BEYOND THE NUMBERS

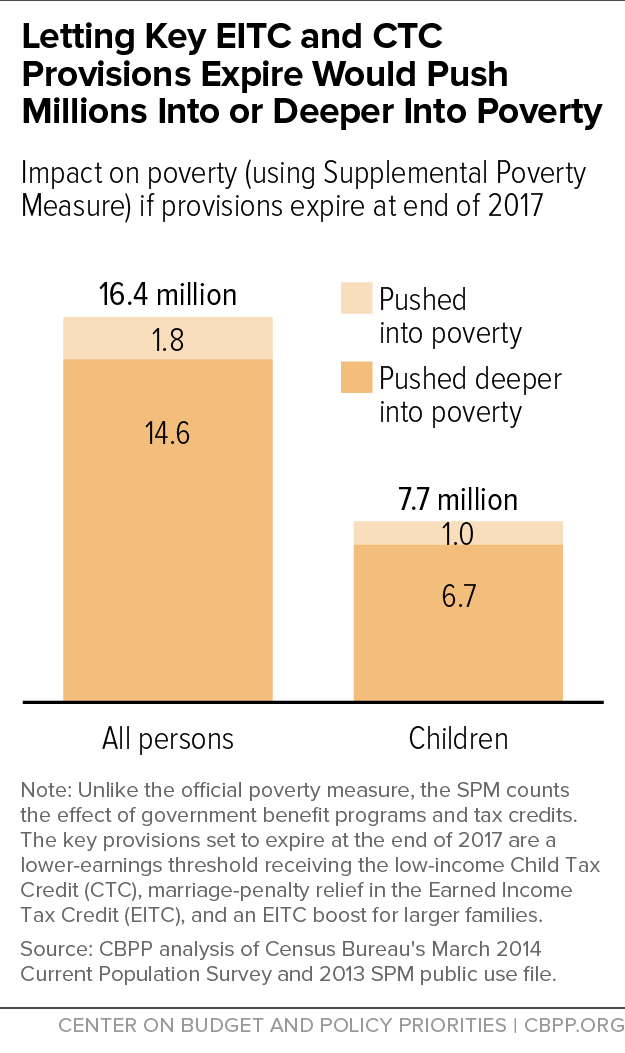

Millions of American families can be thankful this holiday season for two working-family tax credits that help them make ends meet and improve their lives. But if policymakers fail to save key provisions of the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), more than 16 million people in low- and modest-income working families, including nearly 8 million children, will fall into — or deeper into — poverty in 2018. (See graph; state-by-state figures available here.) And over 50 million Americans, including 25 million children, will lose part or all of their EITC or CTC.

The EITC and CTC encourage and reward work, and growing evidence suggests that income boosts from the tax credits lead to better maternal and infant health, improved school performance, higher college enrollment, and increased work effort and earnings in adulthood. Both tax credits have enjoyed bipartisan support, and their underlying provisions are permanent parts of the tax code.

But several key features of the tax credits are set to expire at the end of 2017. They allow millions of working families to earn a more adequate CTC, leave fewer working-poor families out of the credit entirely, provide EITC “marriage-penalty” relief, and boost the EITC for families raising more than two children.

Saving these provisions deserves bipartisan support. Policymakers are expected to try to permanently extend several corporate tax breaks before year’s end; as they consider which expiring tax provisions to make permanent, they should accord top priority to these important EITC and CTC provisions.

The stakes for working families are high. For example, a single mother with two children working full time in a nursing home for the federal minimum wage and earning $14,500 would lose her entire CTC of $1,725 if the CTC provision expires.

Millions of other workers in low-wage jobs — from child care workers to custodians to health care workers — also face losing some or all of these tax credits. Those affected include about 1 million veteran and military families, about 2.6 million rural families, and over 6 million millennial workers.