BEYOND THE NUMBERS

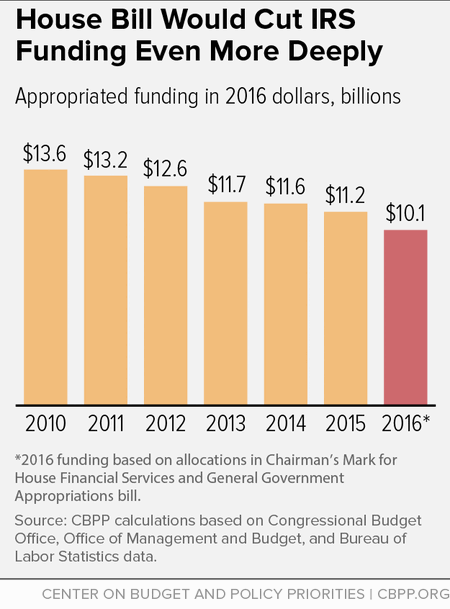

After five years of cuts to the IRS that have compromised taxpayer service and weakened enforcement, House Republicans have proposed what would be the deepest cut yet. Their proposal would fund the IRS at $10.1 billion in 2016, or $838 million below the current level. After adjusting for inflation, IRS funding in 2016 would be 26 percent below its 2010 level (see chart). If the House Appropriations Committee, slated to consider the bill tomorrow, wants the IRS to carry out its essential mission effectively, it needs to restore funding, not cut it more.

The proposed cuts are especially egregious given the damage caused by previous cuts, which shrank the IRS budget by 18 percent between 2010 and 2015, adjusted for inflation. The IRS answered fewer than half of taxpayer calls this tax filing season, and only after average wait times of about a half hour.

Perhaps in response to this year’s problems, the House bill raises funding for taxpayer services by $75 million over the 2015 level for functions directly related to phone service, other correspondence with taxpayers, and identity theft. But that pales in comparison to the cuts in taxpayer services that Congress has enacted since 2010. So even with the proposed increase in 2016, funding for taxpayer services under the House bill would still be about 13 percent below the 2010 level, adjusted for inflation.

The bill also cuts more than $900 million from other IRS areas hindered by earlier cuts, primarily enforcement and information technology (IT). The IRS estimates that audit rates for both individuals and businesses have fallen to their lowest levels in a decade. Cutting tax enforcement actually raises the budget deficit, since each additional $1 spent on IRS enforcement yields $6 or more in added revenue from collecting taxes owed under the law, according to the Treasury Department.

Recent funding cuts have also prevented the IRS from upgrading its IT systems, despite new responsibilities related to implementing health reform and the growing threat of identity theft. Deep new cuts would further erode these functions.

The IRS plays a fundamental role in government, collecting nearly all of the revenue that funds federal programs from national defense and the safety net to roads, scientific research, and education. Congress should give the IRS what it needs to do its job.