010 to 2016,” USDA, July 2018, table H.1. The estimated participation rates are not directly comparable between 2007 and 2013 because of revisions to the methodology. The participation rate dropped slightly (to 83 percent) in 2014 and 2015, but returned to 85 percent in 2016, the most recent year for which USDA estimates are available.

[10] Both Mark Zandi of Moody’s Analytics and CBO have listed SNAP as one of the most effective policies to increase economic growth and employment in a weak economy. CBO has generally ranked transfer payments to individuals, including SNAP, as having one of the top stimulus multipliers as well. See, for example, CBO, “Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output in 2013,” February 2014, http://www.cbo.gov/sites/default/files/cbofiles/attachments/45122-ARRA.pdf. Zandi has consistently ranked SNAP as having one of the top fiscal stimulus multipliers (see, for example, Alan S. Binder and Mark Zandi, “The Financial Crisis: Lessons for the Next One,” Center on Budget and Policy Priorities, October 15, 2015, https://www.cbpp.org/research/economy/the-financial-crisis-lessons-for-the-next-one).

[11] Stacy Dean and Dorothy Rosenbaum, “SNAP Benefits Will Be Cut for Nearly All Participants in November 2013,” Center on Budget and Policy Priorities, August 2, 2013, https://www.cbpp.org/cms/?fa=view&id=3899; and Brynne Keith-Jennings and Dorothy Rosenbaum, “SNAP Benefit Boost in 2009 Recovery Act Provided Economic Stimulus and Reduced Hardship,” Center on Budget and Policy Priorities, March 31, 2015, https://www.cbpp.org/research/food-assistance/snap-benefit-boost-in-2009-recovery-act-provided-economic-stimulus-and. Also see Congressional Budget Office, “A Review of CBO’s Estimate of the Effects of the Recovery Act on SNAP,” December 20, 2018, https://www.cbo.gov/publication/54864.

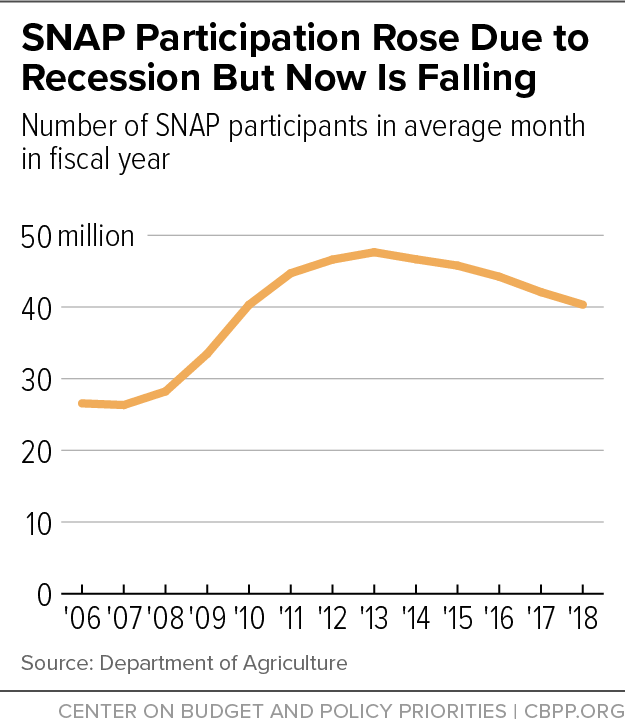

[12] As discussed in the box, “2018 Figures Adjusted to Better Reflect Trends in the ‘Regular’ SNAP Program,” to better reflect the most recent trends, the figures in the text take out Rhode Island for each year, use state-reported data for North Carolina beginning in May 2017 due to data-reporting issues, and take out months when participation was elevated due to disasters in Texas and Florida in 2017 and 2018. Without adjusting for disasters, participation in 2017 fell by 4.3 percent compared to 2016, and fell by 3.7 percent in 2018. Figure 3 uses the USDA data without adjustments because we were not able to adjust all prior years’ data.

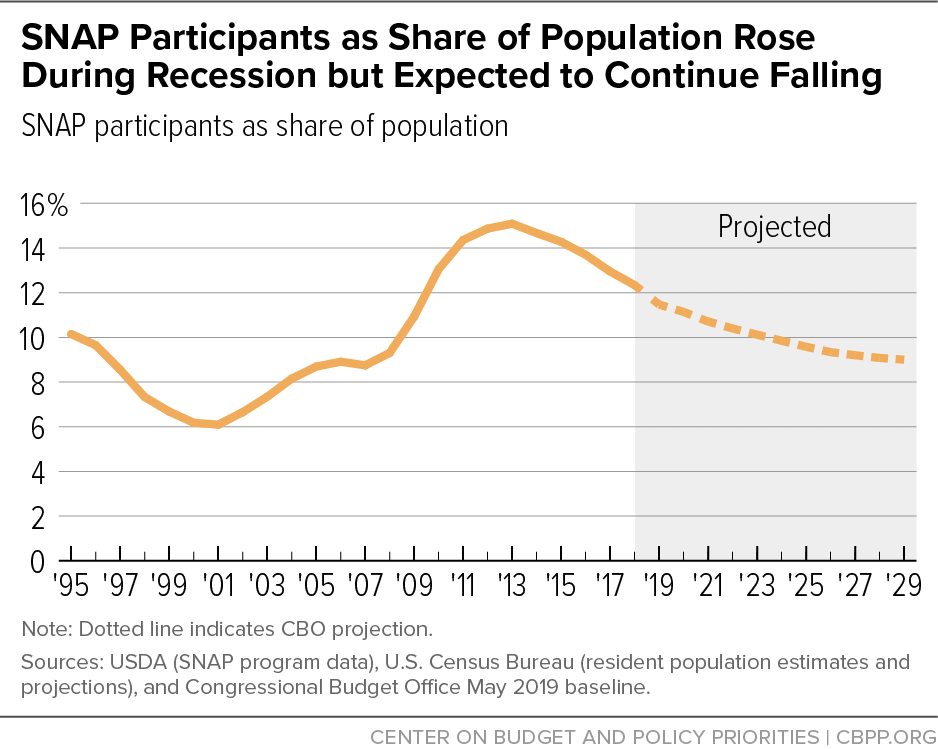

[13] This figure also includes the CBPP adjustments described in the box, “2018 Figures Adjusted to Better Reflect Trends in the ‘Regular’ SNAP Program.”

[14] In California SSI recipients have been ineligible under a state option known as “SSI cash-out.” The amount of SNAP benefits SSI recipients otherwise would have received was expected to be small because of the state’s (at the time) relatively high state-funded SSI supplement, and so was conceptually included in the state’s SSI supplement. Last summer California passed legislation to opt out of “SSI cash-out” and once again make SSI recipients eligible for SNAP. The change, which was fully within the state’s discretion, took effect this June. The legislation includes a state-funded program for holding harmless the subset of households newly ineligible under federal rules. A short summary of the SSI cash-out issue and the state’s estimates can be found here: https://lao.ca.gov/reports/2018/3729/ssi-cash-out-010818.pdf. The state has information about the expansion here: https://www.cdss.ca.gov/inforesources/CalFresh/Supplemental-Security-Income.

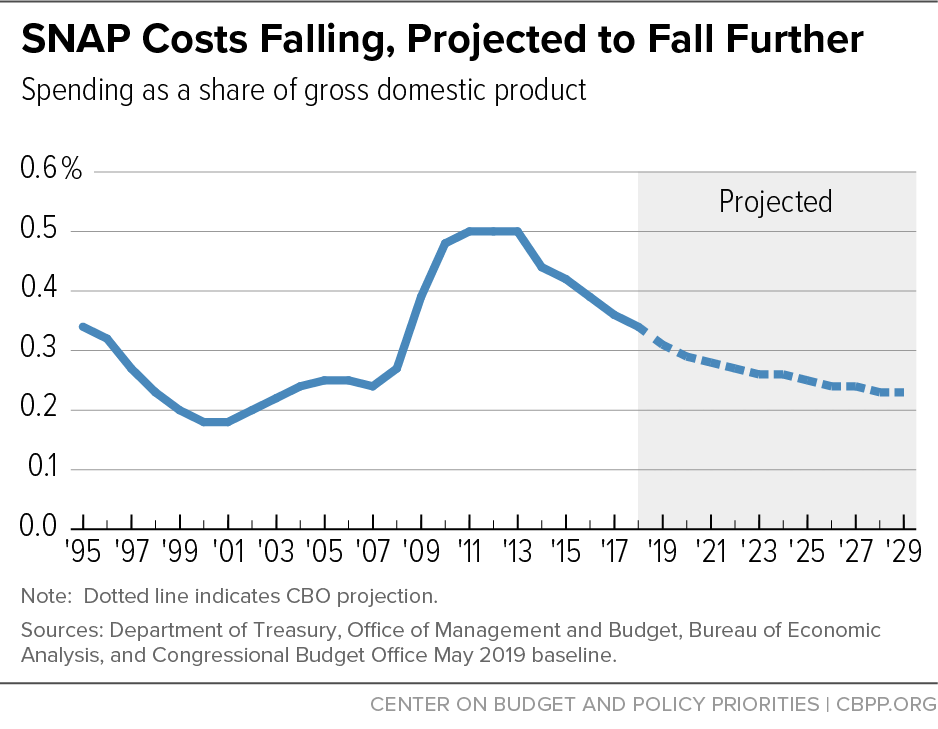

[15] Congressional Budget Office, “Supplemental Nutrition Assistance Program ― CBO’s May 2019 Baseline,” https://www.cbo.gov/system/files?file=2019-05/51312-2019-05-snap.pdf.

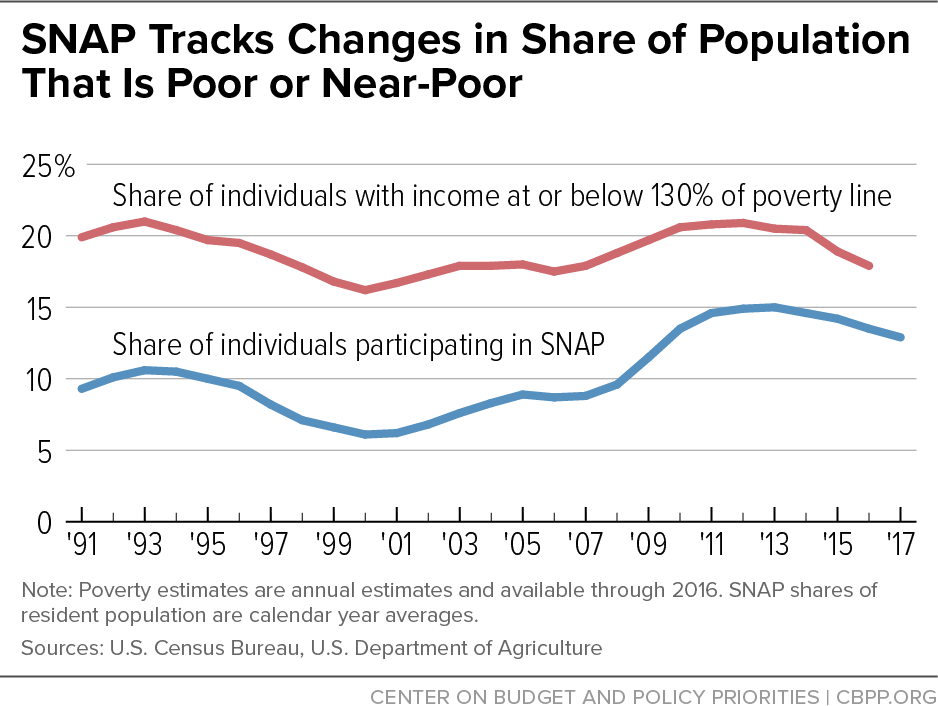

[16] Peter Ganong and Jeffrey B. Liebman, “The Decline, Rebound, and Further Rise in SNAP Enrollment: Disentangling Business Cycle Fluctuations and Policy Changes,” American Economic Journal: Economic Policy, Vol. 10, No. 4, November 2018, pp.153-176, https://www.aeaweb.org/articles?id=10.1257/pol.20140016&&from=f; James P. Ziliak, “Why Are So Many Americans on Food Stamps?” in J. Bartfeld et al., eds., SNAP Matters: How Food Stamps Affect Health and Well Being, Stanford University Press, 2015; Marianne Bitler and Hilary Hoynes, “The More Things Change, the More They Stay the Same? The Safety Net and Poverty in the Great Recession,” Journal of Labor Economics, Vol. 34, Issue S1, 2016; and Jacob Alex Klerman and Caroline Danielson, “Can the Economy Explain the Explosion in the Supplemental Nutrition Assistance Program? An Assessment of the Local-level Approach,” American Journal of Agricultural Economics, 2016.

[17] Klerman and Danielson.

[18] The figures in this paragraph are for calendar years rather than fiscal years.

[19] Brynne Keith-Jennings, “Millions Still Struggling to Afford Food,” Center on Budget and Policy Priorities, September 5, 2018, https://www.cbpp.org/blog/millions-still-struggling-to-afford-food. Food insecurity figures are for calendar years rather than fiscal years.

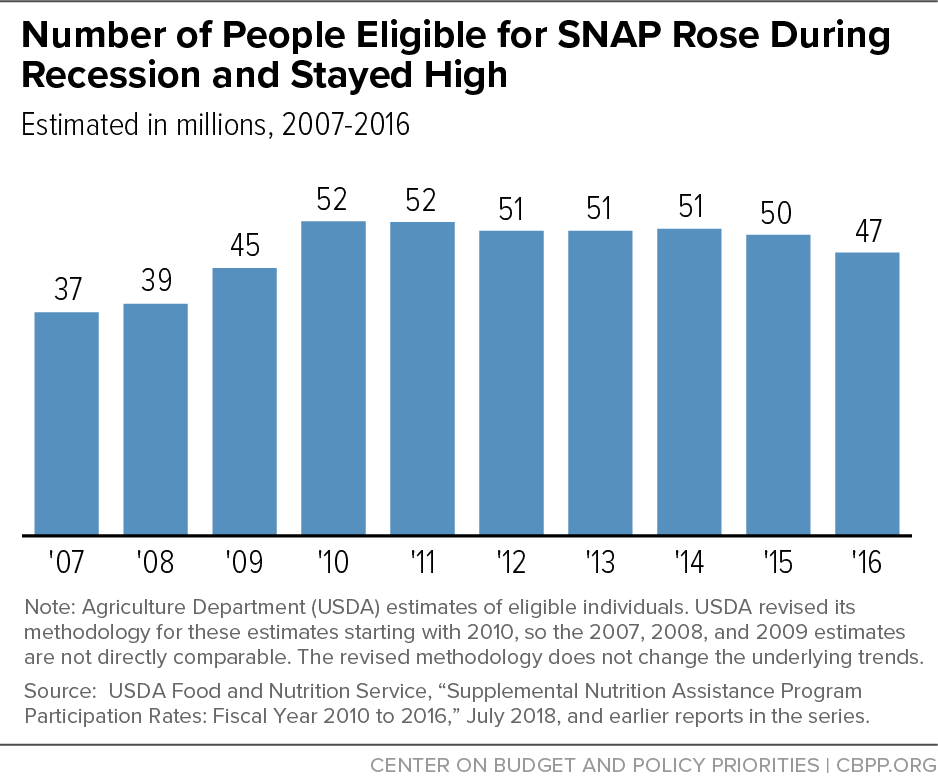

[20] Farson Gray and Cunnyngham. Note that this estimation excludes certain people whose eligibility changed during this period, namely those made eligible through the state option of categorical eligibility.

[21] For an overview of some of the ways states are using technology to improve operations in SNAP and other programs, see Sonal Ambegaokar, Rachel Podesfinski, and Jennifer Wagner, “Improving Customer Service in Health and Human Services Through Technology,” Center on Budget and Policy Priorities, August 23, 2018, https://www.cbpp.org/research/health/improving-customer-service-in-health-and-human-services-through-technology.

[22] Karen Cunnyngham, “Reaching Those in Need: Estimates of State Supplemental Nutrition Assistance Program Participation Rates in 2016,” U.S. Department of Agriculture, Food and Nutrition Service, March 2019.

[23] For example, one recent study found that state policies influenced about one-quarter of the caseload increase between 2000 and 2011. See Stacy Dickert-Conlin et al., “The Downs and Ups of the SNAP Caseload: What Matters?” SSRN, December 1, 2016, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3052570. Another, which compared the caseload growth between Oregon and Florida before and during the Great Recession, found that participants in Oregon, which has a more robust outreach program and longer certification periods, were more likely to participate before the recession, and were less likely to exit, than participants in Florida — differences that could not be explained by economic or demographic trends. See Mark Edwards et al., “The Great Recession and SNAP Caseloads: A Tale of Two States,” Journal of Poverty, Volume 20, Issue 3, 2016, https://www.tandfonline.com/doi/abs/10.1080/10875549.2015.1094770. Another study found that the experience in Michigan of letting clients review information and submit paperwork online reduced the probability that eligible clients would exit the program by about 10 percent. Colin Gray, “Why Leave Benefits on the Table? Evidence from SNAP,” Upjohn Institute Working Paper 18-288, 2018, https://research.upjohn.org/cgi/viewcontent.cgi?referer=&httpsredir=1&article=1306&context=up_workingpapers.

[24] Alicia Mazzara, “Gap Between Federal Rental Assistance and Need Is Growing,” Center on Budget and Policy Priorities, August 16, 2017, https://www.cbpp.org/blog/gap-between-federal-rental-assistance-and-need-is-growing. All figures in this paragraph are for calendar years rather than fiscal years.

[25] Alicia Mazzara, “Census: Renters’ Incomes Still Lagging Behind Housing Costs,” Center on Budget and Policy Priorities, September 13, 2018, https://www.cbpp.org/blog/census-renters-incomes-still-lagging-behind-housing-costs.

[26] “The State of the Nation’s Housing, 2018,” Joint Center for Housing Studies of Harvard University, 2018, https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_State_of_the_Nations_Housing_2018.pdf

[27] Brynne Keith-Jennings and Raheem Chaudhry, “Most Working-Age SNAP Participants Work, But Often in Unstable Jobs,” Center on Budget and Policy Priorities, March 15, 2018, https://www.cbpp.org/research/food-assistance/most-working-age-snap-participants-work-but-often-in-unstable-jobs.

[28] For more information on this harsh time limit and waivers, see Ed Bolen and Stacy Dean, “Waivers Add Key State Flexibility to SNAP’s Three-Month Time Limit,” Center on Budget and Policy Priorities, February 6, 2018, https://www.cbpp.org/research/food-assistance/waivers-add-key-state-flexibility-to-snaps-three-month-time-limit, and other papers available at https://www.cbpp.org/resources-on-snap-and-work#timelimit.

[29] Some 21 states never waived the time limit statewide or implemented in the years prior to 2016. One additional state, Michigan, newly implemented the time limit in some areas in 2017 after having a statewide waiver, and two more states, Illinois and Rhode Island, implemented the time limit in parts of their states in 2018. California also began implementing the time limit in parts of the state beginning in September 2018. See Bolen and Dean.

[30] Some of this decline may also be attributed to other factors besides the time limit, such as improving economic conditions, administrative access issues, or the effects of sanctions in states that mandate employment and training for some populations. In states that continued to waive the time limit statewide in 2016, the number of such adults fell by about 16 percent in this period. In states that had implemented the time limit prior to 2016, the number fell by 17 percent. Because more individuals participate over the course of the year than in an average month, the actual number of people who lost benefits is larger. Some of the non-disabled childless adults we identify as “potentially subject to the time limit” may not be subject to the time limit because they live in an area with a waiver or are exempt due to factors that the data do not allow us to identify. Others may be subject to the time limit and are working or participating during their first three months.

[31] Steven Carlson, Dorothy Rosenbaum, and Brynne Keith-Jennings, “Who Are the Low-Income Childless Adults Facing the Loss of SNAP in 2016?” Center on Budget and Policy Priorities, February 8, 2016, https://www.cbpp.org/research/food-assistance/who-are-the-low-income-childless-adults-facing-the-loss-of-snap-in-2016.

[32] For more on the work incentive feature of categorical eligibility, see Elizabeth Wolkomir and Lexin Cai, “The Supplemental Nutrition Assistance Program Includes Earnings Incentive,” Center on Budget and Policy Priorities, March 6, 2018, https://www.cbpp.org/research/food-assistance/the-supplemental-nutrition-assistance-program-includes-earnings-incentives.

[33] “Broad-Based Categorical Eligibility,” U.S. Department of Agriculture, October 2018, https://fns-prod.azureedge.net/sites/default/files/snap/BBCE.pdf.

[34] CBO estimates that restricting categorical eligibility to households receiving cash assistance under Temporary Assistance for Needy Families — effectively ending broad-based categorical eligibility — would reduce SNAP spending on benefits by about 2 percent a year. The number of participants eligible because of categorical eligibility is based on the 2016 SNAP Household Characteristics data and earlier CBO estimates of the number of people who would be affected by eliminating this state option.

[35] For example, Ganong and Liebman found that this option accounted for about 8 percent of the increase between 2007 and 2011, and Dickert-Conlin et al., found that broad-based categorical eligibility “only explains up to 12 percent of the recent caseload increase.”

[36] Elizabeth Wolkomir, “How SNAP Can Better Serve the Formerly Incarcerated,” Center on Budget and Policy Priorities, March 16, 2018, https://www.cbpp.org/sites/default/files/atoms/files/3-6-18fa.pdf.

[37] Katherine Gregg, “Feds Again Threaten State About Funding Over Food Stamp Problems,” Providence Journal, April 18, 2017, http://www.providencejournal.com/news/20180418/feds-again-threaten-state-about-funding-over-food-stamp-problems; Ann E. Marimow, “Lawsuit alleges widespread problems in District-run food stamp program, Washington Post, August 28, 2017, https://www.washingtonpost.com/local/public-safety/widespread-problems-in-district-run-food-stamp-program-alleged-in-new-lawsuit/2017/08/28/d4cb6c9c-8bf5-11e7-84c0-02cc069f2c37_story.html?utm_term=.d8a19243ea0c.

[38] Bethany Lanese, Rebecca Fischbein, and Chelsea Furda, “Public Program Enrollment Following US State Medicaid Expansion and Outreach,” American Journal of Public Health, Vol. 108, No. 10. October 2018, pp. 1349-1351.

[39] Shelby Gonzales, “Fearing Immigration-Related Consequences, Many Families Forgo Basic Health and Nutrition Services,” Center on Budget and Policy Priorities, September 6, 2018, https://www.cbpp.org/blog/fearing-immigration-related-consequences-many-families-forgo-basic-health-and-nutrition; Danilo Trisi and Guillermo Herrera, “Administration Actions Against Immigrant Families Harming Children Through Increased Fear, Loss of Needed Assistance,” May 15, 2018, https://www.cbpp.org/research/poverty-and-inequality/administration-actions-against-immigrant-families-harming-children; Emily Baumgaertner, “Spooked by Trump Proposals, Immigrants Abandon Public Nutrition Services, New York Times, March 6, 2018, https://www.nytimes.com/2018/03/06/us/politics/trump-immigrants-public-nutrition-services.html.

[40] Hamutal Bernstein et al., “One in Seven Adults in Immigrant Families Reported Avoiding Public Benefit Programs in 2018,” Urban Institute, May 2019, https://www.urban.org/sites/default/files/publication/100270/one_in_seven_adults_in_immigrant_families_reported_avoiding_publi_2.pdf. This study drew from data from the Well-being and Basic Needs Survey that oversampled non-citizen respondents.

[41] Marcella Alsan and Crystal Yang, “Fear and the Safety Net: Evidence from Secure Communities,” National Bureau of Economic Research, Working Paper 24731, March 2019, http://www.nber.org/papers/w24731.pdf.

[42] Trisi and Herrera, op. cit.

[43] Carlson et al., 2016, op. cit.