BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on federal taxes, the federal budget, health, poverty and inequality, state budgets and taxes, food assistance, the economy, and housing.

- On federal taxes, Chuck Marr noted that estimates from the Joint Committee on Taxation highlight how the 2017 tax law’s pass-through deduction benefits flow towards the top 1 percent of households. Marr applauded the Trump Administration’s tax enforcement funding mechanism proposal. Chye-Ching Huang highlighted Greg Leiserson’s work, in which he points out that tax cuts must be judged by their effect on typical households. Huang laid out how recent Senate testimony by David Kamin and Rebecca Kysar highlights the 2017 tax law’s fundamental flaws.

- On the federal budget, Richard Kogan warned that President Trump’s expected spending cuts known as “rescissions” would cut funds that agencies still badly need. Kogan also clarified that procedural advantages for rescissions don’t apply to mandatory programs.

- On health, Hannah Katch and Judith Solomon cautioned that repealing the Medicaid exclusion for institutional care risks worsening services for people with substance use disorders. Katch highlighted a promising Montana program that offers services to help Medicaid enrollees succeed in the workforce.

- On poverty and inequality, Tazra Mitchell described promising policies that could reduce economic hardship and expand opportunity for struggling workers.

- On state budgets and taxes, Erica Williams praised Maryland for likely expanding its Earned Income Tax Credit to young workers without children. Cortney Sanders reported that states facing school funding lawsuits could avoid court disputes by ensuring the proper level and distribution of money in their K-12 budgets.

- On food assistance, Ed Bolen, Lexin Cai, Brynne Keith-Jennings, Dottie Rosenbaum, Elizabeth Wolkomir, and Catlin Nchako updated their explanation of how the House Agriculture Committee’s farm bill would increase food insecurity and hardship.

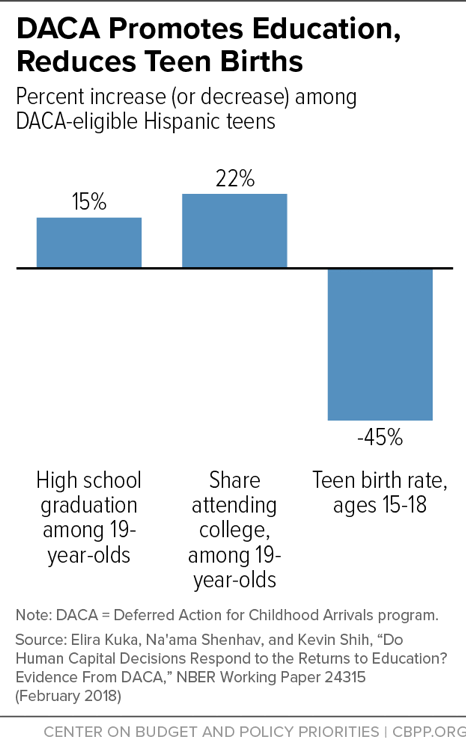

- On the economy, Arloc Sherman detailed a study that found that the Deferred Action for Childhood Arrivals (DACA) program boosts education and lowers teen births. We updated our chart book on the legacy of the Great Recession.

- On housing, Will Fischer testified before the House Financial Services Subcommittee on Housing and Insurance on proposals to reform rents in federal rental assistance programs. Fischer warned that a Trump Administration proposal would raise rents on working families, the elderly, and people with disabilities. Alicia Mazzara explained that the higher rents would put nearly a million children at risk of homelessness.

Chart of the Week – DACA Promotes Education, Reduces Teen Births

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Arizona teacher walkout: how 3 decades of tax cuts suffocated public schools

Vox

April 26, 2018

House Republicans’ push to slash food stamps in the farm bill, explained

Vox

April 25, 2018

HUD Secretary Ben Carson to propose raising rent for low-income Americans receiving federal housing subsidies

Washington Post

April 25, 2018

Conservatives eye new tax cut for capital gains

The Hill

April 25, 2018

Even the CBO Says the GOP Tax Reform Will Incentivize Corporate Offshoring

The American Prospect

April 23, 2018

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.