BEYOND THE NUMBERS

Rising Food and Energy Prices Underscore the Urgency of Acting on the Child Tax Credit

Rising food and energy prices are straining families’ budgets, making it harder for them to afford basics like food, gas, and rent. Meanwhile, families with low incomes have lost a key source of monthly income with the expiration of the expanded Child Tax Credit last December. But Congress can alleviate some of the hardship these families are facing, by swiftly enacting an expanded, monthly, and fully refundable Child Tax Credit that’s available to families with low or no earnings.

Energy prices rose 3.5 percent in February and are 26 percent higher than a year ago, the Bureau of Labor Statistics (BLS) report on February consumer prices showed. (This includes a 38 percent year-over-year increase in the price of gasoline, and a 24 percent increase in the price of natural gas, often used for home heating.) Prices of food eaten at home rose 1.4 percent in February and 8.6 percent in the past year.

The BLS survey was conducted before Russia invaded Ukraine, which has led to a large loss of innocent life and millions of people fleeing their homes as well as enormous economic dislocation. Among other things, that will secondarily result in upward pressure on food and energy prices here in the U.S. and around the world, hitting some poor countries particularly hard.

Ukraine is a major supplier of wheat and corn, while Russia is a major energy producer and supplier of fertilizer. In response to the invasion, several large oil and gas companies have pulled out of Russia, and the U.S. and United Kingdom have imposed bans on imports of Russian oil and gas. These disruptions are projected to add about 0.5 percent to overall global inflation rates over the next several months, Goldman Sachs’ economists estimate.

Rising food and energy prices hit people with low and moderate incomes hard for several reasons. Families with low incomes spend a larger share of their income on groceries and on home energy costs like electricity and natural gas than more affluent families, and they often have little financial cushion to help absorb rising prices.

Most of these families with modest incomes own cars, which they use for essential trips to work, to buy groceries, and to visit the doctor. For these families, higher gas prices mean less money for food, clothes, and other basic expenses.

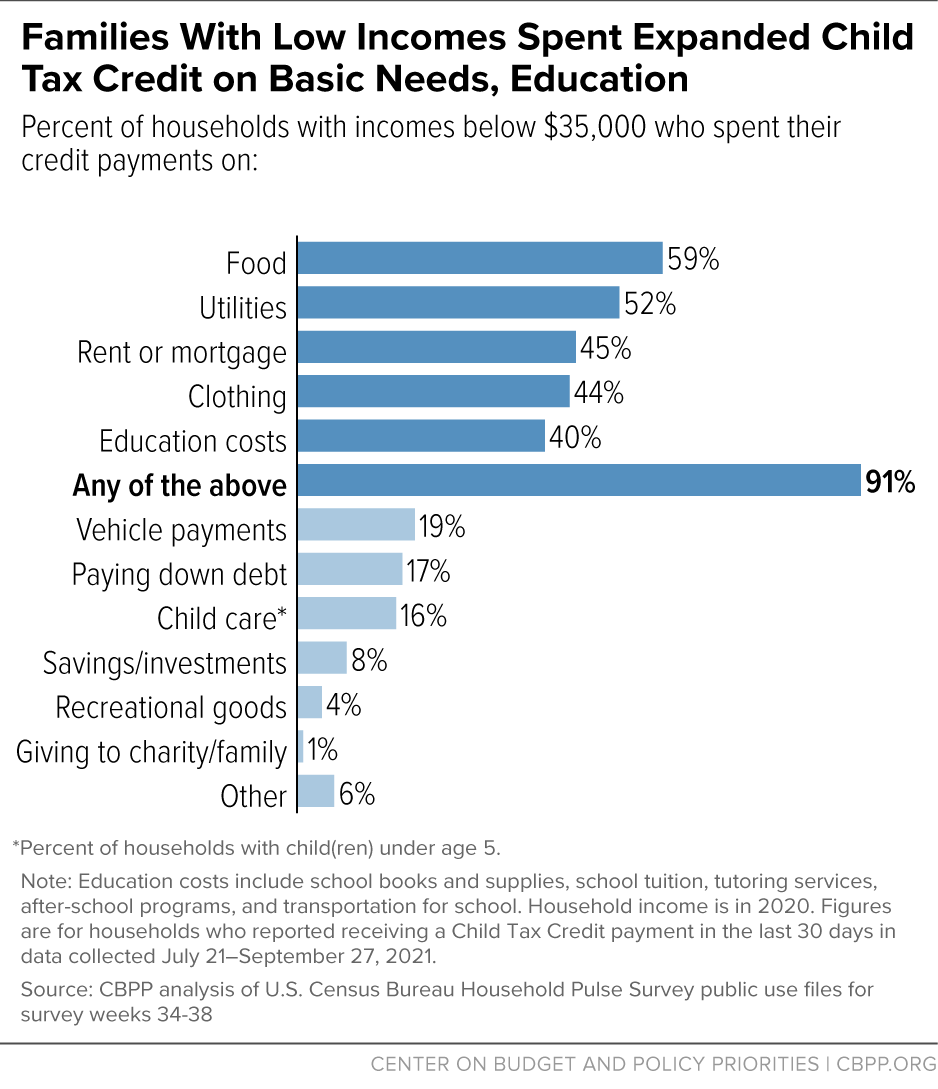

Policymakers can lessen the effects of higher prices on families with low incomes. Last year, through the American Rescue Plan, they enacted a major expansion of the Child Tax Credit, which raised the credit amount, made the full credit available to children in low-income families, and shifted to monthly delivery. As the chart below shows, most low-income families spent their Child Tax Credit payments on food and other basic needs.

Because these monthly Child Tax Credit payments were taken away, 3.7 million children fell below the monthly poverty line in January, according to the Center on Poverty & Social Policy at Columbia University. Census data showed that about 42 percent of adults with children said in early March that it was somewhat or very difficult to cover usual household expenses, up from about 37 percent in December.

Opponents of expanding the Child Tax Credit have questioned whether such an expansion would be inflationary. But Jason Furman, former chair of President Obama’s Council of Economic Advisers, notes that the expansion that passed the House in December is too small as a share of the economy to cause a significant rise in inflation. In addition, Furman wrote, “[u]nder any set of assumptions about inflation, families with children would be worse off if they lose the child tax credit than if it is continued.”

Last year’s expansion of the Child Tax Credit was a striking success, lifting an estimated 3.7 million otherwise-poor children (3 in 10) above the monthly poverty line in December 2021. The credit’s full refundability (ensuring that children with the lowest incomes get the full credit) was the main driver of its poverty reduction; making that provision permanent could have life-long positive impacts in health, educational attainment, and ultimate earnings power for millions of children. It’s urgent that policymakers act now — both to help families with low incomes absorb today’s rising food and gas prices, and to make a critical long-term investment in their children’s futures.