BEYOND THE NUMBERS

Virginia ended its 2019 legislative session after enacting a new tax law that failed to expand the state’s Earned Income Tax Credit (EITC) for low-wage workers. An EITC expansion would have reduced racial inequities in income since the state’s low-wage workers are disproportionately African American, in part due to historical racism and ongoing job discrimination. At the same time, the new tax law included provisions that disproportionately benefit wealthy white families. The law came in the midst of a session dominated by reports of past racially offensive acts by Governor Ralph Northam and officials of both parties.

After enacting the tax law earlier in the session, lawmakers took their final action on tax policy last week when they rejected Governor Northam’s proposal to extend a one-time tax rebate to more families earning low wages.

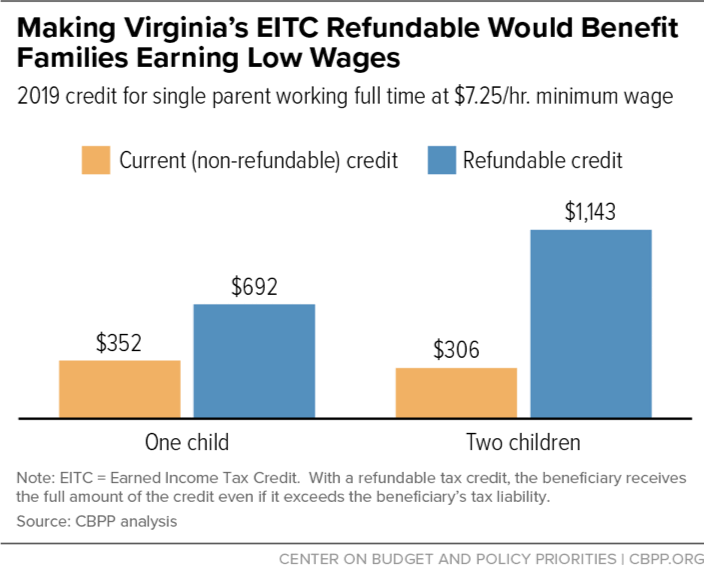

Policymakers should expand Virginia’s EITC, which would help about 385,000 low-wage workers and their families — Black, brown, and white — get ahead. EITCs enable families with low-paying jobs to keep more of what they earn so they can afford necessities like child care and transportation. The overwhelming majority of state EITCs in the 29 states (plus the District of Columbia and Puerto Rico) with them are fully “refundable,” meaning the lowest-income taxpayers receive the full credit even when it exceeds their income tax, but Virginia’s isn’t. As a result, Virginia’s credit leaves behind lower-paid families who owe little to no income tax but still pay a significant part of their incomes in other state and local taxes, such as sales and property taxes. That’s one reason why the lowest-income Virginia families pay a higher share of their income in state and local taxes than the highest-income families do.

For example, a single mother with two children working full time at the minimum wage of $7.25 gets just $306 under the current credit. If the credit were fully refundable, she’d receive $1,143, which could help her cover her rent and put food on the table (see graph).

EITCs are particularly effective at helping communities of color share more fully in economic growth because they are overrepresented in low-paying jobs, due in part to bias and discrimination in hiring. Virginia’s people of color make up 38 percent of the population but 46 percent of the families receiving the federal EITC, so they’d likelier benefit from an improved state EITC.

Unfortunately, Virginia’s new tax law doesn’t make the state’s EITC refundable and makes other changes expanding white families’ existing advantages. For example, it lets taxpayers who itemize deduct all of their state and local property taxes from their state tax liability, even though the federal tax code now caps the deduction for state and local taxes at $10,000. This change mostly benefits well-off and white households, who are likelier to own property and to pay the most in property taxes. In addition, it doesn’t conform to a provision of the 2017 federal tax law that effectively creates a minimum corporate tax on the foreign income of U.S. corporations. Failure to conform to this provision disproportionately benefits wealthy white households, who are much likelier to own corporate stock.

The new law does make some improvements, increasing the state’s standard deduction and retaining a limit on itemized deductions for wealthy households that the 2017 law eliminated at the federal level. But neither change benefits the working families unable to receive the full value of the state’s EITC.

In Virginia and other states, policymakers’ choices over time have embedded racial inequality into the tax code. Governor Northam and lawmakers missed an opportunity to reckon with the harmful legacy of racism and ongoing discrimination and the economic challenges that communities of color face. A refundable EITC, by expanding economic opportunity for families of color, would not only make the state more equitable but also improve its economy over the long term, helping residents of all races and backgrounds.