Roughly 14 million millennial workers (workers ages 18-34) earn the Earned Income Tax Credit (EITC) or low-income component of the Child Tax Credit (CTC), two tax credits for low- and moderate-income working households. Research shows that the EITC and CTC encourage and reward work. A growing body of research also suggests that children in families receiving the credits have improved health, perform better in school, are likelier to attend college, and can be expected to work and earn more as adults.[1] Policymakers concerned with helping millennials succeed should make permanent critical EITC and CTC provisions set to expire at the end of 2017 and plug a glaring hole in the EITC for childless adults and non-custodial parents.

- Working-family tax credits make a major difference to the economic security of millions of millennials and their families. Some 13.9 million working millennials — more than one in five — receive the EITC, the low-income portion of the CTC, or both.

- Millions of millennial workers will lose some or all of their credits if lawmakers fail to act. Key EITC and CTC provisions are set to expire at the end of 2017. If lawmakers don’t save these provisions by making them permanent, 6.3 million millennial workers will lose some or all of their credits.

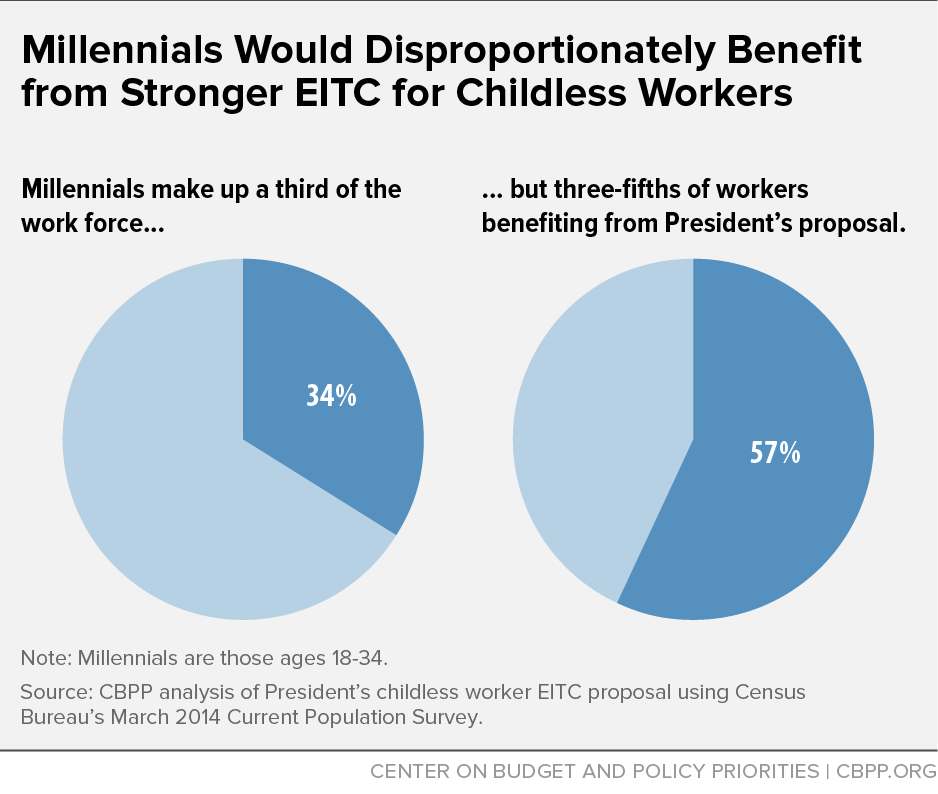

- Closing the large gap in the EITC for childless adults and non-custodial parents is also critical for millennials. The federal tax system taxes 4.1 millennial “childless workers” (workers who don’t claim dependent children for tax purposes) into or deeper into poverty, in part because childless workers receive little or no EITC. President Obama and House Ways and Means Committee Chairman Paul Ryan have offered nearly identical proposals to boost the EITC for childless workers, including making workers aged 21 to 25 eligible; 8.6 millennial workers would benefit. In fact, the President’s proposal would disproportionately help millennial workers, who make up 34 percent of all workers but 57 percent of the workers who would benefit.

EITC and CTC Make Major Difference to Millennials’ Economic Security

Many millennial workers — now about a third of the labor force — have faced a challenging start to their working lives due to the severe recession and slow recovery. For young workers struggling to make ends meet, the income boost from the EITC and CTC helps them meet basic needs and get on a sound economic footing as they build their careers. Some 13.3 million households headed by a millennial worker receive the EITC, low-income portion of the CTC, or both. These households receive an average of about $2,200 per household from the EITC and about $1,300 from the low-income CTC. In these 13.3 million households, one or both of the credits reach: [2]

- 13.9 million millennial workers, or more than one-fifth of all millennial workers (see Table 1 for state-specific data);

- 37.1 million people, including 20.7 million children; and

- 11.3 million millennial parents.[3]

| TABLE 1 |

|---|

| 50 States + DC |

13,900,000 |

|---|

| Alabama |

269,000 |

| Alaska |

27,000 |

| Arizona |

279,000 |

| Arkansas |

173,000 |

| California |

1,683,000 |

| Colorado |

210,000 |

| Connecticut |

106,000 |

| Delaware |

37,000 |

| Dist. of Columbia |

30,000 |

| Florida |

846,000 |

| Georgia |

610,000 |

| Hawaii |

54,000 |

| Idaho |

79,000 |

| Illinois |

573,000 |

| Indiana |

297,000 |

| Iowa |

117,000 |

| Kansas |

141,000 |

| Kentucky |

195,000 |

| Louisiana |

242,000 |

| Maine |

44,000 |

| Maryland |

232,000 |

| Massachusetts |

167,000 |

| Michigan |

393,000 |

| Minnesota |

192,000 |

| Mississippi |

194,000 |

| Missouri |

291,000 |

| Montana |

45,000 |

| Nebraska |

82,000 |

| Nevada |

132,000 |

| New Hampshire |

36,000 |

| New Jersey |

258,000 |

| New Mexico |

116,000 |

| New York |

813,000 |

| North Carolina |

486,000 |

| North Dakota |

26,000 |

| Ohio |

479,000 |

| Oklahoma |

185,000 |

| Oregon |

156,000 |

| Pennsylvania |

425,000 |

| Rhode Island |

38,000 |

| South Carolina |

255,000 |

| South Dakota |

38,000 |

| Tennessee |

354,000 |

| Texas |

1,412,000 |

| Utah |

146,000 |

| Vermont |

20,000 |

| Virginia |

291,000 |

| Washington |

262,000 |

| West Virginia |

71,000 |

| Wisconsin |

212,000 |

| Wyoming |

24,000 |

The EITC and CTC also reduce poverty significantly among millennials and their families. Under the federal government’s Supplemental Poverty Measure, which (unlike the official poverty measure) counts tax credits as income, the EITC and CTC together:

- keep 1.8 million millennials out of poverty and lift 6.1 million others closer to the poverty line;

- keep 1.2 million millennial parents out of poverty and lift 2.8 million closer to the poverty line; and

- keep 1.9 million children of millennials out of poverty and lift 4.2 million others closer to the poverty line. [4]

Congress must act to save key provision of the EITC and CTC before they expire.[5] The stakes for millennials are high: 5.9 million households headed by a millennial worker stand to lose all or part of their EITC, CTC, or both. If these provisions expire at the end of 2017:

Not one penny of the $14,500 in earnings of a full-time, minimum-wage worker would count toward the CTC. The earnings needed to qualify for even a tiny CTC would jump from $3,000 to $14,700. The earnings needed to qualify for the full CTC would rise from $16,330 to more than $28,000 for a married couple with two children. A single mother with two children who works full time at the minimum wage (and earns $14,500) would lose her entire CTC of $1,725, for example.

Many married couples would face higher marriage penalties and cuts to their EITC. Currently, to reduce marriage penalties, the income level at which the EITC begins to phase out is set $5,000 higher for married couples than for single filers. After 2017, it would only be $3,000 higher than for single parents, which would shrink the EITC for many low-income married filers and increase the marriage penalty for many two-earner families.

Larger families would face a cut in their EITC. After 2017, the maximum EITC for families with more than two children would fall by over $700, to the level of the maximum EITC for families with two children.

The blow for millennials would be hard. The 5.9 million households headed by a millennial that would lose some or all of their EITC or CTC include:

- 6.3 million millennial workers (see Table 2 for state-specific data);

- 6.7 million millennial parents; and

- 12.0 million children of millennials.

Letting the provisions expire would also push 4.3 million millennials into or deeper into poverty. Policymakers can avoid this outcome by making these key provisions permanent.

| TABLE 2 |

|---|

| 50 States + DC |

6,300,000 |

|---|

| Alabama |

148,000 |

| Alaska |

12,000 |

| Arizona |

125,000 |

| Arkansas |

92,000 |

| California |

642,000 |

| Colorado |

94,000 |

| Connecticut |

31,000 |

| Delaware |

17,000 |

| Dist. of Columbia |

11,000 |

| Florida |

390,000 |

| Georgia |

351,000 |

| Hawaii |

23,000 |

| Idaho |

34,000 |

| Illinois |

226,000 |

| Indiana |

136,000 |

| Iowa |

48,000 |

| Kansas |

59,000 |

| Kentucky |

95,000 |

| Louisiana |

116,000 |

| Maine |

17,000 |

| Maryland |

79,000 |

| Massachusetts |

69,000 |

| Michigan |

195,000 |

| Minnesota |

62,000 |

| Mississippi |

104,000 |

| Missouri |

149,000 |

| Montana |

18,000 |

| Nebraska |

32,000 |

| Nevada |

50,000 |

| New Hampshire |

11,000 |

| New Jersey |

90,000 |

| New Mexico |

61,000 |

| New York |

323,000 |

| North Carolina |

269,000 |

| North Dakota |

10,000 |

| Ohio |

208,000 |

| Oklahoma |

110,000 |

| Oregon |

65,000 |

| Pennsylvania |

175,000 |

| Rhode Island |

14,000 |

| South Carolina |

148,000 |

| South Dakota |

17,000 |

| Tennessee |

190,000 |

| Texas |

755,000 |

| Utah |

67,000 |

| Vermont |

8,000 |

| Virginia |

127,000 |

| Washington |

123,000 |

| West Virginia |

38,000 |

| Wisconsin |

79,000 |

| Wyoming |

9,000 |

Many “childless workers” — adults without children and non-custodial parents — receive little or no EITC. Childless workers under age 25 are wholly ineligible for the credit, so low-income young people just starting out receive none of the EITC’s proven benefits. Also, the maximum credit for childless workers is just under $500, and most workers receive far less — just $270 on average in 2012. Partly because of this small or nonexistent EITC, childless workers are the sole group that the federal tax system taxes into (or deeper into) poverty. Federal income and payroll taxes pushed 4.1 million millennial childless workers below — or further below — the poverty line in 2013.[6]

Fixing these shortcomings of the EITC for childless workers could boost employment rates because the EITC has been shown to raise labor force participation among parents. Researchers believe that a stronger EITC could do the same for childless workers, including many younger and less-skilled workers. Employment rates have fallen significantly over the past two decades for both men and women who have no schooling beyond high school and are not raising children in their homes. The declines have been particularly steep among young adults — those aged 20-24, who are currently excluded from the childless workers’ EITC.[7]

Increasing employment rates among less educated childless adults could have important benefits beyond raising these workers’ incomes and helping offset their federal taxes. Researchers have noted the connection between higher employment rates and increased income, increased financial stability, lower incarceration rates, and higher marriage rates. For that reason, several leading analysts have argued that a large boost for the childless workers’ EITC could help lower incarceration and boost marriage rates among young, disadvantaged men. For example, John Karl Scholz, an economist and former Treasury official who is one of the nation’s foremost authorities on the EITC, strongly recommends a more ample EITC for childless workers, explaining: “increasing the return to work for childless workers will lower unemployment rates and achieve the dual social benefits of reducing incarceration rates and increasing marriage rates.”[8]

Promisingly, the President and House Ways and Means Committee Chairman Paul Ryan have proposed nearly identical EITC expansions for childless workers. For example, the EITC for a single childless worker making poverty-level wages (roughly $12,600 in 2015) would rise from about $170 under current law to about $840 in 2015 under both proposals. The President’s proposal would help 8.6 million millennial workers, lifting 4.5 million millennials out of poverty or closer to the poverty line.[9] In fact, millennial workers would benefit disproportionately: they make up 34 percent of all workers but 57 percent of the workers who would benefit from the President’s proposal.