BEYOND THE NUMBERS

2019 could be a banner year for state Earned Income Tax Credits (EITCs), as governors and lawmakers have introduced proposals to create and expand the credits in at least 26 states this year. Such proposals would supplement the federal EITC’s well-documented, long-term positive effects on children while improving racial and gender equity and the nation’s economic prospects.

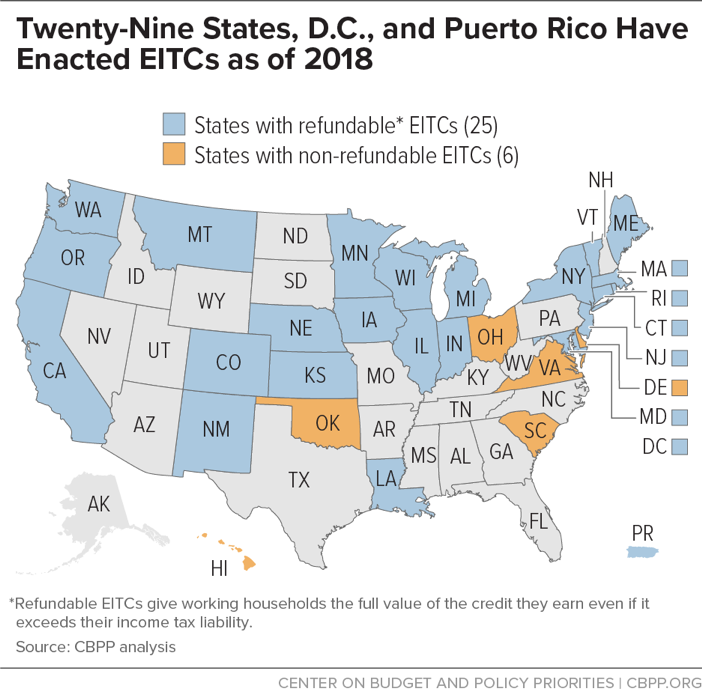

Twenty-nine states plus the District of Columbia and Puerto Rico already have a state EITC to help low-wage, working households meet basic needs (see map below). (Most state credits are structured as a percentage of the federal EITC.) States that haven’t yet enacted an EITC should do so. And those with small or non-refundable credits — which don’t give workers the full value of the credit they’ve earned if it exceeds what they owe in income taxes — should expand them.

Proposals include:

- Creating new credits. One West Virginia proposal would create a credit worth half of the federal credit. Utah’s proposal targets working families experiencing intergenerational poverty. And Georgia’s proposed new credit would be 10 percent of the federal EITC.

- Making the credit refundable. Refundability is key to the EITC’s ability to boost incomes and reduce hardship, because the credit offsets the substantial state and local taxes that low-income families pay as a share of their income. The legislature passed a bill to make Delaware’s credit refundable last year but Governor Carney vetoed it. This year, the governor and legislature have another chance to enact this change to benefit working families. In Virginia, while Governor Northam included a proposal in his budget to make the state EITC refundable, he later abandoned it, to the detriment of many families struggling on low incomes and with disproportionate impact on families of color.

- Increasing the credit. Among other states’ proposals, lawmakers in Michigan are proposing to increase the credit to 30 percent (from 6 percent); in New Mexico to 20 percent (from 10 percent), which the governor supports; and in Rhode Island to 20 percent (from 15 percent).

- Expanding the credit’s reach to workers without children in the home. The federal EITC largely leaves out workers not raising children in their home, even though they’re integral to their communities and local economies — and many are non-custodial or future parents. These workers are the lone group that federal income and payroll taxes push into poverty (or deeper into poverty). Lawmakers in Maine are proposing to increase the credit and expand it to all workers under age 25.

- Implementing the credit. Washington passed its Working Families Tax Credit in 2008 but never fully implemented it. Legislation would do so while also expanding it to such groups who are not now eligible for it as immigrant workers who are ineligible for the federal credit and adults aged 19-70 without children in the home. In total, the expansion would benefit 967,000 households.

EITCs help families afford the very things that keep them working, like child care. They also reduce poverty and help children do better and go further in school. By investing in an EITC, states can make a big difference for children, families, and local economies.