BEYOND THE NUMBERS

Now that President Trump and congressional leaders have raised annual spending caps for defense and non-defense discretionary programs for 2018 and 2019, policymakers should make additional Internal Revenue Service (IRS) funding a top priority. The recent tax bill poses a once-in-a-generation, multi-dimensional challenge for the IRS, and the President and Congress must give the IRS the funds to implement it successfully.

Fortunately, congressional leaders who negotiated the agreement to raise the caps recognized the need for additional IRS funding, per their summary of the agreement: “Adequate Funding for Taxpayer and Social Security Administrative Services – Congressional leaders agree to adequate funding for the Internal Revenue Service and the Social Security Administration to satisfy the demand for constituent services and tax administration.”

After all, the new tax law will affect virtually every taxpayer and business in America. It’s certain to spark questions that individuals and businesses will look to the IRS to answer. Of particular concern, given some of the law’s features and the hasty way it was put together, it is likely to fuel an aggressive effort by some businesses and wealthy individuals to push against the law’s outer limits — and possibly beyond — to minimize their taxes.

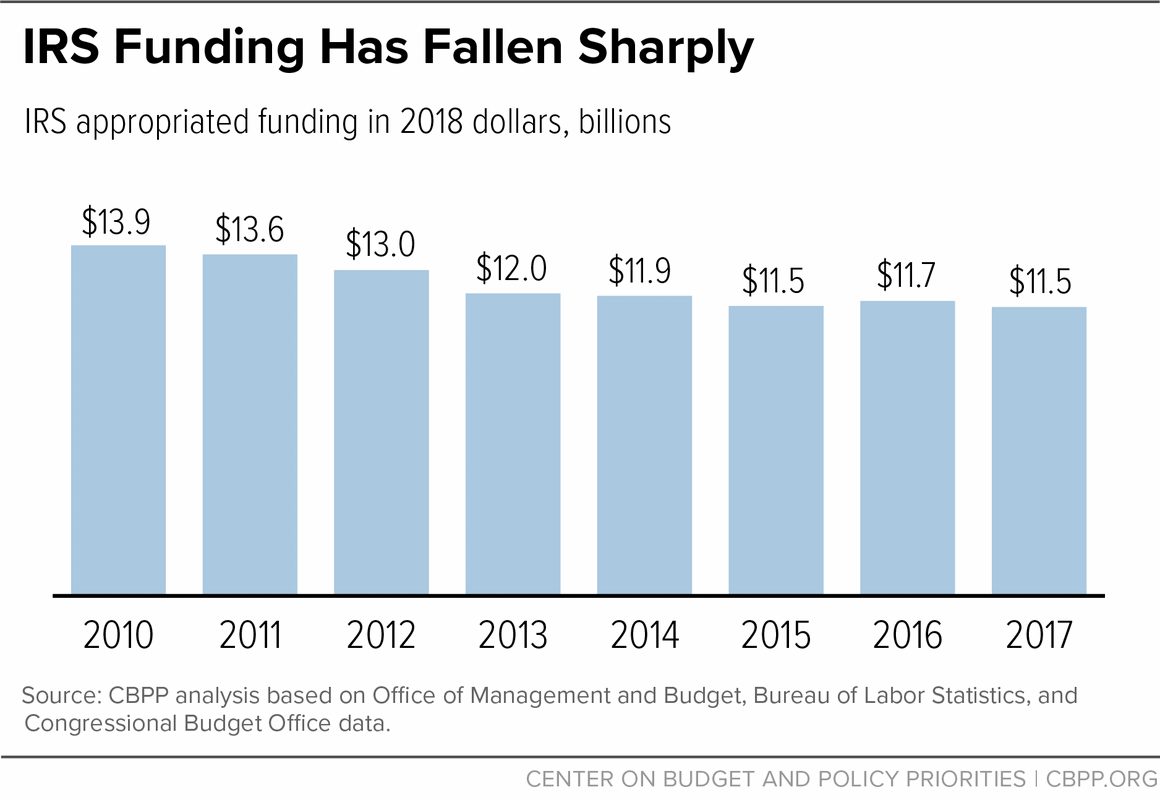

As a result, the IRS will need to provide extensive guidance to taxpayers, update its systems and forms, provide significant public education, expand customer service, and strengthen enforcement in the years to come. The IRS’s shrunken budget and depleted workforce magnify the challenge. Policymakers cut its budget by $2.4 billion, or 18 percent, between 2010 and 2017, after adjusting for inflation (see chart). It has lost 18,000 employees (nearly one-fifth of its workforce), with enforcement personnel accounting for more than three-quarters of that reduction.

Congress’ appropriators, who will write the bills to fund the IRS for 2018 and 2019, must now follow through on the recognized need for more dollars. Specifically, “adequate funding” should mean a robust increase across IRS functions compared to last year. Overall, the agreement raises overall non-defense discretionary (NDD) funding by roughly 12 percent in 2018 compared to last year. While the President has proposed a $581 million increase for the IRS to implement the new tax law and support technology and taxpayer services, he proposes to add that to his original request for 2018 — which was a 2 percent cut — rather than to the 2017 level. As a result, the President’s 2018 proposal amounts to just under a 3 percent increase for the IRS, roughly one-quarter of the overall percentage increase for NDD and far short of what the IRS needs.

The President’s request for 2019 shows further that he’s not taking the IRS’ challenge seriously enough. His budget inexplicably proposes to cut taxpayer services and set a target for it to answer less than half of taxpayer calls during fiscal year 2019, when people will file their first returns under the new law. As the Senate Finance Committee’s Republican chairman, Orrin Hatch, said, "the Administration, in its budget, has proposed additional cuts to funding for the IRS. I think that is a mistake."

Policymakers should heed the example of how the Reagan Administration and Congress responded to major tax reform legislation in 1986. After enacting it, policymakers provided the IRS with more funds to meet its additional demands. In response, the IRS significantly expanded taxpayer service efforts, hiring 1,300 more staff. At the same time, the agency was in the midst of a major effort to recover unpaid taxes, and so was actively strengthening its enforcement capabilities. Moreover, these staff increases occurred at a time when the IRS had about one-fifth more staff than it does today.

In the face of deep budget cuts and personnel reductions, the IRS has struggled to perform its core functions of helping taxpayers comply with the tax code, enforcing the code fairly and credibly, and collecting nearly all of the revenue that funds federal programs. Policymakers must give the IRS sufficient resources over the coming years — a substantial increase above last year’s depleted level, not simply a reversal of a proposed further cut — to meet the additional customer service and enforcement challenges that the new tax law will create.