BEYOND THE NUMBERS

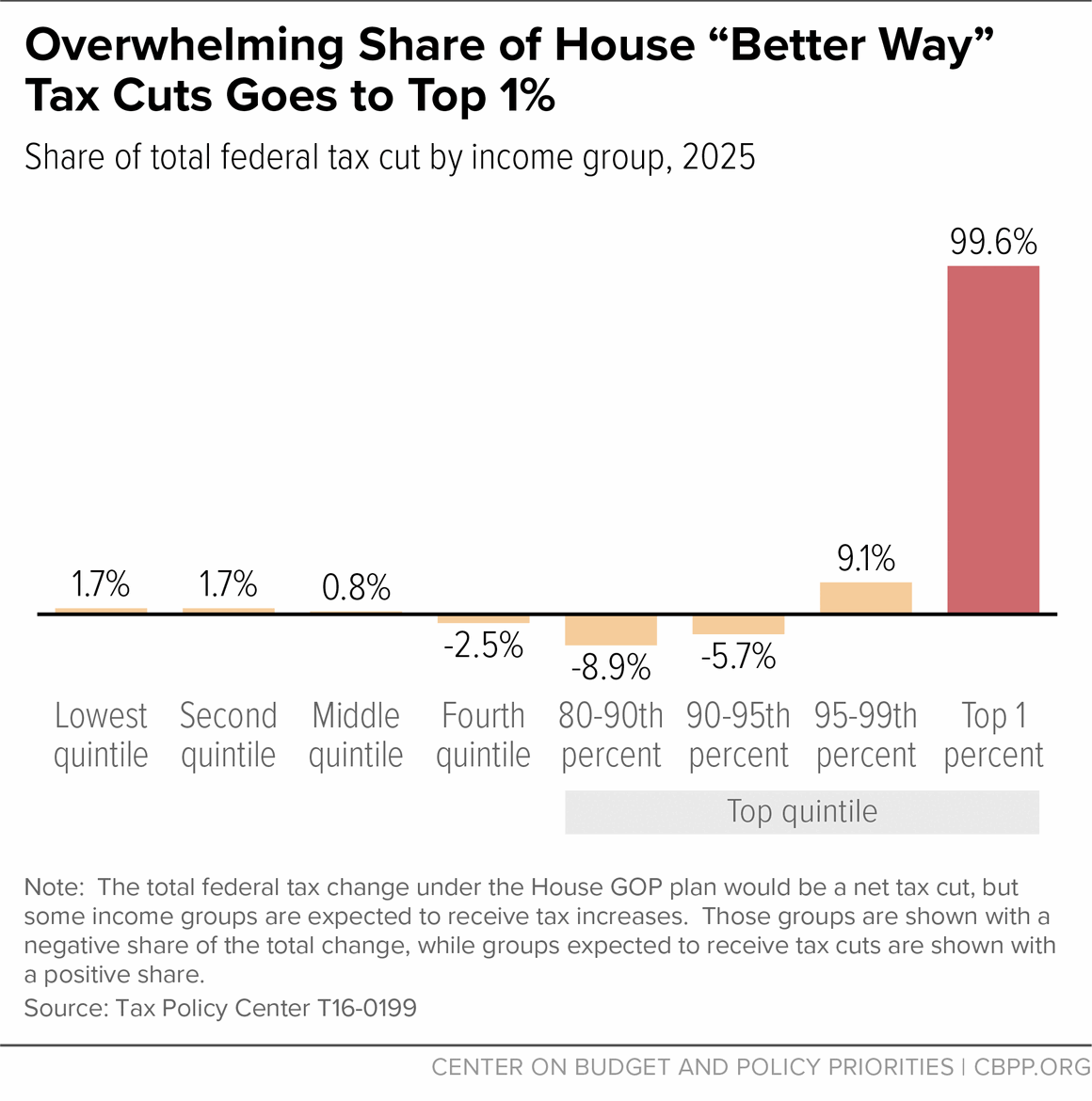

The Republican budget resolution that the House Budget Committee approved would launch a fast-track “reconciliation” process to enact a tax bill without any Democratic votes, and all indications are that the GOP’s tax bill would focus its benefits overwhelmingly on the wealthy and multinational corporations. Although the resolution can’t dictate policy details to the tax-writing House Ways and Means Committee, its “Policy Statement on Tax Reform” section highlights House GOP priorities for the tax bill, each of which favors high-income households or corporations. These priorities are also consistent with the House GOP’s “Better Way” tax plan of 2016, which ultimately would direct a stunning 99.6 percent of its tax benefits to the top 1 percent of households (see chart), and with President Trump’s tax plan. Thus, the House budget resolution represents a key step to enabling Republicans to enact regressive tax policies.

The top-tilted policies listed in the budget include:

- “Lowering marginal rates on pass-through entities.” Both the “Better Way” and Trump tax plans would set a special, lower top rate for pass-through income (business income that’s taxed at the owners’ individual tax rates rather than the corporate rate). Contrary to claims that “small businesses” would benefit, most small businesses are actually small and pay relatively low tax rates, so they’d see no benefit from the proposals. Rather, cutting taxes on pass-through income is a back-door way to cut the top individual tax rate for wealthy investors, including Wall Street hedge funds, real estate partnerships, consultants, and other professionals. It would also create new opportunities for large-scale tax avoidance by high earners, who could reclassify their salaries and wages as pass-through income. The increase in tax complexity and large revenue losses would move the tax code in the opposite direction from true tax reform.

- “Reducing the corporate tax rate.” Both the “Better Way” and Trump tax plans would dramatically lower the top corporate rate. The benefits would mostly flow to high-income investors and, if the tax cuts aren’t paid for by reducing corporate tax breaks and loopholes, they could slow economic growth and leave most Americans worse off by increasing deficits or requiring cuts to federal investments that help working families and the economy. The President reportedly believes that “the corporate rate is the only thing that really matters," but given record corporate profits, a growing stock market, and years of slow wage growth for average workers, what “really matters” shouldn’t be a tax cut that flows largely to shareholders and corporate executives.

- “Transitioning the tax code to a more competitive system of international taxation.” The budget suggests that tax reform should move the United States to a “territorial” tax system, which the President has also proposed. Under a territorial system, U.S.-based multinationals wouldn’t pay U.S. corporate taxes on their foreign profits — that is, they’d face a zero U.S. corporate tax rate. Far from helping the U.S. economy, such a massive, permanent tax advantage for foreign over domestic profits would create a powerful incentive for companies to shift profits and investments overseas, could harm many U.S. businesses and workers, and would likely increase deficits.

- “Repealing the Alternative Minimum Tax [AMT].” The House budget plan, “Better Way” tax plan, and Trump tax plan each specifically call for eliminating the AMT, which is designed to prevent high-income households from exploiting loopholes, exclusions, and deductions in order to owe little or no federal income tax. President Trump exemplifies the type of taxpayer who could benefit from eliminating the AMT; his 2005 tax return, for example, indicates that he paid an effective federal income tax rate of about a quarter of his income of more than $150 million, but without the AMT, his effective rate would have been only 3 percent.