BEYOND THE NUMBERS

With the Disability Insurance (DI) trust fund — an essential part of Social Security — facing a long-anticipated need for more financial resources by late 2016, some congressional Republicans want to force it to borrow from Social Security’s much larger Old-Age and Survivors Insurance (OASI) trust fund rather than adopting the traditional fix of reallocating payroll tax revenues between the two trust funds. That’s a bad idea.

Congress has reapportioned payroll taxes many times between DI and OASI, in both directions and by large bipartisan majorities. Shifting a small portion of the payroll tax would avert a sudden 20-percent reduction in DI benefits, have only a tiny effect on OASI’s solvency, and give the President and Congress time to focus on strengthening long-run solvency for Social Security as a whole. The proposed interfund borrowing, in contrast, is unwise for several reasons:

-

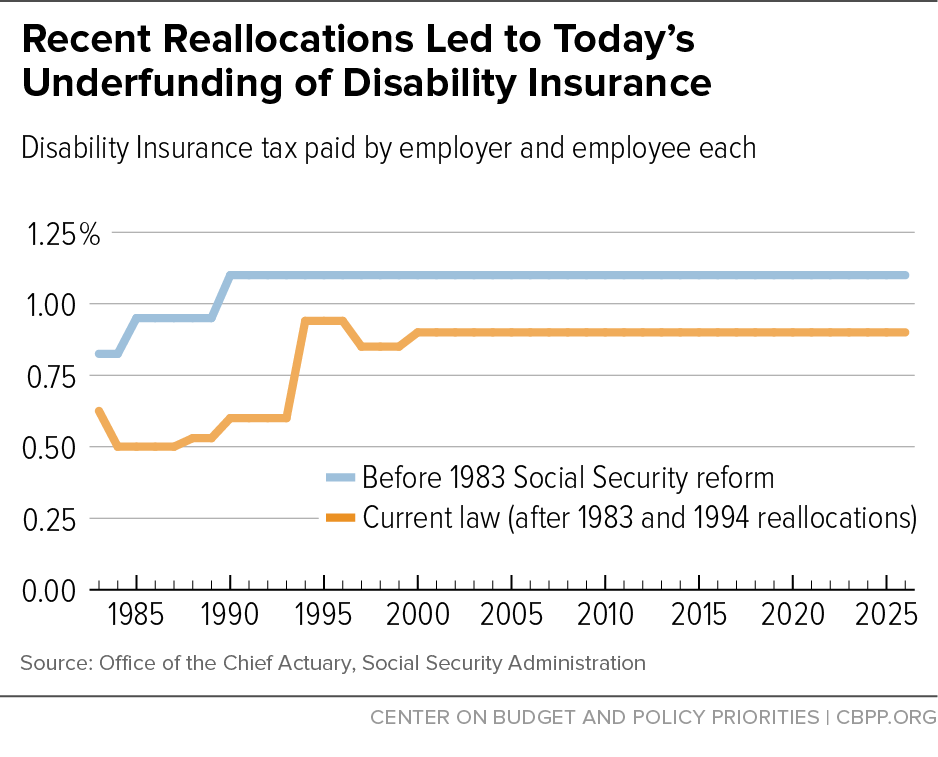

Borrowing doesn’t solve anything. It’s just a gimmick that doesn’t address the underlying issue — namely, that the current allocation of payroll tax revenue between DI and OASI has shortchanged DI for several decades (see graph). Directing DI to borrow from OASI is useless unless DI also receives the means to repay the money.

- Borrowing now sets the stage for disastrous cuts later. Extending a loan with no repayment mechanism simply digs a deeper hole and invites harsh changes in DI in a few years when headlines invariably trumpet DI’s “massive debt.”

- Policymakers won’t know much more in a few years than they know now. Proponents of interfund borrowing claim it would create time to consider broader changes to DI, but Congress should not assume that demonstration projects will provide useful results that could serve as a guide to legislation in just a few years. It’s worth testing promising changes to DI through carefully designed demonstration projects, but those won’t yield quick or dramatic answers.

- Past interfund borrowing was different. The only time policymakers approved interfund borrowing, in the early 1980s, they also tackled long-term Social Security solvency. In 1981, when Congress passed legislation allowing OASI to borrow from DI and from Medicare’s Hospital Insurance (HI) trust fund, President Reagan established a bipartisan commission to develop a plan for restoring Social Security solvency, culminating in comprehensive legislation in 1983. OASI borrowed from DI and HI three times in 1982 and repaid all the loans by 1986. That was a responsible way to borrow — but it’s not what’s being discussed now. Advocates of interfund borrowing offer no proposals that would increase DI’s resources or cut benefits enough to allow the program to repay a loan.

- A short-term solution leaves Americans with disabilities hanging in the balance. DI beneficiaries are some of the most vulnerable Americans. They can no longer support themselves and their families through their earnings due to severe and long-lasting medical impairments. They have earned their modest benefits through their hard work. They face a 20-percent cut in benefits next year unless Congress replenishes the DI trust fund. That threat is stressful enough, and prolonging their uncertainty by forcing DI to borrow isn’t fair.