BEYOND THE NUMBERS

Families With Children at Increased Risk of Eviction, With Renters of Color Facing Greatest Hardship

An estimated 5.7 million adult renters living with children are not caught up on rent, with nearly half of these renters reporting eviction is at least somewhat likely in the next two months, our new analysis of Census Bureau Household Pulse Survey data from August to September 2021 shows. As millions remain months behind on rent, immediate action is needed to protect children from the avoidable harm caused by evictions and unstable housing. States and localities must keep families safely housed by employing eviction diversion programs that provide legal representation and help emergency aid reach families struggling to pay rent. The Build Back Better legislation provides Congress an opportunity to bolster these efforts and recognize the foundational role of safe and affordable housing in the long-term well-being of children most at risk of eviction by including $24 billion to expand the Housing Choice Voucher program.

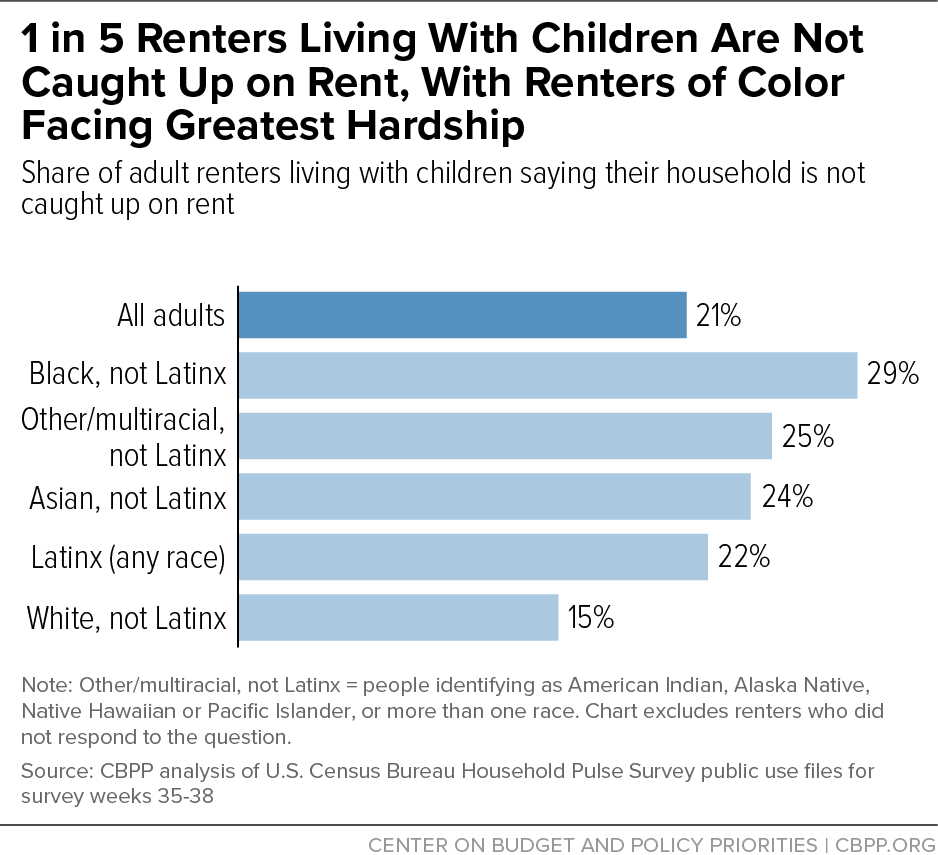

Families with children have been consistently more likely throughout the COVID-19 pandemic to fall behind on rent compared to renters without children in their household. On average, 21 percent of renters living with children reported being in a household behind on rent from early August to late September, compared to 12 percent of renters without children in their household. Among renters living with children, people of color are at even greater risk of losing their homes, reflecting long-standing racial inequities in education, employment, and housing opportunities.

Housing hardship has hit Black renters living with children especially hard, with 29 percent, an estimated 1.7 million renters, reporting that their household is not caught up on rent. (See graph.) Fear of eviction is particularly high among Black renters living with children in households behind on rent, 57 percent of whom report eviction is at least somewhat likely in the next two months. Black renters’ heightened risk of being forced from their homes captures the disproportionate impact of evictions on communities of color, which overwhelmingly displace low-income Black and Latinx renters. Black women are especially likely to face eviction, partly reflecting intersecting racial and gender disparities in wages and employment.

The end of national eviction protections in late August has left children in these families particularly vulnerable to experiencing homelessness and other unstable housing situations as parents struggle to keep a roof over their heads. The homelessness, housing instability, and overcrowding that evictions cause often have harmful consequences for children, including increased likelihood of physical and mental health problems and poor school performance. While in effect, the federal eviction moratorium averted an estimated 1.55 million evictions, effectively preventing many families from losing their homes.

The predicted surge in evictions once the moratorium ended has yet to materialize, partly due to the accelerating pace of emergency aid disbursement in recent months and the patchwork of state and local protections still covering nearly half of all renter households. Courts may also be backlogged with eviction cases, while renters without legal representation may choose to leave their homes upon receiving an eviction notice instead of fighting the case in court. However, eviction risk remains high for families with children, particularly single parents, who are disproportionately likely to have accrued rental debt during the pandemic; households with children headed by women that experienced a pandemic-related job loss owe an average of $7,600 in back rent, the Federal Reserve Bank of Philadelphia estimates.

Protecting families with children from the immediate threat of eviction requires preventative measures such as implementing eviction diversion programs and distributing remaining emergency aid. Beyond that, a major expansion of the Housing Choice Voucher program is the most effective way to help families with low incomes afford housing and prevent future eviction spikes following economic and public health crises. The significant voucher program expansion included in the Build Back Better legislation would reduce housing instability and homelessness, helping shield more children from the preventable harm caused by evictions and unstable housing. Expanding the voucher program would also strengthen other recovery agenda investments and help cut poverty and reduce racial disparities. By helping more families with low incomes afford housing, Congress can take a critical step toward ensuring all children have the safe and stable housing they need.