BEYOND THE NUMBERS

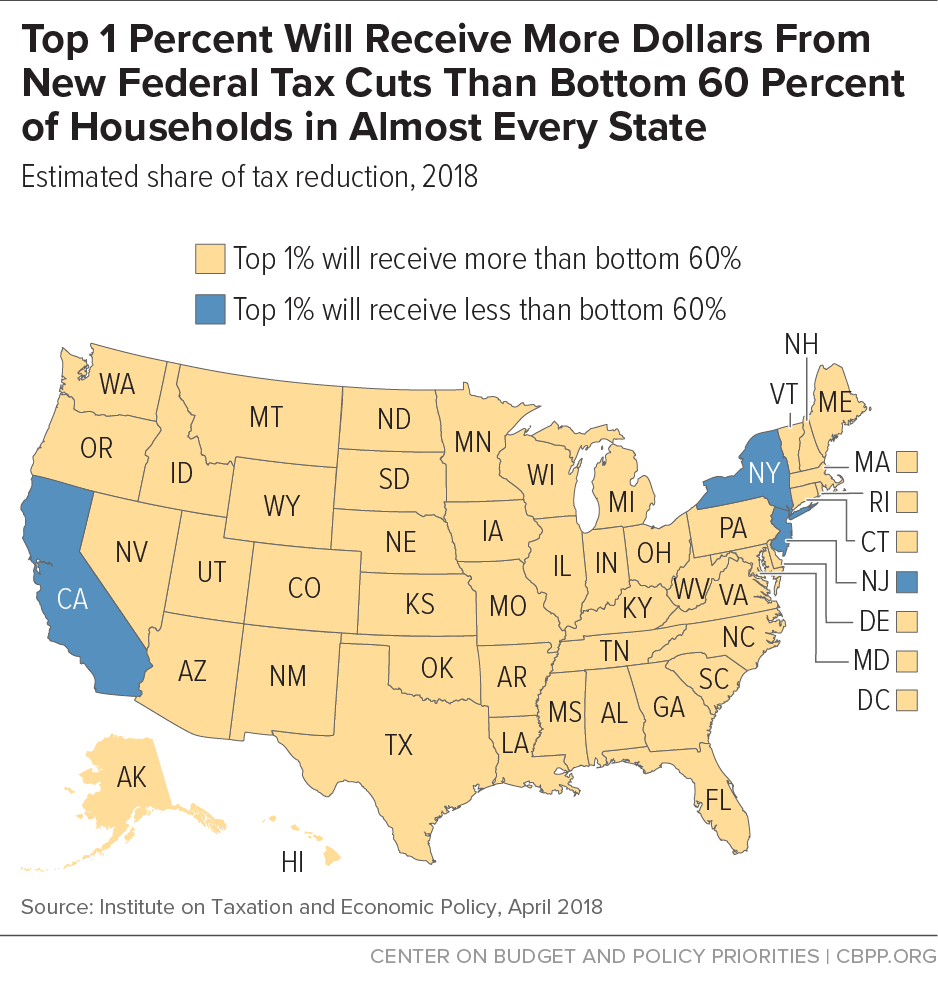

With people focused on filing their tax returns for last year, it’s a good time to consider the future effect of the new federal tax law, which gives big tax cuts to corporations and wealthy families while hurting the nation’s ability to finance public services and investments that can help everyone thrive. In states across the country, the wealthiest families are disproportionately benefitting from the new law, according to a new state-by-state analysis of the law’s 2018 distributional impact from the Institute on Taxation and Economic Policy.

In fact, in every state except three, the top 1 percent of households are receiving a bigger share of their state’s tax cut dollars than the entire bottom 60 percent. Even in those other three states, the tax benefits remain extremely lopsided. The top 1 percent get 13 percent of the tax cut in New York and 10 percent in both New Jersey and California. In comparison, the share going to the bottom 60 percent is 16 percent in New York, 17 percent in New Jersey, and 20 percent in California.

In addition to heavily benefitting large corporations and wealthy households, the new tax law will lead millions of Americans to lose health coverage due to its repeal of the individual mandate — the requirement that most people have health coverage or pay a penalty. The new law will also lead to larger federal deficits — about $1.5 trillion over ten years — which congressional leaders may use to justify proposals for spending cuts to public services and assistance programs on which millions of families rely. These cuts would likely squeeze state budgets across the country, at a time when many of those states are already struggling to meet residents’ and businesses’ needs.

In the shorter term, many states expect to see a change in revenues due to the new federal tax law. As we’ve noted, states should respond with substantial caution to the possibility of a revenue boost and instead focus on preparing for potential cuts in federal funding for states, as well as the next recession. At the same time, they should consider raising new revenue from corporations and other wealthy taxpayers that just received a large federal tax break, and strengthening investments in education systems, transportation networks, and other public services that support broadly shared prosperity.

If states take these steps, they can build stronger economies and more equitable tax codes for years to come.